Nj State Tax Write Offs Information on claiming exemptions on your New Jersey Income Tax return

The state income tax rates range from 1 4 to 10 75 and the sales tax rate is 6 625 New Jersey offers tax deductions and credits to reduce your tax liability including Unfortunately New Jersey does not offer as many deductions as other states or the federal government There are however some tax breaks that people often overlook In order to figure

Nj State Tax Write Offs

Nj State Tax Write Offs

https://i.pinimg.com/originals/65/e8/37/65e837e5a63eeda2ce2fb664c209b759.jpg

Nj Tax Abatement Letter Onvacationswall

https://www.taxaudit.com/getattachment/444d5c80-042d-485e-8416-405a74b995d1/New-Jersey-Division-of-Taxation-Letter-Sample-1;

What Can You Write Off On Your Taxes SoundOracle Sound Kits

http://cdn.shopify.com/s/files/1/1042/7832/articles/Tax_Write_Offs_1024x1024.jpg?v=1641387925

Business Income If you have losses in certain business related categories of income you may be able to use those losses to calculate an adjustment to your taxable Find out how much you ll pay in New Jersey state income taxes given your annual income Customize using your filing status deductions exemptions and more Menu burger

Previous year s New Jersey tax return All applicable NJ W 2s 1099s Applicable Federal Schedules Make your check or money order payable to State of New Jersey TGI The Income tax rates and personal allowances in New Jersey are updated annually with new tax tables published for Resident and Non resident taxpayers The Tax tables below include the tax rates thresholds and

Download Nj State Tax Write Offs

More picture related to Nj State Tax Write Offs

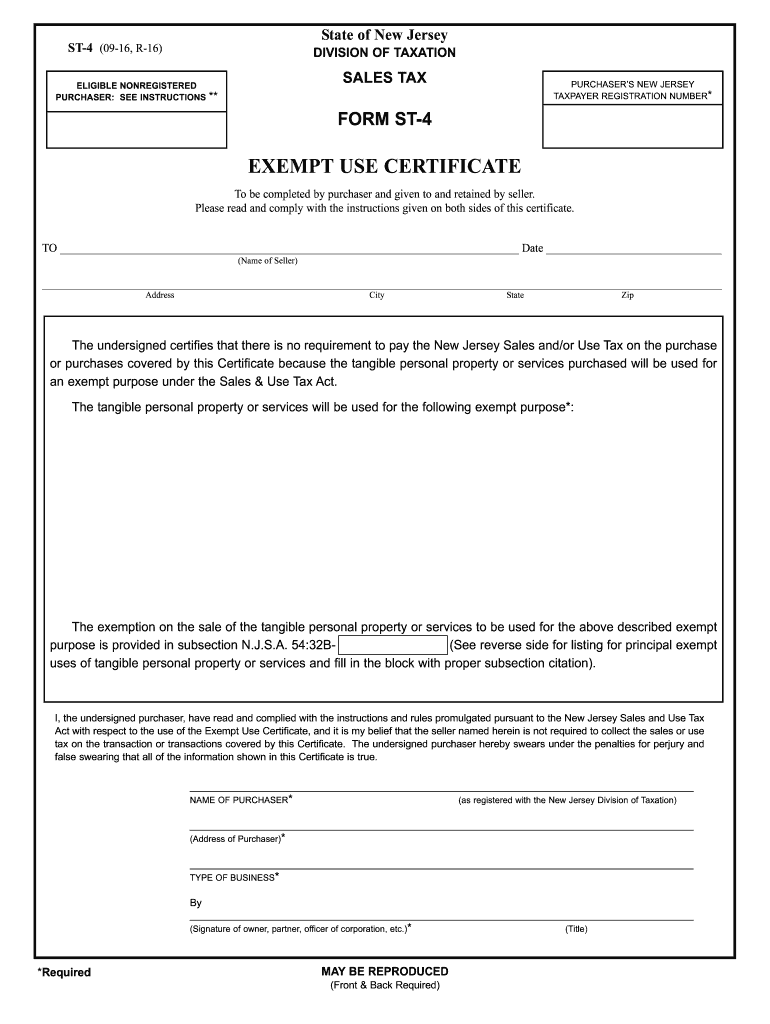

NJ ST 4 2016 2022 Fill Out Tax Template Online US Legal Forms

https://www.pdffiller.com/preview/395/763/395763626/large.png

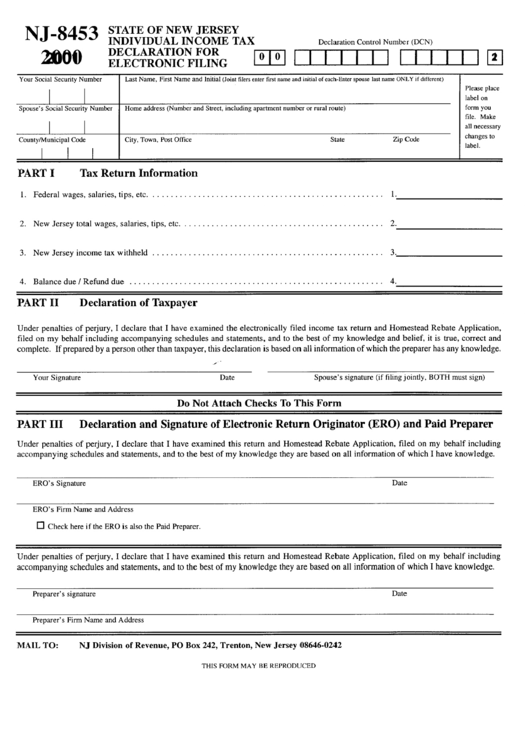

Form Nj 8453 Individual Income Tax Declaration For Electronic Filing

https://data.formsbank.com/pdf_docs_html/227/2276/227676/page_1_thumb_big.png

The Ultimate Checklist Of Tax Write Offs For Small Business Blog

https://blog.taxbandits.com/wp-content/uploads/2017/08/Social-Media-Sq_ExpressTaxFilings_Ultimate-Write-Off-Checklist-768x768.png

The deadline to file a New Jersey state tax return is April 15 2024 which is also the deadline for federal tax returns For help estimating your annual income taxes The standard tax deduction is a reduction from your taxable income that is available to taxpayers who opt not to itemize deductions on their tax return Choosing whether to use the standard

Information on completing and filing a New Jersey Income Tax Return New Jersey Self Employment Tax Calculator Use Keeper s 1099 tax calculator to see an estimate of your tax bill or refund Feel free to tinker around or get serious with our

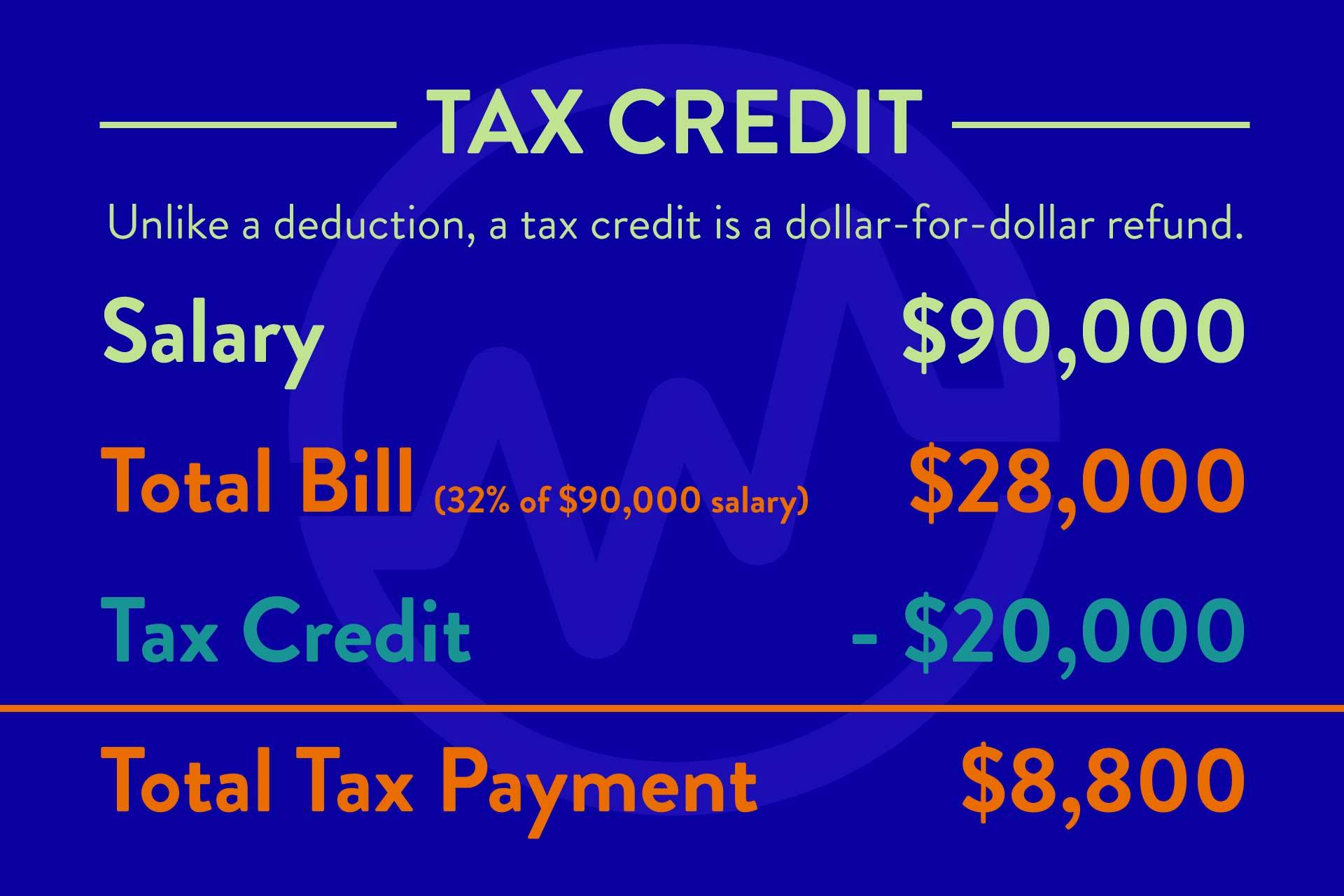

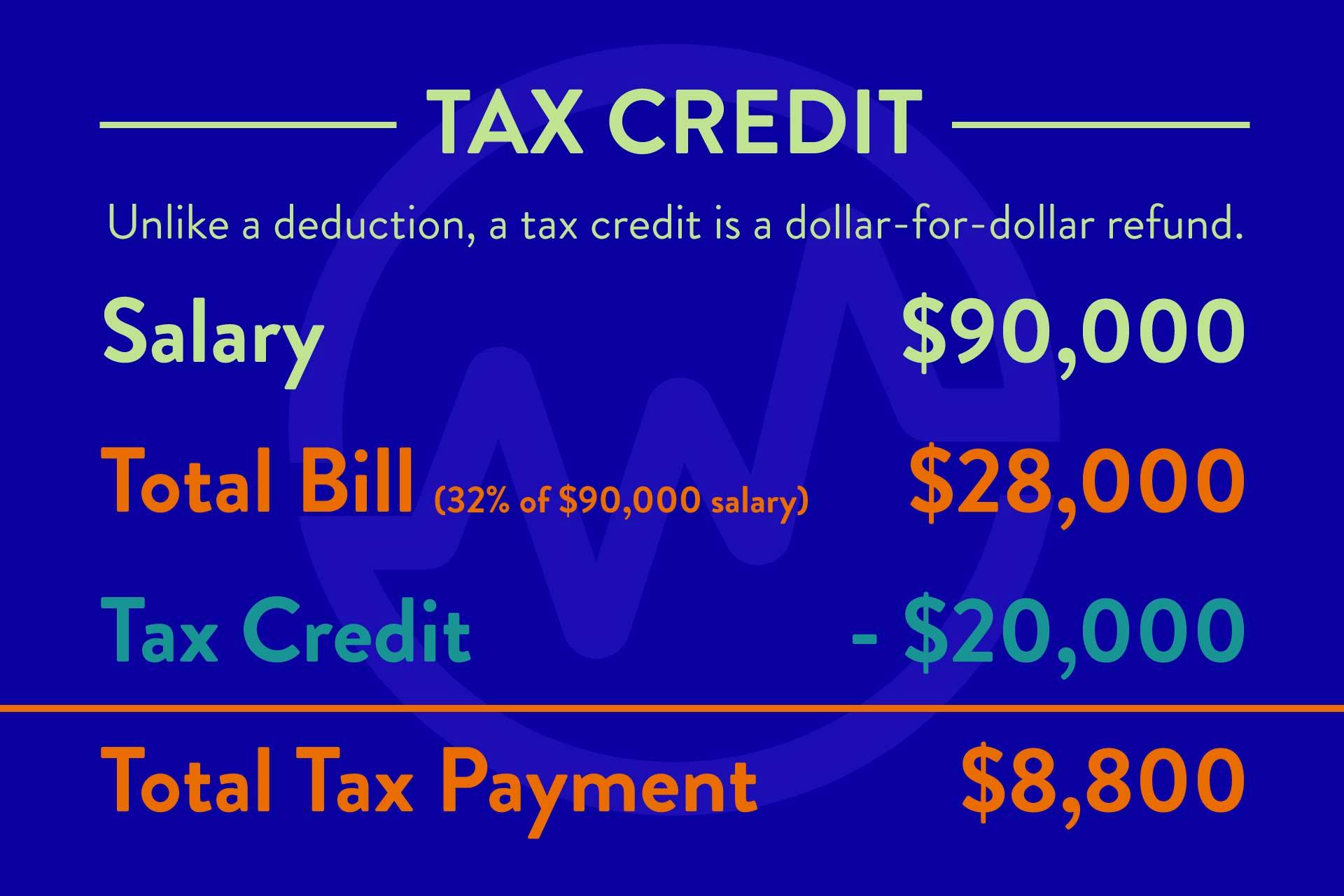

How Do Tax Write Offs Work WealthFit 2022

https://images.prismic.io/wealthfit-staging/e2041efe-0737-4be6-8d77-5e5f57ecf01d_03-how-does-a-tax-credit-work.jpg?auto=compress

LOVE YOUR MONEY New Jersey On Path To Tying For Highest Corporate Tax

https://files.taxfoundation.org/20180312103730/NJCIT2018-02.png

https://www.nj.gov/treasury/taxation/njit2.shtml

Information on claiming exemptions on your New Jersey Income Tax return

https://www.forbes.com/advisor/income-tax-calculator/new-jersey

The state income tax rates range from 1 4 to 10 75 and the sales tax rate is 6 625 New Jersey offers tax deductions and credits to reduce your tax liability including

Deductible Or Not Tax Guide 1040 File Your Taxes Online

How Do Tax Write Offs Work WealthFit 2022

What Is A Tax Write off And How Does It Work Workhy Blog

What Is A Tax Write Off

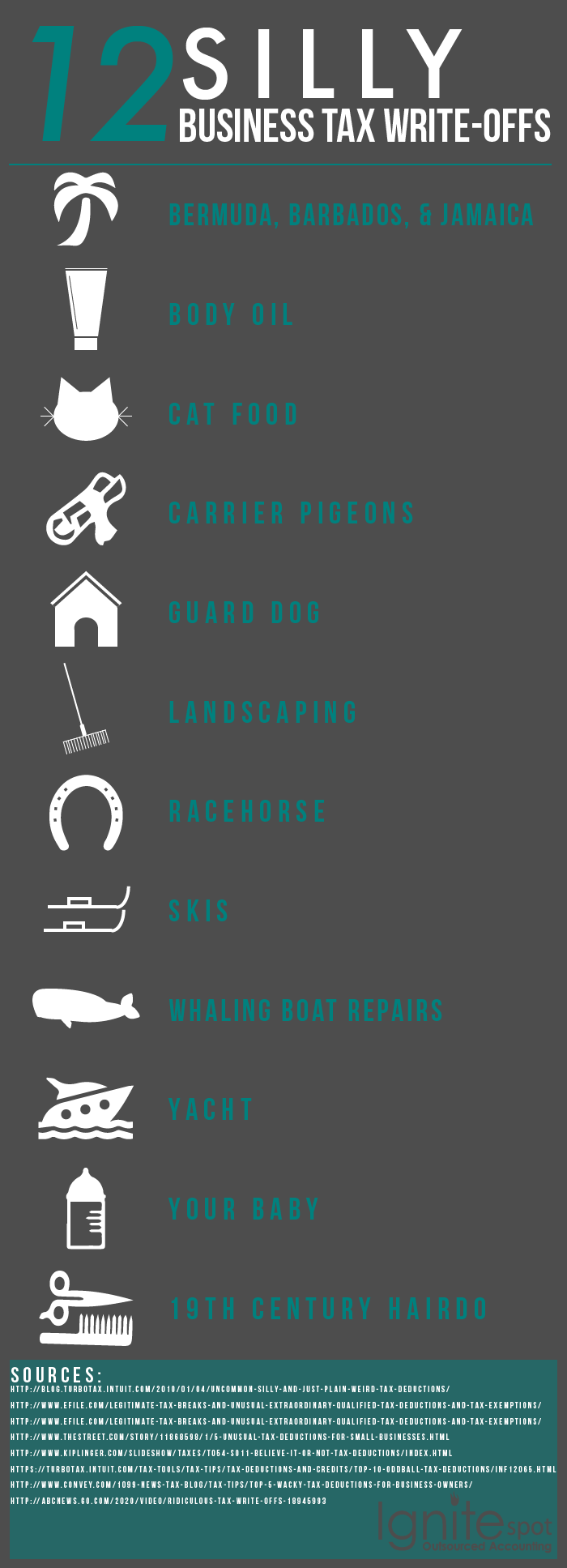

12 Silly Tax Write Offs That Actually Happened infographic

Tax Write Offs Your Guide To All Itemized Deductions Tax Write Offs

Tax Write Offs Your Guide To All Itemized Deductions Tax Write Offs

Make The Most Of Tax Write offs Money

What Is A Tax Write Off Tax Deductions Explained The TurboTax Blog

Ohio Tax Write Offs 2020 QATAX

Nj State Tax Write Offs - In this article we will discuss what you need to know about itemized tax deductions how they stack up against standard deductions and how they impact your