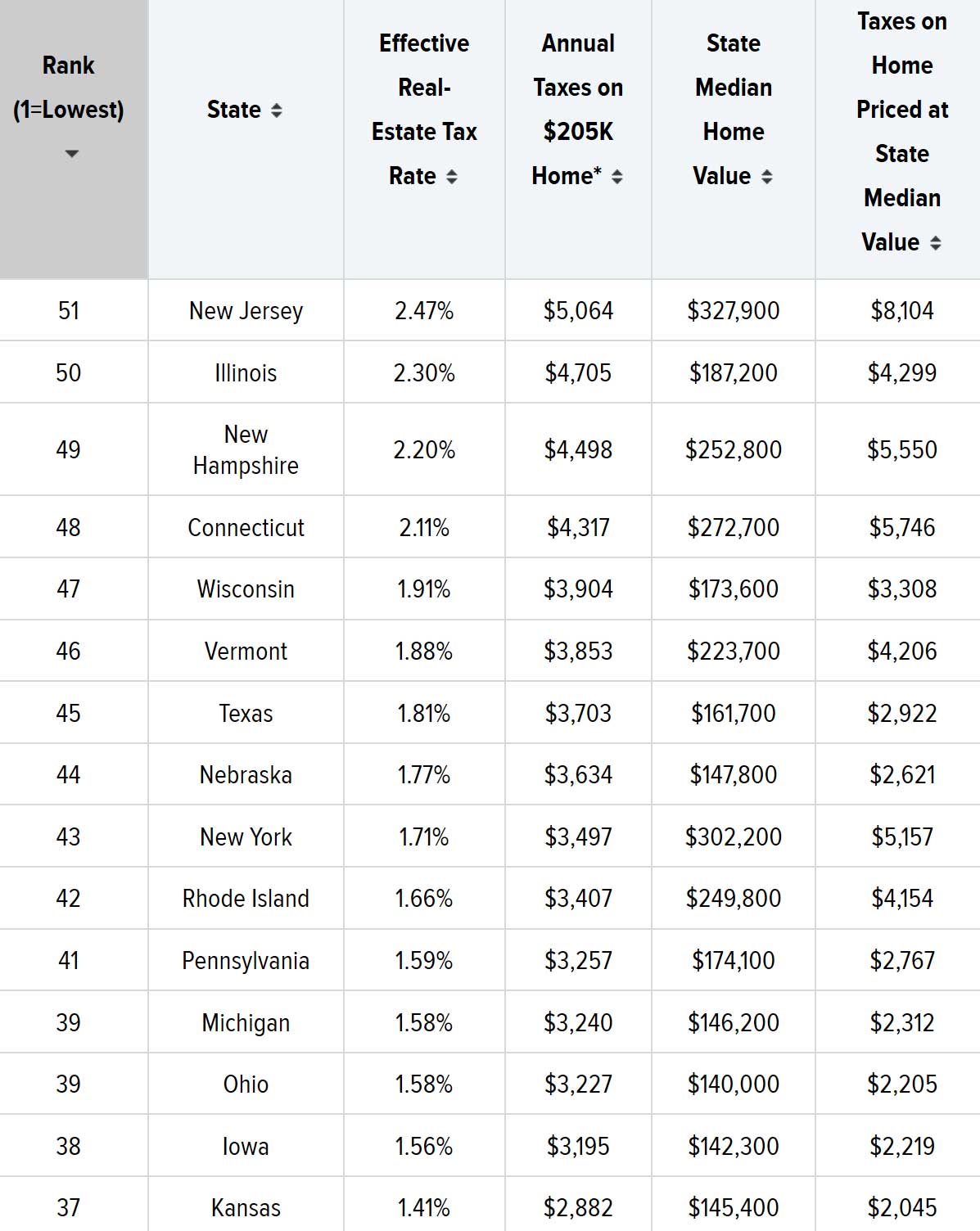

Nj Property Tax Rebate Eligibility Web Eligibility requirements You are eligible if you met these requirements You were a New Jersey resident and You owned and occupied a home in New Jersey that was your

Web Division of Taxation Eligibility Requirements Find Out If I Am Eligible You are not eligible for a reimbursement on A vacation home or second home Property that you rent to Web 1 f 233 vr 2023 nbsp 0183 32 Proceeds from spouse s civil union partner s life insurance Capital gains on the sale of a principal residence of up to 250 000 if single and up to 500 000 if

Nj Property Tax Rebate Eligibility

Nj Property Tax Rebate Eligibility

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/new-jersey-property-tax-relief-for-seniors-property-walls-1.jpg

PPT New Jersey Property Tax Relief Programs PowerPoint Presentation

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2022/10/ppt-new-jersey-property-tax-relief-programs-powerpoint-presentation-12.jpg?resize=768%2C576&ssl=1

PPT New Jersey Property Tax Relief Programs PowerPoint Presentation

https://i0.wp.com/www.rentersrebate.net/wp-content/uploads/2022/10/ppt-new-jersey-property-tax-relief-programs-powerpoint-presentation-1.jpg?w=1024&ssl=1

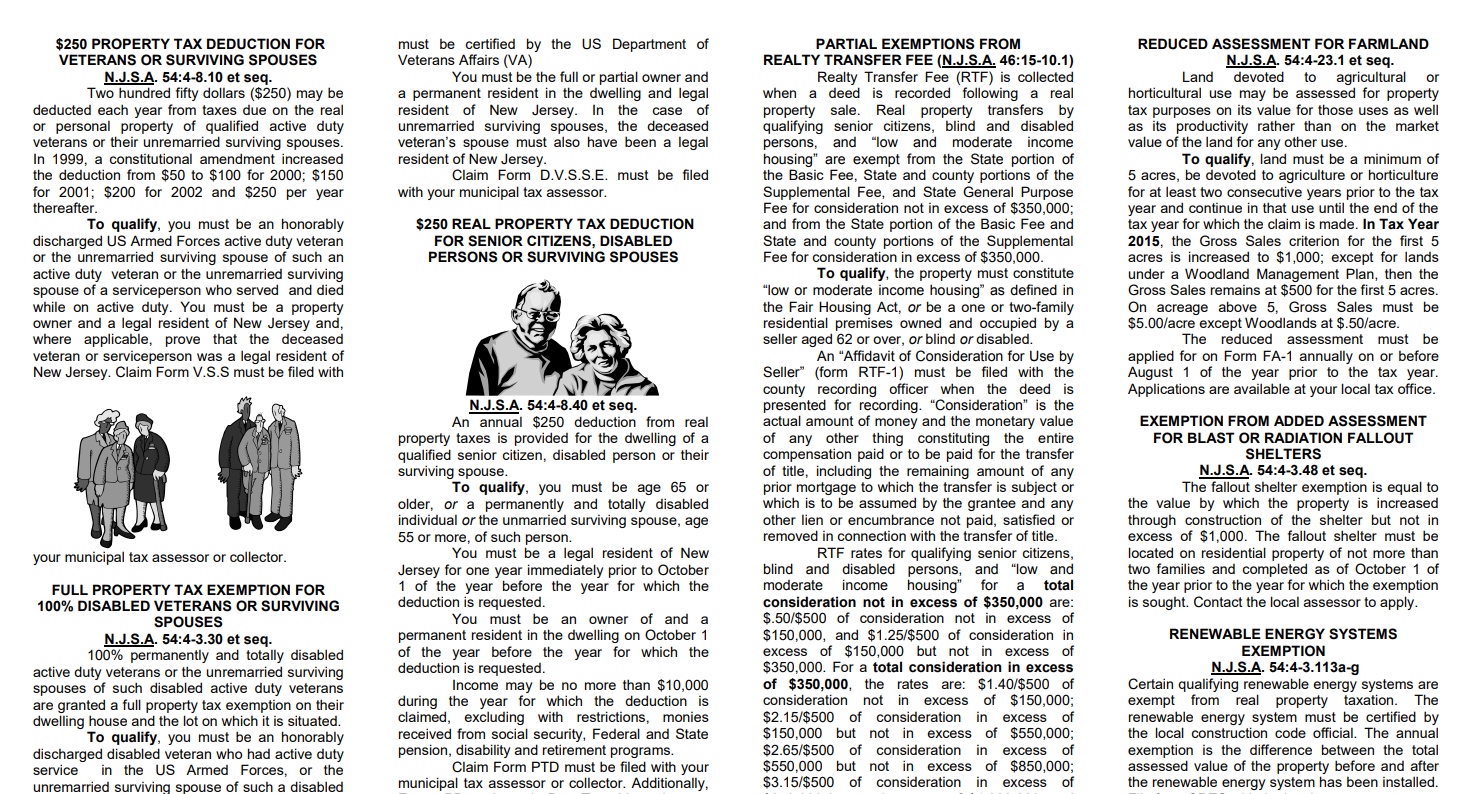

Web 31 d 233 c 2020 nbsp 0183 32 Note Residents with gross income of 20 000 or less 10 000 if filing status is single or married CU partner filing separate return are eligible for a property Web 4 mars 2022 nbsp 0183 32 Homeowners making up to 250 000 per year may be eligible for rebates averaging 700 lowering the effective rate to 2016 levels And renters earning up to

Web 8 juin 2023 nbsp 0183 32 maximum of 10 000 per year The bill defines eligible claimant as a person who is 65 or more years of age and the owner of a homestead in this State that is the Web The Senior Freeze Program reimburses eligible senior citizens and disabled persons for property tax or mobile home park site fee increases on their principal residence main

Download Nj Property Tax Rebate Eligibility

More picture related to Nj Property Tax Rebate Eligibility

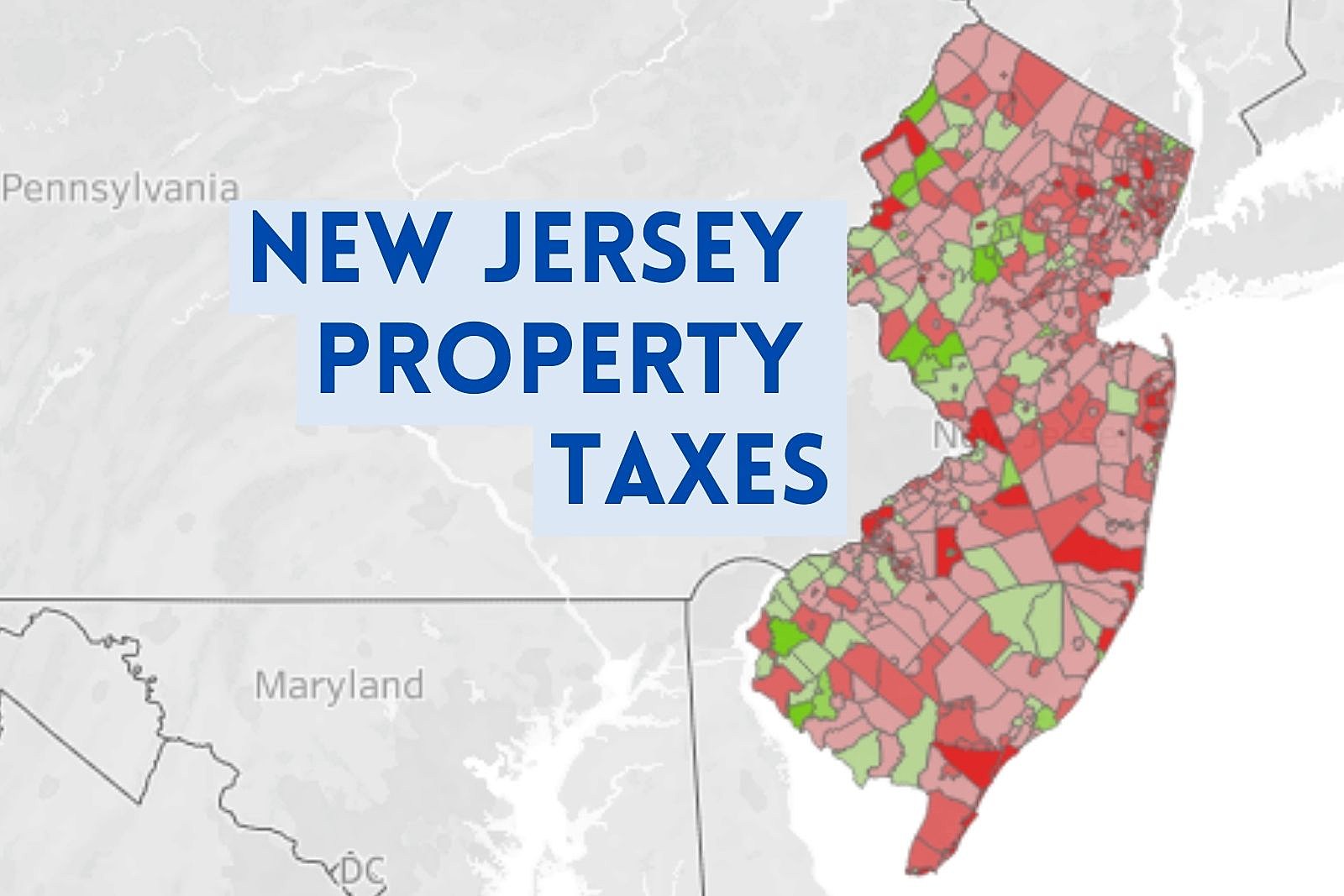

Bold Plan To Significantly Reduce NJ Property Taxes

https://townsquare.media/site/385/files/2022/01/attachment-New-Jersey-property-taxes.jpg

NJ Tax Rebate 2023 How To Apply And Eligibility Criteria Taxation

https://www.tax-rebate.net/wp-content/uploads/2023/04/Nj-Tax-Rebate-2023.jpg

NJ Anchor Property Tax Rebate Deadline Is Today TomsRiver

https://i0.wp.com/tomsriver.org/wp-content/uploads/2023/02/anchorprogram.png?resize=507%2C480&ssl=1

Web 3 mars 2022 nbsp 0183 32 Nearly 1 8 million homeowners and renters would get property tax rebates averaging 700 next year under a new plan Gov Phil Murphy unveiled Thursday If it s Web 2 juil 2022 nbsp 0183 32 Under the new program known as ANCHOR homeowners making up to 150 000 will receive 1 500 rebates on their property tax bills and those making

Web 18 nov 2022 nbsp 0183 32 New Jersey homeowners and renters now have until Jan 31 to apply for relief and renters who were previously ineligible because their unit is under a Payment Web 8 sept 2022 nbsp 0183 32 Taxpayers can qualify as tenants if on Oct 1 2019 they rented an apartment condominium or house rented or owned a mobile home located in a

NJ s New 2B Tax Rebate Program Underway How To Get Your Cut Across

https://patch.com/img/cdn20/users/1062528/20221003/045552/styles/patch_image/public/anchor___03165458849.jpg

Nys Property Tax Rebate Checks 2023 Eligibility Application Process

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/Nys-Property-Tax-Rebate-Checks-2023.jpg

https://www.state.nj.us/treasury/taxation/anchor/home.shtml

Web Eligibility requirements You are eligible if you met these requirements You were a New Jersey resident and You owned and occupied a home in New Jersey that was your

https://www.nj.gov/treasury/taxation/ptr/eligibility.shtml

Web Division of Taxation Eligibility Requirements Find Out If I Am Eligible You are not eligible for a reimbursement on A vacation home or second home Property that you rent to

NYS Property Tax Rebate 2023 Eligibility Criteria And Application

NJ s New 2B Tax Rebate Program Underway How To Get Your Cut Across

Property Tax Rebates Coming In NJ Track Your ANCHOR Status Across

NJ s New 2B Property Tax Rebate How To Get Your Cut Across New

N J s New ANCHOR Property Tax Program Your Questions Answered Nj

Nj Property Tax Rebate Deadline PropertyRebate

Nj Property Tax Rebate Deadline PropertyRebate

33 How To Calculate Nj Property Tax LadyArisandi

Nj Homestead Rebate 2022 Renters RentersRebate

There Is A NJ Real Estate Tax Rebate Program YouTube

Nj Property Tax Rebate Eligibility - Web 7 mars 2022 nbsp 0183 32 For New Jersey homeowners making up to 250 000 rebates would be applied as a percentage of property taxes paid up to 10 000 Renters making up to