Non Working Spouse Dependent Tax Purposes If you file a separate return you can claim an exemption for your spouse only if your spouse Had no gross income Is not filing a return and Was not the

This interview will help you determine whom you may claim as a dependent Information you ll need Marital status relationship to the dependent and the amount of support provided Basic income You can claim a child spouse relative and even a friend as a tax dependent to lower your taxes This is how the IRS determines who can qualify

Non Working Spouse Dependent Tax Purposes

Non Working Spouse Dependent Tax Purposes

https://digitalasset.intuit.com/IMAGE/A7GUqbw2k/rules-for-claiming-a-dependent-on-your-tax-return_L8LODbx94.jpg

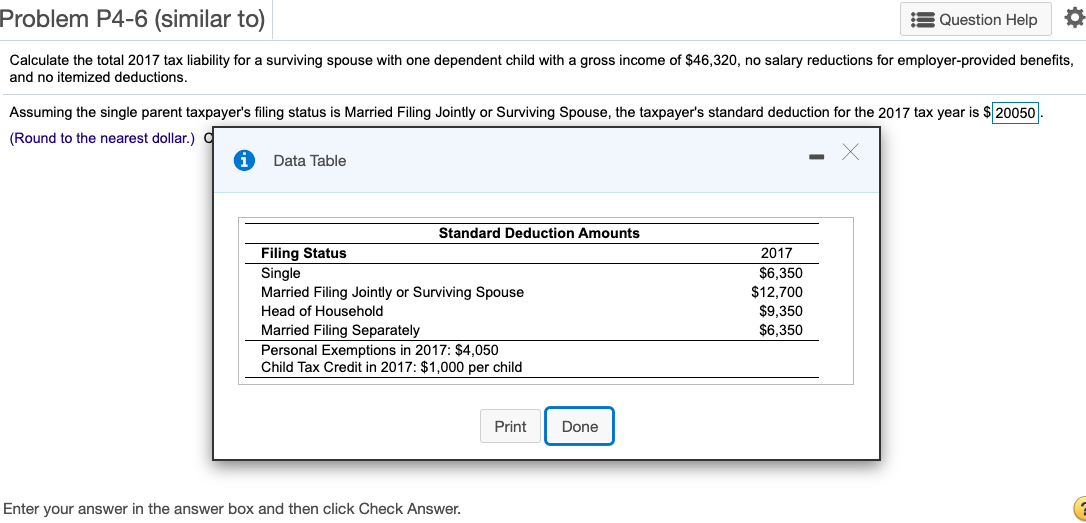

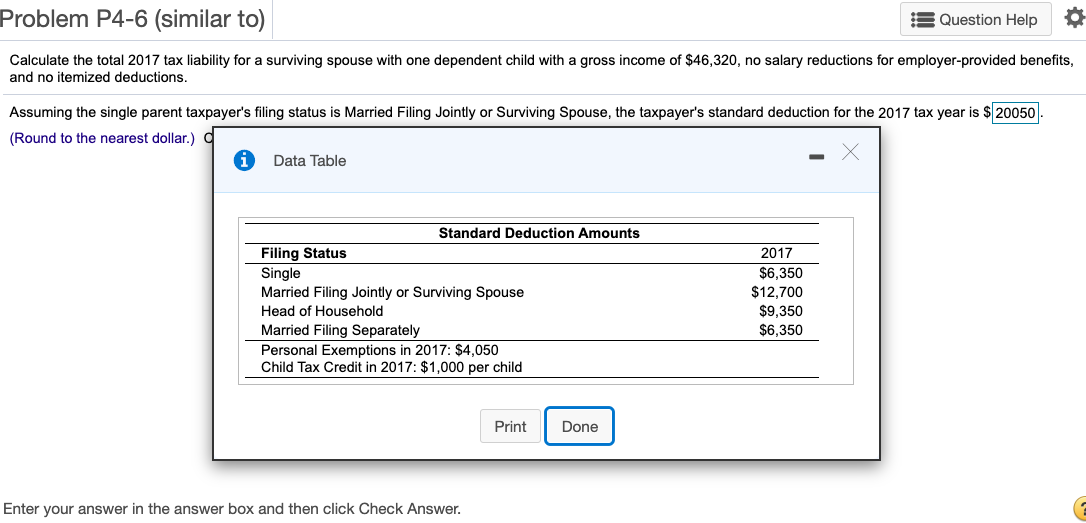

Solved Problem P4 6 similar To Question Help Calculate The Chegg

https://media.cheggcdn.com/media/b01/b011a9f1-150d-4348-b67e-8a016a5eb75d/phpBOUCCQ.png

/claiming-adult-dependent-tax-rules-4129176-83b1f0c58bf94edca0609dacc7e750fe.gif)

Tax Rules For Claiming Adult Dependents

https://www.thebalance.com/thmb/FXks3aphUUVlzdXrmiOO3JpDr74=/1500x1000/filters:fill(auto,1)/claiming-adult-dependent-tax-rules-4129176-83b1f0c58bf94edca0609dacc7e750fe.gif

The IRS allows you to claim two types of dependents on your tax return qualifying children and qualifying relatives Qualifying relatives don t need to be related by blood or under a state level It s never been possible to claim your spouse as a dependent but you could claim their personal exemption on your return under some circumstances through the tax year 2017 The Tax Cuts

A tax dependent is a qualifying child or relative who can be claimed on a tax return Dependents must meet certain criteria including residency and relation in order to qualify Employing the spouse can reduce overall tax liability because under Sec 105 b the spouse can receive tax free reimbursement of medical expenses from the

Download Non Working Spouse Dependent Tax Purposes

More picture related to Non Working Spouse Dependent Tax Purposes

Can I Claim My Girlfriend Or Boyfriend As A Dependent Me As A

https://i.pinimg.com/originals/ff/e6/42/ffe642da513749f656865c29fc9202fc.png

Spouse Dependent Work Permit Extension For Canada Know More From Given

https://i.pinimg.com/originals/85/01/6c/85016c012379a4b19396034d23811491.jpg

What Is The Phase Out For Dependent Care Credit Latest News Update

https://i2.wp.com/static.twentyoverten.com/5afae91ee233a94fd2b8b963/AyQa5SwvUG/1616431432591.png

Your non married partner cannot be claimed as a tax dependent if they had a 2022 gross income of more than 4 400 Gross income includes any income that is subject to federal taxations i e A higher percent of your Social Security benefits may be taxable Your limit for SALT state and local taxes and sales tax will be only 5000 per spouse In many

You do not claim a spouse as a dependent When you are married and living together you can only file a tax return as either Married Filing Jointly or Married Parents who are divorced separated never married or live apart and who share custody of a child with an ex spouse or ex partner need to understand the specific

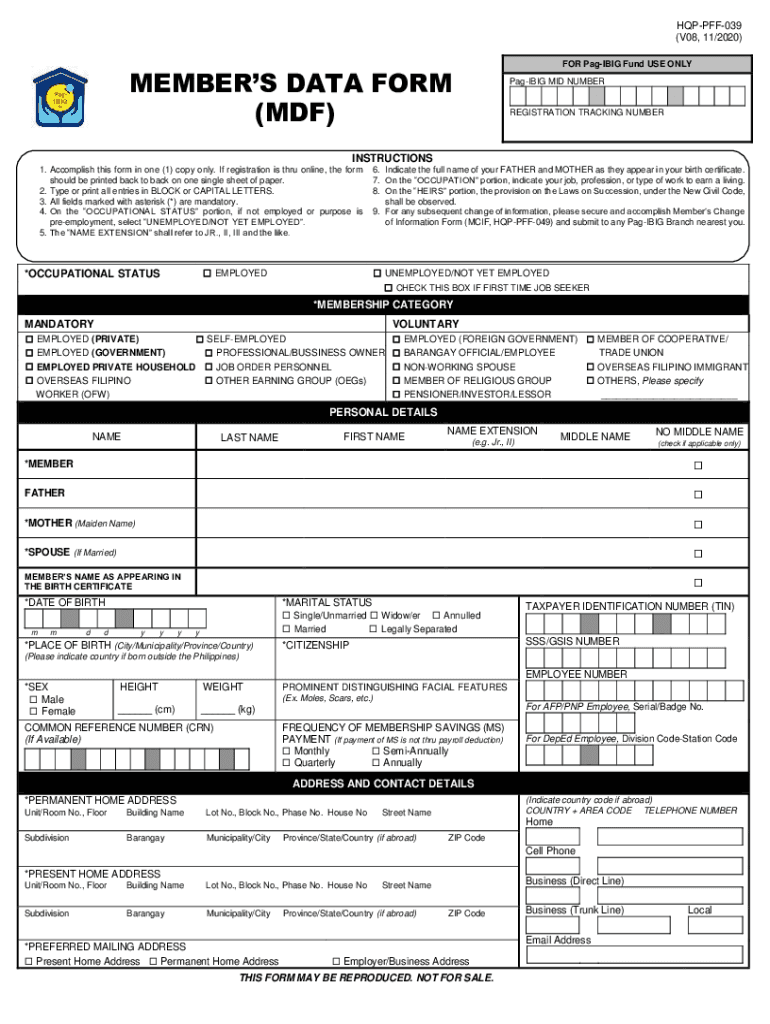

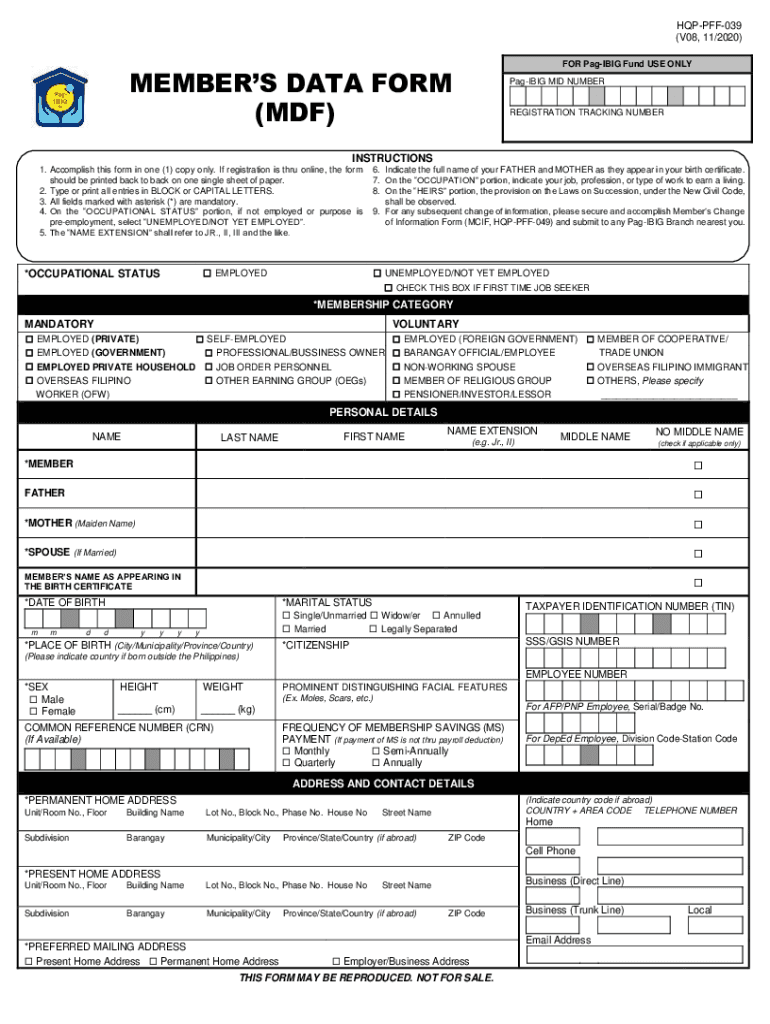

Pag Ibig Membership Registration 2020 2024 Form Fill Out And Sign

https://www.signnow.com/preview/533/146/533146929/large.png

How To Determine If You Can Claim A Dependent On Your Tax Return

https://polstontax.com/wp-content/uploads/2019/04/Dependent-Tax-ReturnjpgkeepProtocol-1024x694.jpeg

https://ttlc.intuit.com/community/taxes/discussion/...

If you file a separate return you can claim an exemption for your spouse only if your spouse Had no gross income Is not filing a return and Was not the

https://www.irs.gov/help/ita/whom-may …

This interview will help you determine whom you may claim as a dependent Information you ll need Marital status relationship to the dependent and the amount of support provided Basic income

Splitting Rental Income With A Spouse For Tax Purposes Legislate

Pag Ibig Membership Registration 2020 2024 Form Fill Out And Sign

DIC Benefits Benefit Tax Free Spouse

Who Can I Claim As Dependents On My Taxes Tax Tax Return Dependable

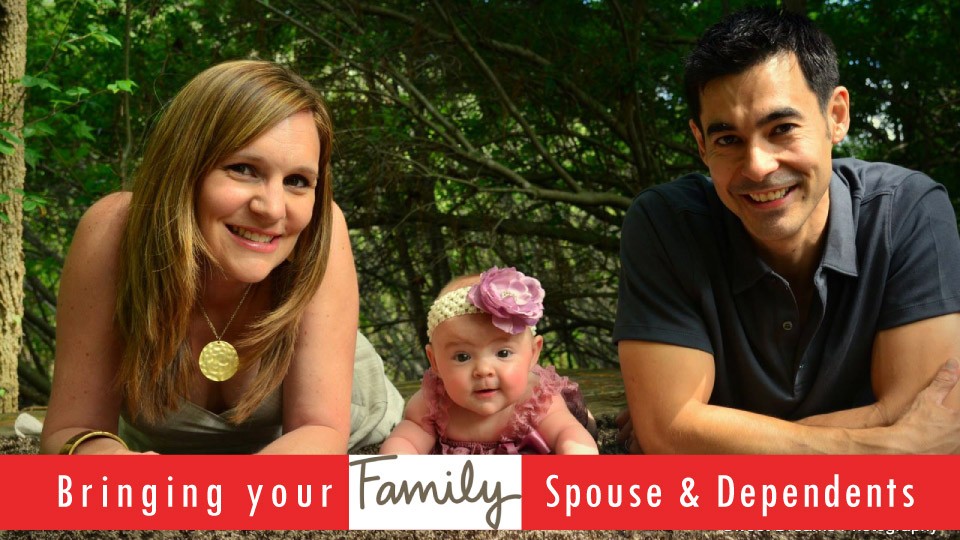

Bringing Spouse Dependent UK Study Abroad

Care Credit Printable Application Printable Word Searches

Care Credit Printable Application Printable Word Searches

Dependent Tax Credit Claim Eligibility And Exceptions FastnEasyTax

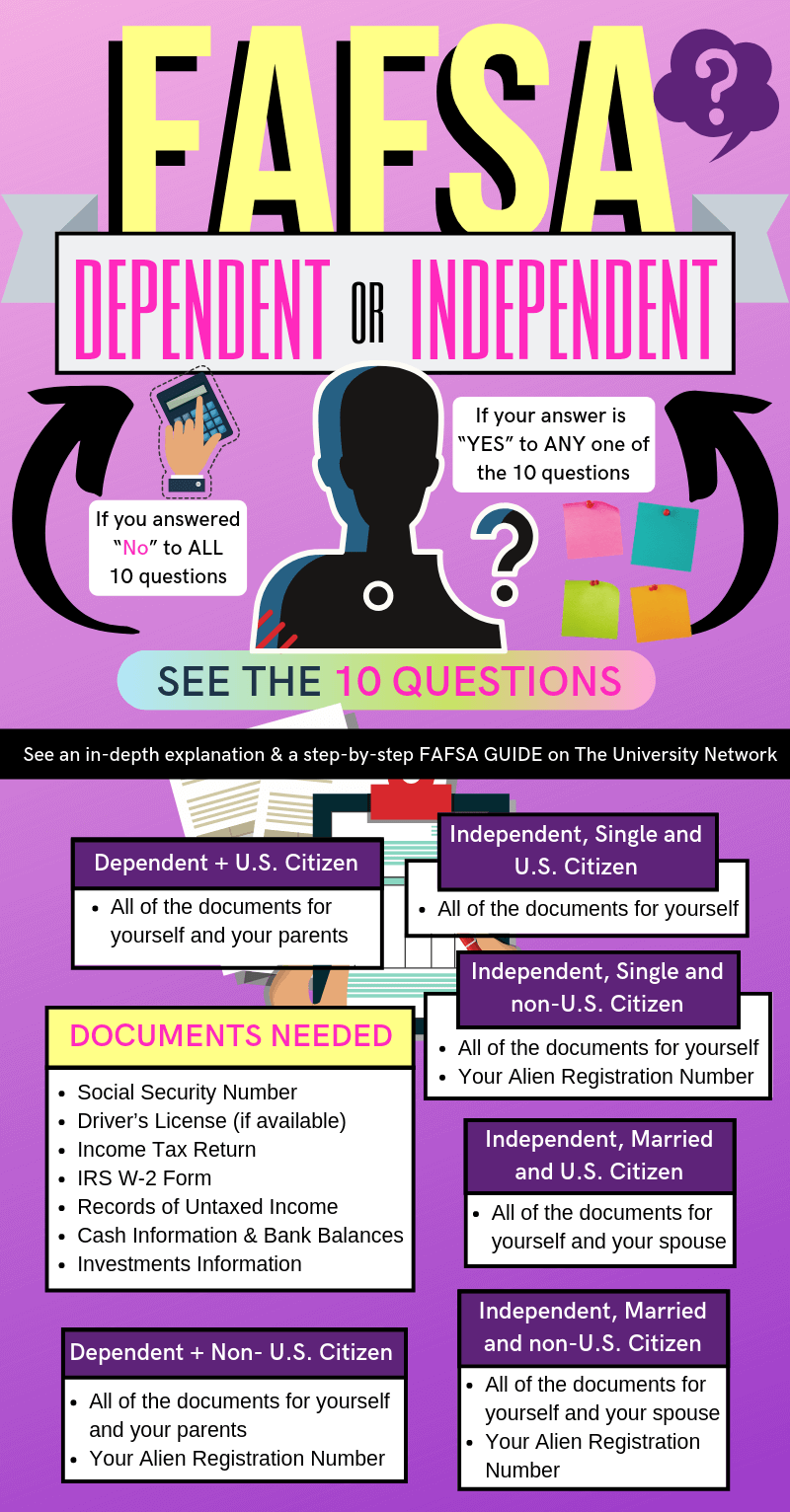

Am I A Dependent Or Independent Student For FAFSA Purposes TUN

Spouse Dependent Work Permit For Canada Processing Time Application

Non Working Spouse Dependent Tax Purposes - If your spouse is a nonresident alien you can treat your spouse as a resident alien for tax purposes If you choose this option you can file a joint tax return