Non Highway Use Fuel Tax Credit Untaxed uses of fuels Not all fuels are taxed by the federal government There are a variety of circumstances where the government may not tax or implement

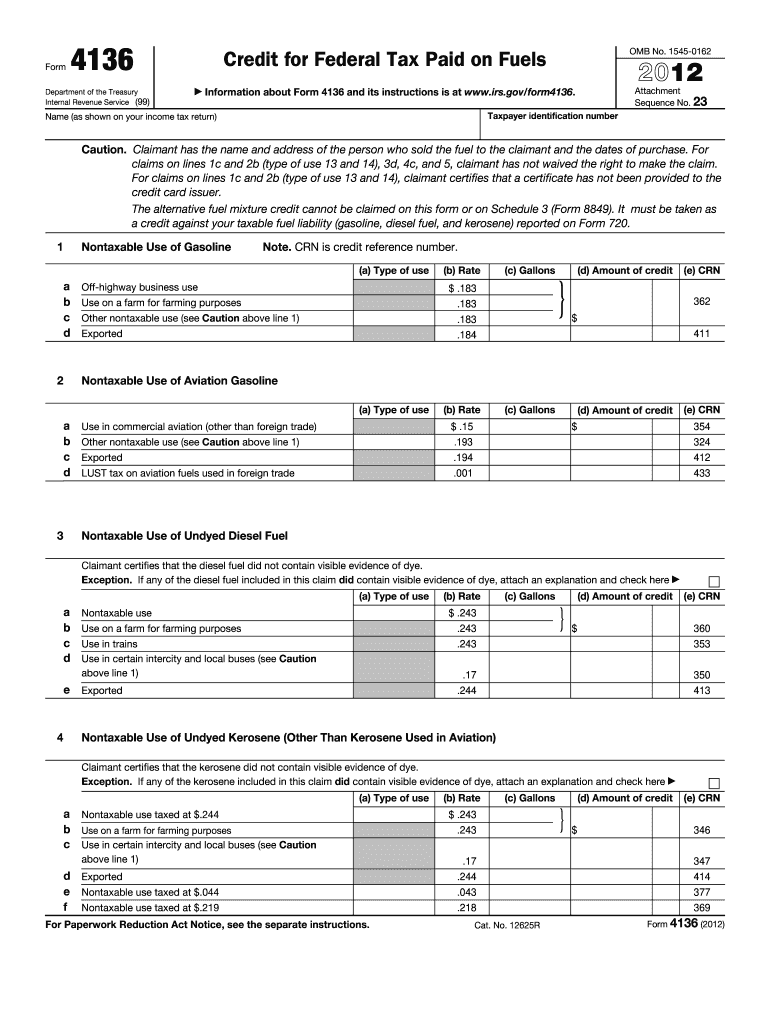

The form lists specific fuels and their applicable credit rates Nontaxable Uses of Fuel You can claim credits for nontaxable uses of fuels such as off highway Line 1 Nontaxable Use of Gasoline Who can claim this credit Generally the ultimate purchaser is the only entity who can claim a tax credit on business use of gasoline Allowable uses A taxpayer may

Non Highway Use Fuel Tax Credit

Non Highway Use Fuel Tax Credit

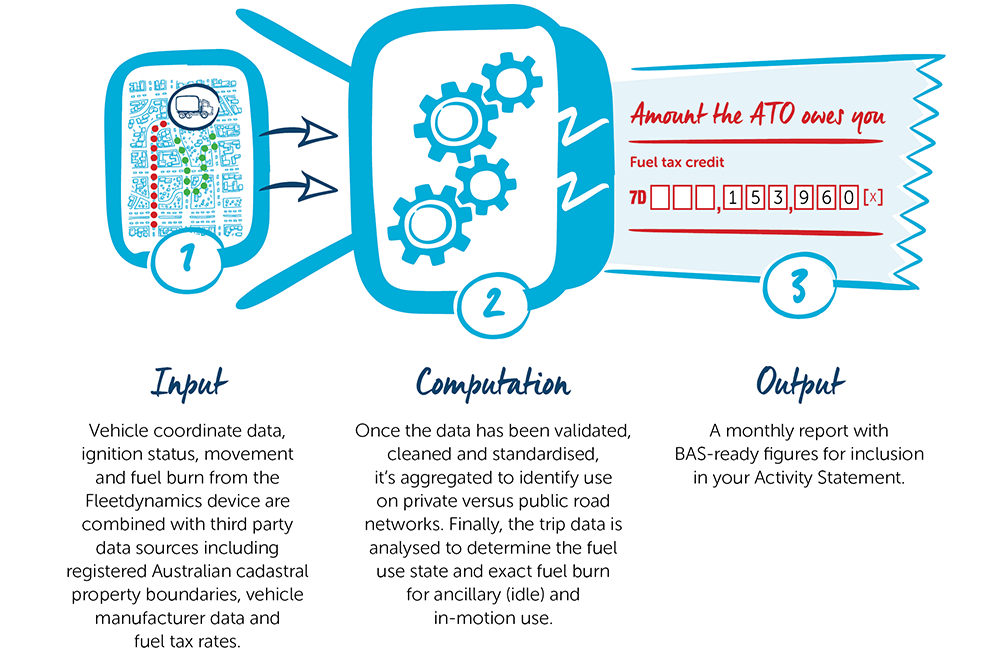

https://www.fleetcare.com.au/Fleetcare/media/Images/Infographic/Fuel-Tax-Credits-Infographic.png?ext=.png

Fuel Tax Credit UPDATED JUNE 2022

https://telematics-australia.com/wp-content/uploads/2020/06/Fuel-Tax-Credits.png

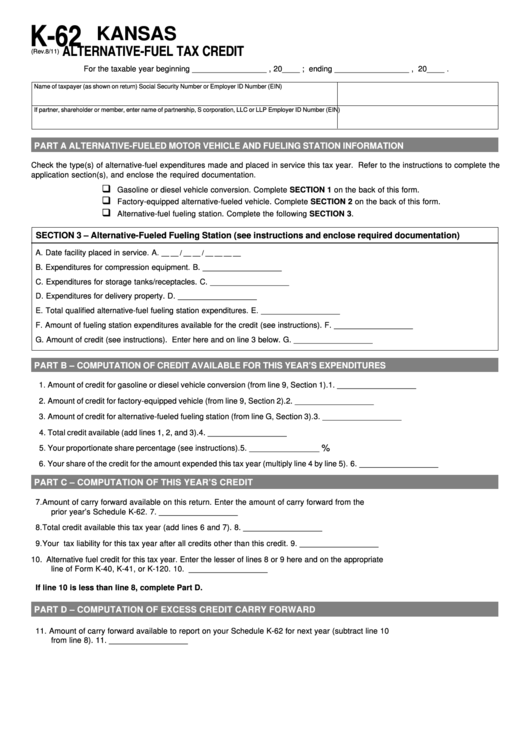

Schedule K 62 Alternative Fuel Tax Credit Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/320/3203/320397/page_1_thumb_big.png

You can claim a credit for fuels used for nontaxable purposes like off highway business use or use on a farm for farming purposes For example fuel used The primary reason for the federal fuel tax credit is to give a break to non highway use fuel purchases The federal government imposes two types of tax on gasoline and diesel fuel Excise tax

1 min read Share You can claim a credit for federal excise tax you paid on fuels you used On a farm for farming purposes Ex fuel used to run a tractor while plowing On a boat Form 4136 allows taxpayers to claim a credit for federal excise taxes paid on fuels used for nontaxable purposes such as Off highway business use Use on a

Download Non Highway Use Fuel Tax Credit

More picture related to Non Highway Use Fuel Tax Credit

Fuel Tax Credits MYOB AccountRight MYOB Help Centre

http://help.myob.com/wiki/download/attachments/9340523/journal.PNG?version=2&modificationDate=1480472857000&api=v2

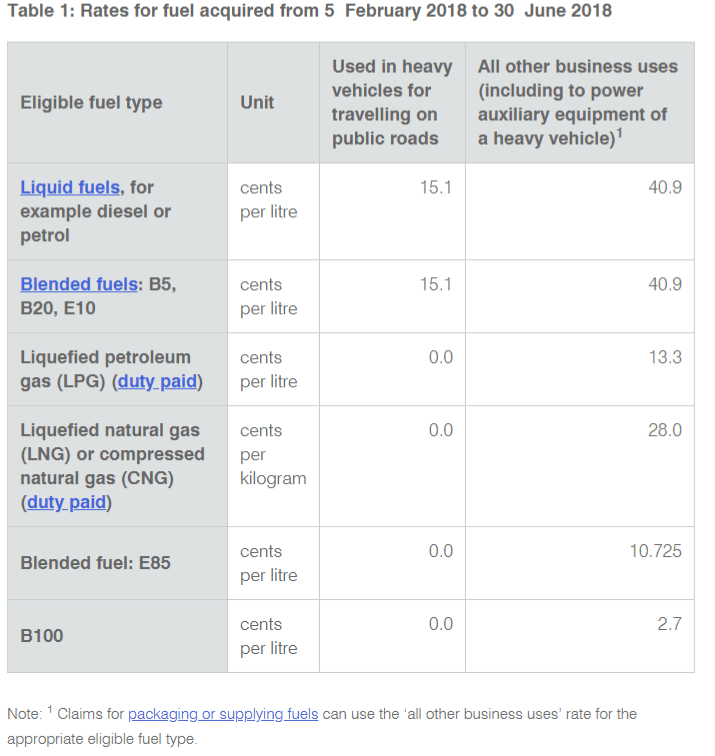

Fuel Tax Credit Atotaxrates info

https://atotaxrates.info/wp-content/uploads/2018/02/hoZSxv1.png

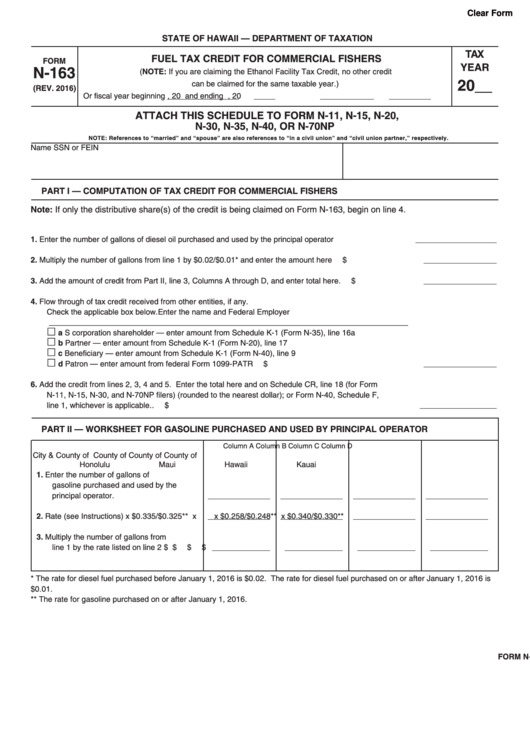

Fillable Form N 163 Fuel Tax Credit Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/128/1280/128053/page_1_thumb_big.png

The rate varies between 18 3 cents and 24 3 cents per gallon depending on the fuel type In general Sec 4041 imposes excise taxes on fuels used for specific purposes including There are many other non taxable uses of fuel that are also intitled to the credit For instance if you are a non profit organization you may benefit too even if you are using

The information contained in the Knowledgebase KB is for general information only and is not intended to be tax financial or legal advice The user is encouraged to review To claim a refund for motor fuel tax paid on fuel used for exempt non highway purposes the ultimate consumer or retailer must file the claim within one year of the date of

Fuel Tax Credits Explained BOX Advisory Services

https://boxas.com.au/wp-content/uploads/2021/05/Fuel-980x570.jpg

Credit For Federal Tax Paid On Fuels IRS Gov Fill Out And Sign

https://www.signnow.com/preview/6/954/6954663/large.png

https://turbotax.intuit.com/tax-tips/small...

Untaxed uses of fuels Not all fuels are taxed by the federal government There are a variety of circumstances where the government may not tax or implement

https://www.taxfyle.com/blog/form-4136-tax-credit...

The form lists specific fuels and their applicable credit rates Nontaxable Uses of Fuel You can claim credits for nontaxable uses of fuels such as off highway

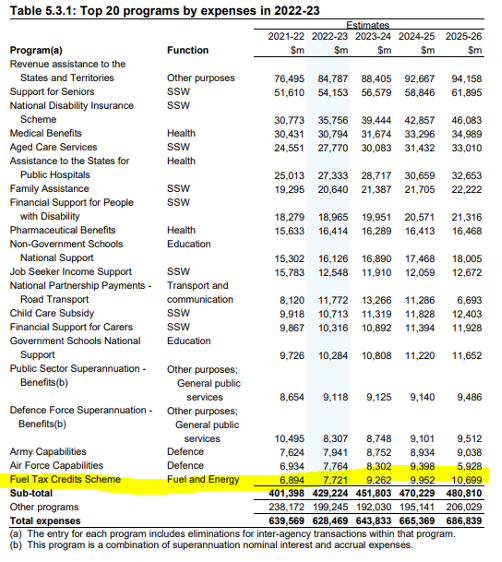

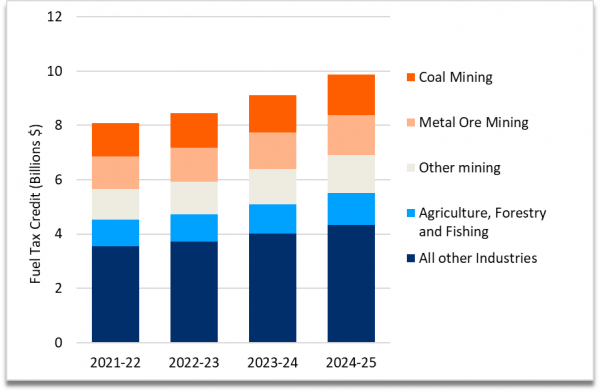

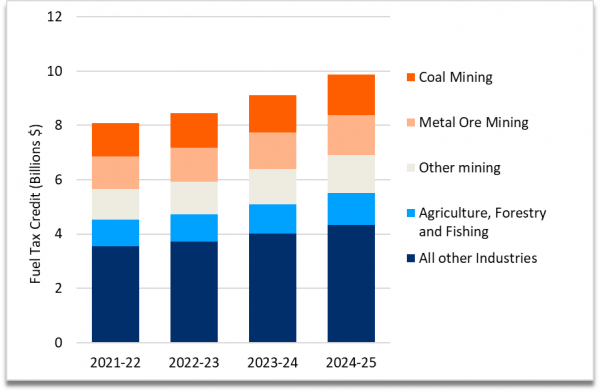

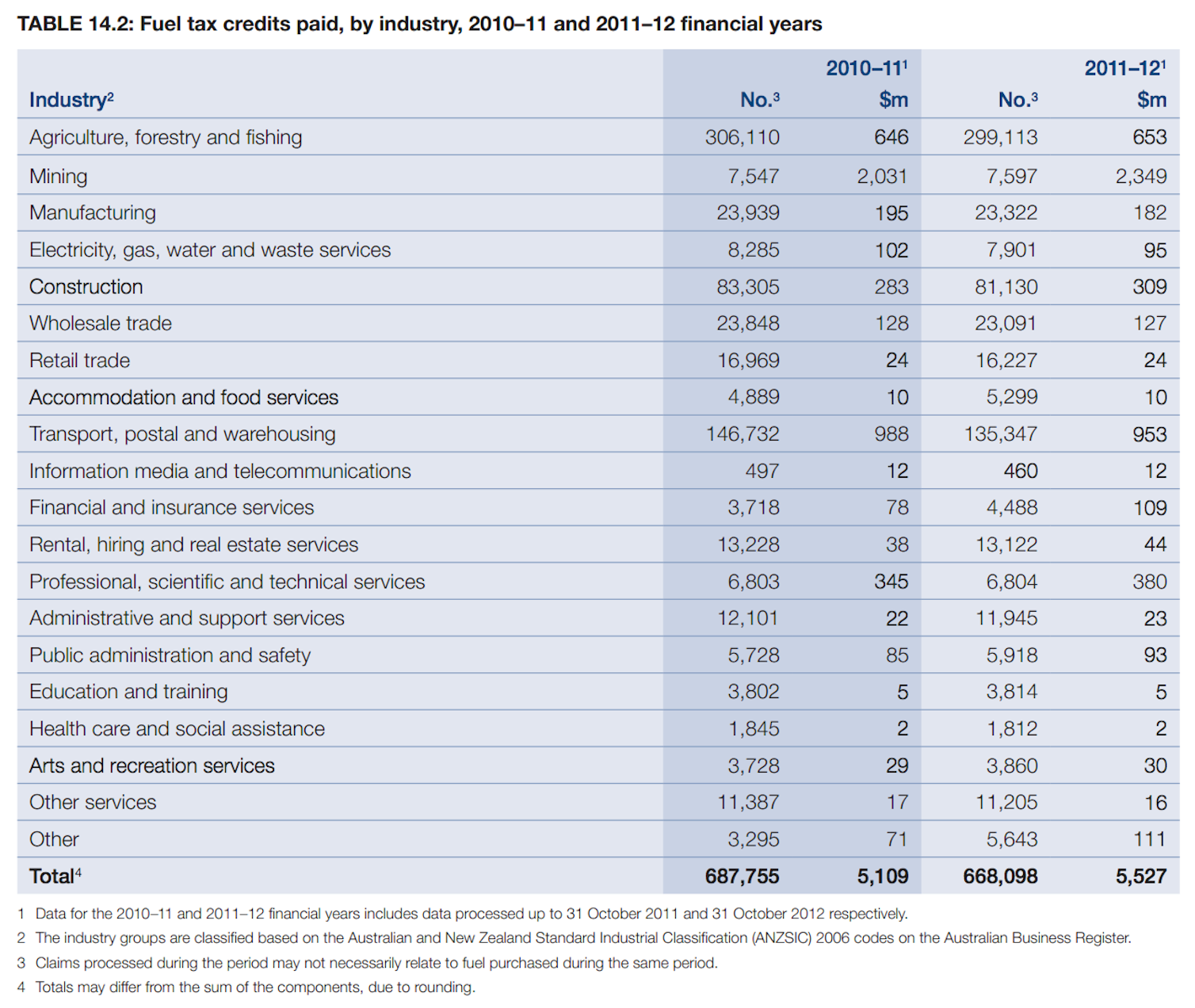

Never Mine The Budget Here s The Fuel Tax Credit Scheme The

Fuel Tax Credits Explained BOX Advisory Services

Automatic Fuel Tax Credit Calculation PS Support

Fuel Tax Credit Changes 2022 Aintree Group

:max_bytes(150000):strip_icc()/FuelTaxCredit4-3V1-3b25b99dc86b458a877911fb8fea6c80.png)

Fuel Tax Credit Definition

And The Award For Biggest Fossil Fuel Subsidy Goes To The Fuel Tax

And The Award For Biggest Fossil Fuel Subsidy Goes To The Fuel Tax

Viewpoints Should Fuel Tax Credits Be Cut In The Budget

Fuel Tax Credit Calculator Banlaw

Fuel Tax Credits CIB Accountants Advisers

Non Highway Use Fuel Tax Credit - Businesses that use fuel for off highway purposes i e in equipment not meant to travel on roads or highways such as lawnmowers blowers etc are eligible for a 100 refund