Nps Tax Benefit For Salaried Employees In New Tax Regime The budget has encouraged retirement planning by increasing the tax benefit on NPS payments and adding a new option to the pension system

Finance Minister Nirmala Sitharaman s Budget 2025 announcement has brought some relief for salaried individuals with the tax free income limit now raised to Rs 12 lakh The Employees contributing to NPS are eligible for following tax benefits on their own contribution Tax deduction up to 10 of salary Basic DA under section 80 CCD 1 within the overall ceiling

Nps Tax Benefit For Salaried Employees In New Tax Regime

Nps Tax Benefit For Salaried Employees In New Tax Regime

https://pbs.twimg.com/media/Fn4acNbaMAYAokV.jpg

Opinion It s Time For A New Tax Regime The Daily Iowan

https://dailyiowan.com/wp-content/uploads/2022/06/taxop.jpg

List Of Allowances Exemptions Relevant To Salaried Employees TAXCONCEPT

https://i0.wp.com/taxconcept.net/wp-content/uploads/2021/12/WhatsApp-Image-2021-12-10-at-12.22.57-PM.jpeg?fit=700%2C410&ssl=1

Latest NPS benefits under new tax regime after Budget 2024 If your basic salary is Rs 1 lakh your employer can contribute Rs 10 000 10 of basic pay to the NPS on your behalf which is exempt from tax This New tax Regime A maximum deduction of 14 of their salary basic DA contributed by any other employer towards NPS There is a maximum limit of Rs 7 50 000 on employer contribution to PF NPS and

Section 80CCD 1 gives a tax deduction on NPS contributions up to 10 of their salary basic salary DA made by employees However the total amount of deduction of 80C and 80CCD 1 cannot exceed Rs 1 50 lakhs in Under the new regime salaried employees can claim a deduction against NPS contributions made by their employer The maximum contribution and deduction limit is 14 of

Download Nps Tax Benefit For Salaried Employees In New Tax Regime

More picture related to Nps Tax Benefit For Salaried Employees In New Tax Regime

5 Tax Saving Options For Salaried Employees Zaggle Save Employee

https://www.zagglesave.com/blog/wp-content/uploads/2022/03/Zaggle-Save-Blog-1-2048x1195.jpg

INTRODUCTION OF SECTION 115BAC TO INCOME TAX ACT 1961 Onfiling Blog

https://blog.onfiling.com/wp-content/uploads/2021/04/49134-1940x1455-1.jpg

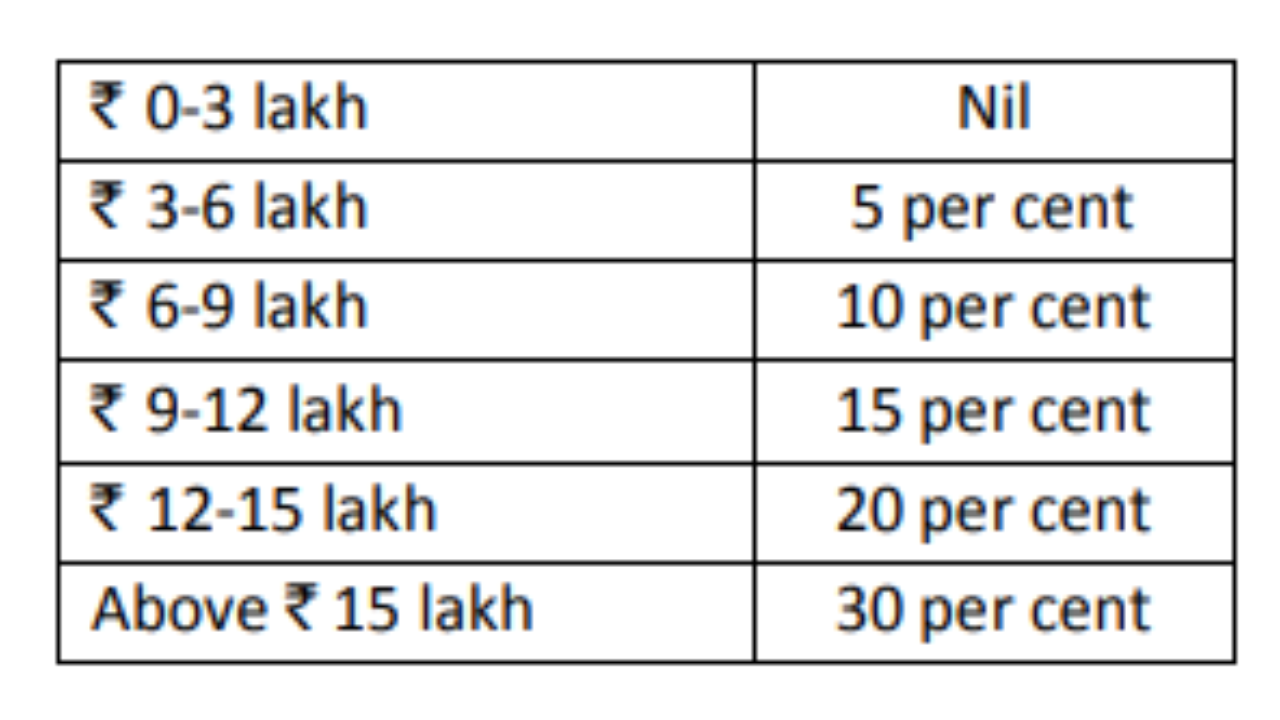

New Income Tax Regime Changes In Tax Slabs And Rebate Limits See

https://static.tnn.in/photo/msid-101208384/101208384.jpg

New Tax Regime If you are going ahead with New Tax Regime then you can not claim income tax benefits u s 80 CCD 1 The self employed individual other than the salaried class can contribute up to 20 of their Employees choosing the New Tax Regime are now eligible for a higher deduction of up to 14 of their basic salary for the contribution made to the NPS by the employer on behalf of the employee

This can become a lucrative option for individuals investing in NPS to build retirement funds Deductions Section 80CCD 2 introduced in Union Budget 2024 Under New tax slab 2025 impact In her Budget statement on February 1 Finance Minister Nirmala Sitharaman introduced a major tax relief for middle class salaried taxpayers in the latest

New Tax Regime To Benefit Middle Class Leave More Money In Their Hands

https://english.cdn.zeenews.com/sites/default/files/2023/02/11/1152625-untitled-design-2023-02-11t204926.977.jpg

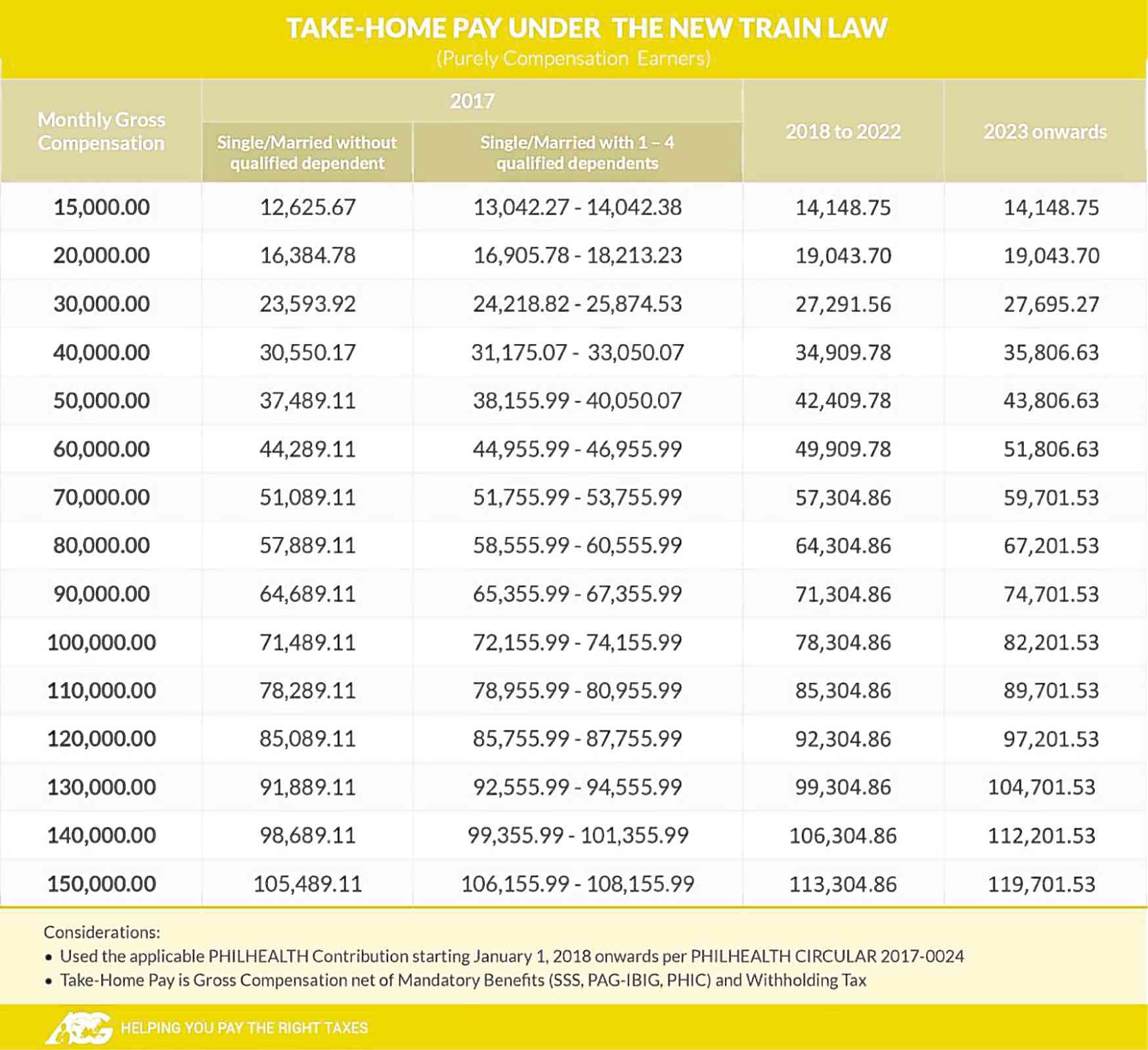

New Tax Regime For The New Year Inquirer Business

http://business.inquirer.net/files/2018/01/graph-2.jpg

https://economictimes.indiatimes.com › w…

The budget has encouraged retirement planning by increasing the tax benefit on NPS payments and adding a new option to the pension system

https://www.indiatoday.in › business › story › new-tax...

Finance Minister Nirmala Sitharaman s Budget 2025 announcement has brought some relief for salaried individuals with the tax free income limit now raised to Rs 12 lakh The

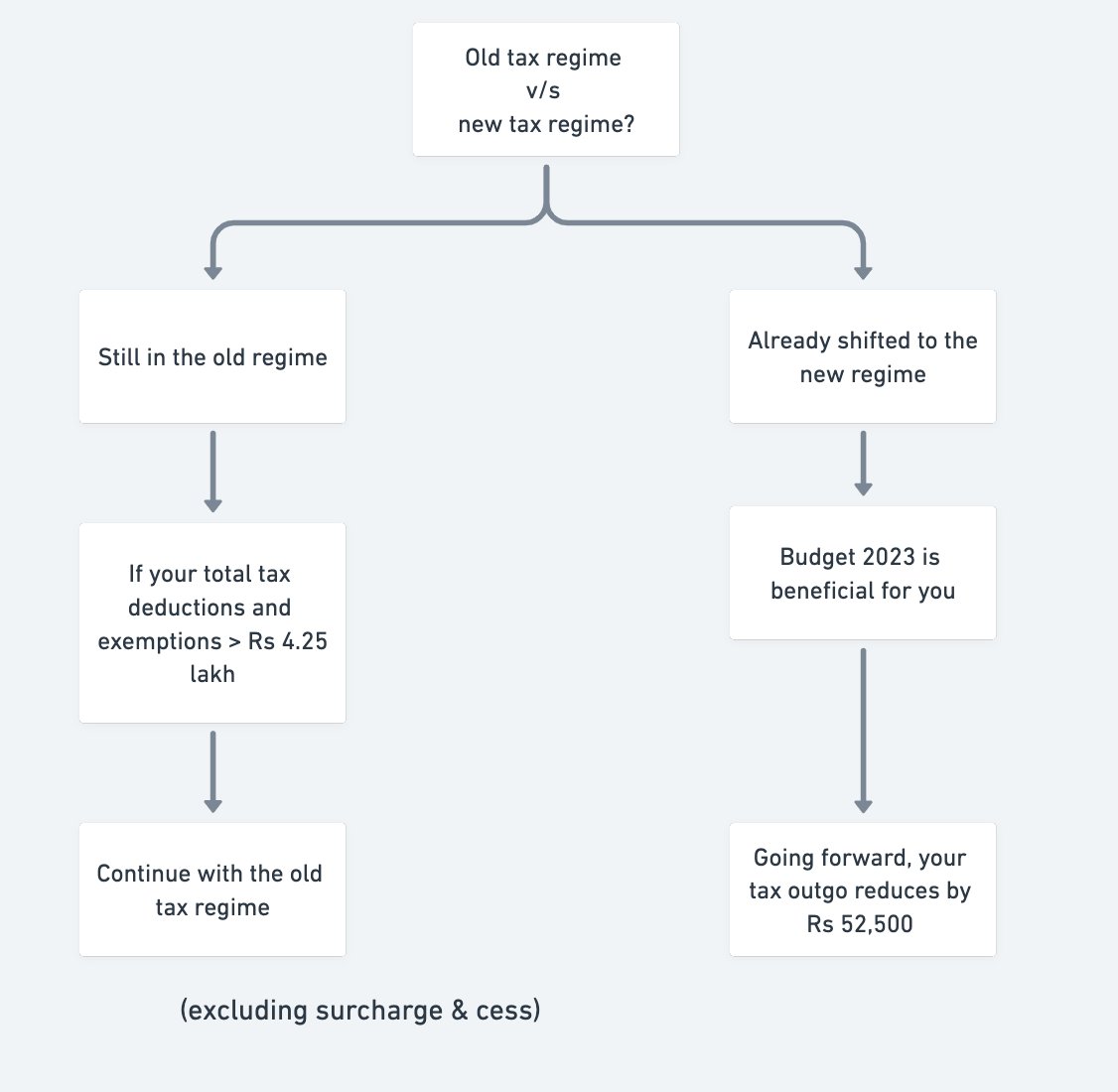

Should You Go For The New Tax Regime The Indian Express

New Tax Regime To Benefit Middle Class Leave More Money In Their Hands

Budget 2023 Relating To Individual Income Tax

All The Salaried Employees Out There Save More With These Simple Tax

Incomes That Are Exempted Under The Proposed New Tax Regime India

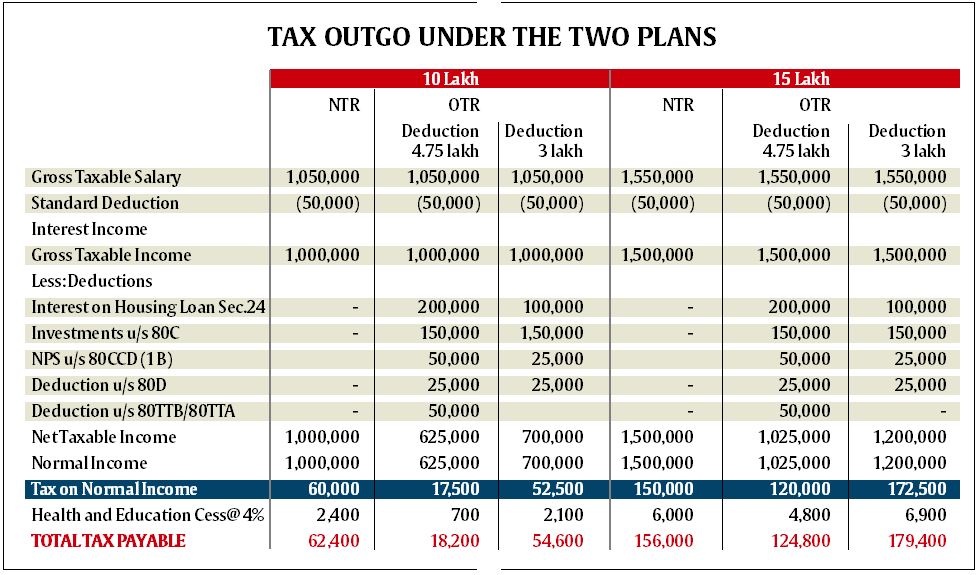

Old Vs New Tax Regime Which Is Better New Or Old Tax Regime For

Old Vs New Tax Regime Which Is Better New Or Old Tax Regime For

Budget 2020 Current Tax Regime Vs New Tax Regime Causing A Stir For

NPS Income Tax Benefits FY 2020 21 Old New Tax Regimes

Online Salary Tax Calculator MckenzyJoani

Nps Tax Benefit For Salaried Employees In New Tax Regime - If you are a salaried individual you can achieve a tax free annual income of up to Rs 13 7 lakh under the new tax regime by utilising the standard deduction and employer