Notice Cp12 Recovery Rebate Credit 2023 IR 2023 217 Nov 17 2023 The Internal Revenue Service is reminding those who may be entitled to the Recovery Rebate Credit to file a tax return and claim their money

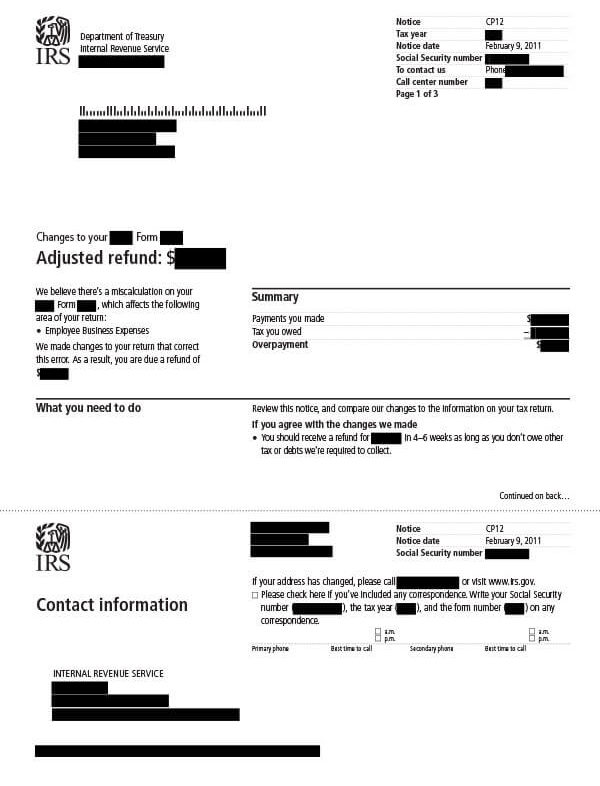

A CP12 Notice is sent when the IRS corrects one or more mistakes on your tax return which either result in a different refund amount or in an overpayment when Millions of taxpayers have received math error notices adjusting their returns including the amount of recovery rebate credit RRC child tax credit or other

Notice Cp12 Recovery Rebate Credit 2023

Notice Cp12 Recovery Rebate Credit 2023

https://i.ytimg.com/vi/7wxdqtNS2Ko/maxresdefault.jpg

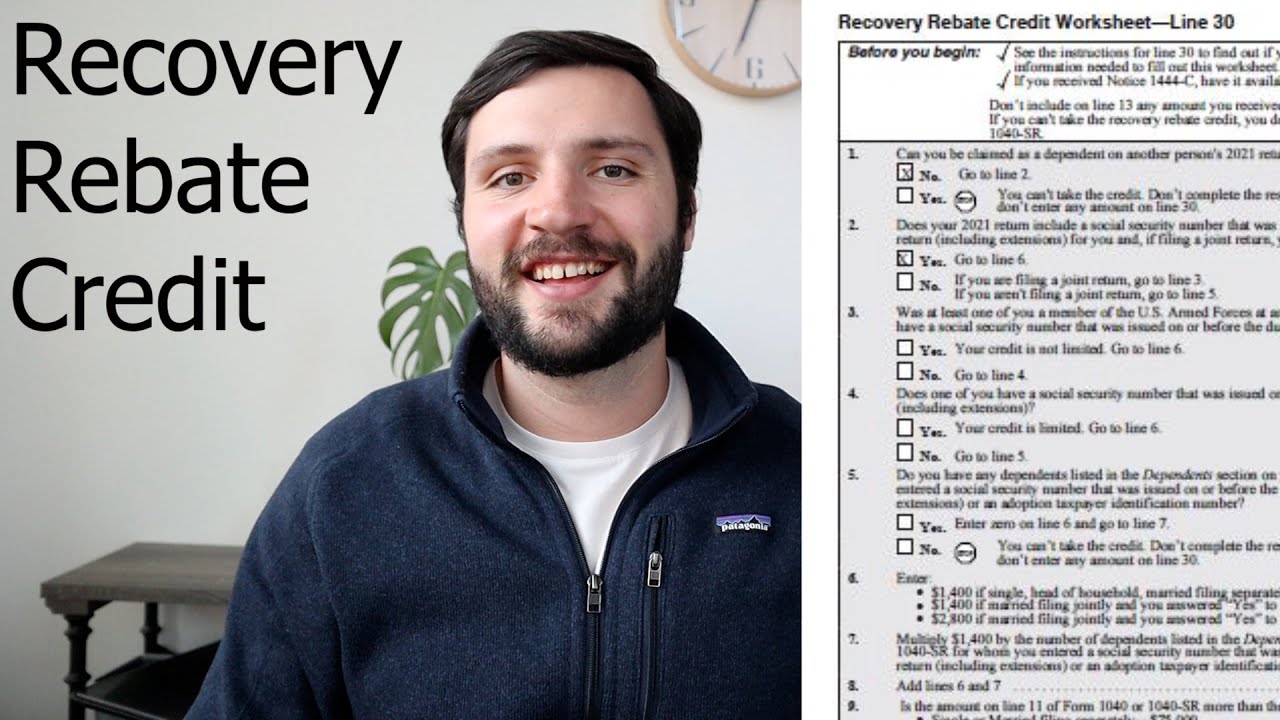

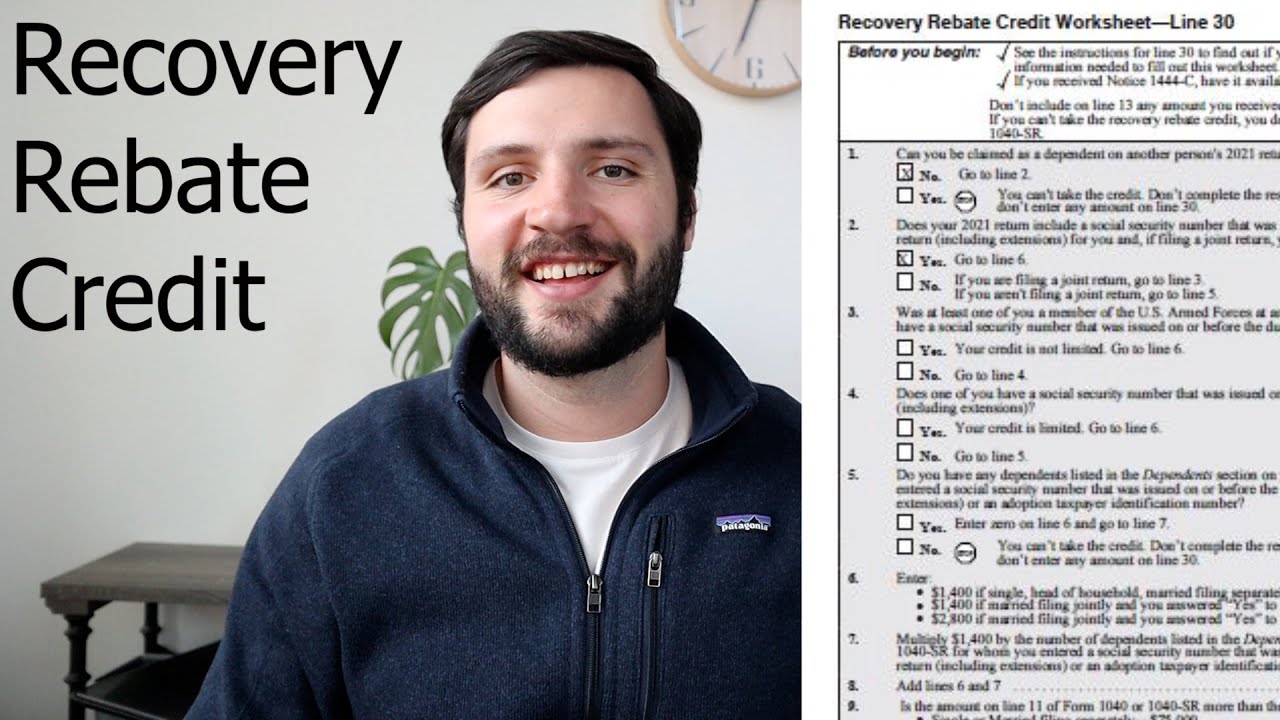

Recovery Rebate Credit Worksheet YouTube

https://i.ytimg.com/vi/5Jvgs4afxv0/maxresdefault.jpg

IRS Letter Needed To Claim Stimulus Check With Recovery Rebate Credit

https://www.gannett-cdn.com/presto/2022/01/31/PDTF/b7acf011-8827-427c-87dd-1b4ac9c5ff02-extra.jpg?crop=2015,1134,x0,y75&width=2015&height=1134&format=pjpg&auto=webp

Recovery Rebate Credit The recovery rebate credit was paid out to eligible individuals in two rounds of advance payments called economic impact payments EIP You may be The IRS sends Notice CP12 to inform you of a change made to your tax return This notice usually indicates an error in your calculations resulting in a refund a

How can these mistakes lead to a CP12 notice If you make a mistake on your tax return that affects your tax liability the IRS will correct it and send you a CP12 The Notice CP12 is normally sent by the IRS when they determine that there is an overpayment on your part It indicates that the IRS has adjusted your return and as

Download Notice Cp12 Recovery Rebate Credit 2023

More picture related to Notice Cp12 Recovery Rebate Credit 2023

Recovery Rebate Credit Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021-768x767.jpg

What To Do If You Get A CP12 Notice From The IRS Wcnc

https://media.wcnc.com/assets/WCNC/images/7541d15c-03eb-46d7-9fb0-b63620e22844/7541d15c-03eb-46d7-9fb0-b63620e22844_1920x1080.jpg

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

https://i2.wp.com/lh5.googleusercontent.com/proxy/lGA90iOjY_1LO-OBBI3qmZMyKEj47RMisqIykTyVbIbO-V2GqH4xUV92z9Uq0pojRygogoMZtKIKKsqfiqET_2bvfJQoMviJq-wHNdbSR8ZyQ-ukMly2632ZZ7bKcCkHDaCeogT6Skm16tenIHu_TkBU8w=w1200-h630-p-k-no-nu

You should receive your adjusted refund check within 4 6 weeks provided you don t owe other taxes or debts that the IRS is required to collect It s also a good Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return

Notice Cp12 Recovery Rebate Credit 2023 The Recovery Rebate offers taxpayers the opportunity to receive a tax return with no tax return altered The program As a credit the Recovery Rebate Credit can be claimed when you file your income tax return However since the stimulus payments were made in 2020 and 2021

How To Fill Out The Recovery Rebate Credit Line 30 Form 1040 YouTube

https://i.ytimg.com/vi/Sr_Y0Z2IVqM/maxresdefault.jpg

Recovery Rebate Credit How To Apply And Who Qualifies YouTube

https://i.ytimg.com/vi/AeQXuigtZmw/maxresdefault.jpg

https://www.irs.gov/newsroom/irs-reminds-eligible...

IR 2023 217 Nov 17 2023 The Internal Revenue Service is reminding those who may be entitled to the Recovery Rebate Credit to file a tax return and claim their money

https://www.taxpayeradvocate.irs.gov/notices/notice-cp12

A CP12 Notice is sent when the IRS corrects one or more mistakes on your tax return which either result in a different refund amount or in an overpayment when

Recovery Rebate Credit 2023

How To Fill Out The Recovery Rebate Credit Line 30 Form 1040 YouTube

How Do I Know If I Received A Recovery Rebate In 2023 Leia Aqui Who

How To Figure Out IRS Letters Notice CP12 And CP11 YouTube

How To Claim Recovery Rebate Credit Turbotax Romainedesign Recovery

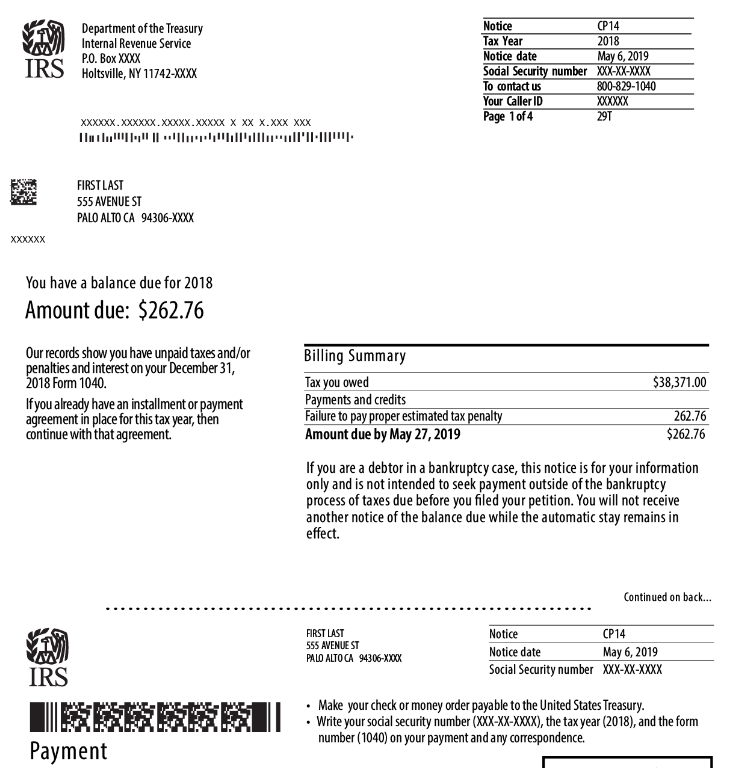

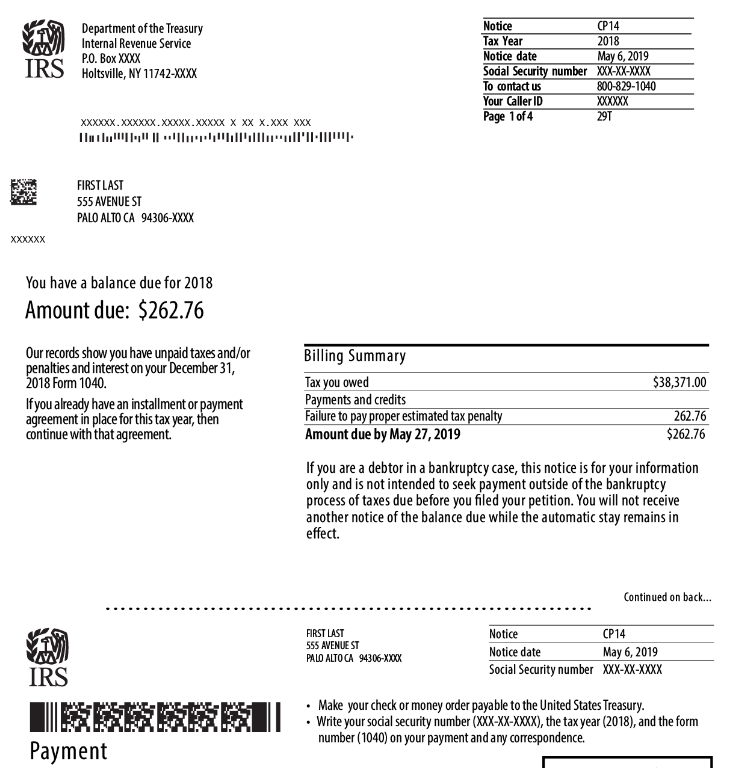

IRS Letter Notice CP11 CP12 CP13 And CP14 For Refund Adjustments Or

IRS Letter Notice CP11 CP12 CP13 And CP14 For Refund Adjustments Or

Line 30 Recovery Rebate Credit 2022 Recovery Rebate

IRS Notice CP12 Tax Defense Network

Recovery Rebate Credit 2023 Eligibility Calculator How To Claim

Notice Cp12 Recovery Rebate Credit 2023 - A common reason this year is if you tried to claim the Recovery Rebate Credit for the 3rd Stimulus 1 400 per person when the IRS already sent it to you Line