Nps Govt Contribution In New Tax Regime New Tax Regime You can still get tax benefit on NPS contributions Check when it is possible Income Tax News The Financial Express Budget 2024

In this post lets discuss What are the NPS Income Tax benefits for FY 2023 24 or AY 2024 25 Can you claim Income Tax Deduction on NPS contribution Under the new tax regime NPS contributions are eligible for a tax deduction of up to 10 of salary including dearness allowance DA and further deductions of

Nps Govt Contribution In New Tax Regime

Nps Govt Contribution In New Tax Regime

https://rupiko.in/wp-content/uploads/2020/08/New-vs-Old-Tax-Regime-1.png

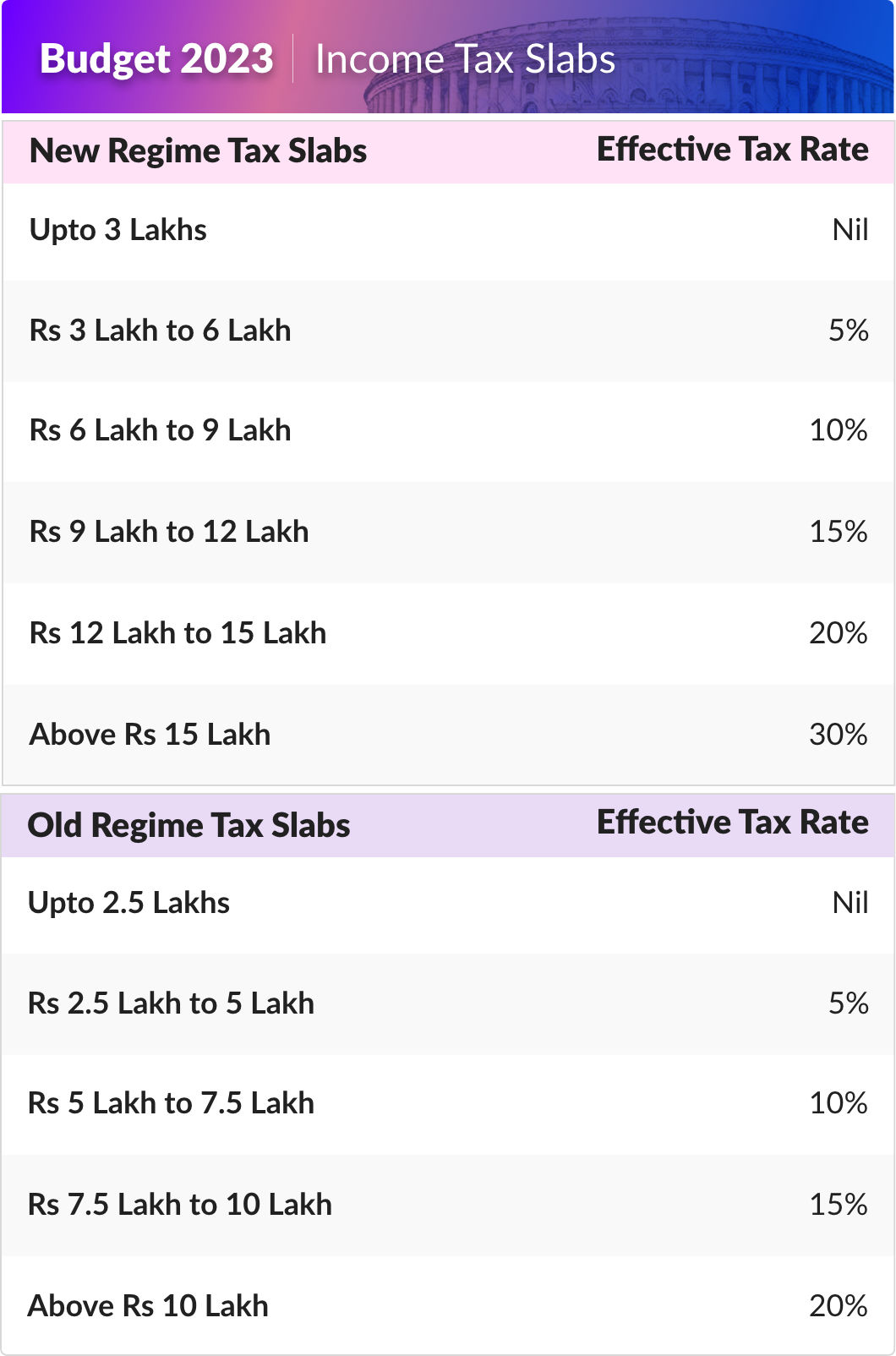

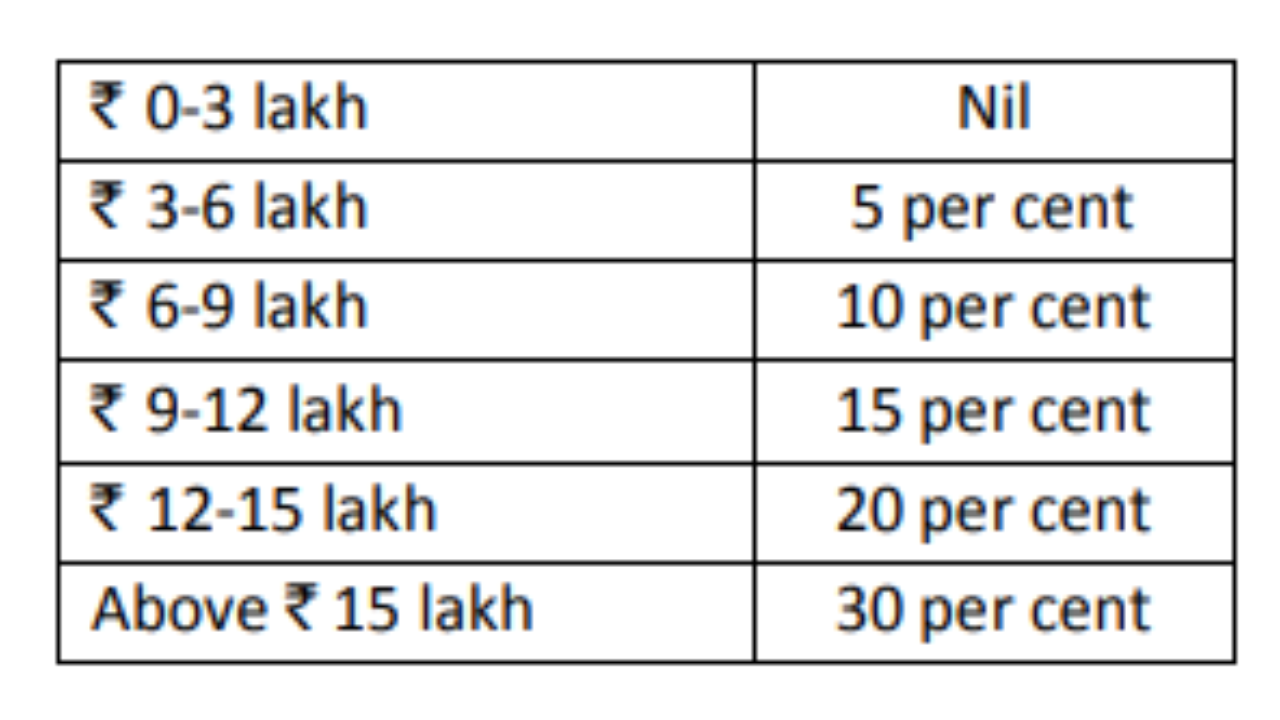

Budget 2023 New Income Tax Slabs How To Calculate Your Tax Hindustan

https://images.hindustantimes.com/img/2023/02/01/original/Tax_Regime_table_Web_1675260619284.png

NPS Govt Contribution Hike Rollback News By Dainik Bhasker Central

https://www.staffnews.in/wp-content/uploads/2020/05/NPS-Govt-Contribution-Hike-rollback-news-by-Dainik-Bhasker.jpeg

24 Jan 2024 Aakar Rastogi SHARE I believe there is a provision that allows claiming an additional deduction of up to Rs 50 000 from taxable income which is available Deduction under Section 80CCD 2 for employer s contribution to employee s National Pension System NPS account New income tax slabs 2023 24 Deductions you can claim under new tax

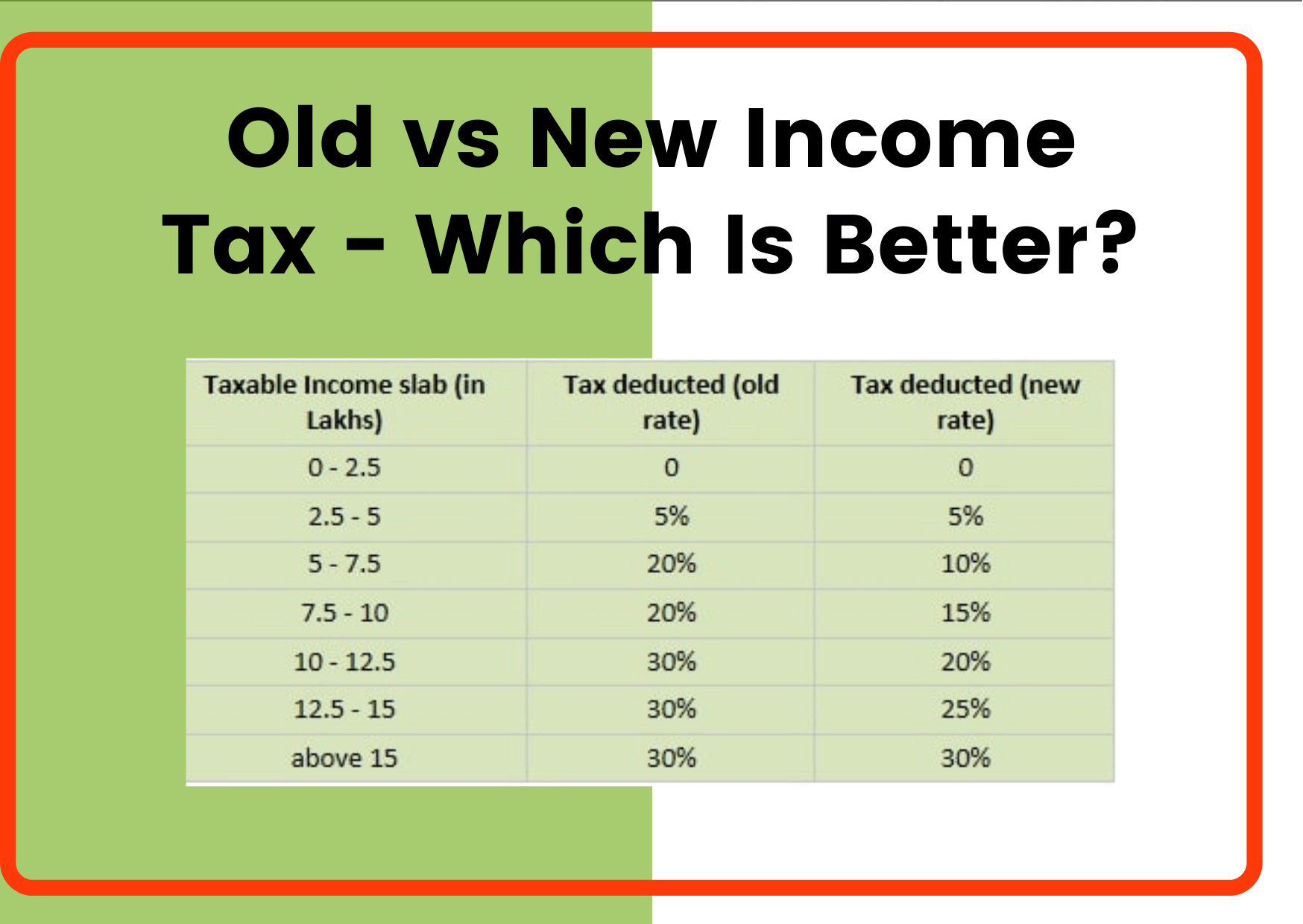

New Tax Regime NPS deduction Provident fund The taxpayers can choose between the new tax regime or the old tax regime from FY 2020 21 If you plan to choose the new tax regime you can National Pension Scheme NPS India is a voluntary and long term investment plan for retirement under the purview of the Pension Fund Regulatory and

Download Nps Govt Contribution In New Tax Regime

More picture related to Nps Govt Contribution In New Tax Regime

Is EPF Employer Contribution Taxable In The Revised New Tax Regime

https://freefincal.com/wp-content/uploads/2023/02/Is-EPF-employer-contribution-taxable-in-the-revised-New-Tax-Regime.jpg

Income Tax Clarification Opting For The New Income Tax Regime U s

https://blog.quicko.com/wp-content/uploads/2020/04/tax-slabs-scaled-1-1024x512.jpg

Sss Contribution Schedule 2021 Sss Inquiries CLOUD HOT GIRL

https://mattscradle.com/wp-content/uploads/2015/07/sss-contribution-table-effective-2021-for-self-employed-members.jpg

Limited to 10 of salary Limited to 14 for central government contributions 10 of salary Thus the total maximum tax rebate an individual can avail on NPS is of INR 2 lakh including INR 1 5 In essence by investing in NPS you can claim tax deductions of up to Rs 2 lakhs in total Rs 1 5 lakhs under Section 80C and an additional Rs 50 000 under Section 80CCD 1B This means

The government wants to encourage people to move to the new tax regime which combines lower tax rates with a very limited number of exemptions As of now an There is also a demand for tax breaks on NPS contributions under the new tax regime Currently an individual s contribution of up to Rs 50 000 to the NPS is

New Tax Regime To Benefit Middle Class Leave More Money In Their Hands

https://english.cdn.zeenews.com/sites/default/files/2023/02/11/1152625-untitled-design-2023-02-11t204926.977.jpg

Exemptions Still Available In New Tax Regime with English Subtitles

https://i.ytimg.com/vi/_UAh2kQIrtc/maxresdefault.jpg

https://www.financialexpress.com/money/new-tax...

New Tax Regime You can still get tax benefit on NPS contributions Check when it is possible Income Tax News The Financial Express Budget 2024

https://www.relakhs.com/nps-income-tax-benefits-fy...

In this post lets discuss What are the NPS Income Tax benefits for FY 2023 24 or AY 2024 25 Can you claim Income Tax Deduction on NPS contribution

Budget Decoder How To Choose Between Old And New Tax Regime Times Of

New Tax Regime To Benefit Middle Class Leave More Money In Their Hands

Budget 2023 Old Tax Regime And New Tax Regime Explained In 3 Scenarios

How To Make Online Contributions To NPS Tier I And Tier II Accounts

New Tax Regime For The New Year Inquirer Business

New Tax Regime Vs Outdated Tax Regime Which One To Choose Https

New Tax Regime Vs Outdated Tax Regime Which One To Choose Https

Deductions Under The New Tax Regime Budget 2020 Blog By Quicko

Income Tax Slabs In India Complete Salary Wise Per Cent Wise Details

Income Tax Return Which Tax Regime Suits You Old Vs New

Nps Govt Contribution In New Tax Regime - New Tax Regime NPS deduction Provident fund The taxpayers can choose between the new tax regime or the old tax regime from FY 2020 21 If you plan to choose the new tax regime you can