Nj Property Tax Deduction For Veterans If you are an honorably discharged veteran with active duty military service you may qualify for an annual 250 Property Tax Deduction Reservists and National Guard personnel must be called to active duty service to qualify Active duty for training is ineligible

The bipartisan proposal seeking to boost the size of New Jersey s veterans property tax deduction from 250 to 2 500 via a constitutional amendment was approved by a key Senate committee last week New Jersey has long provided a property tax deduction of 250 to some wartime veterans and their surviving spouses A ballot measure extending that deduction to peacetime veterans and their surviving spouses passed on November 3 2020

Nj Property Tax Deduction For Veterans

Nj Property Tax Deduction For Veterans

https://mycommunitysource.com/wp-content/uploads/2020/09/NJ-Question-2--700x350.png

NJ OKs Veterans Property Tax Deduction Election 2020 Results

https://townsquare.media/site/385/files/2020/10/IMG_3294.jpg?w=1200&h=0&zc=1&s=0&a=t&q=89

18 States With Full Property Tax Exemption For 100 Disabled Veterans

https://vaclaimsinsider.com/wp-content/uploads/2021/05/11-States-With-Full-Property-Tax-Exemption-for-100-Disabled-Veterans-scaled.jpg

250 PROPERTY TAX DEDUCTION FOR VETERANS OR SURVIVING SPOUSES N J S A 54 4 8 10 et seq An annual 250 deduction from real property taxes is provided for the property of a qualified veteran or their surviving spouse Two hundred fifty dollars 250 may be deducted each year from taxes due on the real or personal property of qualified active duty veterans or their unremarried surviving spouses In 1999 a constitutional amendment increased the deduction from 50 to 100 for 2000 150 for 2001 200 for 2002 and 250 per year thereafter

A disabled Veteran in New Jersey may receive an annual tax exemption on their primary residence if they are 100 totally and permanently disabled during active duty service Must be a legal resident of New Jersey NJ Veteran 250 Property Tax Deduction In late 2020 the requirements for the 250 New Jersey Veteran Property Tax Deduction changed You may now qualify if You are an honorably discharged veteran with active military service You are a surviving spouse civil union domestic partner of an honorably discharged veteran with active military

Download Nj Property Tax Deduction For Veterans

More picture related to Nj Property Tax Deduction For Veterans

Tax Deductions For Veterans And Seniors CMC Digest

http://cmcdigest.com/wp-content/uploads/2013/07/DSCN0340-777x437.jpg

Are Veterans Exempt From Property Taxes In Nj PRFRTY

http://www.northhanovertwp.com/Tax Collector/img3.jpg

NJ Election Expand Tax Aid For Veterans What You Need To Know

https://www.gannett-cdn.com/presto/2020/07/01/PNJM/42c0dc60-6b77-4e54-94f0-6bec302209e9-070120_Montclairvoterrally_10.JPG?crop=5181,2915,x0,y266&width=3200&height=1801&format=pjpg&auto=webp

New Jersey Property Tax Deduction Honorably discharged New Jersey resident veterans who served at least 14 days in a combat zone are eligible for an annual 250 property tax deduction This amendment implemented Public Law 2019 chapter 413 which provides that N J resident honorably discharged disabled veterans or their surviving spouses no longer need to serve during a specific war period or other emergency to receive the property tax exemption

VETERAN DEFINED means any New Jersey citizen and resident honorably discharged from active wartime service in the United States Armed Forces Current statute does not provide for deduction for military personnel still in active The State of New Jersey gives a couple of tax benefits to veterans You re asking about the annual 250 property tax deduction

Do Disabled Vets Pay Property Taxes In Nj PROFRTY

https://www.njpp.org/wp-content/uploads/2020/06/NJPP-Income-Tax-Report-New-Proposal-Who-Pays-Share-of-Income-Paid-in-Taxes-01.png

Senator Gopal Urges NJ Veterans To Apply For Newly Doubled 6 000

https://d3n8a8pro7vhmx.cloudfront.net/njdistrict11/pages/1709/meta_images/original/veterans'_income_tax_deduction.png?1573598931

https://www.nj.gov/treasury/taxation/lpt/lpt-veterans.shtml

If you are an honorably discharged veteran with active duty military service you may qualify for an annual 250 Property Tax Deduction Reservists and National Guard personnel must be called to active duty service to qualify Active duty for training is ineligible

https://www.njspotlightnews.org/2024/06/nj...

The bipartisan proposal seeking to boost the size of New Jersey s veterans property tax deduction from 250 to 2 500 via a constitutional amendment was approved by a key Senate committee last week

VA Application For Real Property Tax Relief For Veterans With Rated 100

Do Disabled Vets Pay Property Taxes In Nj PROFRTY

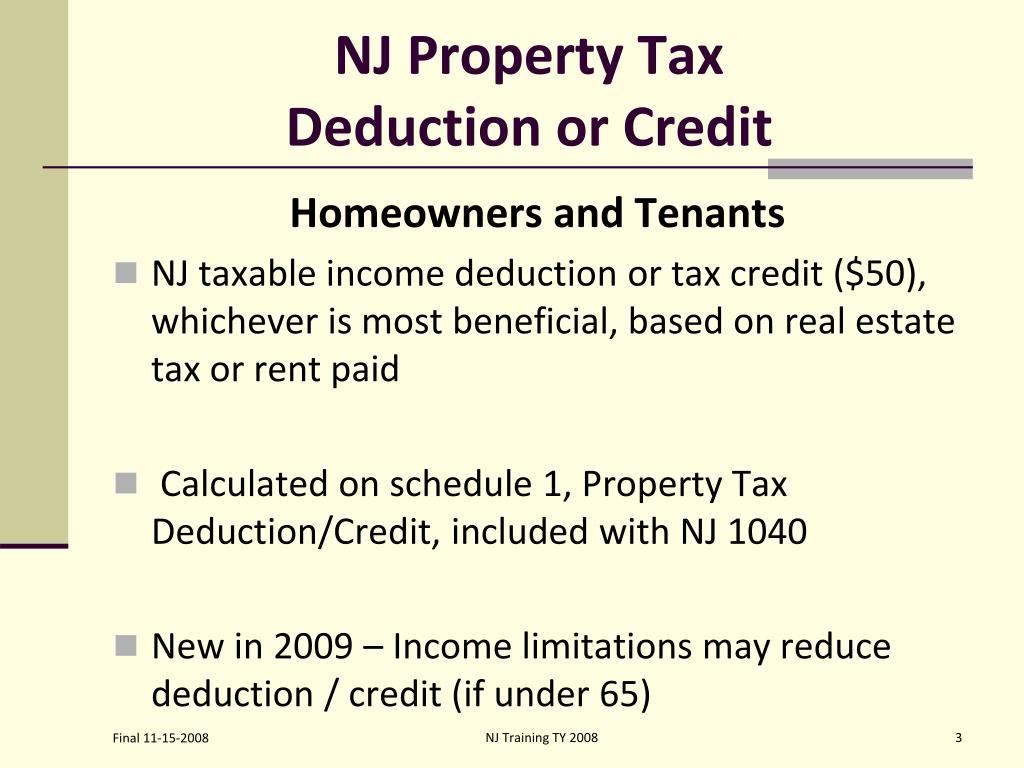

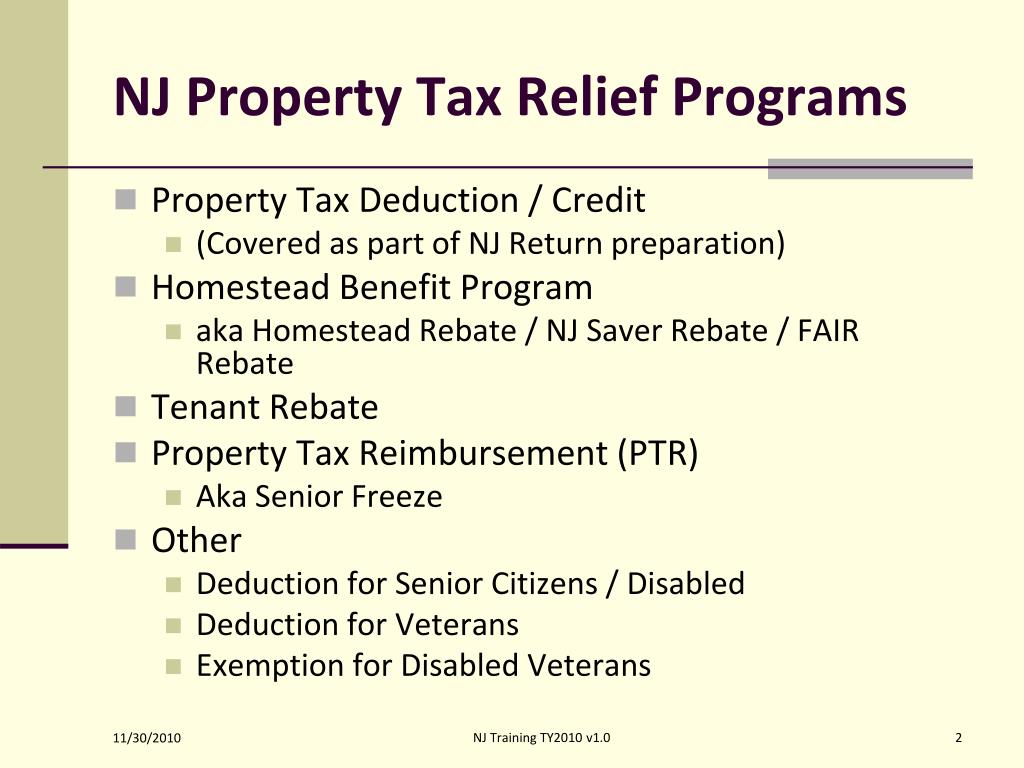

PPT New Jersey Property Tax Relief Programs PowerPoint Presentation

PPT New Jersey Property Tax Relief Programs PowerPoint Presentation

PPT New Jersey Property Tax Relief Programs PowerPoint Presentation

NJ Property Tax Update Access Wealth

NJ Property Tax Update Access Wealth

NJ 2 Property Tax Relief Programs V1 0

Veterans Tax Deduction Township Of Bethlehem

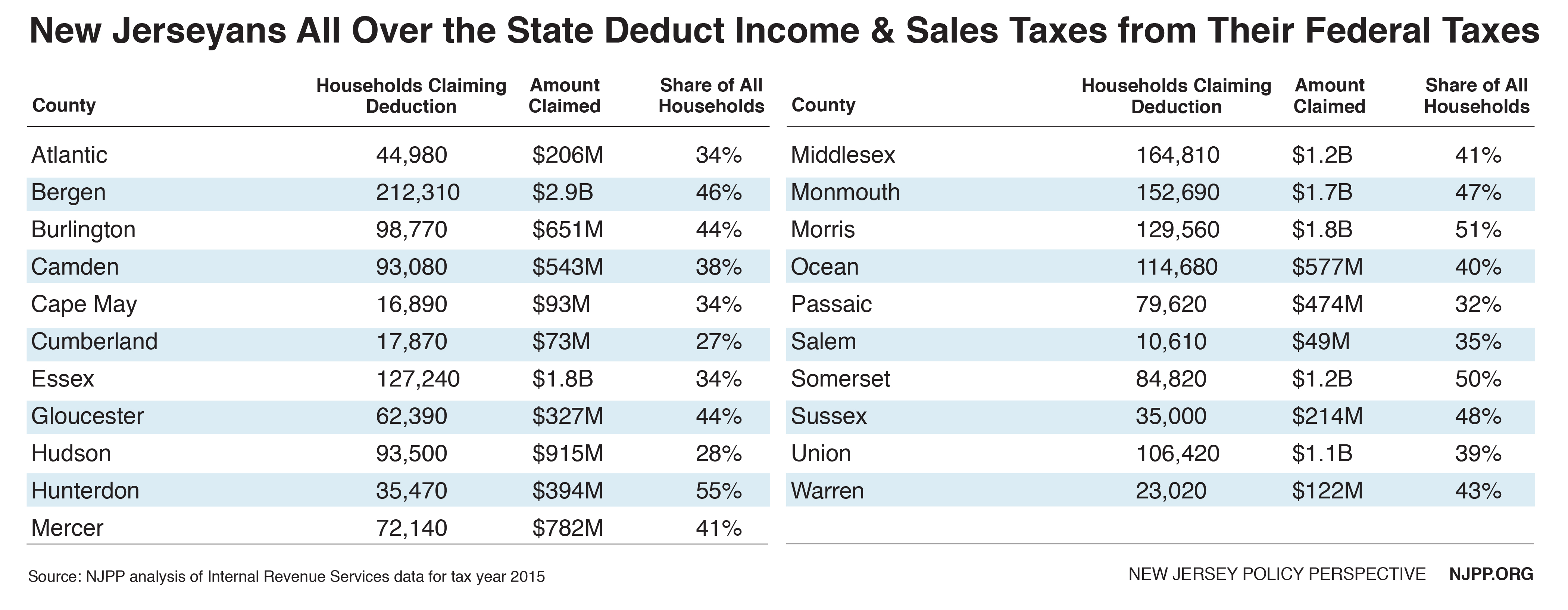

Millions Of New Jerseyans Deduct Billions In State And Local Taxes Each

Nj Property Tax Deduction For Veterans - Two hundred fifty dollars 250 may be deducted each year from taxes due on the real or personal property of qualified active duty veterans or their unremarried surviving spouses In 1999 a constitutional amendment increased the deduction from 50 to 100 for 2000 150 for 2001 200 for 2002 and 250 per year thereafter