Non Resident Canada Tax Return Address You are a non resident of Canada for tax purposes if any of the following applies You did not have significant residential ties in Canada and lived outside Canada throughout the

To ensure that the correct portion of tax is deducted by your Canadian payers people employers or other entities who pay you money you should notify For a non resident who emigrated in early 2022 what mailing address do I use on the T1 condensed form as the form StudioTax seems to offer only Canadian address fields ie

Non Resident Canada Tax Return Address

Non Resident Canada Tax Return Address

https://manojkukreja.ghost.io/content/images/2021/08/Non-Resident-Purchasing-a-Property-in-Canada.jpg

I Am A Non Resident And I Own A Rental Property In Canada Grant

http://grantcga.com/wp-content/uploads/2019/01/non-resident-rax-1024x640.jpg

https://www.reallifeincanada.ca/wp-content/uploads/2015/03/canada-tax-return.resized-600x400.jpg

Non residents or people with non Canadian addresses can t use netfile If you need to file a non resident return you can use Genutax print and mail the return Does your financial If living in the US UK France Netherlands or Denmark mail your non resident tax return to Winnipeg Tax Centre Post Office Box 14001 Station Main Winnipeg MB R3C 3M3

If all of the income for a non resident from Canadian sources is subject to withholding tax the non resident is not required to file a tax return This article will To file your Canadian non resident tax return you need your Social Insurance Number but if you don t have one you need to apply for an Individual Tax Number using Form T1261 Application for a CRA ITN

Download Non Resident Canada Tax Return Address

More picture related to Non Resident Canada Tax Return Address

Tax Obligations As A Non Resident Of Canada

https://www.nbgcpa.ca/wp-content/uploads/2022/07/Non-resident-taxes-1024x683.jpg

Open A Non Resident Bank Account In Canada GlobalBanks

https://globalbanks.com/wp-content/uploads/2020/03/open-non-resident-bank-account-canada-760x507.jpg

How To Become A Non Resident Of Canada

https://i0.wp.com/www.onthemovetoronto.com/wp-content/uploads/2018/06/exit-tax.jpg?w=3000&ssl=1

Learn about the process of filing a Canadian income tax return as a non resident including the use of income tax packages based on your income sources It s crucial to send your tax return to the correct tax centre to prevent any delays in processing For instance if you reside in British Columbia Alberta

You may be considered a non resident for Canadian tax purposes You can apply to the CRA for an assessment of your resident status by filling out Form NR74 Determination If you are a non resident you can only send your tax return by mail Online Filing online is the fastest and easiest way to do your taxes Before you file your taxes online make

BUY CANADIAN RESIDENT PERMIT Global Doc Vendors

https://globaldocvendors.com/wp-content/uploads/2023/02/7427224_f520.jpg

Top 6 Tax Tips For Filing A Canadian Tax Return

https://workingholidayincanada.com/wp-content/uploads/2017/03/tax.png

https://www.canada.ca/en/revenue-agency/services/...

You are a non resident of Canada for tax purposes if any of the following applies You did not have significant residential ties in Canada and lived outside Canada throughout the

https://turbotax.intuit.ca/tips/filing-income-tax...

To ensure that the correct portion of tax is deducted by your Canadian payers people employers or other entities who pay you money you should notify

The Basics Of Tax In Canada WorkingHolidayinCanada

BUY CANADIAN RESIDENT PERMIT Global Doc Vendors

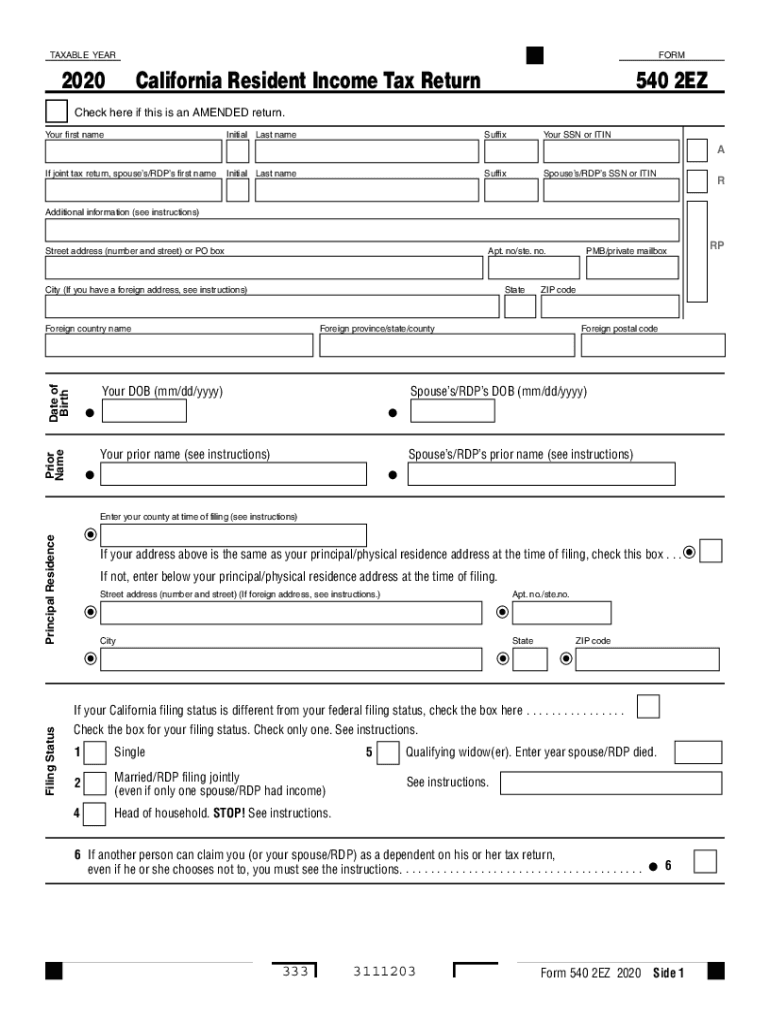

Ca 2020 2024 Form Fill Out And Sign Printable PDF Template SignNow

Open Your Account As Non resident Canada Tax

Open Your Account As Non resident Canada Tax

Tax Obligations For A Non Resident Of Canada Filing Taxes

Tax Obligations For A Non Resident Of Canada Filing Taxes

Certificate Of Residency Sample Only PDF Immigration Law Citizenship

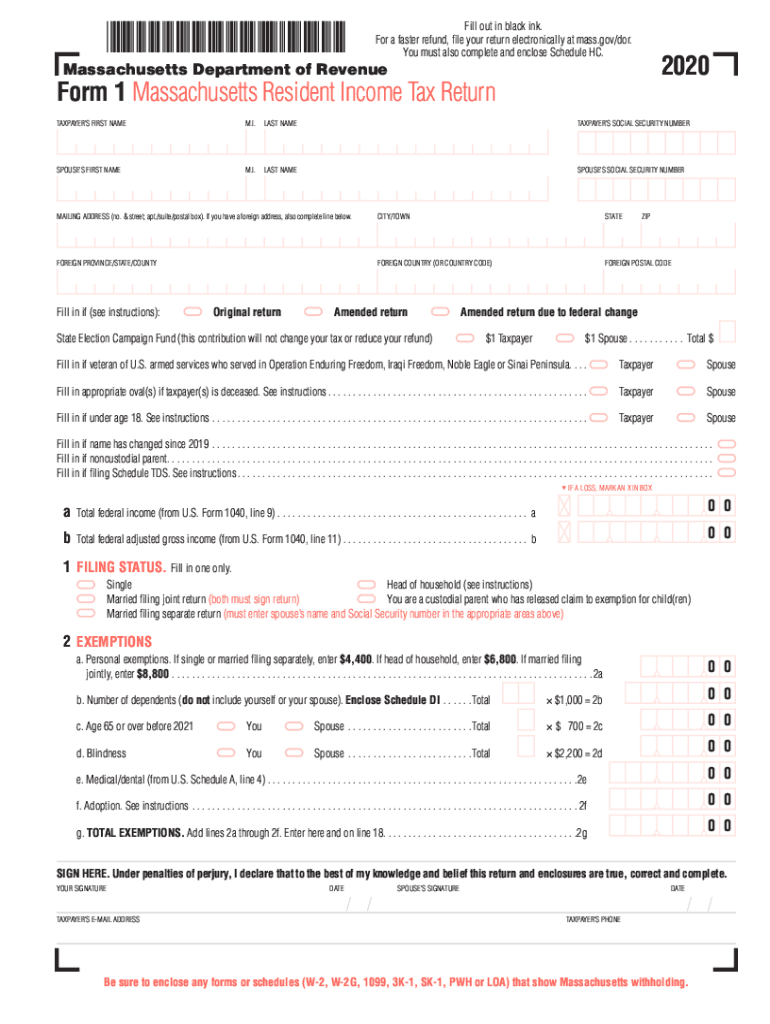

Massachusetts Tax S 2020 2024 Form Fill Out And Sign Printable PDF

Non resident Buying Property In Canada Here s What You Need To Know

Non Resident Canada Tax Return Address - If all of the income for a non resident from Canadian sources is subject to withholding tax the non resident is not required to file a tax return This article will