Nps Contribution Tax Benefit In New Tax Regime The budget has encouraged retirement planning by increasing the tax benefit on NPS payments and adding a new option to the pension system for minor children The

Here are the income tax benefits of investing in NPS under the old tax regime Contributions made by employees to the NPS are eligible for tax deduction However such National Pension Scheme NPS NPS contribution limit for employer in private sector raised from 10 to 14 of the employees basic salary For both private and public

Nps Contribution Tax Benefit In New Tax Regime

Nps Contribution Tax Benefit In New Tax Regime

https://carajput.com/art_imgs/why-we-should-invest-in-nps-just-for-the-tax-benefits.jpg

Tax Benefits On Business Loans In India India Today

https://akm-img-a-in.tosshub.com/indiatoday/images/story/202209/Tax_Benefits.jpg?VersionId=KA.W.Wl1CpsUjL4.dw1jXJ24fvBRYd1v

New Tax Regime Vs Old Which Is Better For You Rupiko

https://rupiko.in/wp-content/uploads/2020/08/New-vs-Old-Tax-Regime-1.png

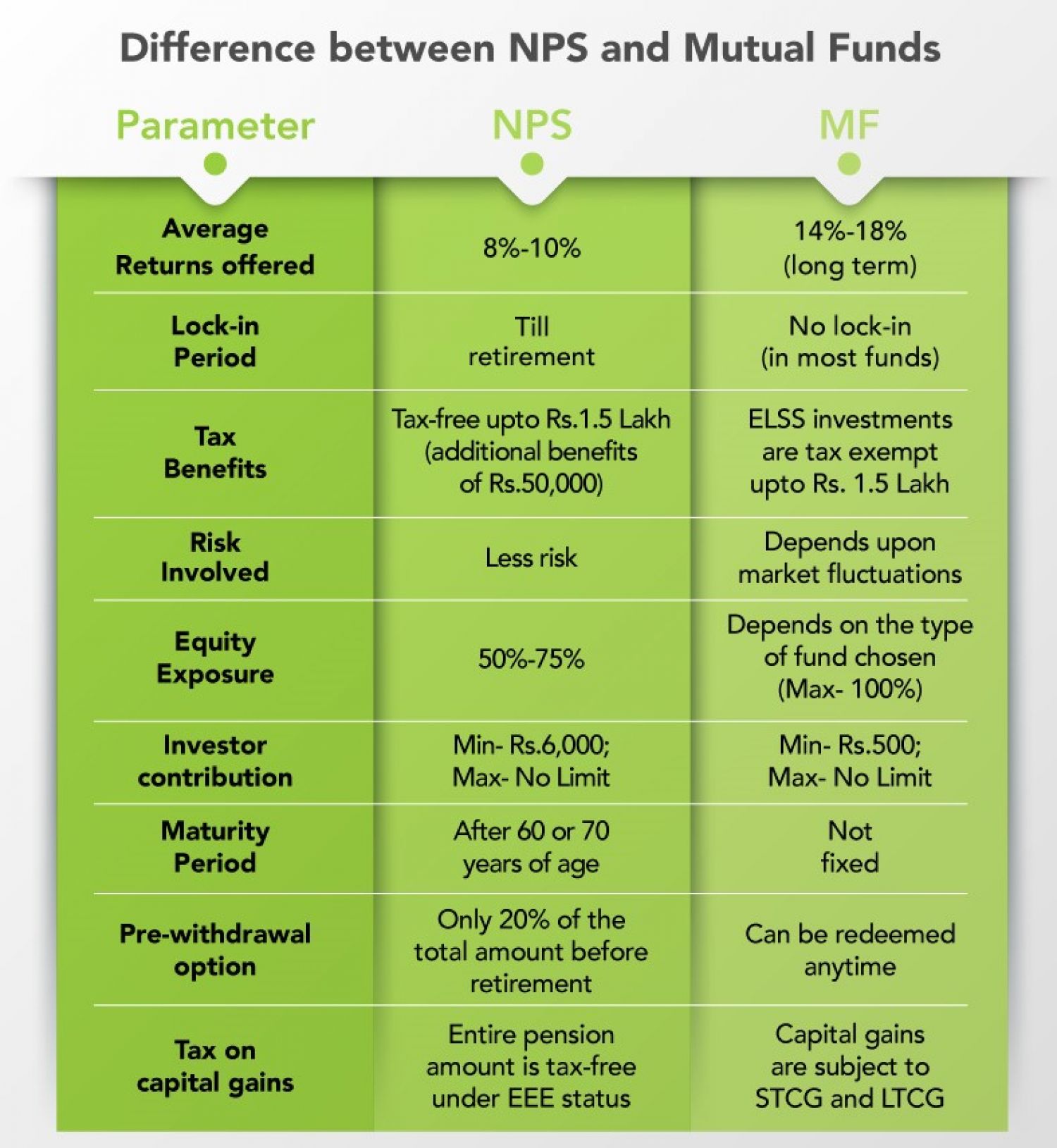

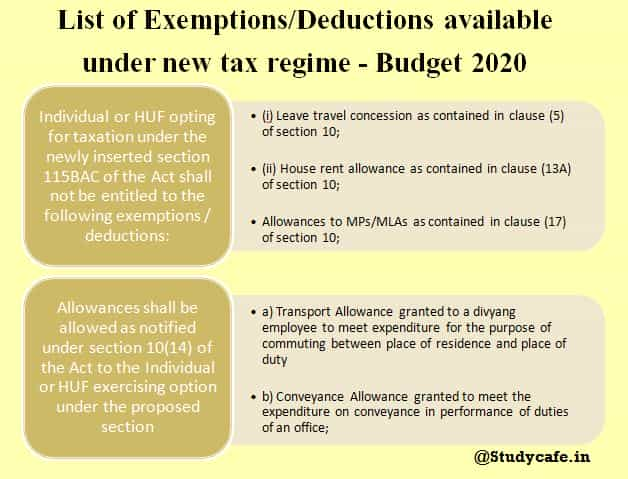

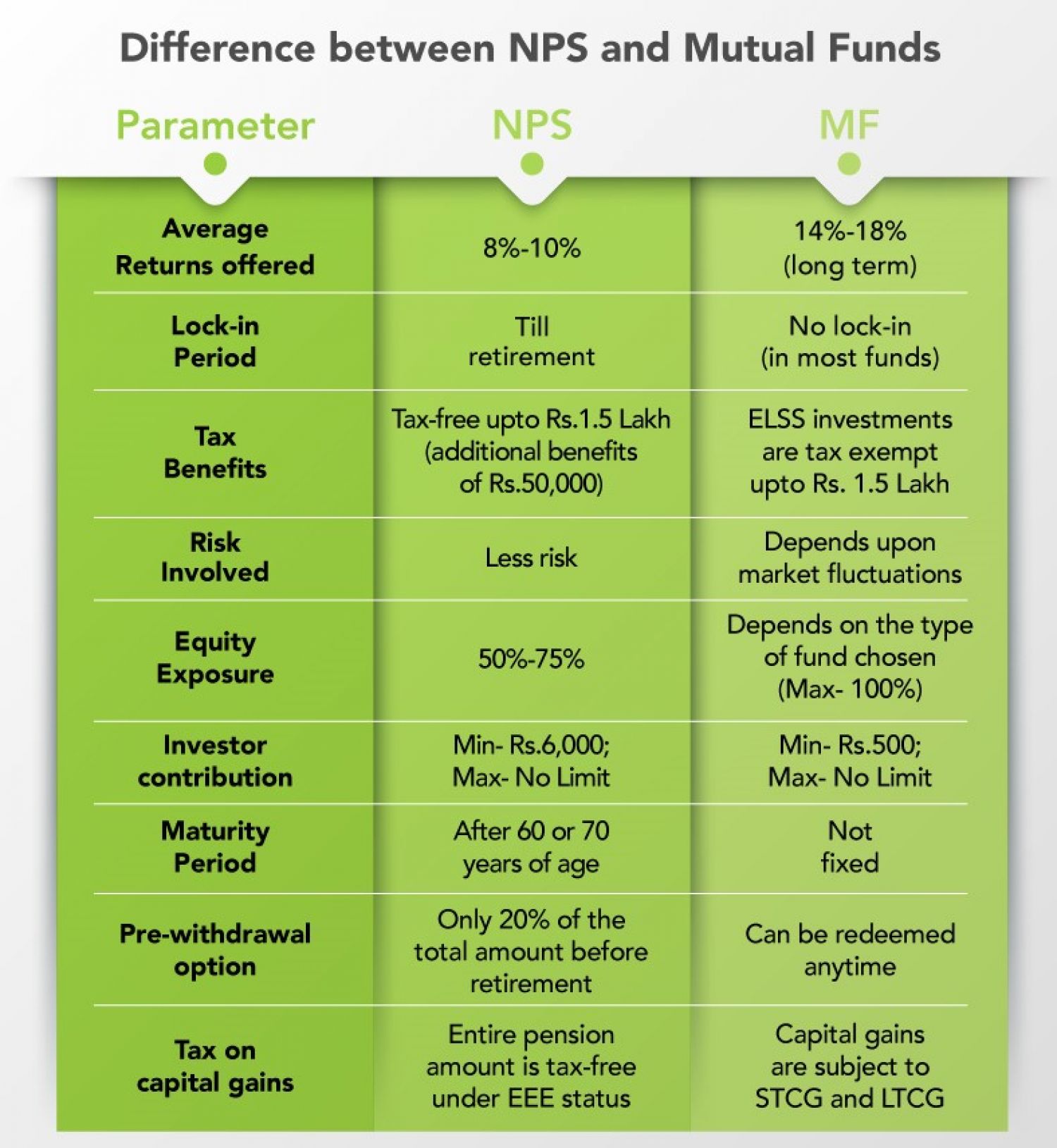

Can you claim Income Tax Deduction on NPS contribution under New Tax Regime Are there any tax deductions under NPS Tier 2 account Under what sections of the IT act NPS investments can be claimed as tax Employees choosing the New Tax Regime are now eligible for a higher deduction of up to 14 of their basic salary for the contribution made to the NPS by the employer on behalf of the employee

NPS subscribers can also claim deductions for contributions to the pension scheme under the new tax regime However the deductions are only allowed for the employer s part up to 10 per cent NPS In New Tax Regime To make the New Pension Scheme NPS more attractive under the new tax regime Finance Minister Nirmala Sitharaman proposed increasing tax deductions for employers contributions

Download Nps Contribution Tax Benefit In New Tax Regime

More picture related to Nps Contribution Tax Benefit In New Tax Regime

Deductions Allowed Under The New Income Tax Regime Paisabazaar Com

https://studycafe.in/wp-content/uploads/2020/02/List-of-ExemptionsDeductions-available-under-new-tax-regime-Budget-2020-1.jpg

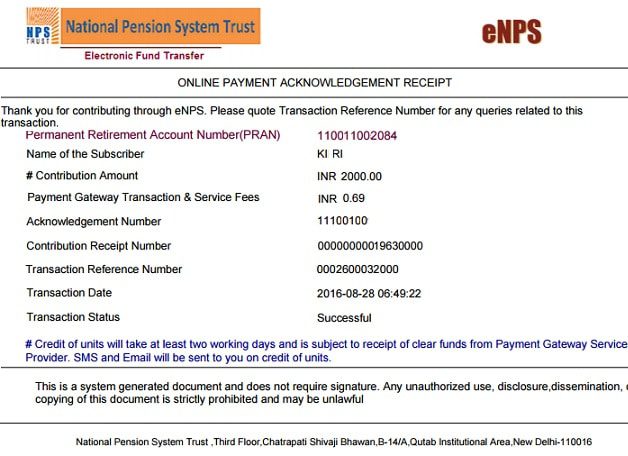

Nps contribution payment receipt

https://bemoneyaware.com/wp-content/uploads/2016/10/nps-contribution-payment-receipt.jpg

INTRODUCTION OF SECTION 115BAC TO INCOME TAX ACT 1961 Onfiling Blog

https://blog.onfiling.com/wp-content/uploads/2021/04/49134-1940x1455-1.jpg

New Tax Regime The NPS related deduction under Section 80CCD 2 of the Income tax Act 1961 was allowed under the New Tax Regime Under this regime the deduction is on the Employees opting for the New Tax Regime are now entitled to a larger deduction of up to 14 of their basic salary for the contributions made by the employer towards the NPS

Under the new tax regime the contribution made by employer towards Tier 1 NPS account is eligible for tax deduction under section 80CCD 2 of Income Tax Act 1961 without NPS is for everyone Also Read Preparing For The Tax Season How To Calculate Your Taxable Income Myth 9 The Entire Employer Contribution Is Taxable Reality Employer

Nps Contribution By Employee Werohmedia

https://www.jagoinvestor.com/wp-content/uploads/files/Tax-Benefits-of-contributing-in-NPS.png

NPS Income Tax Benefits FY 2020 21 Old New Tax Regimes

https://www.relakhs.com/wp-content/uploads/2020/02/NPS-Income-Tax-Benefits-for-FY-2020-2021-AY-2021-2022-New-Tax-Regime-Sec-80CCD.jpg

https://economictimes.indiatimes.com › wealth › tax › ...

The budget has encouraged retirement planning by increasing the tax benefit on NPS payments and adding a new option to the pension system for minor children The

https://economictimes.indiatimes.com › wealth › tax › ...

Here are the income tax benefits of investing in NPS under the old tax regime Contributions made by employees to the NPS are eligible for tax deduction However such

How To Make Online Contributions To NPS Tier I And Tier II Accounts

Nps Contribution By Employee Werohmedia

New Tax Regime Vs Outdated Tax Regime Which One To Choose Https

Old Vs New Income Tax Slabs After Budget Which Is Better Mint

Deductions Under The New Tax Regime Budget 2020 Blog By Quicko

Budget 2023 Tax Saving Under New Tax Regime Vs Old Tax Regime For Rs 7

Budget 2023 Tax Saving Under New Tax Regime Vs Old Tax Regime For Rs 7

Rebate Limit New Income Slabs Standard Deduction Understanding What

New Tax Regime Vs Old Which Is Better For You Rupiko Peoplesoft

New Vs Old Income Tax Regime Which One Should You Opt In 2020 Tata

Nps Contribution Tax Benefit In New Tax Regime - NPS subscribers can also claim deductions for contributions to the pension scheme under the new tax regime However the deductions are only allowed for the employer s part up to 10 per cent