Not Filing Itr Penalty Not filing your Income Tax Return ITR can lead to serious consequences especially if you owe more than Rs 25 000 in taxes In such cases you could face imprisonment for 6 months to 7 years and a fine

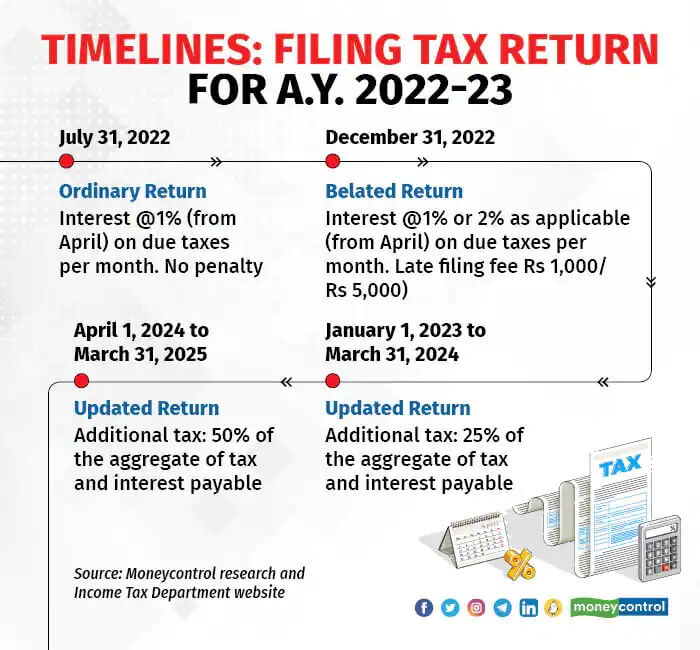

If you miss filing the ITR by the due date you can file the belated return by 31st December 2025 However you For FY 2023 24 the last date to file ITR without penalty is 31st July 2024 Failing to meet the deadline can result in significant penalties Understanding the penalty for late filing of ITR can save you from unnecessary stress and additional costs

Not Filing Itr Penalty

Not Filing Itr Penalty

https://images.moneycontrol.com/static-mcnews/2022/07/Penalties-2-belate-returns-ITR-.jpg

ITR Filing Last Date To File ITR For AY 2022 23 FY 2021 22 Lendingkart

https://media.lendingkart.com/wp-content/uploads/2022/07/ITR-returns-1024x538.jpg

File Income Tax Return For FY 2021 22 Now Online To Avoid Rs 5000

https://images.hindustantimes.com/tech/img/2022/07/15/960x540/itr_1638249050262_1657879361820_1657879361820.PNG

Penalty for not Filing ITR Know more about the Penalty for Not Filing the ITR Late Filing of ITR How to Pay the Penalty Online and Offline Check all the Consequences of Not Filing ITR on Penalty After December 31 2023 Assessees who fail to file their ITR even after December 31 2023 will be subjected to a stiffer penalty of Rs 10 000 This additional penalty highlights the importance of taking prompt

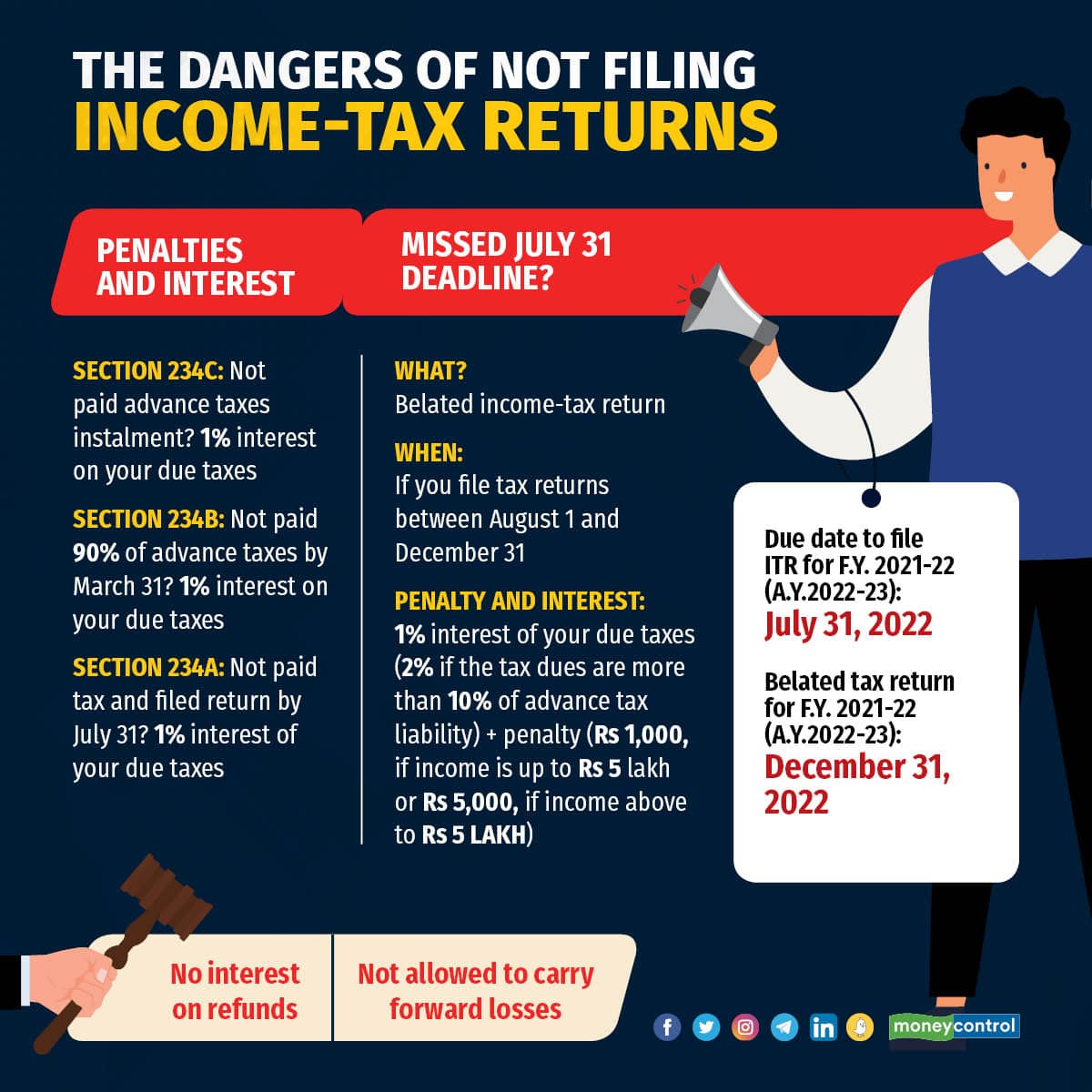

As per income tax laws not everyone is required to pay a late filing fee for filing ITR after the expiry of the deadline If a person whose gross total income does not exceed the basic exemption limit files a belated ITR then Section 234F of the Income tax Act 1961 levies a penalty on the taxpayer if his her ITR is filed after the deadline An income tax return filed after the last date is called belated ITR A penalty of Rs 5 000 is levied at the time

Download Not Filing Itr Penalty

More picture related to Not Filing Itr Penalty

Penalty For Late Filing Of ITR Everything You Need To Know

https://www.taxhelpdesk.in/wp-content/uploads/2023/07/Penalty-for-late-filing-of-ITR.png

ITR Filing Due To Technical Difficulties People Are Unable To Fill ITR

https://images.news18.com/ibnkhabar/uploads/2022/07/ITR-Filing-Last-Date-12x9.jpg

Income Tax Return Shah Doshi Chartered Accountants

https://shahdoshi.com/wp-content/uploads/Income-Tax-Return.png

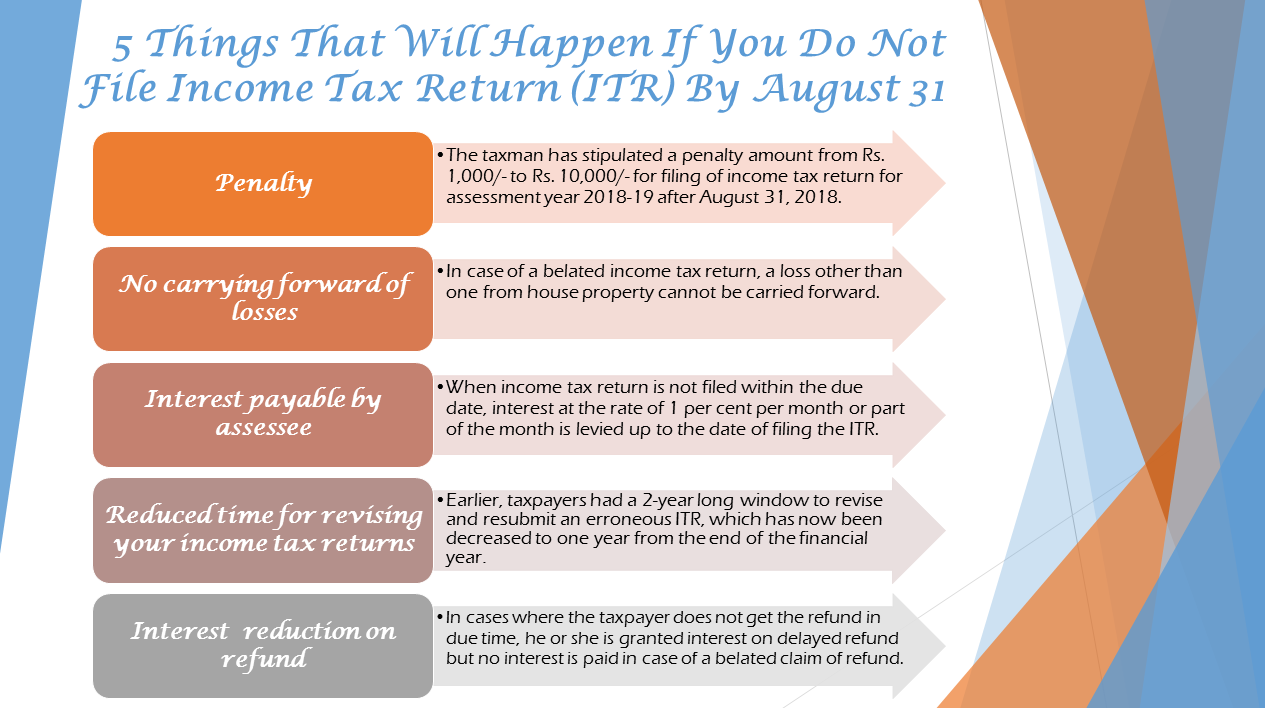

Penalty for Late Filing of ITR in New Income Tax 2025 Clause 428 of income Tax Bill 2025 specifies the fee for failing to file a return of income under Section 263 Here s the fee structure in a tabular format A maximum penalty of 5 000 will be assessed if you file your ITR after 31st July 2024 but before 31st December 2024 However there is leniency for small taxpayers If their total income does not exceed 5 lakh the maximum penalty

If you miss filing the ITR by the due date you can file the belated return by 31st December 2024 However you are required to pay the penalty for late filing The maximum penalty of Rs 5 000 will be levied if you file your ITR after the due date of 31st July 2024 but before 31st December 2024 The Income Tax Act 1961 s Section 234F imposes a penalty of up to Rs 5 000 for late ITR filing If the taxable income does not surpass Rs 5 lakh the penalty amount for small taxpayers is limited to Rs 1 000

ITR Filing FY 2021 22 Know Last Date And Penalty If You Miss DEADLINE

https://cdn.zeebiz.com/sites/default/files/2022/07/18/190204-itr.jpg

ITR Filing Last Due Date FY 2023 24

https://static.wixstatic.com/media/a64f72_d07e6b0e5f6a4fd9ab73f487ed58b899~mv2.jpeg/v1/fill/w_1000,h_563,al_c,q_85,usm_0.66_1.00_0.01/a64f72_d07e6b0e5f6a4fd9ab73f487ed58b899~mv2.jpeg

https://tax2win.in › guide › consequences-if-i-fail-to...

Not filing your Income Tax Return ITR can lead to serious consequences especially if you owe more than Rs 25 000 in taxes In such cases you could face imprisonment for 6 months to 7 years and a fine

https://cleartax.in › belated-return-not-filed...

If you miss filing the ITR by the due date you can file the belated return by 31st December 2025 However you

ITR Filing Last Date Is Holiday For Banks Key Things Taxpayers Should

ITR Filing FY 2021 22 Know Last Date And Penalty If You Miss DEADLINE

ITR Filing Penalty These Taxpayers Are Exempt From Paying A Late Fee

2018 Penalty For Not Filing Annual Return IndiaFilings

ITR Filing Missed Filing Your Tax Returns You Can Still File Them

Know These 6 Benefits Of Filing ITR On Time One Minute Pages

Know These 6 Benefits Of Filing ITR On Time One Minute Pages

Penalty For Late Filing Of Income Tax Return ITR 5paisa

Penalty For Late Filing ITR Investigating The Penalty Structure

Filing Income Tax Returns After Deadline

Not Filing Itr Penalty - So what happens if you don t file your ITR today Let s find out ITR Filing Late Fee Penalty First off individuals who fail to pay their returns by July 31 will have to pay a penalty fee