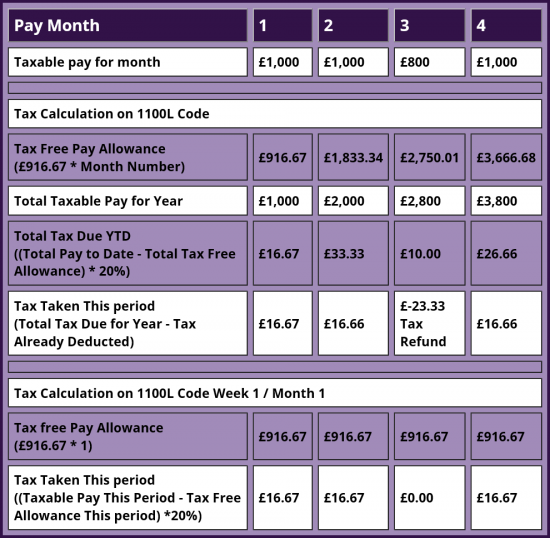

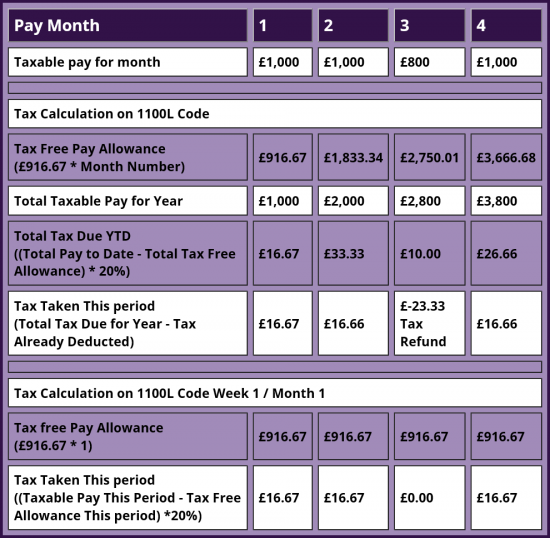

Non Cumulative Tax Code Rebate Web 13 avr 2023 nbsp 0183 32 Most commonly an emergency tax code will end with M1 or W1 indicating that your tax is non cumulative meaning your tax will be calculated based on your pay this period not your overall year to date

Web 5 janv 2022 nbsp 0183 32 Scenario 2 Non Cumulative Code tax is calculated only on earnings that week In weeks one and two Dave would pay 163 11 60 in tax based on gross weekly Web 21 avr 2022 nbsp 0183 32 What the numbers mean The numbers in the codes tell your employer or pension provider how much tax free income you get in each tax year For the vast

Non Cumulative Tax Code Rebate

Non Cumulative Tax Code Rebate

https://i0.wp.com/www.verizonrebates.net/wp-content/uploads/2023/04/Verizon-Rebate-Code.jpg

The Steps To Going Self Employed Explained Goselfemployed co

https://goselfemployed.co/wp-content/uploads/2023/04/Cumulative-v-non-cumulative-768x576.png

The Steps To Going Self Employed Explained Goselfemployed co

https://goselfemployed.co/wp-content/uploads/2023/04/go-self-employed-7.png

Web Non cumulative tax codes W1 or M1 If you see W1 or M1 attached to your tax code it means your tax is calculated only on your earnings in that individual pay period The tax due on each payment is determined Web W1m M1 or X These are emergency tax codes non cumlative tax codes The above tax codes can also include an S or a C If they contain an S you are being taxed under

Web A non cumulative tax code is represented by the X at the end of the tax code This means that tax is calculated on the gross pay earned in the current pay period only Whereas a Web 12 oct 2022 nbsp 0183 32 Non cumulative tax codes can be assigned to individuals by HMRC due to any of the following reasons the individual is changing jobs and has been assigned a

Download Non Cumulative Tax Code Rebate

More picture related to Non Cumulative Tax Code Rebate

The Figure Shows The Coefficient On Tax Rebate At Time T 1 first Row

https://www.researchgate.net/profile/Paolo-Surico/publication/228222751/figure/fig4/AS:669492430508044@1536630842986/The-figure-shows-the-coefficient-on-tax-rebate-at-time-t-1-first-row-tax-rebate-at.png

The Steps To Going Self Employed Explained Goselfemployed co

https://goselfemployed.co/wp-content/uploads/2023/04/go-self-employed-6.png

Non Cumulative Rebate Codes Problem Issue 16117 PrestaShop

https://user-images.githubusercontent.com/7033391/67558288-fd265600-f716-11e9-8741-54664c9987f1.png

Web 25 ao 251 t 2023 nbsp 0183 32 Yes you can get a tax refund on a non cumulative tax code if you have overpaid tax This can happen if you have had more than one job during the tax year or Web However this does not happen on a week1 month1 basis and it is classed as Non cumulative There could be a number of reasons for this treatment one being that they

Web The standard tax codes 1185L and BR The standard PAYE tax code for your main job in 2018 19 is 1185L 2017 18 1150L It represents 163 11 850 of tax free income For a Web 1 ao 251 t 2022 nbsp 0183 32 What Does Tax Code BR NonCum Mean BR Noncum means you will pay a tax of 20 on gross non Cumulative earnings starting from the date that the tax

The Steps To Going Self Employed Explained Goselfemployed co

https://goselfemployed.co/wp-content/uploads/2023/04/40-percent-tax-bracket-1536x1152.png

Tax Codes For 2018 19 New Tax Code 1185L Tax Rebates

https://www.taxrebates.co.uk/wp-content/uploads/tax-codes-for-2018-19.jpeg

https://www.which.co.uk/money/tax/income-ta…

Web 13 avr 2023 nbsp 0183 32 Most commonly an emergency tax code will end with M1 or W1 indicating that your tax is non cumulative meaning your tax will be calculated based on your pay this period not your overall year to date

https://claimmytaxback.co.uk/guide-uk-emergency-tax-codes

Web 5 janv 2022 nbsp 0183 32 Scenario 2 Non Cumulative Code tax is calculated only on earnings that week In weeks one and two Dave would pay 163 11 60 in tax based on gross weekly

Incorrectly Taxed Due To 2 Different Payslips From Different Periods

The Steps To Going Self Employed Explained Goselfemployed co

Alcon Choice Rebate Code 2023 Printable Rebate Form

Payroll Year End Process IRIS PAYE Master

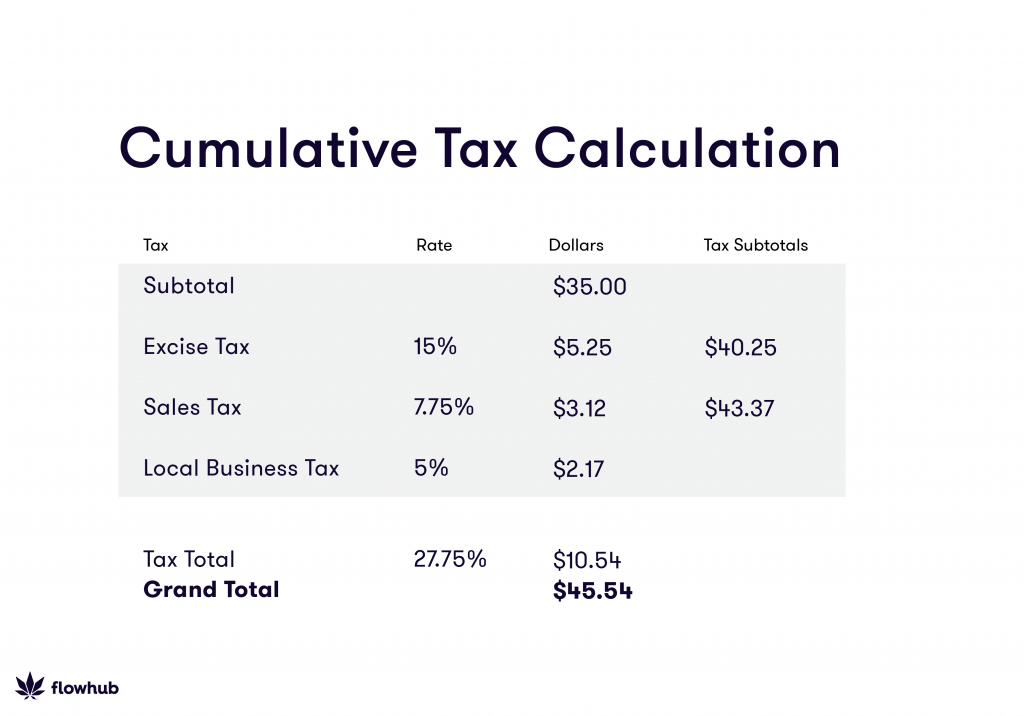

How To Calculate Cannabis Taxes At Your Dispensary

11897 What Is A Week 1 Month 1 Tax Code

11897 What Is A Week 1 Month 1 Tax Code

What Does Tax Code 1257L Mean Tax Rebates

STOP TRUDEAU S CARBON TAX 2 Conservative Party Of Canada

The Steps To Going Self Employed Explained Goselfemployed co

Non Cumulative Tax Code Rebate - Web W1m M1 or X These are emergency tax codes non cumlative tax codes The above tax codes can also include an S or a C If they contain an S you are being taxed under