Not Married 2 Dependents Tax Rebates Web 4 janv 2016 nbsp 0183 32 Ajout Modification 04 01 2016 3 r 233 actions Imp 244 ts gt Exemple gt Couple mari 233 sans enfant revenus modestes Couple mari 233 sans enfant revenus modestes

Web 31 juil 2023 nbsp 0183 32 2 children 47 915 53 865 for married joint filers 1 child 42 158 48 108 for married joint filers The credit ranges from 1 502 no children to 6 728 Web 28 f 233 vr 2021 nbsp 0183 32 Divorced and never married co parents have the chance to pick up an extra 1 100 per dependent child when they file their 2020 returns It requires trust

Not Married 2 Dependents Tax Rebates

Not Married 2 Dependents Tax Rebates

https://media.cheggcdn.com/media/29e/29e60ea7-ac4f-41b4-b3e5-479b24bec3f3/phpYWR6IU

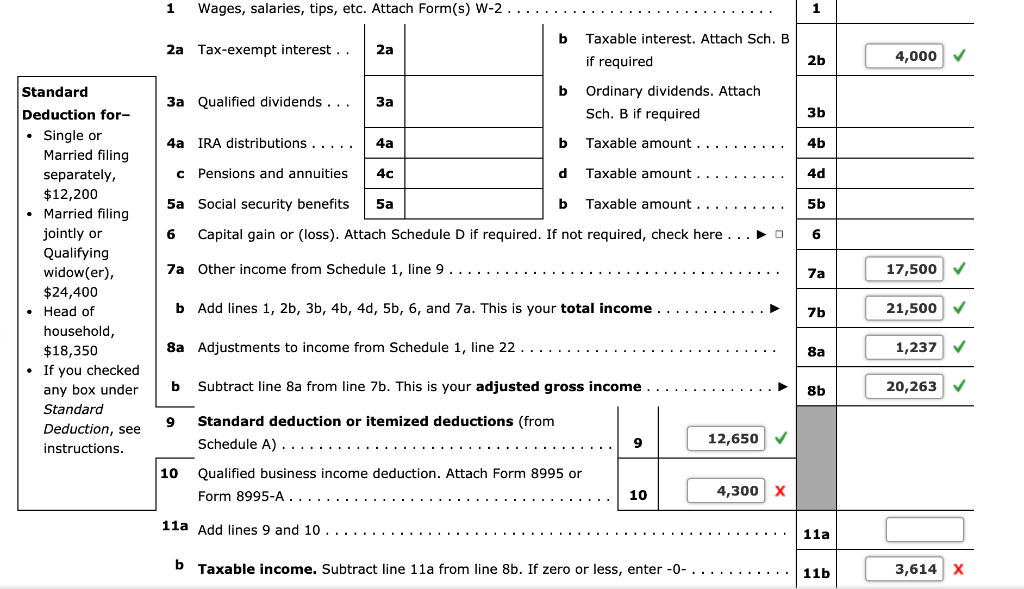

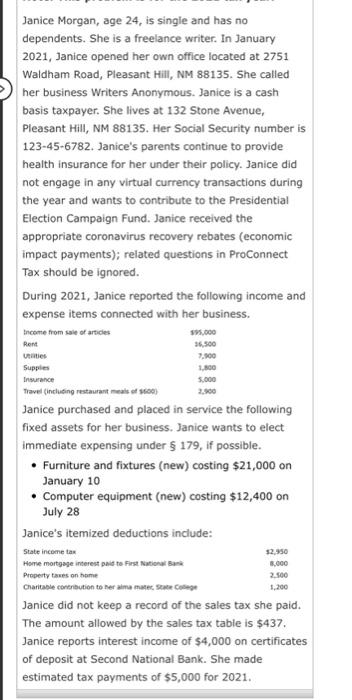

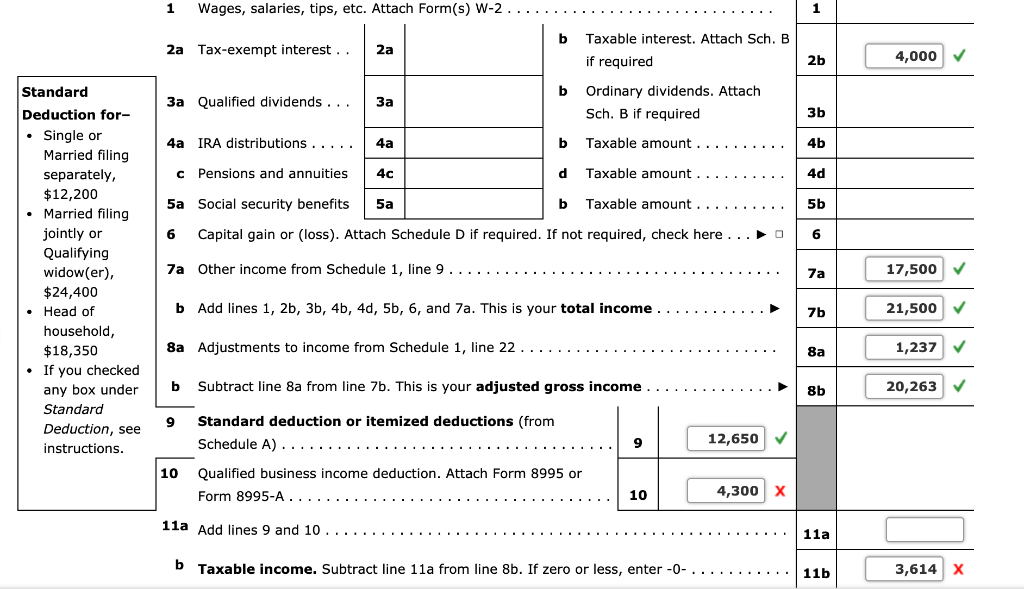

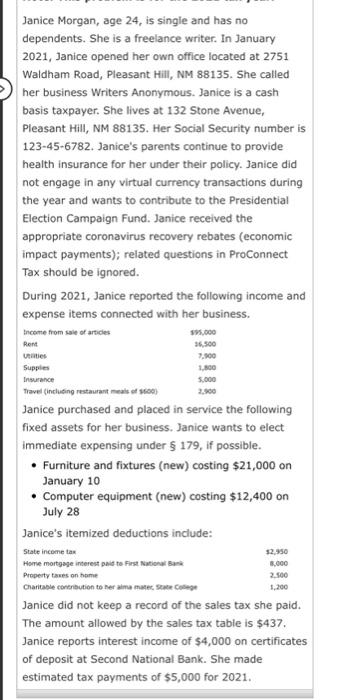

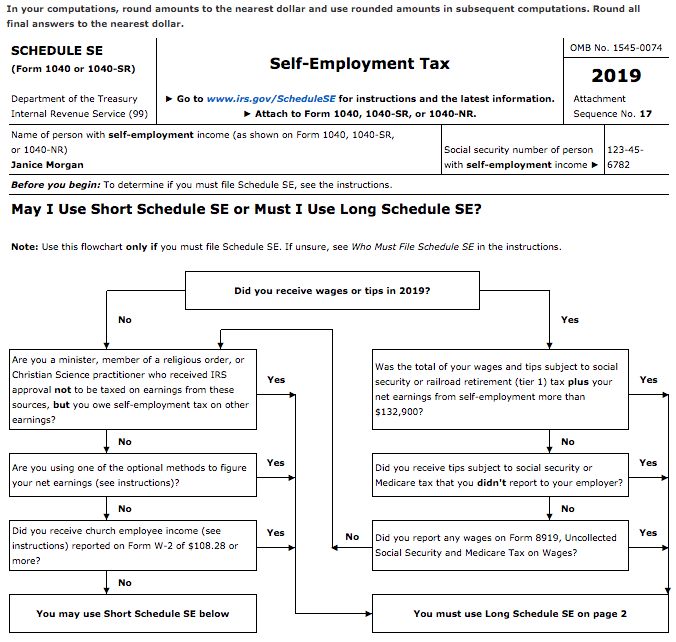

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/study/0c8/0c80c6f8-f7a3-49ea-b3bc-a334342a2f87/image

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/media/cd5/cd50fb5b-bf8f-4b45-9d3c-6ca906f26a72/php0YnyaW.png

Web 4 mars 2021 nbsp 0183 32 If you support children relatives or non relatives then you may be able to claim them as dependents on your tax return but things can get a bit more complicated Web 30 avr 2023 nbsp 0183 32 Jean Folger Updated April 30 2023 Reviewed by Lea D Uradu Fact checked by Jiwon Ma Can you claim a dependent on your tax return If so several federal tax

Web Individuals who did not qualify for or did not receive the full amount of the third Economic Impact Payment may be eligible to claim the 2021 Recovery Rebate Credit based on Web 17 d 233 c 2022 nbsp 0183 32 Tax Credits and Deductions for Dependents Several tax credits are based on the number of dependents you have including Child Tax Credit Additional Child

Download Not Married 2 Dependents Tax Rebates

More picture related to Not Married 2 Dependents Tax Rebates

57 Janice Morgan Age 24 Is Single And Has No Dependents She Is A

https://img.homeworklib.com/questions/39b63020-c59f-11ea-9b23-fd4f3fc1f433.png?x-oss-process=image/resize,w_560

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/media/5f4/5f446443-3876-4bdf-af30-bd53ed6ed3da/phpQaHDkw

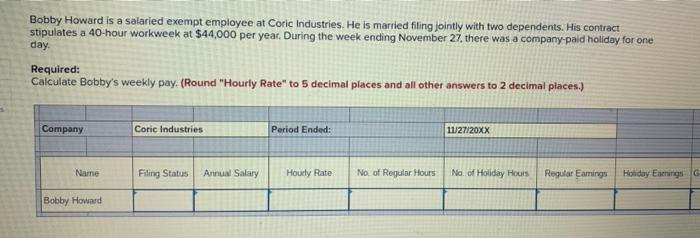

Solved Bobby Howard Is A Salaried Exempt Employee At Coric Chegg

https://media.cheggcdn.com/study/e24/e24d0a32-2380-4aca-89b1-b410fb380e42/image

Web 8 juin 2023 nbsp 0183 32 Vous pouvez b 233 n 233 ficier d une r 233 duction d imp 244 t si vous vivez dans un 233 tablissement d h 233 bergement pour personnes 226 g 233 es d 233 pendantes 201 hpad ou un Web 13 janv 2022 nbsp 0183 32 If you didn t get the full amount of the first and second Economic Impact Payment you may be eligible to claim the 2020 Recovery Rebate Credit and must file a

Web There s one exception If the married couple didn t earn enough to have to file a tax return and did so only to get a refund the supporting partner can claim the dependent Learn Web Generally U S citizens and resident aliens who are not eligible to be claimed as a dependent on someone else s income tax return are eligible for this second payment of

Who Are Your Dependents Tax Defense Partners

https://www.taxdefensepartners.com/wp-content/uploads/2018/10/Who-Are-Your-Dependents.jpg

How To Reduce Withholding Tax Outsiderough11

https://www.nerdwallet.com/assets/blog/wp-content/uploads/2017/09/22Q1_CONTENT_W4-2020_v1_NC.png

https://impotsurlerevenu.org/exemple/126-couple-marie-sans-enfant-re...

Web 4 janv 2016 nbsp 0183 32 Ajout Modification 04 01 2016 3 r 233 actions Imp 244 ts gt Exemple gt Couple mari 233 sans enfant revenus modestes Couple mari 233 sans enfant revenus modestes

https://americantaxservice.org/dependents-the-tax-deductions-they-bring

Web 31 juil 2023 nbsp 0183 32 2 children 47 915 53 865 for married joint filers 1 child 42 158 48 108 for married joint filers The credit ranges from 1 502 no children to 6 728

2021 Tax Brackets Irs Pdf Kindergatenideas

Who Are Your Dependents Tax Defense Partners

2022 Tax Brackets Married Filing Jointly With Dependents

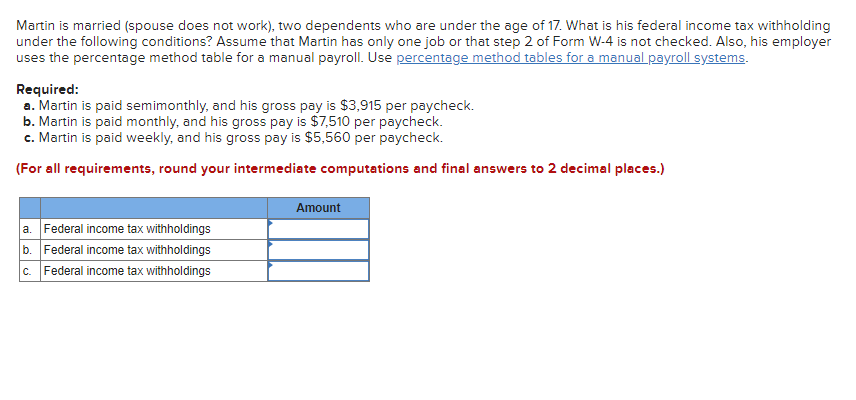

Solved Martin Is Married spouse Does Not Work Two Chegg

Solved Janice Morgan Age 24 Is Single And Has No Chegg

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022 2022

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022 2022

Janice Morgan Age 24 Is Single And Has No Chegg

2022 Form W 4 IRS Tax Forms W4 Form 2022 Printable

Solved Janice Morgan Age 24 Is Single And Has No Dependents She Is

Not Married 2 Dependents Tax Rebates - Web 1 mai 2020 nbsp 0183 32 higher income taxpayers generally with income over 99 000 if single 198 000 if married with higher thresholds for those with qualifying children Generally