Nova Scotia Tax Rebate Web 29 ao 251 t 2023 nbsp 0183 32 The Province is returning almost 17 million in provincial income tax to Nova Scotia seniors through its Guaranteed Income Supplement rebate program More

Web 30 ao 251 t 2023 nbsp 0183 32 The program will provide eligible seniors a minimum refund payment of 50 and maximum of 10 000 depending on how much they have paid in provincial income Web 6 juil 2023 nbsp 0183 32 July 6 2023 Dartmouth Nova Scotia Nova Scotians will be receiving a direct cash rebate known as the Climate Action Incentive beginning the week of July 14

Nova Scotia Tax Rebate

Nova Scotia Tax Rebate

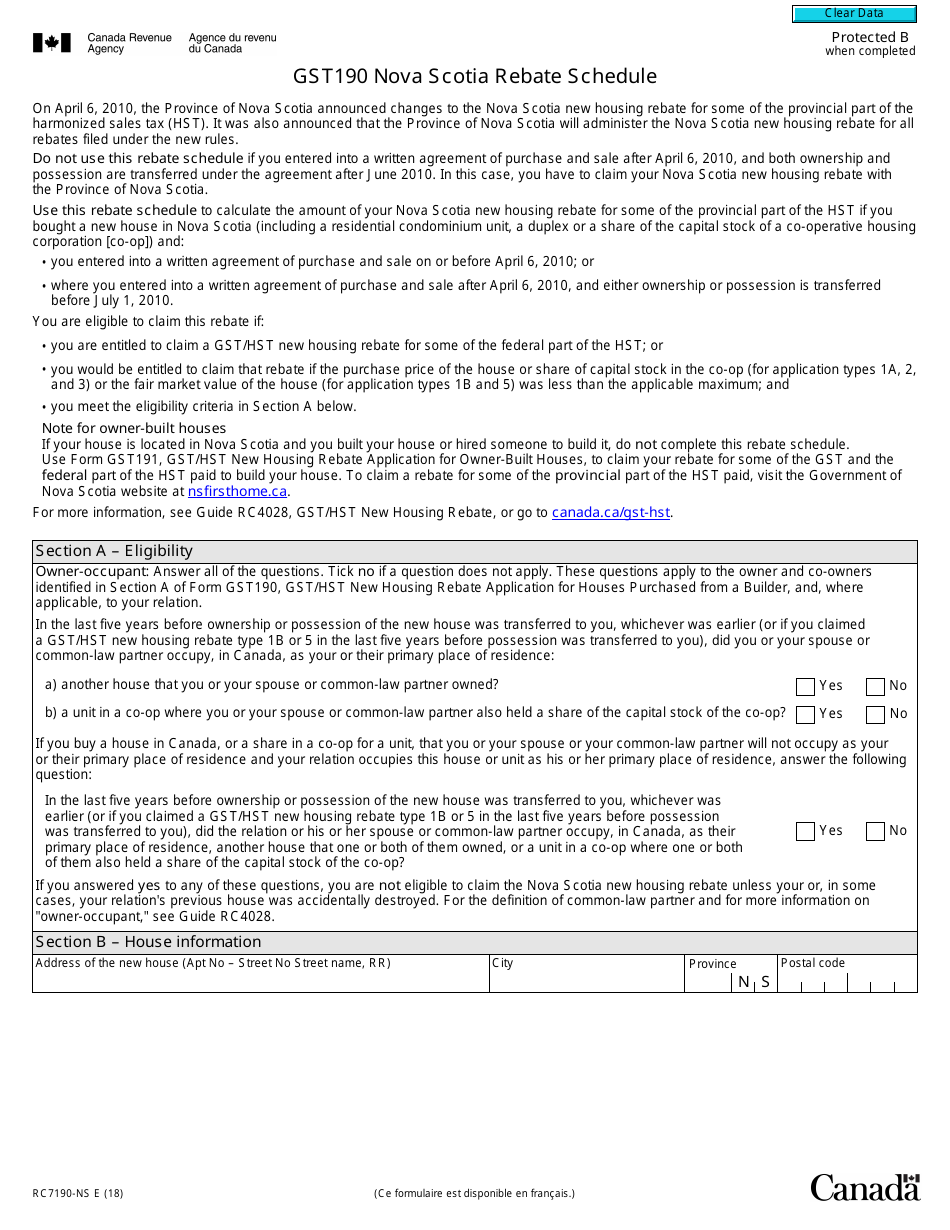

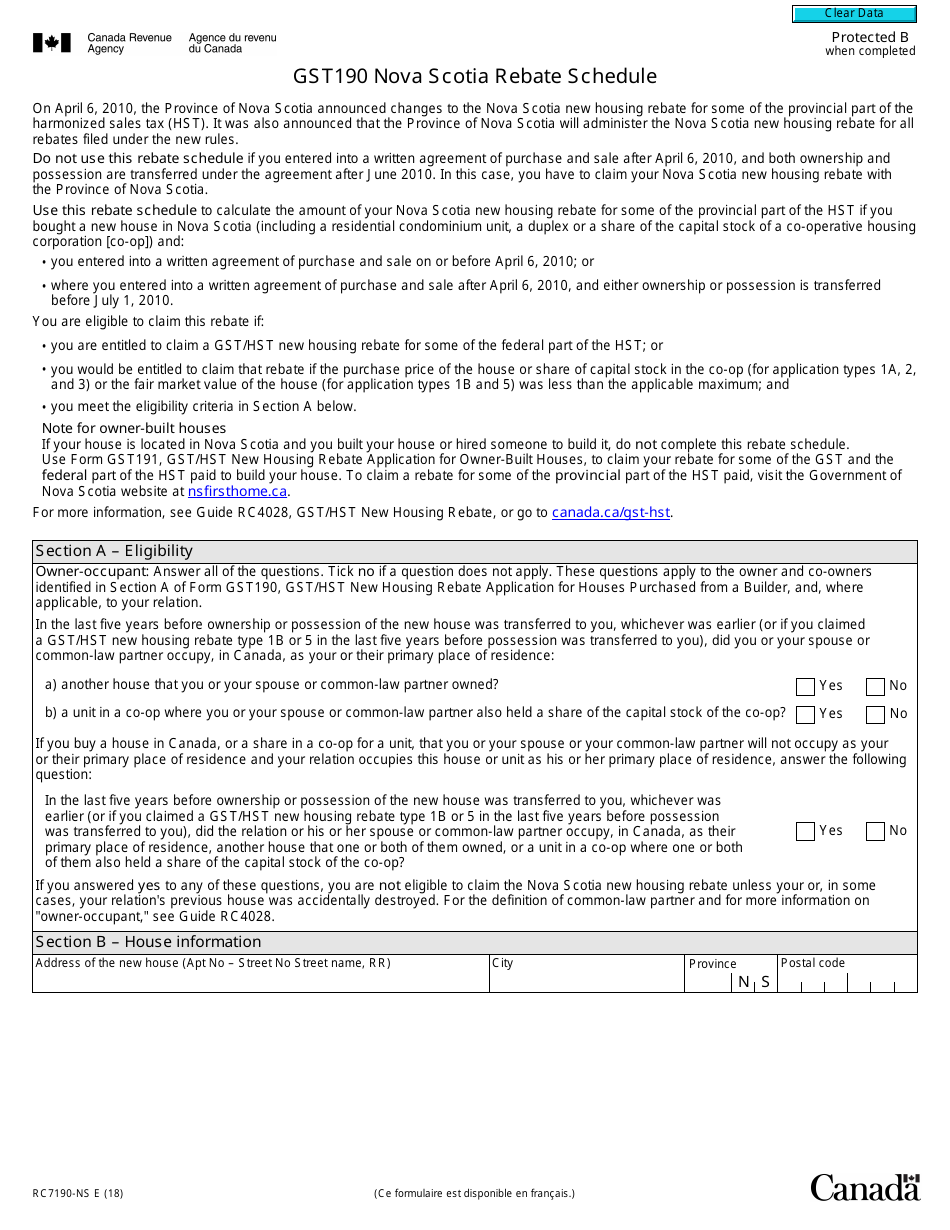

https://data.templateroller.com/pdf_docs_html/1869/18690/1869029/form-rc7190-ns-gst190-nova-scotia-rebate-schedule-canada_print_big.png

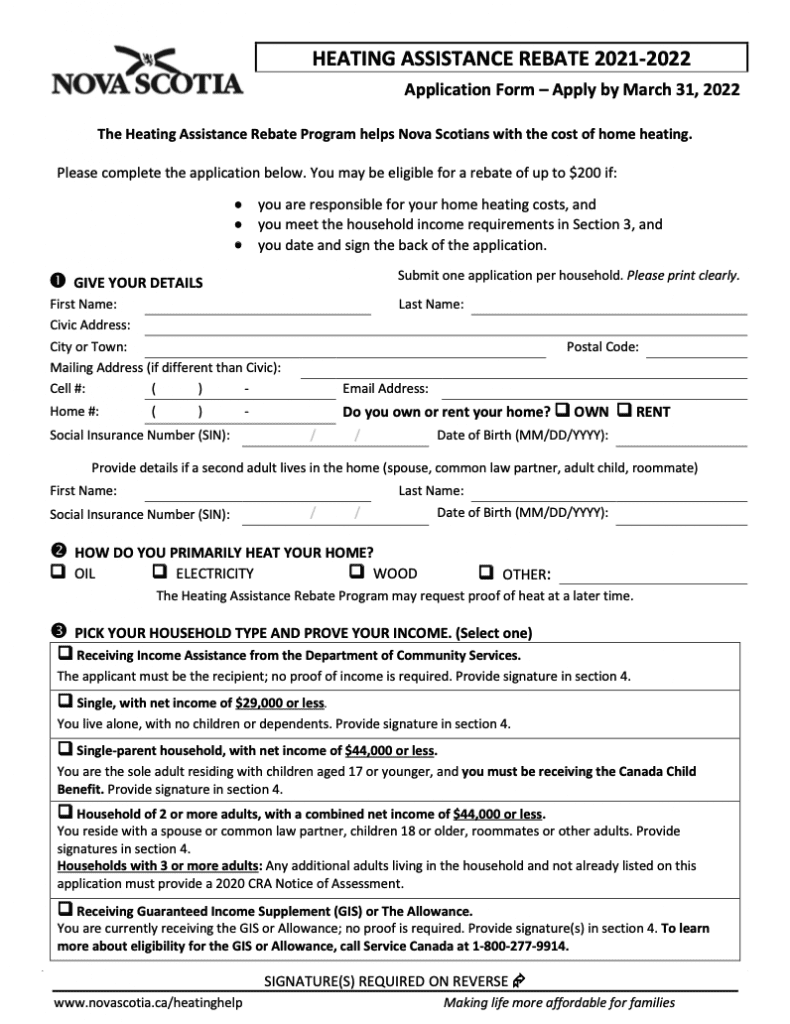

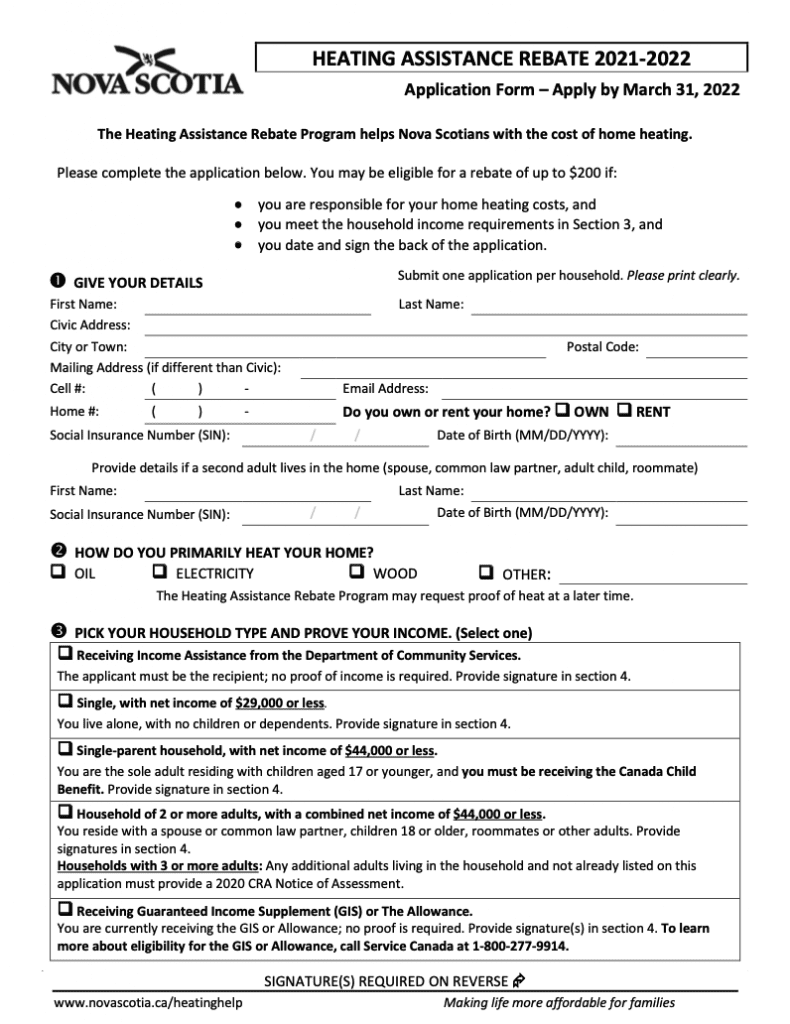

Heating Rebates 2022 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/02/Heating-Rebate-Nova-Scotia-2022-790x1024.png

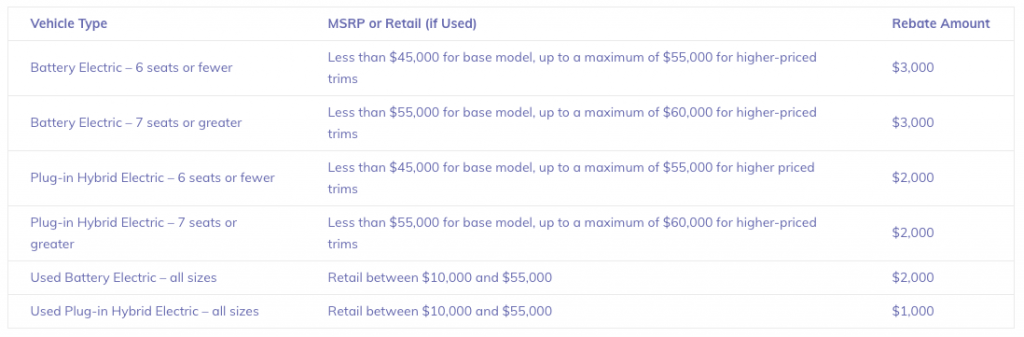

Nova Scotia Electric Vehicle Rebate Program Now Accepting Applications

https://driveteslacanada.ca/wp-content/uploads/2021/03/Nova-Scotia-rebate-1024x337.png

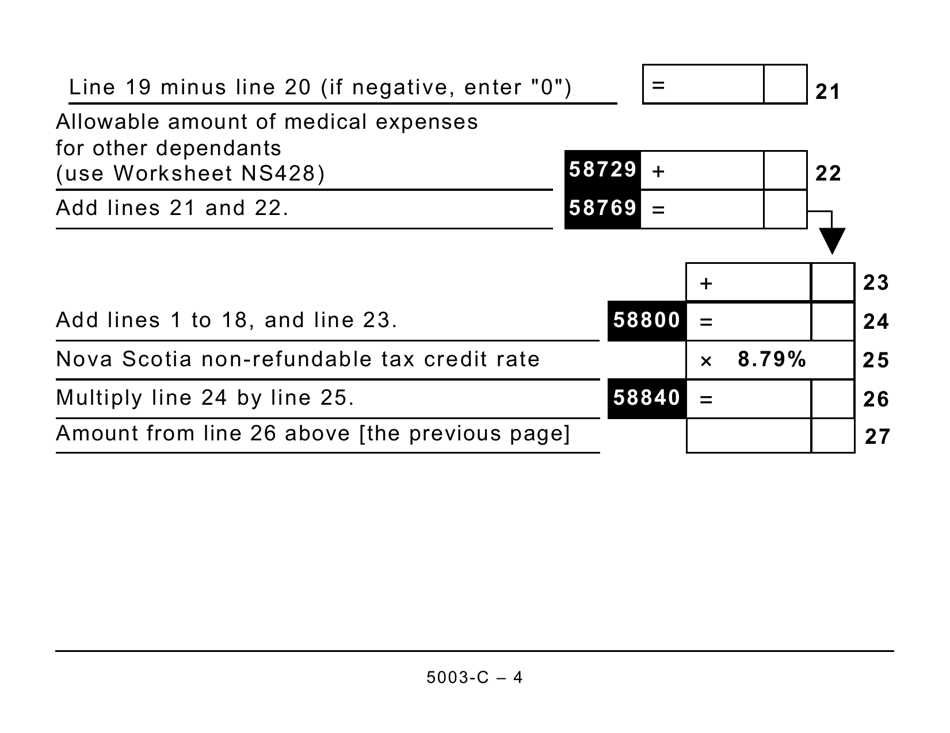

Web Nova Scotia tax rates for 2022 The following tax rates are used in the calculation of your Nova Scotia tax on taxable income 8 79 on the portion of your taxable income that is Web Rebate equivalent to 10 per cent HST applied to the purchase Vendors may automatically apply the rebate to fuel bills Additional information is available at

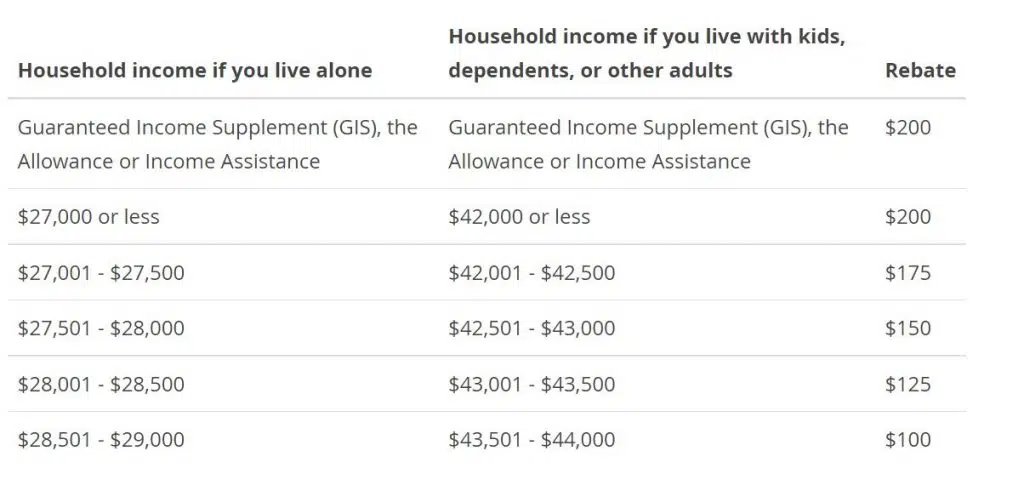

Web 27 juin 2022 nbsp 0183 32 the budget for the 2021 Property Tax Rebate for Seniors program was 8 8 million 17 085 senior households received the rebate in 2021 totalling 9 1 million the Web 30 juin 2023 nbsp 0183 32 Service Nova Scotia June 30 2023 12 19 PM Applications for the Property Tax Rebate for Seniors which helps seniors on a low income with their municipal

Download Nova Scotia Tax Rebate

More picture related to Nova Scotia Tax Rebate

Nova Scotia Gov On Twitter 2022 Property Tax Rebate For Seniors

https://pbs.twimg.com/media/FWRfLnXWAAAf7V5?format=jpg&name=medium

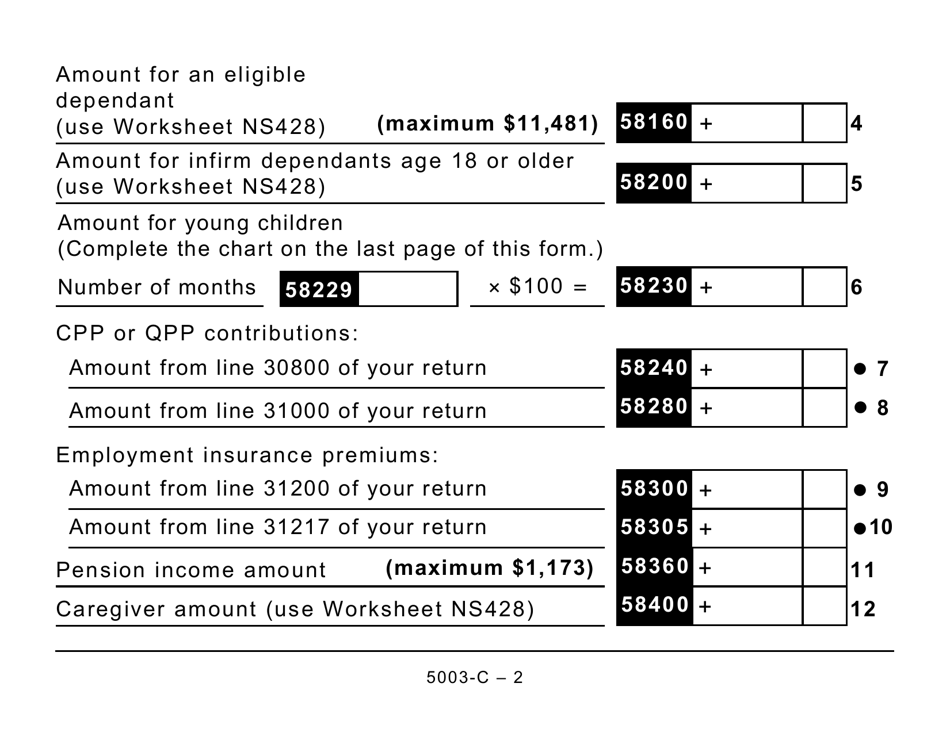

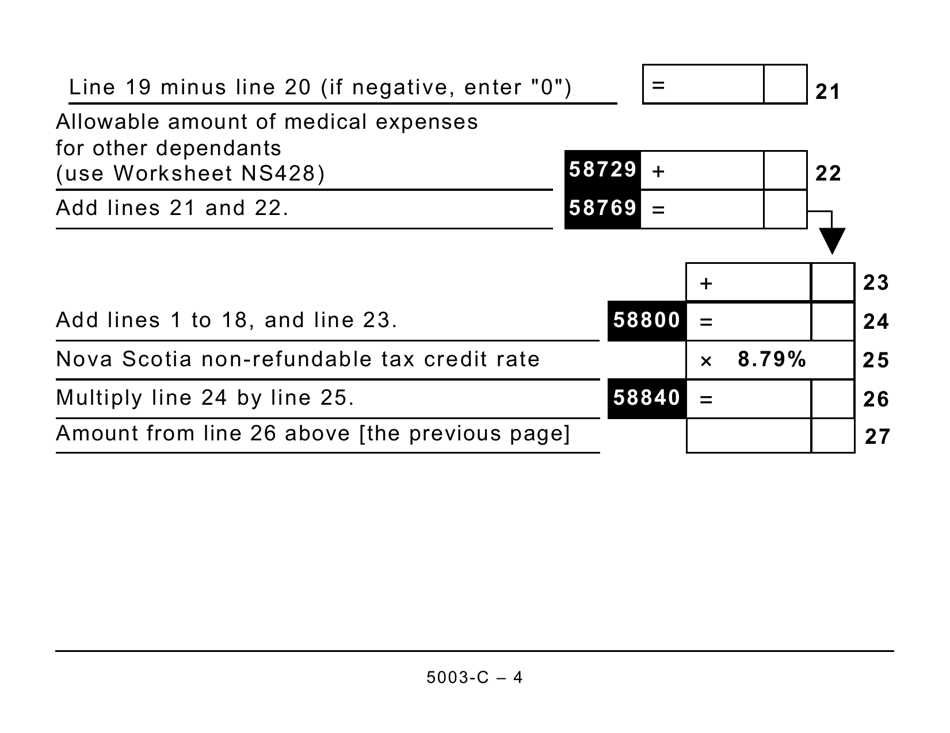

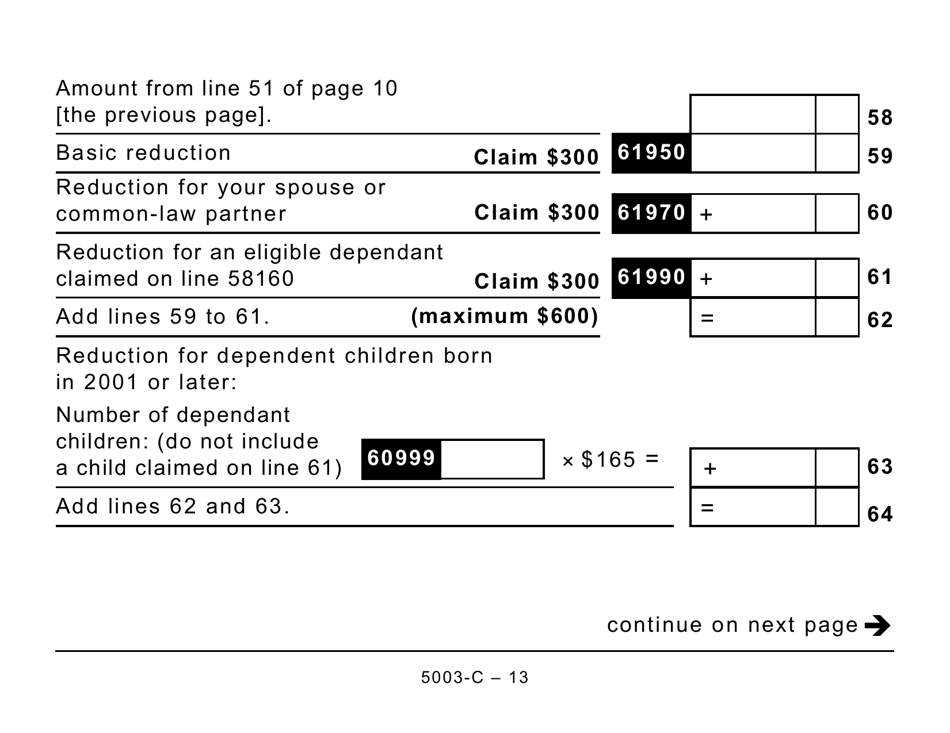

Form NS428 5003 C Download Printable PDF Or Fill Online Nova Scotia

https://data.templateroller.com/pdf_docs_html/2066/20665/2066580/page_2_thumb_950.png

Nova Scotia Grants For Homeowners 28 Grants Rebates Tax Credits

https://149688362.v2.pressablecdn.com/wp-content/uploads/2018/06/nova_scotia_grants-for_homeowners.jpg?x74268

Web 6 juin 2023 nbsp 0183 32 If you need help paying your property taxes the municipality offers a few choices You can apply for Rebate if your household income is less than 45 000 the Web 17 juin 2021 nbsp 0183 32 June 17 2021 10 32 AM The province is helping low income seniors with their municipal residential property taxes Applications for the 2021 22 Property Tax

Web Property Tax Rebate for Seniors helps low income seniors with the cost of municipal residential property taxes Supporting forms Municipal Property Tax Sheet Property Tax Web The refund is available to seniors who reported GIS income on line 146 of their tax return and have Nova Scotia provincial income tax owing on line 428 of their tax return

Form NS428 5003 C Download Printable PDF Or Fill Online Nova Scotia

https://data.templateroller.com/pdf_docs_html/2066/20665/2066580/page_4_thumb_950.png

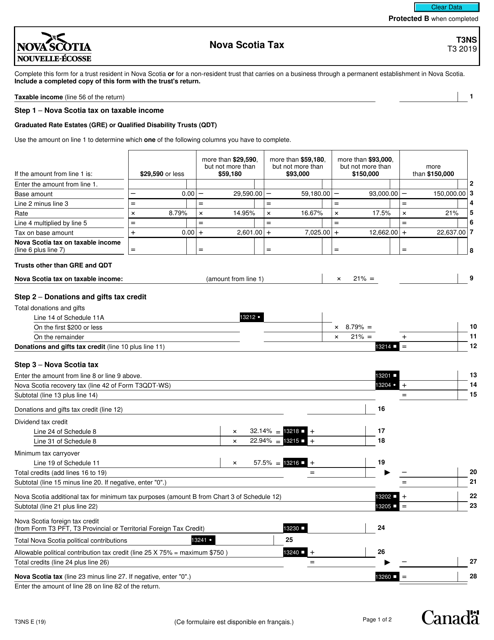

Form T3NS Download Fillable PDF Or Fill Online Nova Scotia Tax 2019

https://data.templateroller.com/pdf_docs_html/2031/20311/2031178/form-t3ns-nova-scotia-tax-canada_big.png

https://novascotia.ca/news/release/?id=20230829001

Web 29 ao 251 t 2023 nbsp 0183 32 The Province is returning almost 17 million in provincial income tax to Nova Scotia seniors through its Guaranteed Income Supplement rebate program More

https://thelaker.ca/low-income-nova-scotia-seniors-to-receive-tax...

Web 30 ao 251 t 2023 nbsp 0183 32 The program will provide eligible seniors a minimum refund payment of 50 and maximum of 10 000 depending on how much they have paid in provincial income

Solved 9 Consider The Table Below Showing Combined Tax Chegg

Form NS428 5003 C Download Printable PDF Or Fill Online Nova Scotia

How To Apply For The Nova Scotia Heating Assistance Rebate Program

Nova Scotia Power Rebate 2023 PowerRebate

Form NS428 5003 C Download Printable PDF Or Fill Online Nova Scotia

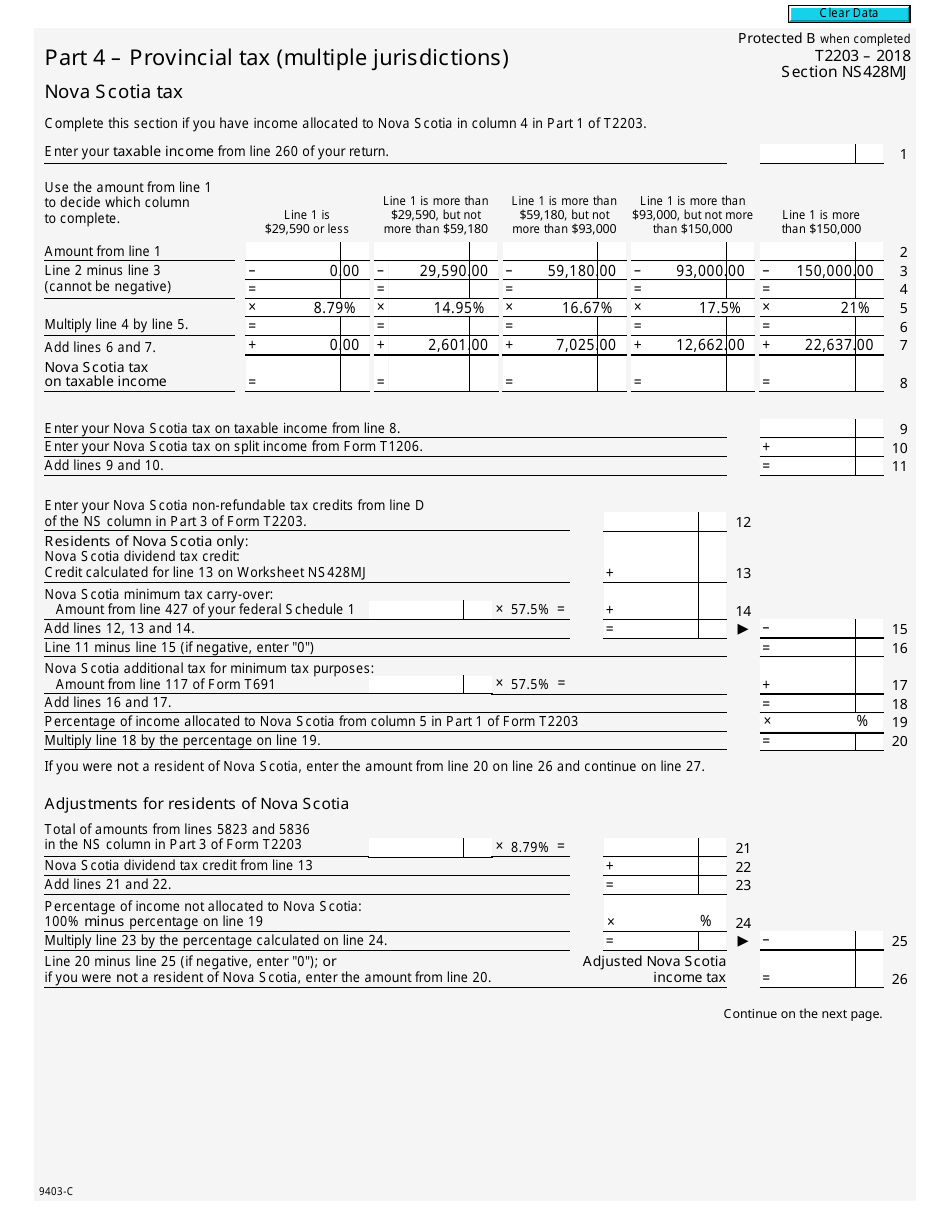

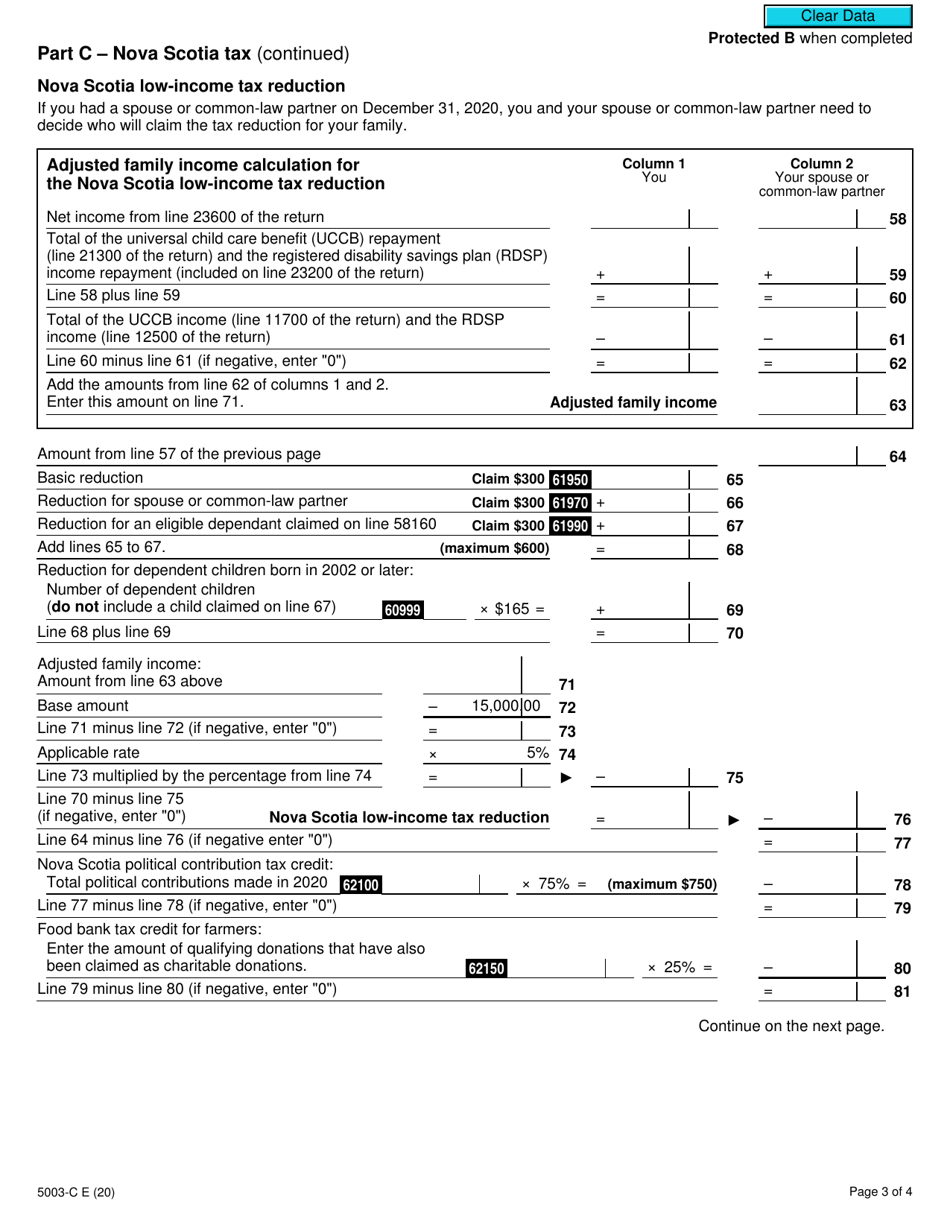

Form T2203 Section NS428MJ Download Fillable PDF Or Fill Online Part 4

Form T2203 Section NS428MJ Download Fillable PDF Or Fill Online Part 4

Nova Scotia Heating Rebate Application 2016 PumpRebate

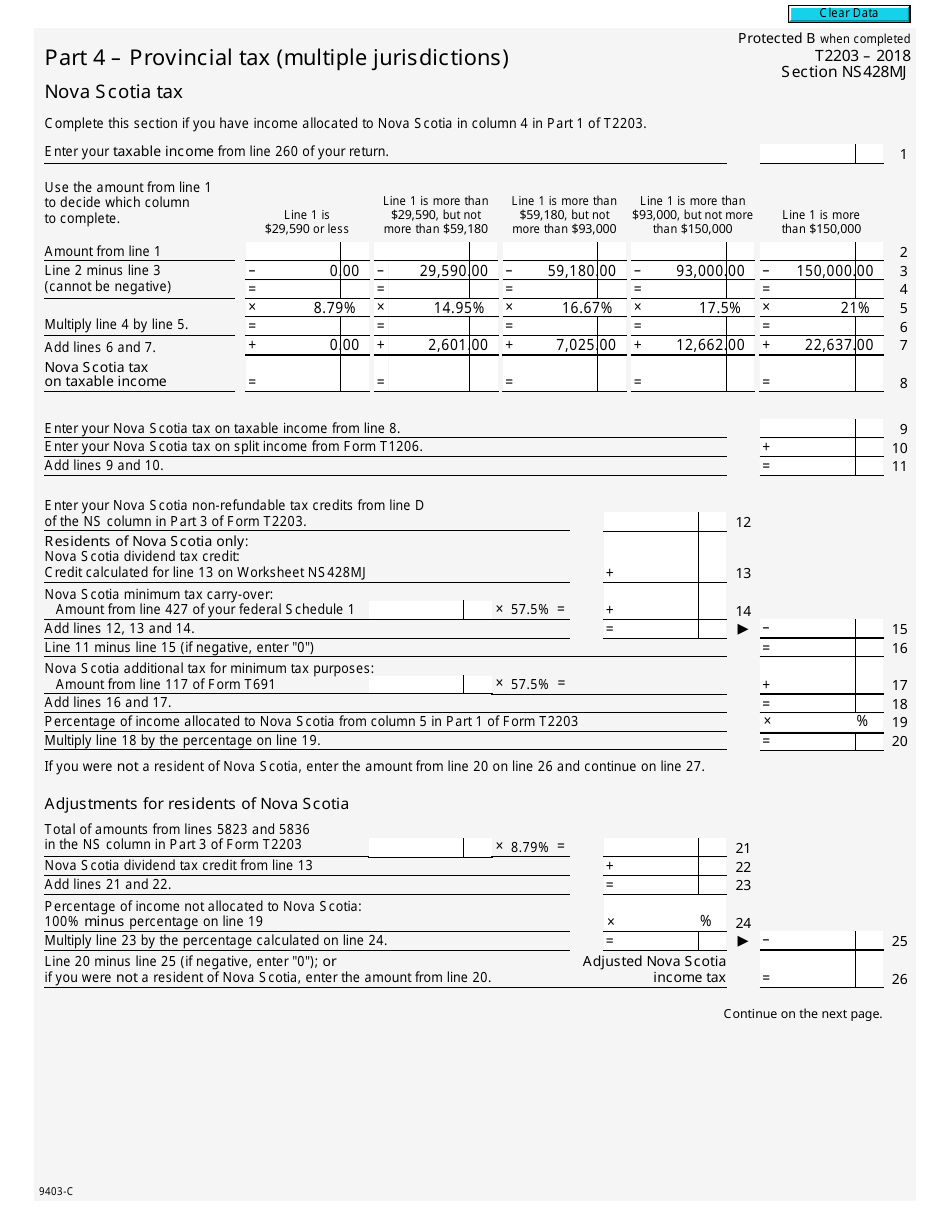

Form T225 Download Fillable PDF Or Fill Online Nova Scotia Innovation

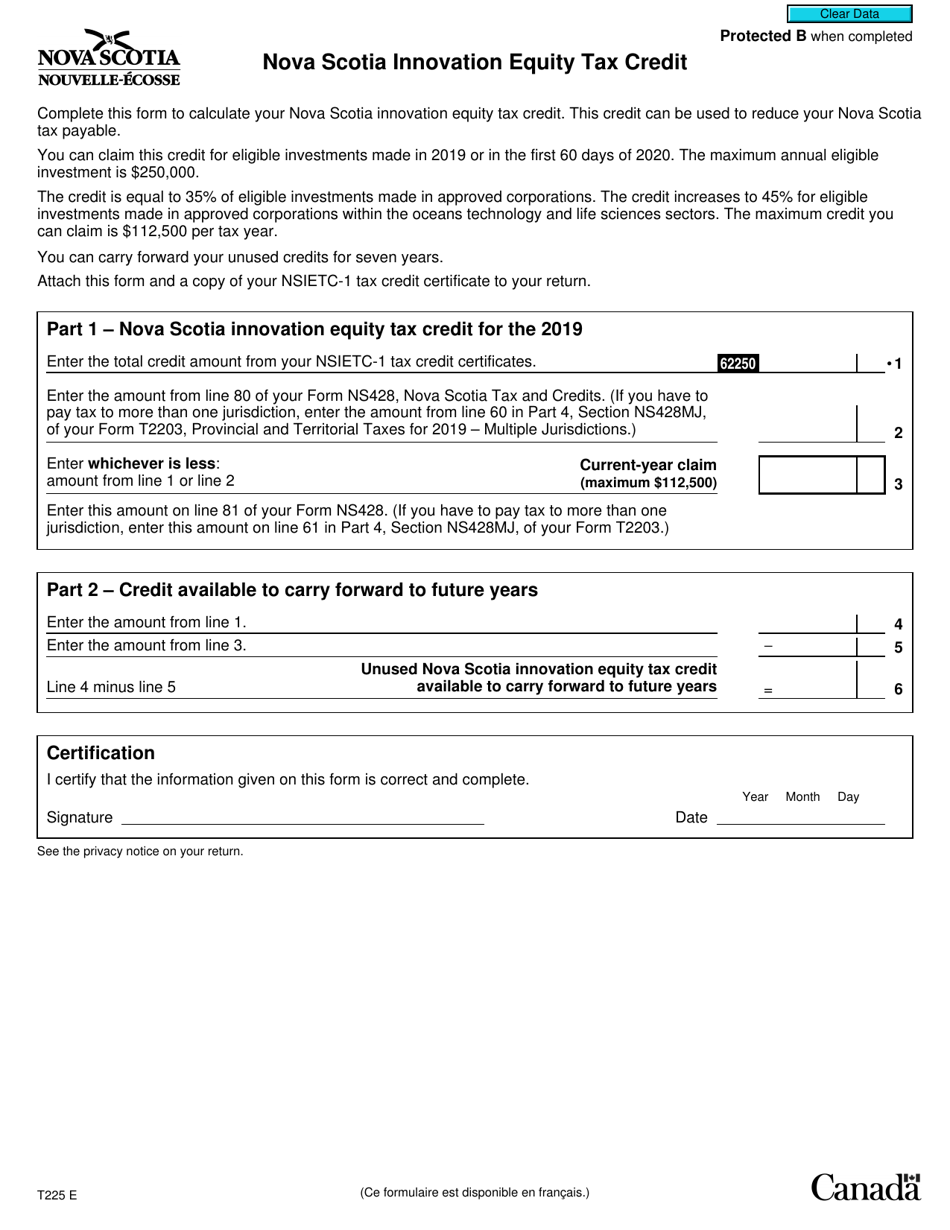

Form 5003 C NS428 Download Fillable PDF Or Fill Online Nova Scotia

Nova Scotia Tax Rebate - Web 30 juin 2023 nbsp 0183 32 Service Nova Scotia June 30 2023 12 19 PM Applications for the Property Tax Rebate for Seniors which helps seniors on a low income with their municipal