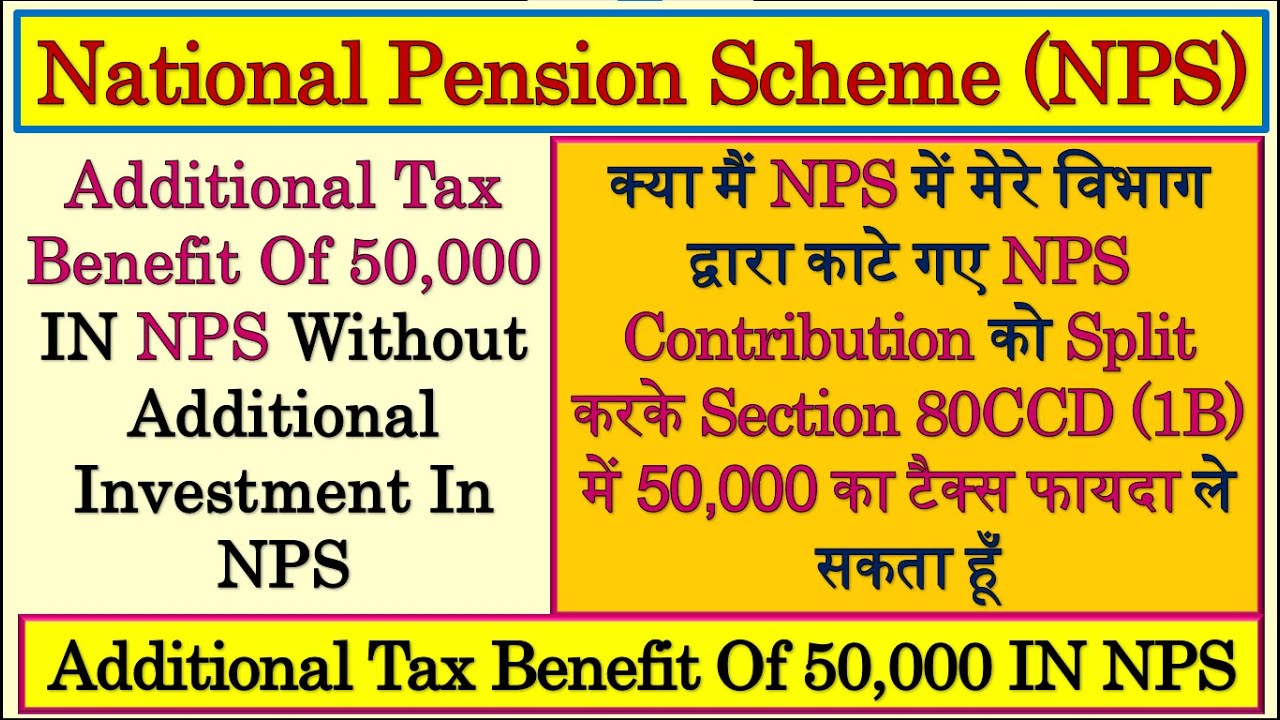

Nps Deduction Section 80ccd Section 80CCD 1B gives an additional deduction of Rs 50 000 on their NPS contributions Section 80CCD 2 provides that employees can claim

Section 80CCD relates to the tax deduction for the contributions made in the National Pension System NPS and the Atal Pension Yojana APY Under this section you can claim a deduction of up to 2 lakh in a financial Deduction benefits under section 80CCD of the Income Tax Act Amount deposited to pension scheme is allowed as deduction under section 80CCD of the Income Tax Act Let us individually understand the relevant sub

Nps Deduction Section 80ccd

Nps Deduction Section 80ccd

https://i.ytimg.com/vi/EpqXDIqNGX0/maxresdefault.jpg

Section 80CCD 1B Deduction Contribution To NPS

https://taxguru.in/wp-content/uploads/2022/03/Section-80CCD1B-deduction-Contribution-to-National-Pension-System-NPS.jpg

NPS Tax Benefits How To Avail NPS Income Tax Benefits

https://www.godigit.com/content/dam/godigit/directportal/en/contenthm/nps-tax-benefits.jpg

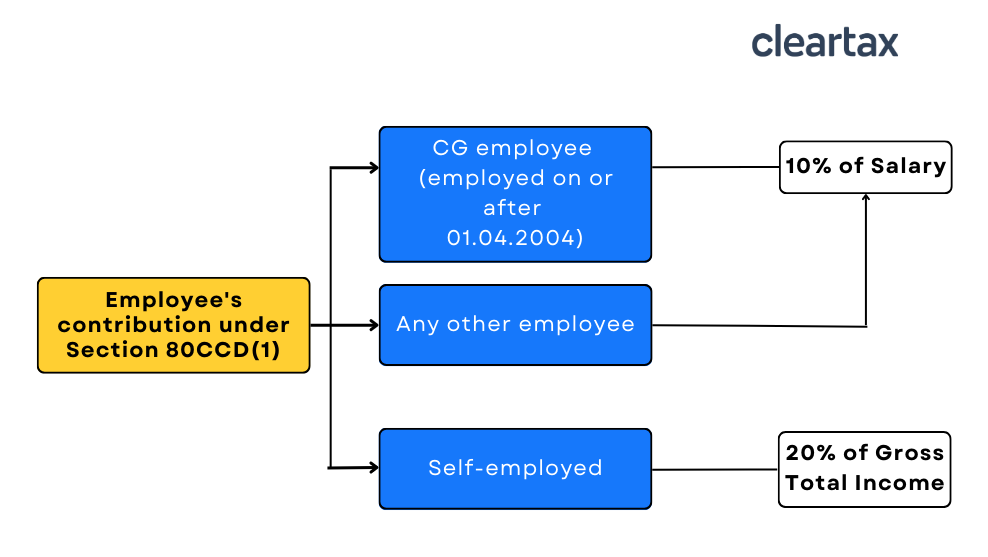

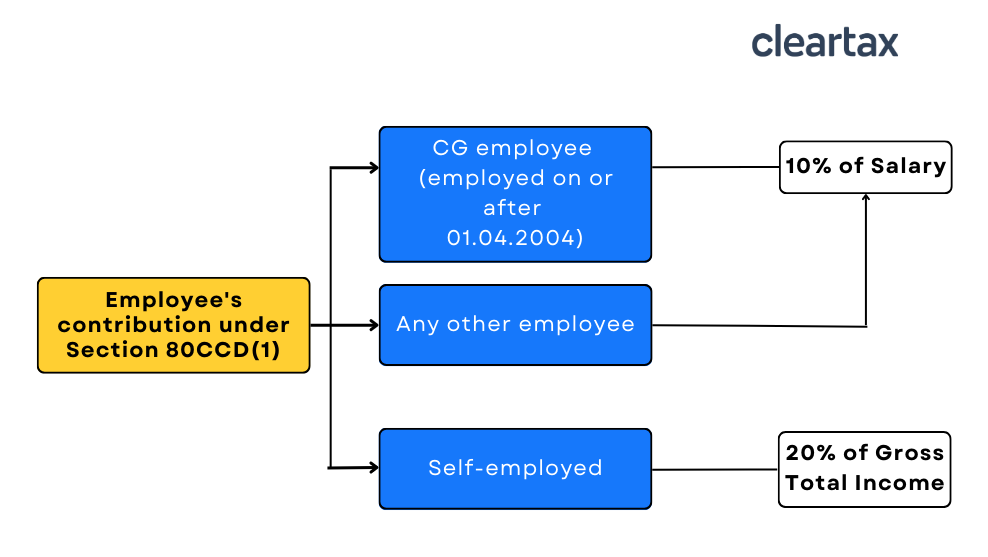

Section 80CCD of the Income Tax Act 1961 provides such an opportunity by allowing deductions on contributions made to the National Under Section 80CCD you can claim a deduction of up to Rs 1 5 lakhs for contributions made towards your NPS account The deduction limit is Rs 2 lakhs if you are not covered under the

Section 80CCD provides for Income Tax deductions for contributions made to the notified Pension Scheme of the Central Govt i e for contribution to the National Pension Scheme NPS Deduction under this Section is only available to National Pension scheme NPS Income tax deduction Section 80CCD 1 80CCD 1B 80CCD 2 form 16 Dear Reader please find below the key summarized

Download Nps Deduction Section 80ccd

More picture related to Nps Deduction Section 80ccd

NPS 80CCD 1 AND SECTION 80CCD 1B YouTube

https://i.ytimg.com/vi/9zU4iMCWPdM/maxresdefault.jpg

Section 80C Deductions List To Save Income Tax FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2022/09/section-80C-deductions-list-to-save-income-tax-video.webp

Money Musingz Personal Finance Blog Section 80D 80CCD Explained

http://moneymusingz.in/wp-content/uploads/2017/12/NPSOptions.png

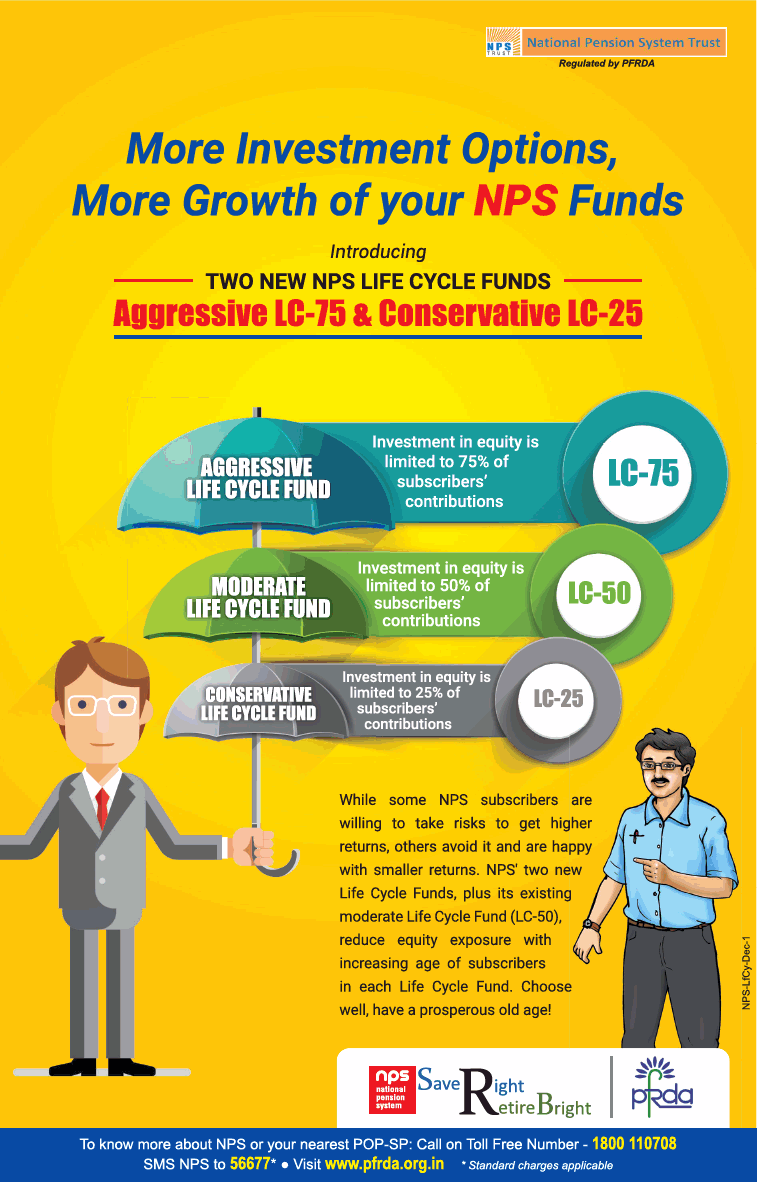

Deduction under Section 80CCD for National Pension Scheme Contribution is one of the most popular deduction Many users take advantages of this deduction at the time of filing of their Income tax Return As per the last Budget an additional tax deduction of up to R50 000 can be claimed under Section 80CCD 1B on investments in NPS However the aggregate amount of deduction under section 80C 80CCC and

Section 80CCD1 allows every tax paying individual in India to get tax deduction benefits from the amount you deposit in your NPS account This tax benefit is open to both employed and self A salaried person is eligible to claim the following deduction under Section 80CCD 2 a maximum contribution from the Central Government or State Government to NPS of

Can I Split NPS Deduction Into 80CCD 1B 80CCD 1 How To Get

https://i.ytimg.com/vi/f5BI0lDIUCE/maxresdefault.jpg

Have You Claimed These ITR Deductions On Section 80C 80CCD 80D

https://cdn-blob-fincart.azureedge.net/blog/wp-content/uploads/2021/12/61c0282800867-61c0282800869Deductions-on-Section-80C-80CCD-80D.png.png

https://cleartax.in

Section 80CCD 1B gives an additional deduction of Rs 50 000 on their NPS contributions Section 80CCD 2 provides that employees can claim

https://www.etmoney.com › learn › income-tax

Section 80CCD relates to the tax deduction for the contributions made in the National Pension System NPS and the Atal Pension Yojana APY Under this section you can claim a deduction of up to 2 lakh in a financial

Section 80CCD Of Income Tax Act Deduction For NPS Contribution

Can I Split NPS Deduction Into 80CCD 1B 80CCD 1 How To Get

Section 80C Deduction Under Section 80C In India Paisabazaar

Deduction Under Section 80C 80CCC 80CCD 80D For AY 2019 20

What Is Section 80G Tax Deductions On Your Donations Deduction U s

Deductions Under Section 80CCD Of Income Tax

Deductions Under Section 80CCD Of Income Tax

Section 80D Income Tax Act Dialabank Best Offers

All About Of National Pension Scheme NPS CA Rajput Jain

NPS Tax Benefit Under Section 80CCD 1 80CCD 2 And 80CCD 1B

Nps Deduction Section 80ccd - National Pension scheme NPS Income tax deduction Section 80CCD 1 80CCD 1B 80CCD 2 form 16 Dear Reader please find below the key summarized