Non Refundable Tax Credit Vs Refundable A nonrefundable tax credit is a reduction in the amount of income taxes that a taxpayer owes It can reduce the amount owed to zero but no further In other words the taxpayer forfeits

Key Takeaways Tax credits can reduce the amount of income tax you have to pay and even get you money from the government Refundable tax credits are amounts that you receive regardless of how much income tax Taxpayers subtract both refundable and nonrefundable credits from the income taxes they owe If a refundable credit exceeds the amount of income taxes owed the difference is paid as a refund If a nonrefundable credit exceeds the

Non Refundable Tax Credit Vs Refundable

Non Refundable Tax Credit Vs Refundable

https://i.ytimg.com/vi/uMhxbPTRo8I/maxresdefault.jpg

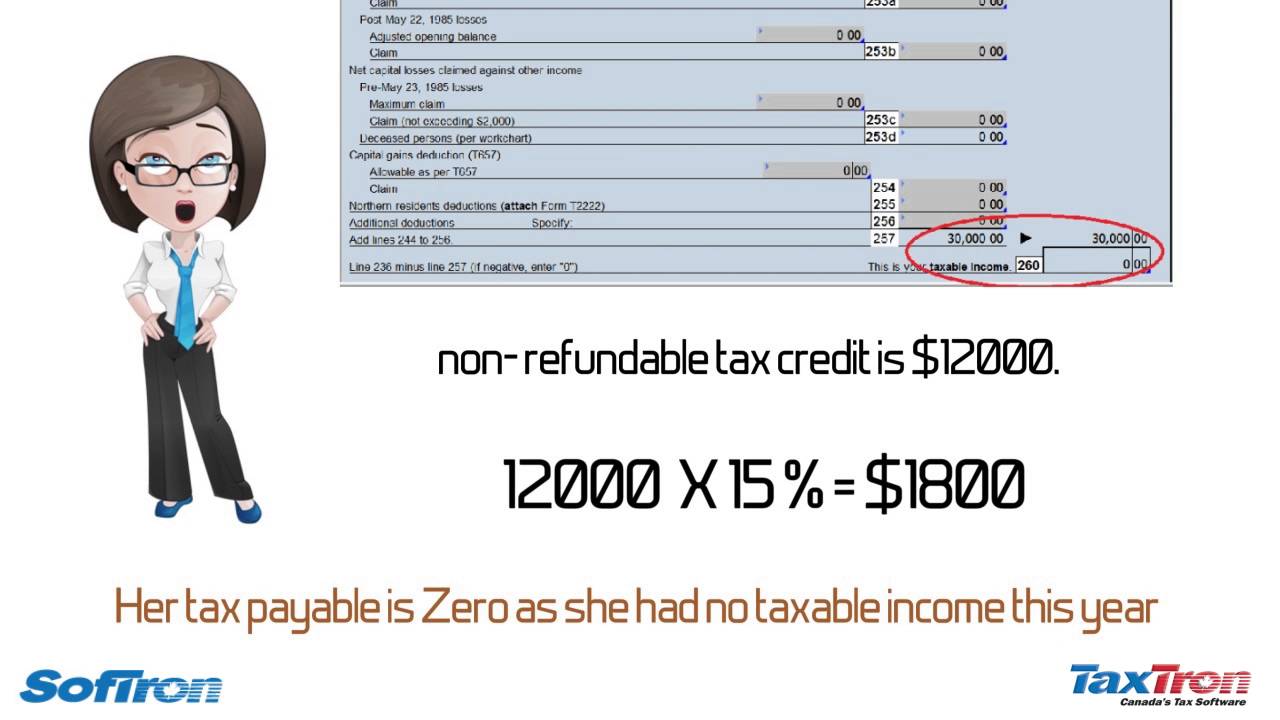

Refundable V Non refundable Tax Credits What s The Difference YouTube

https://i.ytimg.com/vi/38DAHVg252Q/maxresdefault.jpg

Refundable Vs Nonrefundable Tax Credits

https://edgefinancial.com/wp-content/uploads/2020/02/refundable-tax-credits-vs-nonrefundable-tax-credits.jpg

A tax credit is a dollar for dollar amount taxpayers claim on their tax return to reduce the income tax they owe Eligible taxpayers can use them to reduce their tax bill and Both refundable and nonrefundable tax credits lower your tax bill dollar for dollar Nonrefundable credits only apply to your tax liability while refundable tax credits can wipe out your tax bill and provide a refund for the

A nonrefundable tax credit is a type of state or federal credit that offsets your tax bill dollar for dollar It s called nonrefundable because once your tax bill has been reduced to A refundable tax credit is a credit you can get as a refund even if you don t owe any tax Tax credits are amounts you subtract from your bottom line tax due when you file your

Download Non Refundable Tax Credit Vs Refundable

More picture related to Non Refundable Tax Credit Vs Refundable

What Is The Difference Between Non refundable And Refundable Tax

https://cdn.taxory.com/wp-content/uploads/2020/12/refundable-and-non-refundable-tax-credits.jpg

Refundable Vs Non Refundable Tax Credits

https://heavencpa.com/wp-content/uploads/2019/04/tax-credits.jpg

Non Refundable Tax Credits Use It Or Lose It CPA Brampton

https://www.cpabrampton.com/wp-content/uploads/2020/05/tax-credits-services.jpg

A tax credit is subtracted from the amount of tax due and is more valuable than a tax deduction which reduces the income subject to tax A non refundable tax credit can only take your tax For example if you owe 200 in taxes but have a 300 refundable credit you ll get a 100 refund Non refundable tax credits on the other hand can only reduce your tax

The key difference between a non refundable and a refundable tax credit is that non refundable tax credits are designed to reduce your tax payable to zero and don t result in a tax refund So you can get a refund if you overpaid your taxes even though the tax credit is called non refundable On the other hand suppose your total tax is 5000 for the year Then the fact that

Maximizing Your Refundable And Non Refundable Tax Credits

https://torontoaccountant.ca/wp-content/uploads/2014/04/TaxCredits-1484x742.png

TaxTips ca 2023 Non Refundable Personal Tax Credits Tax Amounts

https://www.taxtips.ca/nrcredits/2023-personal-tax-credits.jpg

https://www.investopedia.com › terms …

A nonrefundable tax credit is a reduction in the amount of income taxes that a taxpayer owes It can reduce the amount owed to zero but no further In other words the taxpayer forfeits

https://turbotax.intuit.ca › tips › refunda…

Key Takeaways Tax credits can reduce the amount of income tax you have to pay and even get you money from the government Refundable tax credits are amounts that you receive regardless of how much income tax

United States How Do Non refundable Tax Credits Combine With Fully

Maximizing Your Refundable And Non Refundable Tax Credits

Refundable Non Refundable Tax Credits YouTube

Tax Credit Refundable Vs Non refundable YouTube

Refundable Vs Non Refundable Tax Credits What s The Difference

Refundable Vs Non refundable Tax Credits Caras Shulman

Refundable Vs Non refundable Tax Credits Caras Shulman

Refundable Vs Non refundable Tax Credits

Tax Credit Vs Tax Deduction What s The Difference Guide

What Are Refundable Tax Credits YouTube

Non Refundable Tax Credit Vs Refundable - A refundable tax credit is a credit you can get as a refund even if you don t owe any tax Tax credits are amounts you subtract from your bottom line tax due when you file your