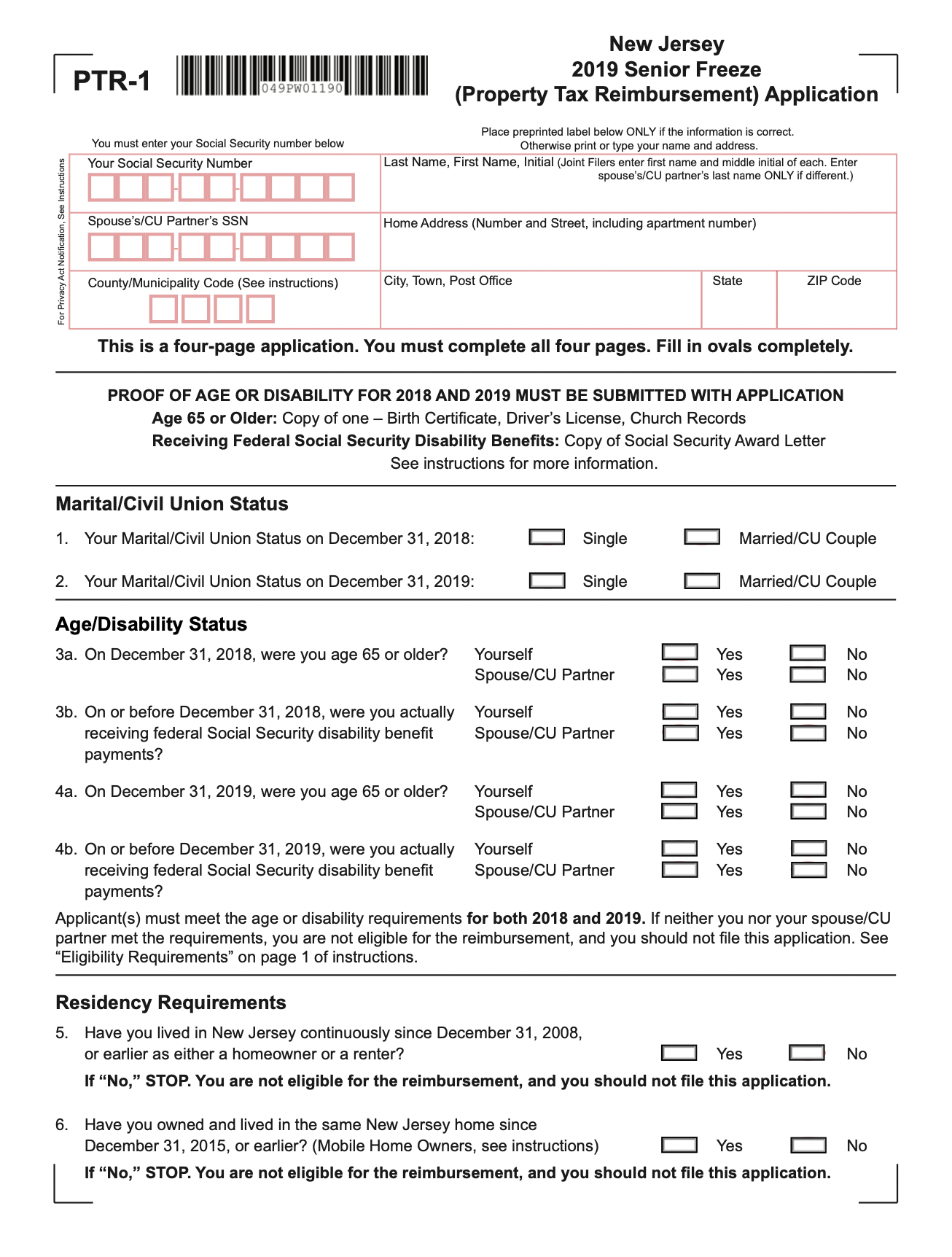

Nj Tax Credit For Renters You are eligible for a property tax deduction or a property tax credit only if You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey during the tax year and Your primary residence whether owned or rented was subject to property taxes that were paid either as actual property taxes or through rent and

The Affordable New Jersey Communities for Homeowners and Renters ANCHOR property tax relief program was instituted last year by the Governor and Legislature It updated and expanded upon the former Homestead Benefit property tax relief program by extending eligibility to renters for the first time in a generation as well as For renters who don t pay property taxes directly the write off generally allows them to deduct up to 18 of their annual rent payments Several years ago Gov Phil Murphy and the Democratic controlled Legislature worked together to lift the cap on the tax write off from 10 000 up to 15 000

Nj Tax Credit For Renters

Nj Tax Credit For Renters

https://www.einsiders.com/wp-content/uploads/2020/12/Affordable-Renters-Insurance-1536x1024.jpeg

Vacant Homes Tax Tax Credit For Renters Among Measures

https://img.rasset.ie/001bd883-1600.jpg

What Is An R D Tax Credit

https://www.letsbegamechangers.com/wp-content/uploads/2020/01/load-image-2020-01-24T030638.645-1536x1024.jpeg

Property Tax Deduction Credit for Homeowners and Renters Homeowners and renters who pay property taxes on a primary residence main home in New Jersey either directly or through rent may qualify for either a deduction or a This program provides property tax relief to New Jersey residents who own or rent property in New Jersey as their principal residence and meet certain income limits The current filing season for the ANCHOR benefit is based on 2020 residency income and age Filing Deadline Scam Alert Check Benefit Status

Renters with 2019 gross incomes of 150 000 or less will receive 450 You are considered a homeowner if you owned a house or condominium before Oct 1 2019 and paid property taxes Hundreds of thousands of New Jerseyans who rent their homes are eligible for 450 in property tax relief under the ANCHOR Program Tenants and renters who were previously ineligible because their unit was covered by a PILOT agreement can now apply for the ANCHOR benefit Eligible applicants will receive a 450 payment this spring

Download Nj Tax Credit For Renters

More picture related to Nj Tax Credit For Renters

Tution Tax Credit For Students NCS CA

https://www.ncscorp.ca/wp-content/uploads/2022/03/Untitled-design-12-e1648708763193.png

Over 300 000 Have Yet To Claim New Tax Credit For Renters Farrelly

https://farrellyscully.com/wp-content/uploads/2023/01/fha-mortgage-rent-out-home-scaled-1.jpg

NJ Tax Rebate Form Printable Rebate Form

http://printablerebateform.net/wp-content/uploads/2021/08/NJ-Tax-Rebate-Form.png

The credit would cost an additional 550 million in Fiscal Year 2023 for a total of 893 million in property tax credits and would increase in subsequent years i The average yearly credit amount for homeowners would be 682 and the renter credit would be fixed at either 150 or 250 depending on other factors New Jersey homeowners and renters now have until Jan 31 to apply for relief and renters who were previously ineligible because their unit is under a Payment in Lieu of Taxes PILOT

If you were a part year New Jersey resident and you were either a qualified homeowner or tenant or both a homeowner and a tenant during the part of the year you lived in New Jersey use the amount of property taxes or 18 of Qualified homeowners making less than 150 000 in 2021 will receive a tax credit of 1 500 while those making 150 000 to 250 000 will get a tax credit of 1 000 Renters who made 150 000 or less will receive a direct check for 450 The program was a key component of this year s state budget

Renters Rebate 2021 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Minnesota-Renters-Rebate-Form-2021.jpg

Millions Of Americans Could Be In Line For Boosted Tax Credits Worth

https://www.the-sun.com/wp-content/uploads/sites/6/2022/02/MF-Tax-Credit-OFFPLAT.jpg?strip=all&quality=100&w=1500&h=1000&crop=1

https://www.nj.gov/treasury/taxation/proptaxdeduc_credit.shtml

You are eligible for a property tax deduction or a property tax credit only if You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey during the tax year and Your primary residence whether owned or rented was subject to property taxes that were paid either as actual property taxes or through rent and

https://www.nj.gov/treasury/media/anchor/index.shtml

The Affordable New Jersey Communities for Homeowners and Renters ANCHOR property tax relief program was instituted last year by the Governor and Legislature It updated and expanded upon the former Homestead Benefit property tax relief program by extending eligibility to renters for the first time in a generation as well as

New NJ Tax Credit Delays Payment To Families Until 2024

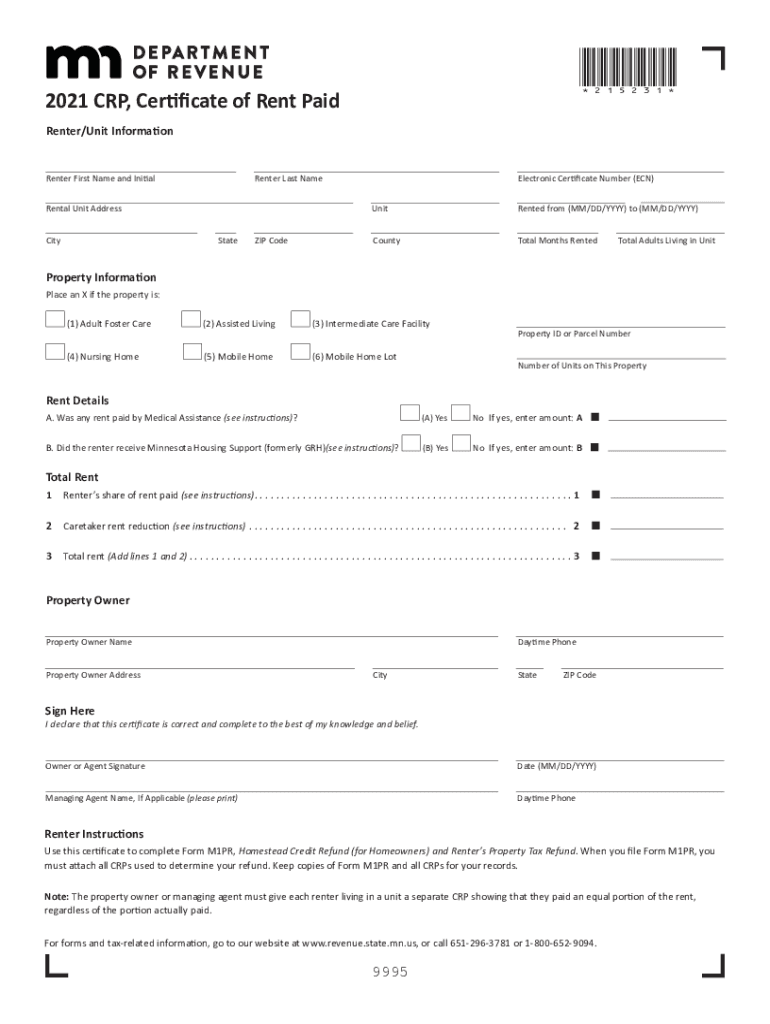

Renters Rebate 2021 Printable Rebate Form

US Treasury Department Issues Guidelines Around A New Tax Credit For

Government Considering Tax Credit For Renters In Budget T naiste Says

Renters Insurance Vs Homeowners Insurance Explained

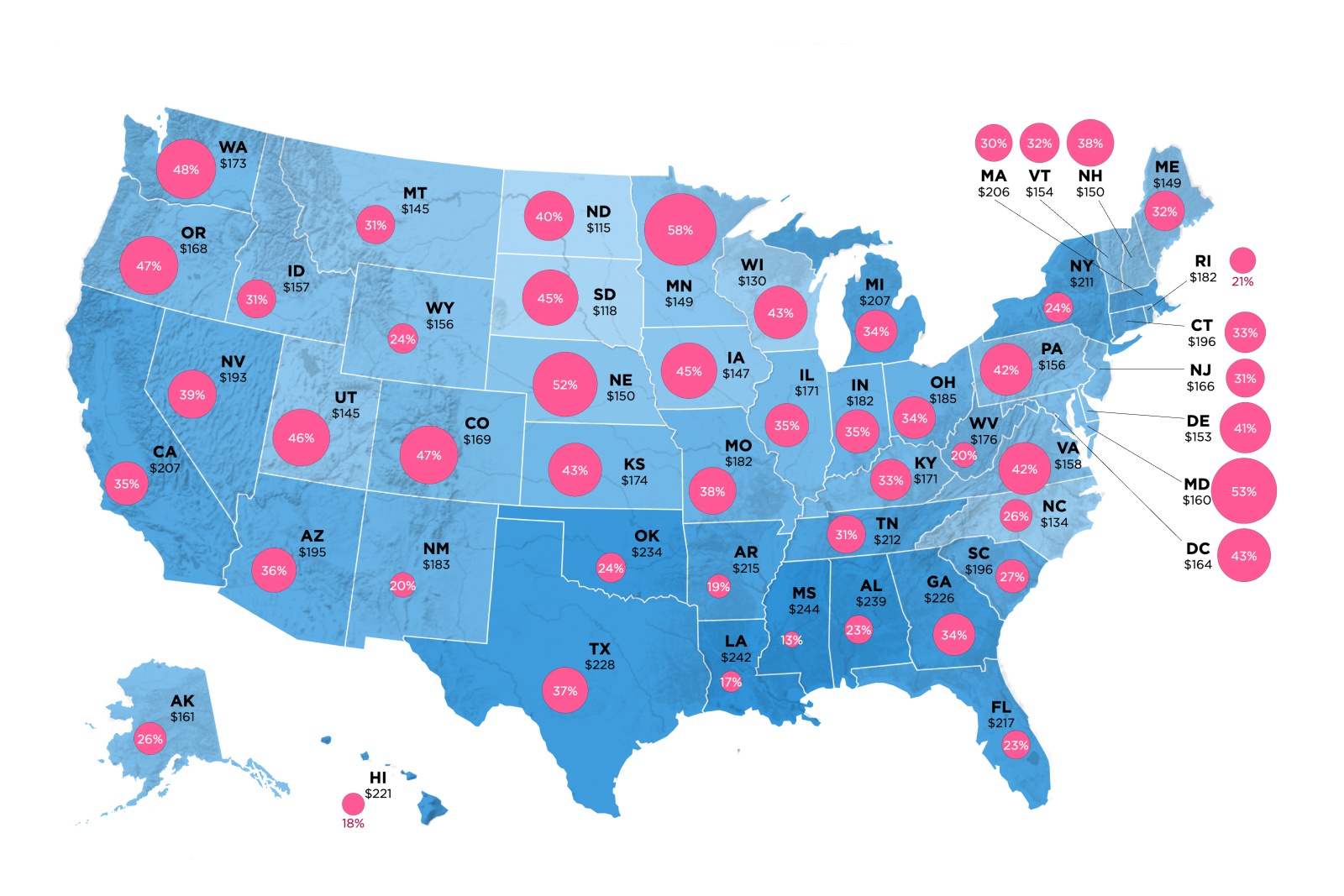

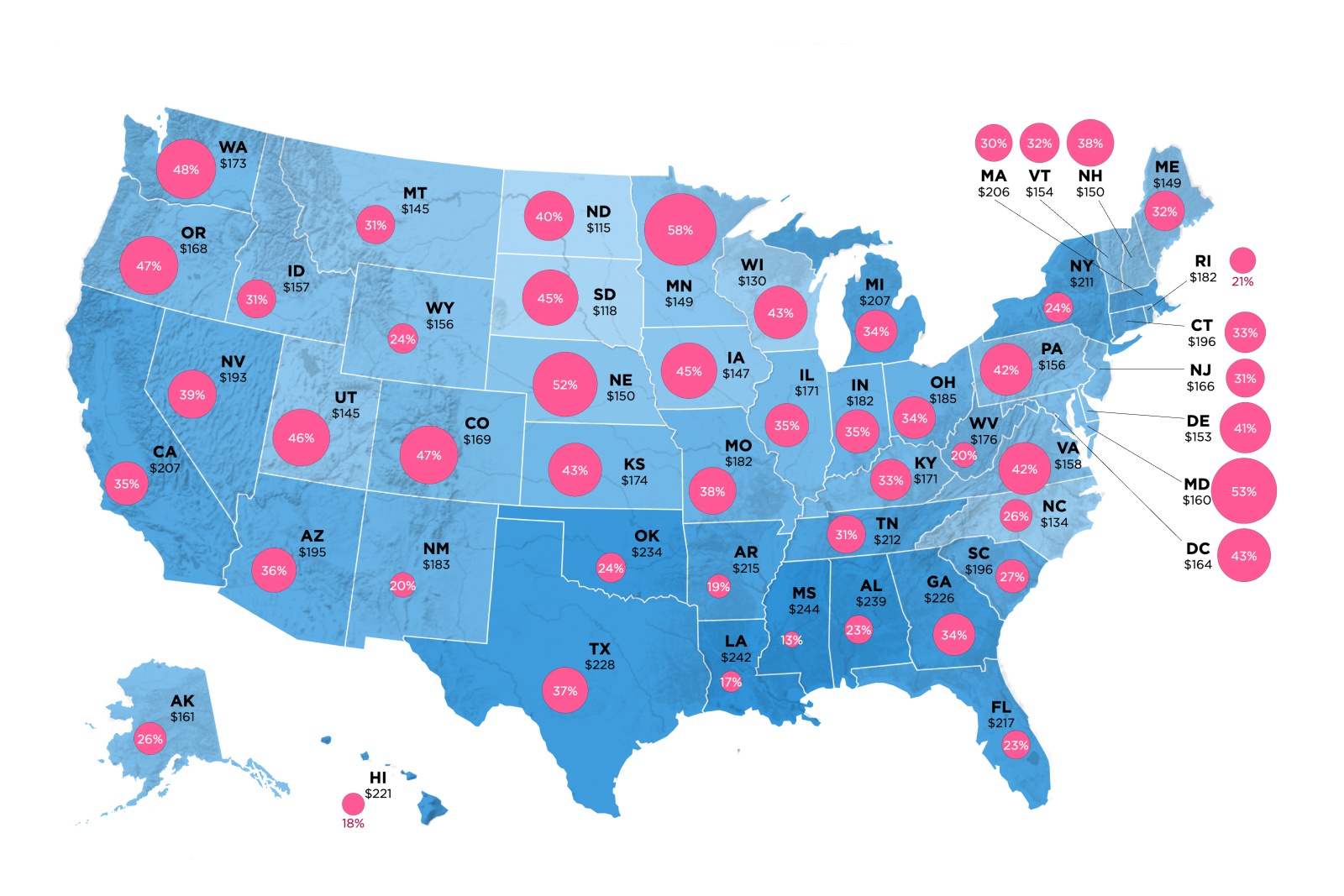

Looking At Average Renters Insurance Rates Across All 50 States

Looking At Average Renters Insurance Rates Across All 50 States

Georgia Tax Credits For Workers And Families

Renters Rebate Mn 2021 2024 Form Fill Out And Sign Printable PDF

Marlboro Mayor Lends His Support To STAY NJ Tax Credit For Seniors

Nj Tax Credit For Renters - This program provides property tax relief to New Jersey residents who own or rent property in New Jersey as their principal residence and meet certain income limits The current filing season for the ANCHOR benefit is based on 2020 residency income and age Filing Deadline Scam Alert Check Benefit Status