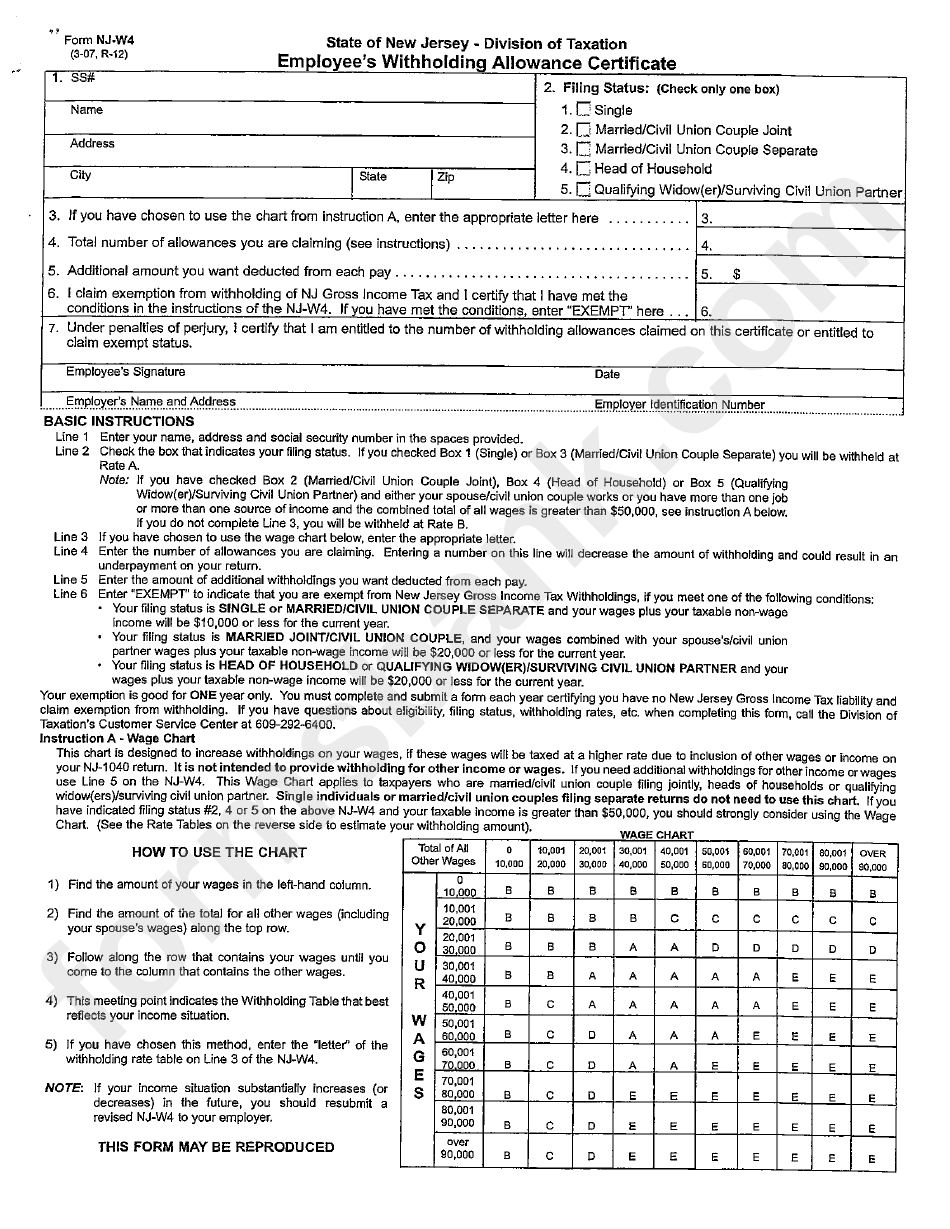

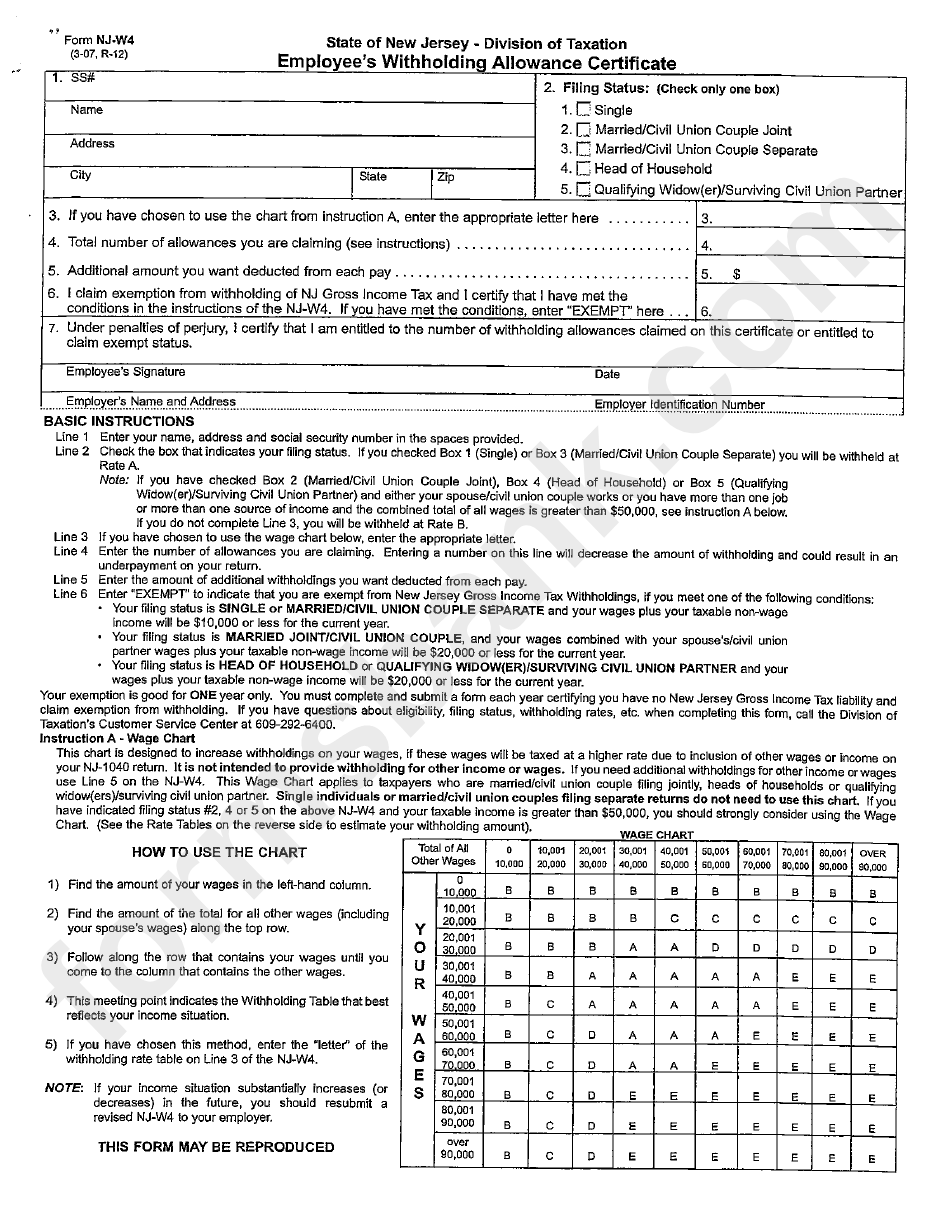

Nj State Tax Withholding Percentage New Jersey income tax rate 1 40 10 75 Median household income 97 126 U S Census Bureau Number of cities with local income taxes 0 How Your New Jersey

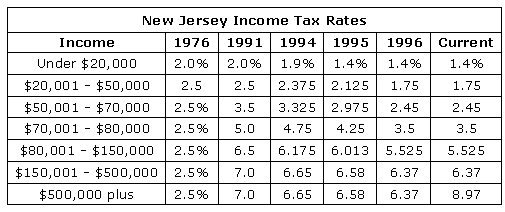

If your New Jersey taxable income is less than 100 000 you can use the New Jersey Tax Table or New Jersey Rate Schedules When using the tax table use the correct The state income tax rates range from 1 4 to 10 75 and the sales tax rate is 6 625 New Jersey offers tax deductions and credits to reduce your tax liability including

Nj State Tax Withholding Percentage

Nj State Tax Withholding Percentage

https://w4formsprintable.com/wp-content/uploads/2021/07/nj-form-w-4-employee-s-withholding-allowance-certificate.png

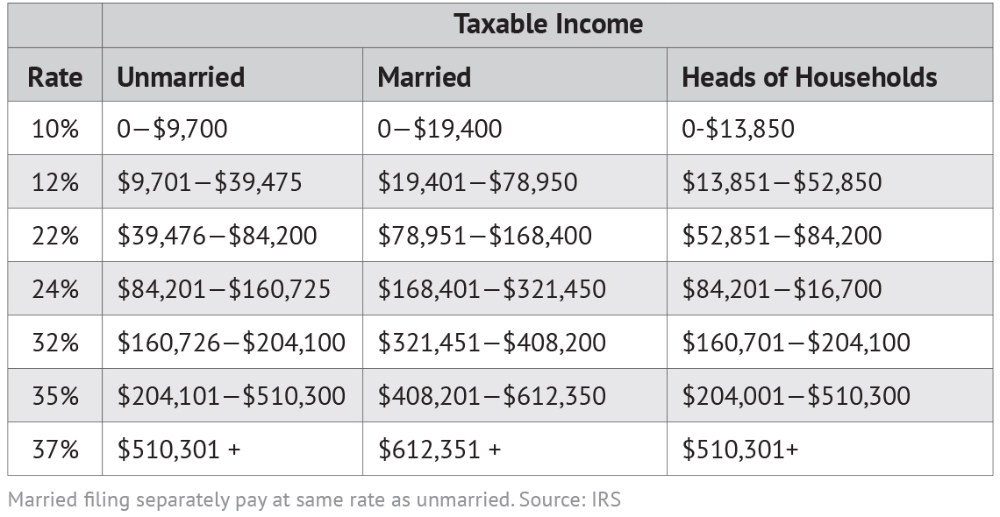

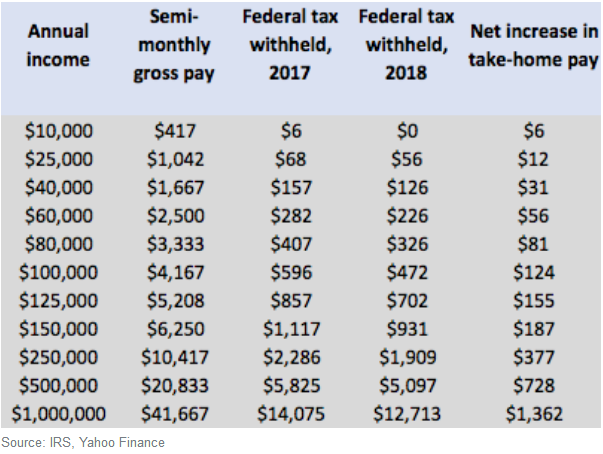

2021 Federal Tax Brackets Withholding Federal Withholding Tables 2021

https://federal-withholding-tables.net/wp-content/uploads/2021/07/2020-income-tax-brackets-pasivinco.png

Nj State Tax Withholding Form WithholdingForm

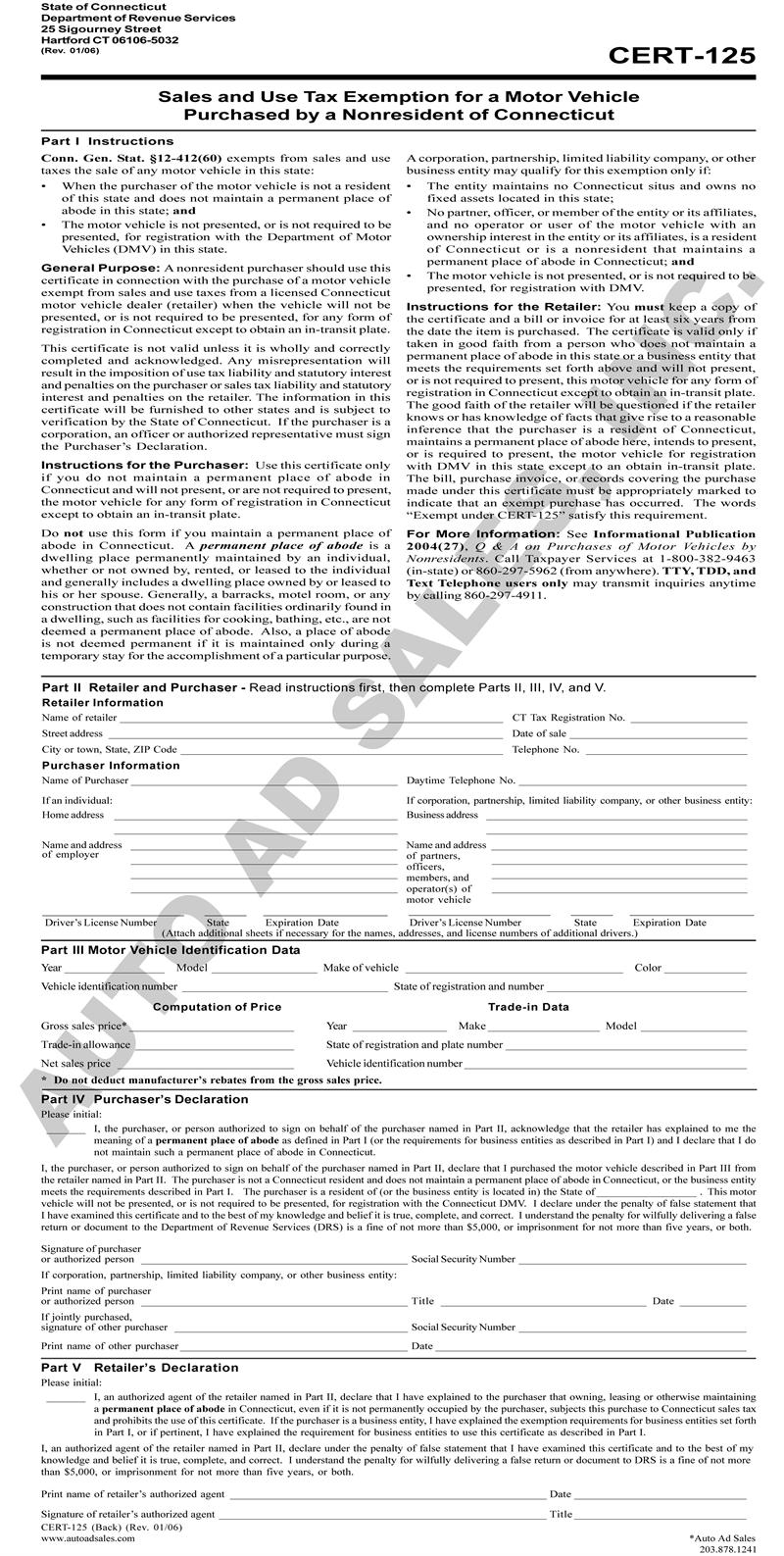

https://www.withholdingform.com/wp-content/uploads/2022/08/out-of-state-tax-exemption-form.jpg

43 rowsThe state supplemental income tax withholding rates currently available for 2020 are shown in the chart below The chart also shows if the state has a flat tax rate NJ WT New Jersey Income Tax Withholding Instructions This Guide Contains Mandatory Electronic Filing of 1099s How to Calculate Withhold and Pay New Jersey

The New Jersey income tax brackets vary between 1 4 and 10 75 depending on your filing status and adjusted gross income For a New Jersey resident that files their tax return as Single or Married Filing Published March 9 2021 Effective Pay Period 05 2021 Summary The tax rate on wages over 1 000 000 and up to 5 000 000 for the State of New Jersey has changed from

Download Nj State Tax Withholding Percentage

More picture related to Nj State Tax Withholding Percentage

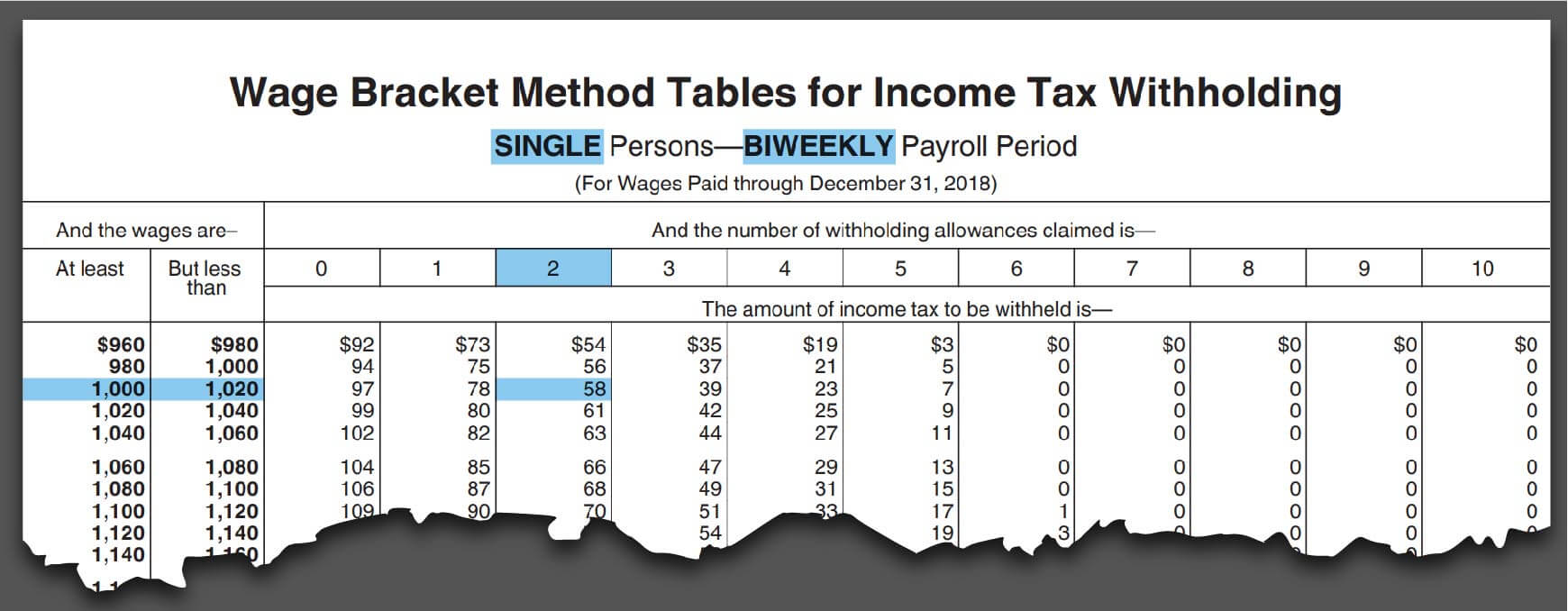

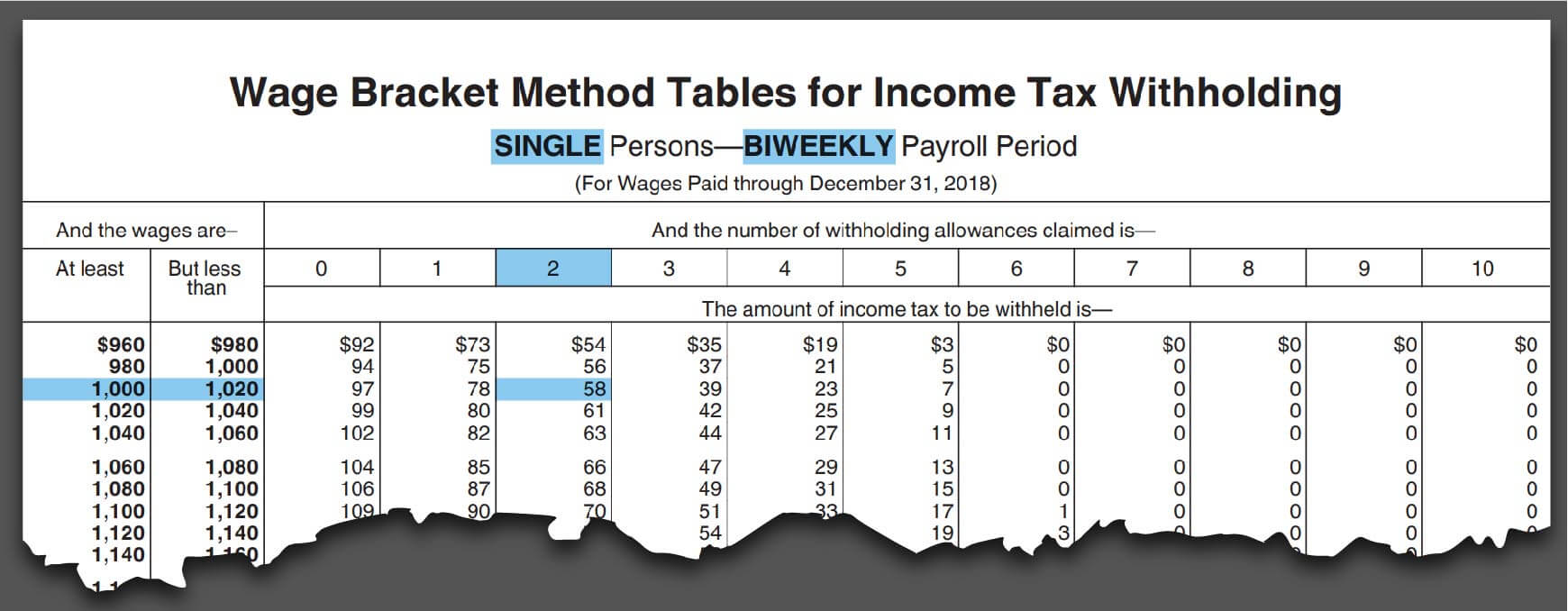

Printable Federal Withholding Tables 2022 Table Onenow

https://i2.wp.com/federalwithholdingtables.net/wp-content/uploads/2021/06/2020-income-tax-brackets-pasivinco.png

Az State Income Tax Brackets 2024 Ania Meridel

https://files.taxfoundation.org/20230217151820/2023-state-individual-income-tax-rates-2023-state-income-taxes-by-state.png

Arkansas Withholding Tax Formula 2023 Printable Forms Free Online

https://www.patriotsoftware.com/wp-content/uploads/2022/12/2023-Publication-15-T-1-768x705.png

New Jersey Residents State Income Tax Tables for Head of Household Filers in 2023 Personal Income Tax Rates and Thresholds Tax Rate Taxable Income Threshold The revised tables reflect a reduction of the withholding rate for individuals earning over 5 million to 11 8 beginning January 1 2019 down from the 15 6 withholding rate

How Income Taxes Are Calculated First we calculate your adjusted gross income AGI by taking your total household income and reducing it by certain items The new law increases the Gross Income Tax rate for income between 1 million and 5 million and provides a new withholding rate for the remainder of 2020 Effective January

Tax Table 2022

https://www.patriotsoftware.com/wp-content/uploads/2022/12/2023-Publication-15-T-1.png

Missouri Use Tax Rate 2024 Babita Appolonia

https://www.patriotsoftware.com/wp-content/uploads/2022/12/2023-Publication-15-T-1-768x705.png

https://smartasset.com/taxes/new-jersey-paycheck-calculator

New Jersey income tax rate 1 40 10 75 Median household income 97 126 U S Census Bureau Number of cities with local income taxes 0 How Your New Jersey

https://www.nj.gov/treasury/taxation/taxtables.shtml

If your New Jersey taxable income is less than 100 000 you can use the New Jersey Tax Table or New Jersey Rate Schedules When using the tax table use the correct

State Of NJ Department Of The Treasury Division Of Taxation NJ

Tax Table 2022

New IRS Tax Withholding Tables Mean Your Paycheck Might Be Getting A

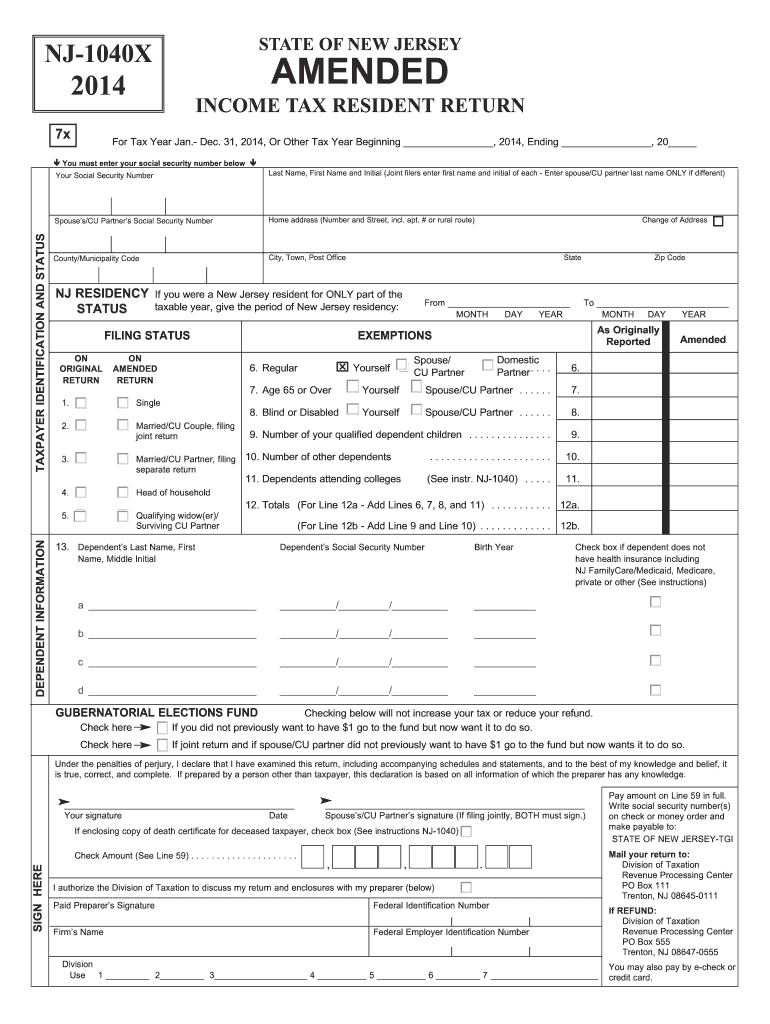

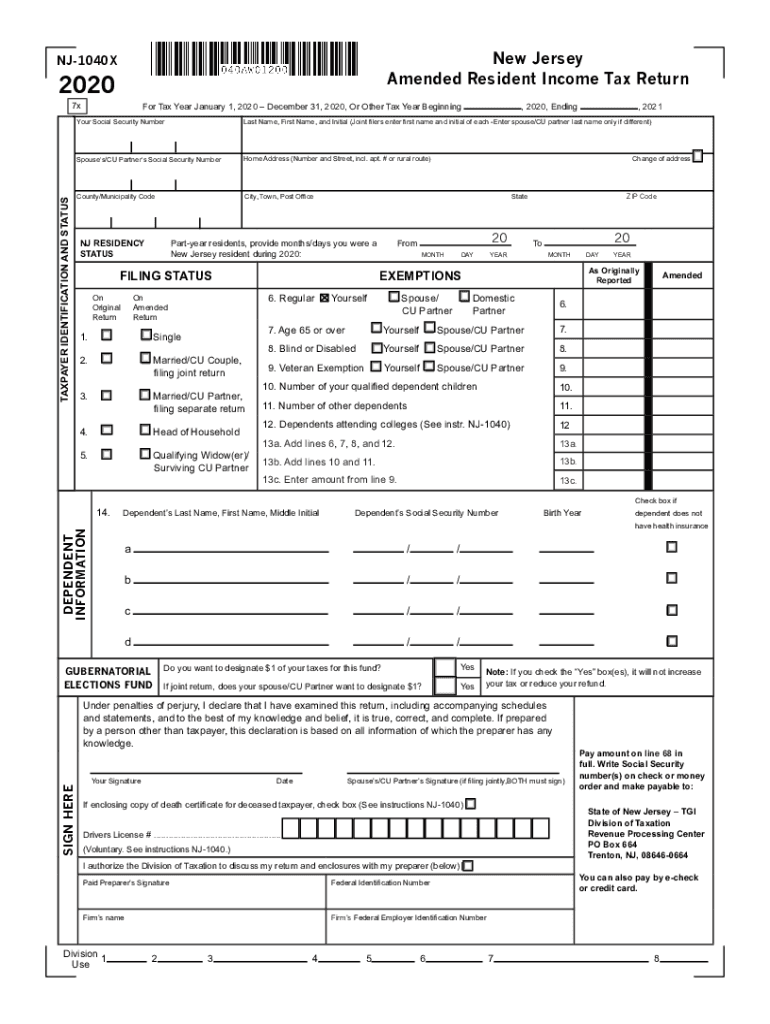

NJ State Tax Form Fill Out And Sign Printable PDF Template SignNow

Revised Withholding Tax Table Bureau Of Internal Revenue

What Is Federal Income Tax Withholding Guidelines And More

What Is Federal Income Tax Withholding Guidelines And More

NJ Division Of Taxation Income Exclusions

Nj Income Tax Table Brokeasshome

New Jersey 1040x 2020 2024 Form Fill Out And Sign Printable PDF

Nj State Tax Withholding Percentage - New Jersey s SUTA taxes are based on a taxable wage base of 34 400 with the SUTA rates running from 0 5 to 5 8 for experienced employers The SUTA tax rates are