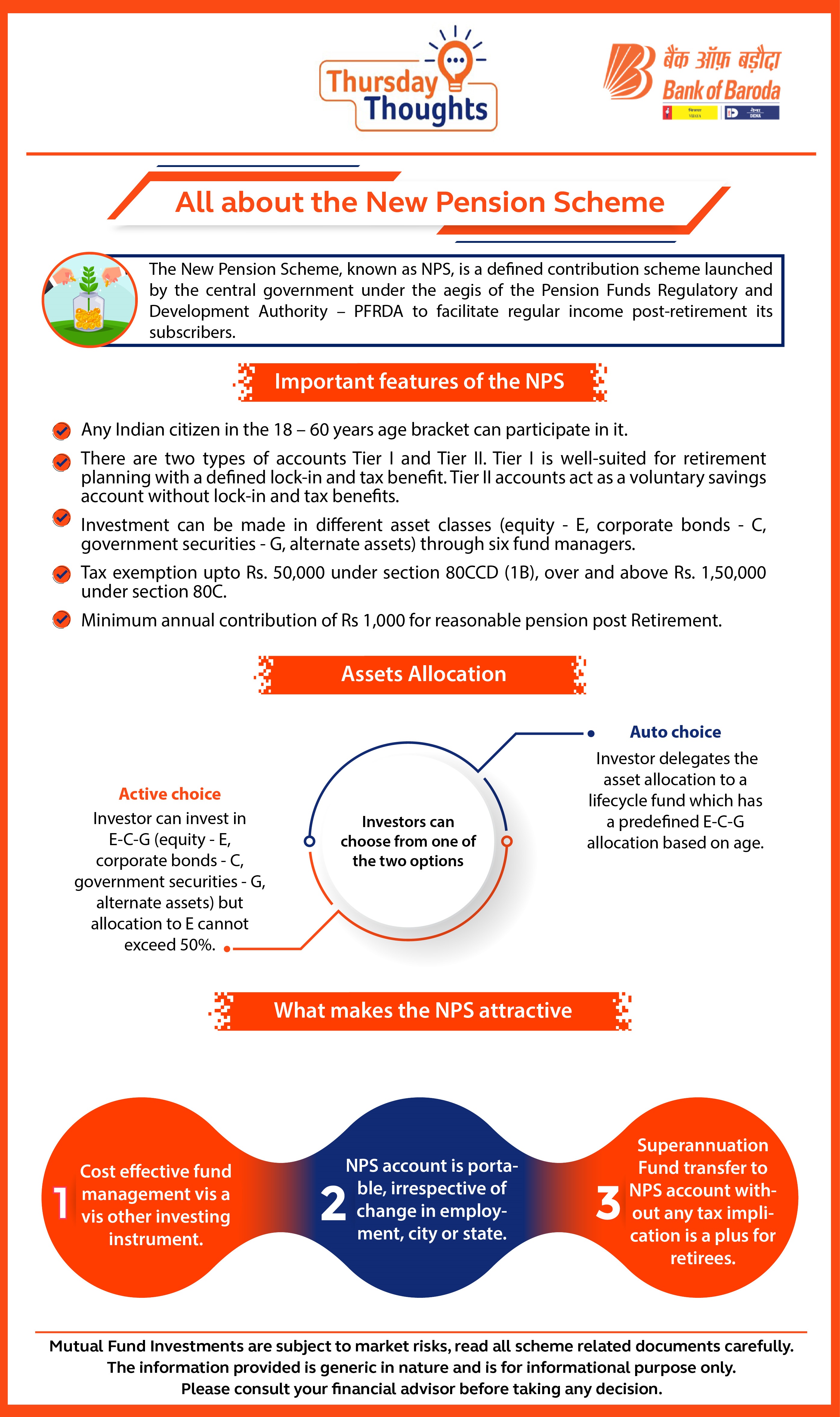

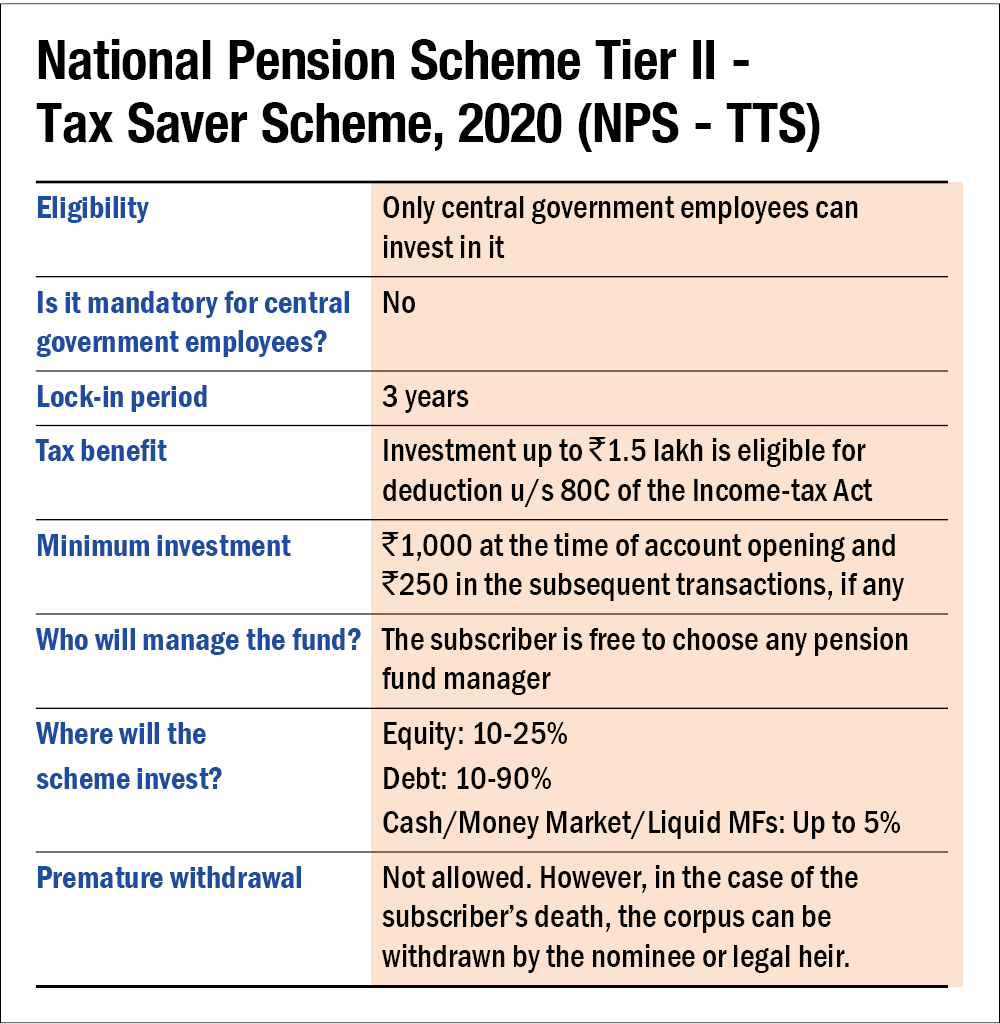

Nps Income Tax Benefit Tier 1 Verkko 21 syysk 2022 nbsp 0183 32 NPS Tier 1 tax benefits are as follows Tax Benefits under Section 80C The National Pension System NPS is one of the listed investment options where you can allocate your funds to avail of tax benefits under Section 80C The deduction limit for this section is Rs 1 5 lakhs

Verkko 16 syysk 2022 nbsp 0183 32 What are NPS Tier 1 and Tier 2 Tax Benefits The contributions made to an NPS Tier 1 account are eligible for tax deductions Contributions to an NPS Tier 2 account do not offer any tax benefits Tax Benefits under Section 80C The deduction limit for this section is Rs 1 5 lakhs Verkko 25 syysk 2023 nbsp 0183 32 NPS Tier 1 is a primary NPS account that opens by default when opting to invest in an NPS scheme It is mandatory to open Tier 1 for those who register under NPS It is meant for retirement savings with a minimum contribution of

Nps Income Tax Benefit Tier 1

Nps Income Tax Benefit Tier 1

http://cachandanagarwal.com/wp-content/uploads/2022/03/Income-Tax-NPS.jpeg

National Pension Scheme NPS Scheme NPS Tier 1 And Tier 2 NPS Tax

https://i.ytimg.com/vi/4Wn7yxDxwLQ/maxresdefault.jpg

Should Invest In NPS Just For The Tax Benefits NPS

https://carajput.com/art_imgs/why-we-should-invest-in-nps-just-for-the-tax-benefits.jpg

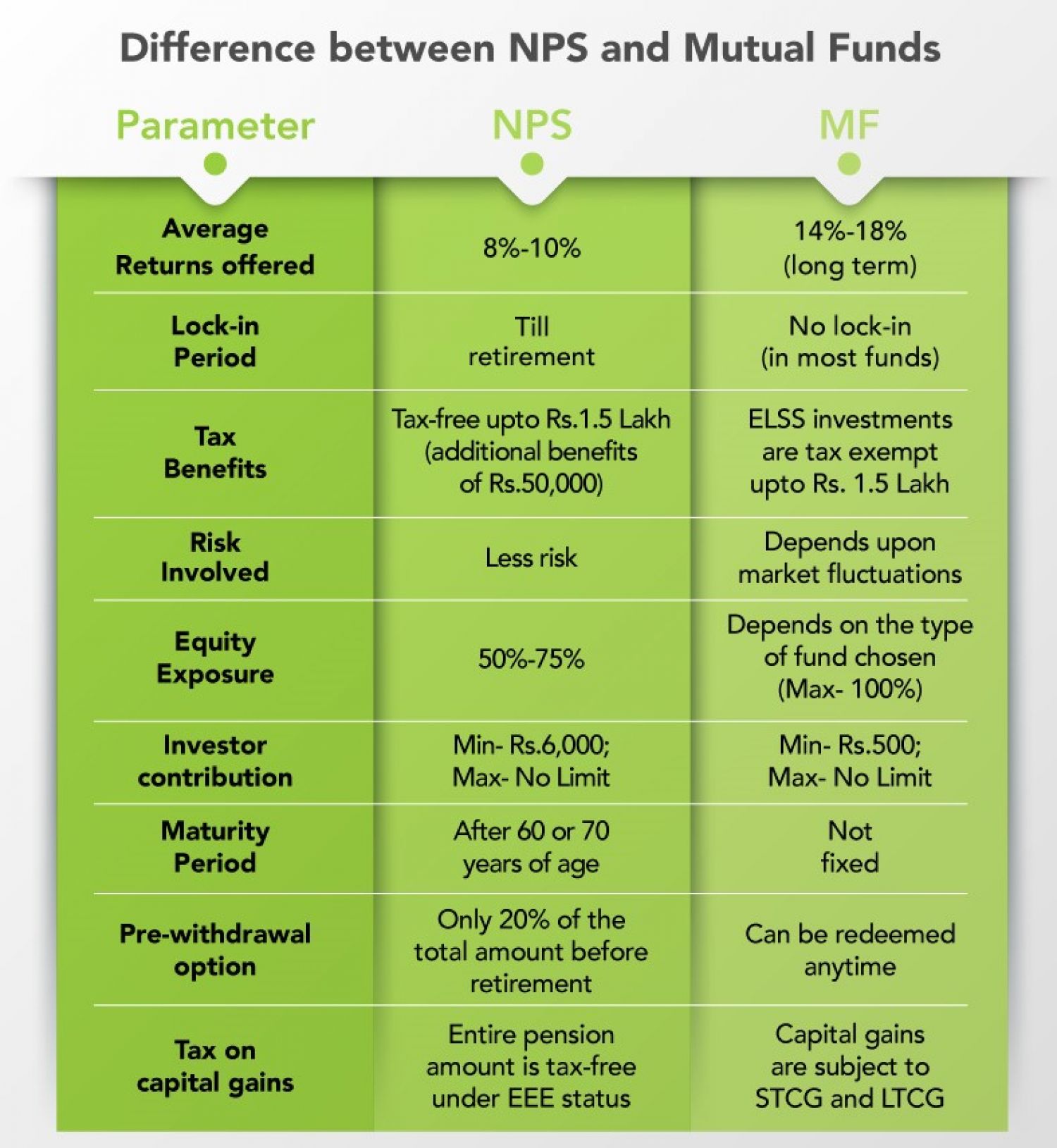

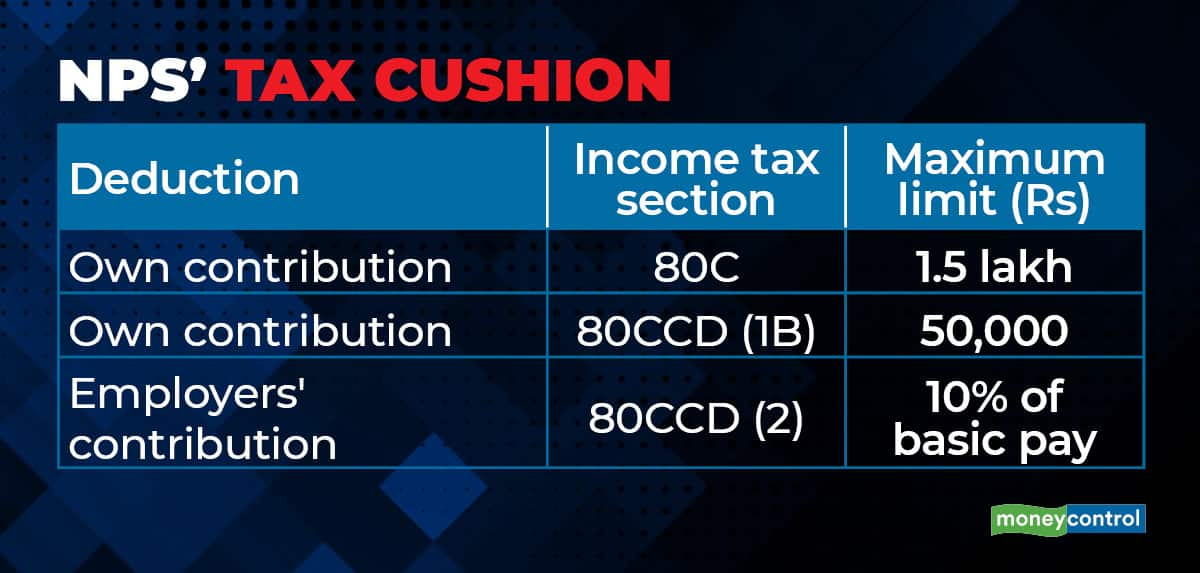

Verkko NPS Tier I tax benefits As mentioned earlier you get the benefits of NPS tier 1 by investing in a Tier I Account of the NPS scheme These benefits are as follows Investment up to Rs 1 5 lakhs would be allowed as a deduction under Section 80CCD 1 This limit includes the deductions under Section 80C Verkko 30 tammik 2023 nbsp 0183 32 Let s see in a nutshell the various tax benefits of the NPS investment for the salaried and self employed individuals Eligible to claim deduction on contribution up to 10 of the salary basic

Verkko 1 What are the tax benefits under NPS Tax Benefit available to Individual Any individual who is Subscriber of NPS can claim tax benefit under Sec 80 CCD 1 with in the overall ceiling of Rs 1 5 lac under Sec 80 CCE Exclusive Tax Benefit to all NPS Subscribers u s 80CCD 1B Verkko Under Section 80CCD 1 of the Income Tax Act NPS offers a tax exemption of up to Rs 1 5 lakh In case a company provides an NPS facility the employer s contribution to NPS offers a tax rebate of up to 10 of the salary basic plus

Download Nps Income Tax Benefit Tier 1

More picture related to Nps Income Tax Benefit Tier 1

Different Types Of National Pension Scheme Accounts And Tax Benefits

https://www.alankit.com/blog/blogimage/different-types-of-nps-accounts-and-tax-benefits.jpg

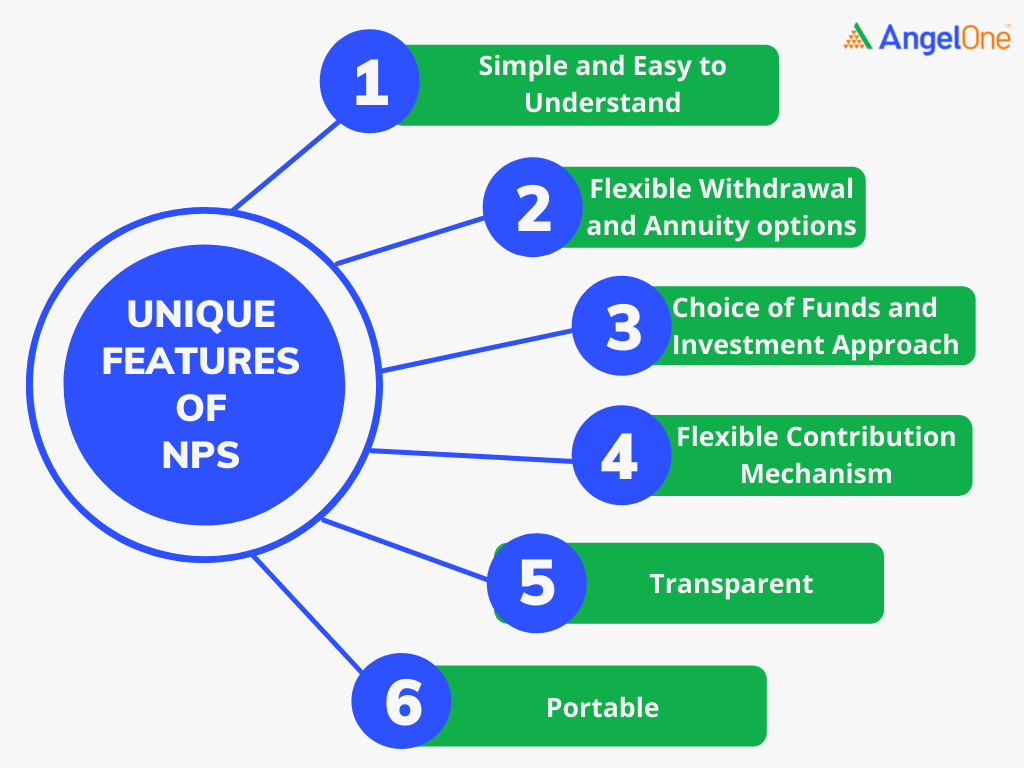

NPS All You Need To Know Angel One

https://w3assets.angelone.in/wp-content/uploads/2022/06/NPS.png

What Are The Tax Benefits That NPS Offers

https://images.moneycontrol.com/static-mcnews/2022/02/NPS-tax_001.jpg

Verkko 20 syysk 2022 nbsp 0183 32 NPS National Pension Scheme tax benefits available only in Tier 1 NPS accounts NPS tax saving comes under Sec 80CCD 1 80CCD 1B 80CCD 2 deduction Verkko 6 huhtik 2023 nbsp 0183 32 In accordance with Section 80C of the Income Tax Act NPS Tier 1 accounts are eligible for a deduction of up to 1 5 lakh from taxable income and an additional deduction of up to

Verkko Claiming Tax Benefits on tier 1 and tier 2 NPS Returns Tax Deductions Under Section 80CCD 1 For all NPS Tier 1 subscribers there s the opportunity to claim tax deductions of up to 1 5 lakhs under Section 80CCD 1 Additional Deduction Under Section 80CCD 1B Tier 1 investors can also benefit from an extra deduction of up to 50 000 Verkko 22 syysk 2022 nbsp 0183 32 When it comes to claiming NPS tax benefit only contributions to Tier I accounts are eligible for NPS tax deductions for private sector employees For government sector employees both Tier I and Tier II contributions are eligible for NPS tax deductions Upon maturity up to 60 of the NPS corpus can be withdrawn tax free

All About The New Pension Scheme Bank Of Baroda

https://www.bankofbaroda.in/-/media/project/bob/countrywebsites/india/blogs/thursday-thoughts/images/new-pension-scheme-10-11.jpg

Latest NPS Income Tax Benefits 2019 20 Tax Saving Through NPS

https://www.relakhs.com/wp-content/uploads/2019/08/Latest-NPS-Income-Tax-Benefits-for-FY-2019-2020-AY-2020-2021-pic.jpg

https://www.etmoney.com/learn/nps/nps-tax-benefit

Verkko 21 syysk 2022 nbsp 0183 32 NPS Tier 1 tax benefits are as follows Tax Benefits under Section 80C The National Pension System NPS is one of the listed investment options where you can allocate your funds to avail of tax benefits under Section 80C The deduction limit for this section is Rs 1 5 lakhs

https://www.etmoney.com/learn/nps/investing-in-nps-tier-i-and-tier-ii...

Verkko 16 syysk 2022 nbsp 0183 32 What are NPS Tier 1 and Tier 2 Tax Benefits The contributions made to an NPS Tier 1 account are eligible for tax deductions Contributions to an NPS Tier 2 account do not offer any tax benefits Tax Benefits under Section 80C The deduction limit for this section is Rs 1 5 lakhs

Solved 2 EJ Company s Taxable Income In Four Previous Years Chegg

All About The New Pension Scheme Bank Of Baroda

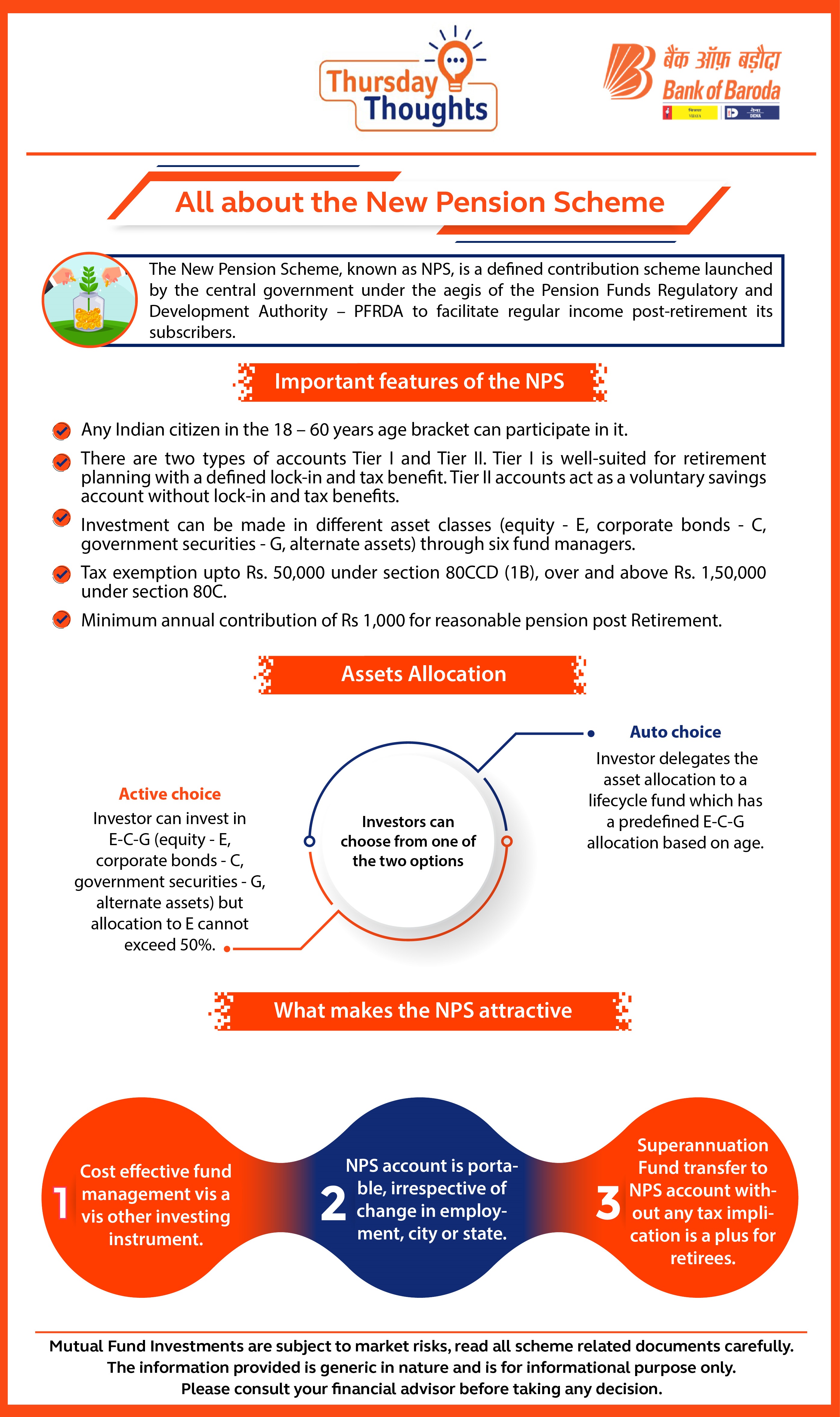

CPS NPS Income Tax Clarification On 80CCD 1B Memo No

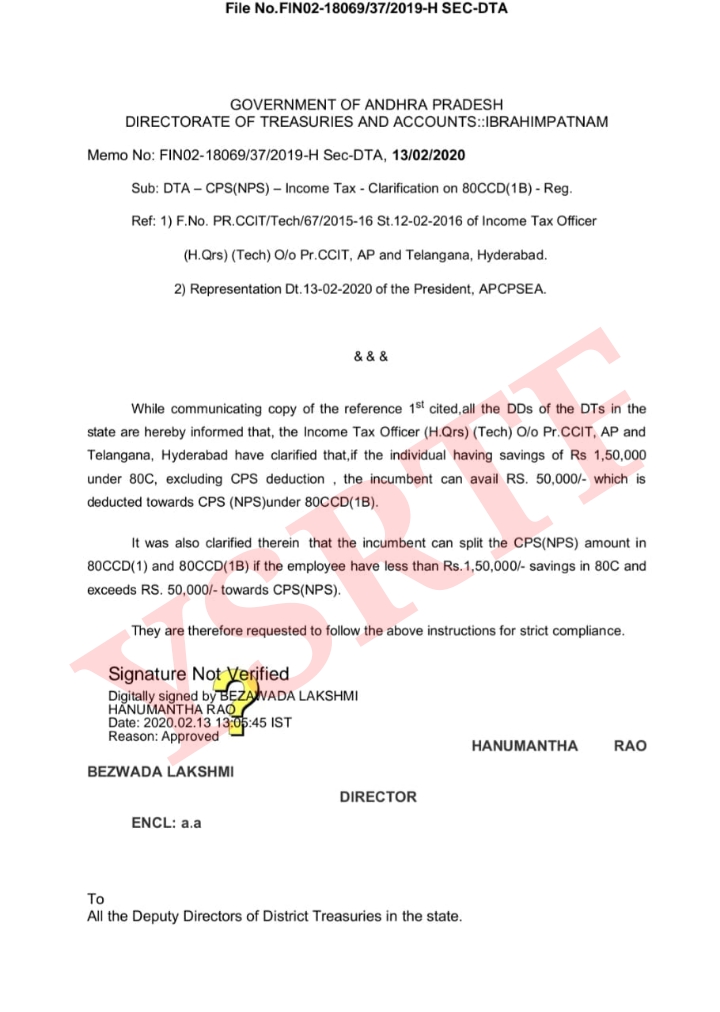

New NPS Tier II Scheme Gives Tax Benefit To Central Government

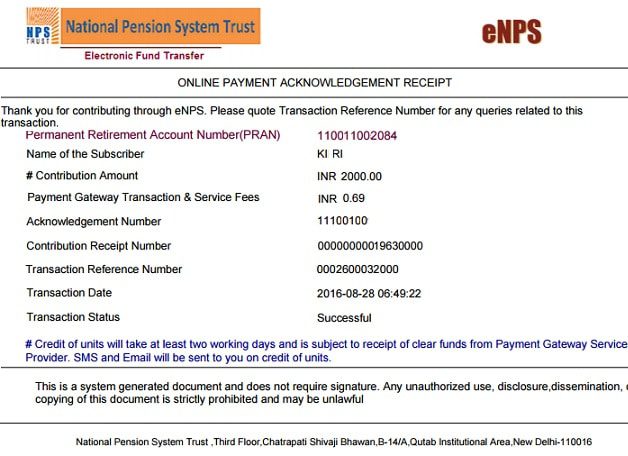

Nps contribution payment receipt

NPS Invest Rs 5000 Per Month Get Rs 2 Lakh Monthly Pension From THIS

NPS Invest Rs 5000 Per Month Get Rs 2 Lakh Monthly Pension From THIS

Nps Contribution By Employee Werohmedia

NPS Tax Benefits Sec 80CCD 1 80CCD 2 And 80CCD 1B BasuNivesh

NPS Investment How To Maximise Income Tax Benefits Business League

Nps Income Tax Benefit Tier 1 - Verkko 4 hein 228 k 2023 nbsp 0183 32 Tax Exemption Benefits NPS Tier 1 accounts also offer lucrative tax exemption benefits in the form of the Exempt Exempt Exempt model The first Exempt is related to individual contributions Subscribers can claim tax benefits under Section 80 CCD 1 of the Income Tax Act 1961 within the overall ceiling of 1 5 Lakhs under