Nps Tax Benefit Under New Tax Regime Is NPS deduction allowed under New Tax Regime In the new tax regime taxpayers will have to forgo most of the income tax exemptions and deductions to avail

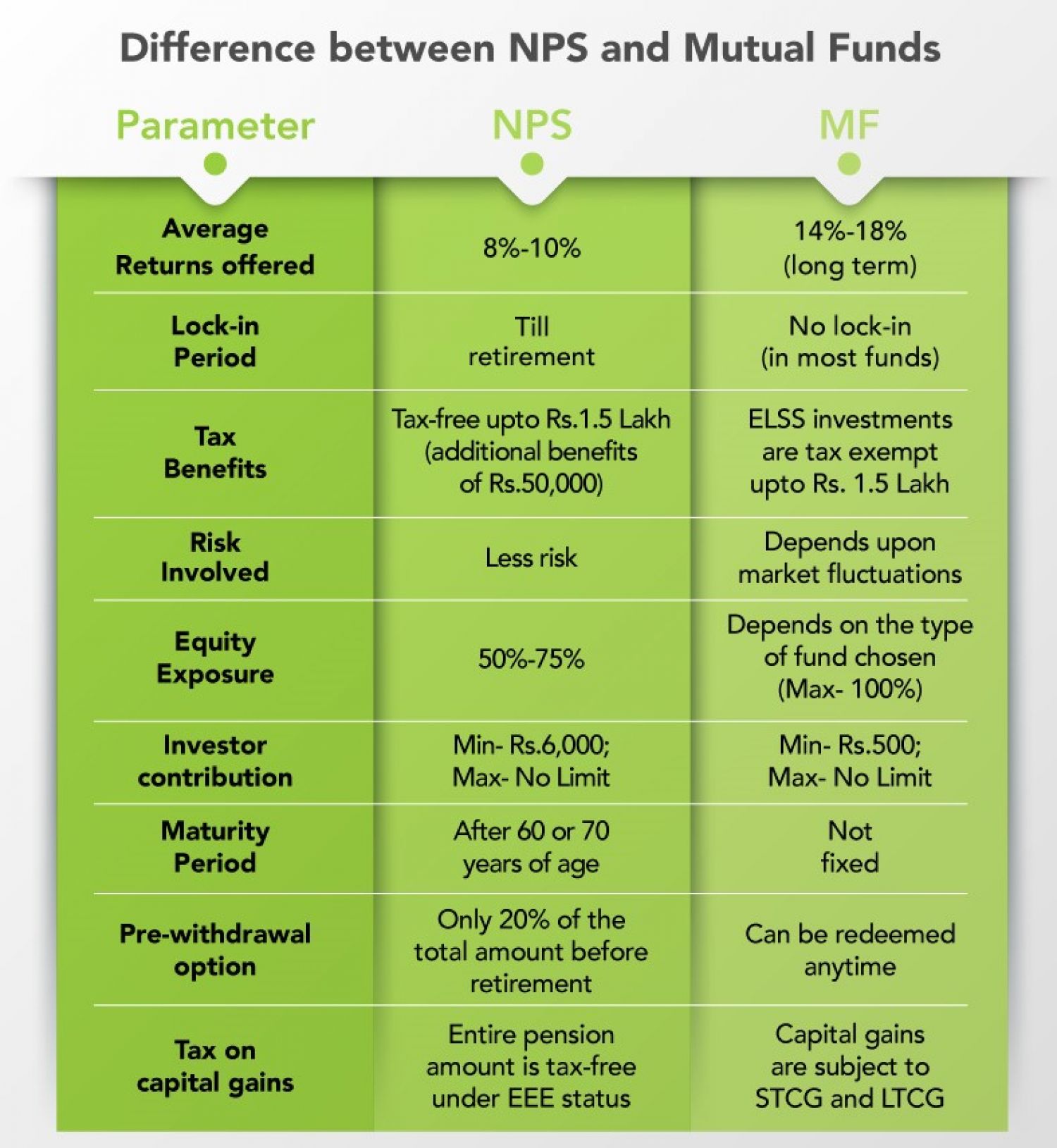

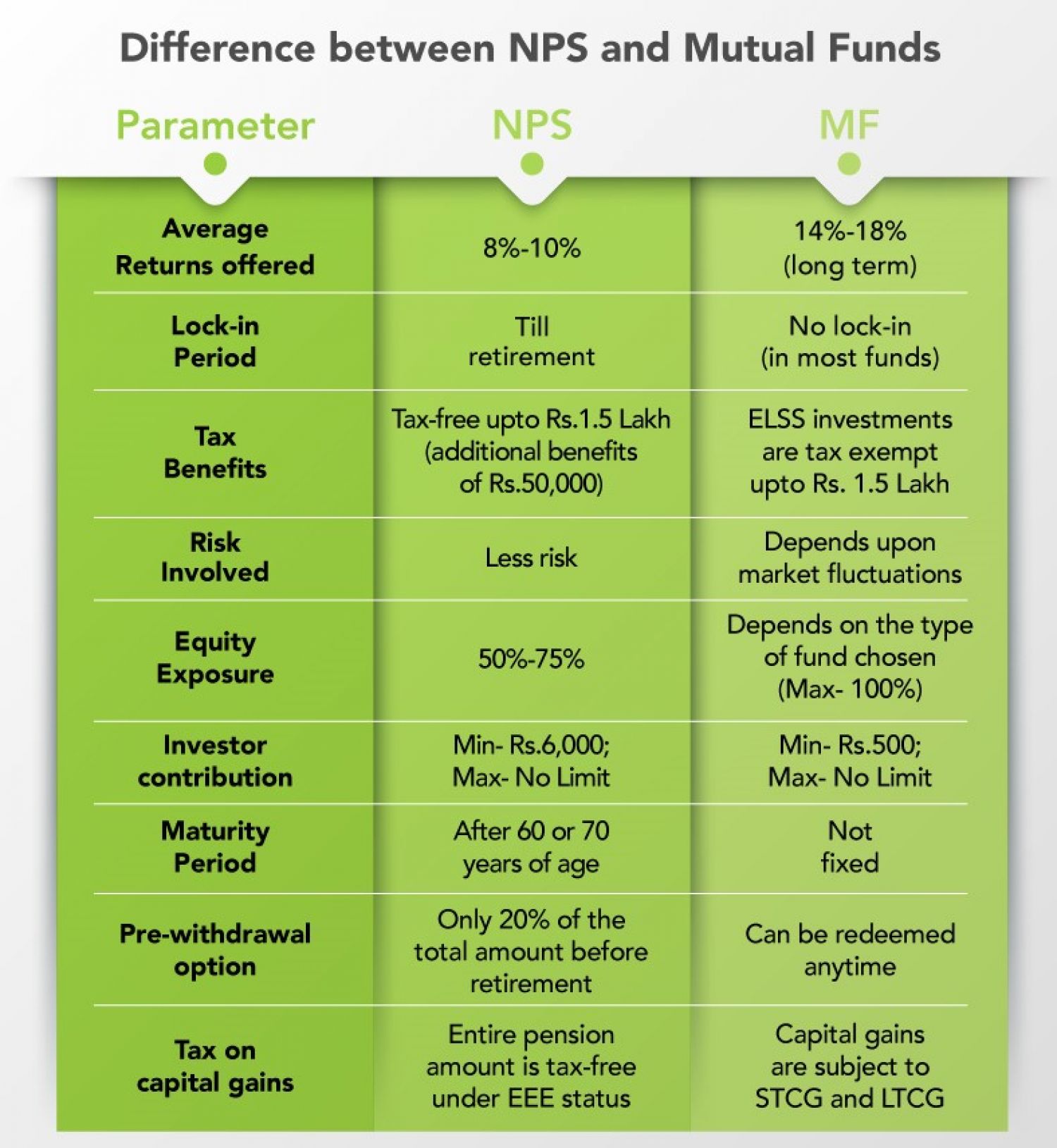

In essence by investing in NPS you can claim tax deductions of up to Rs 2 lakhs in total Rs 1 5 lakhs under Section 80C and an additional Rs 50 000 under Section 80CCD 1B This means If you are under the new tax regime and are investing in NPS Tier 1 you are not eligible to get the additional deduction of up to Rs 50 000 Only those who have

Nps Tax Benefit Under New Tax Regime

Nps Tax Benefit Under New Tax Regime

https://carajput.com/art_imgs/why-we-should-invest-in-nps-just-for-the-tax-benefits.jpg

Tax Benefit On NPS Save More Money

https://savemoremoney.in/wp-content/uploads/2022/04/Tax-Benefit-On-NPS.png

New Tax Regime Definition Advantages And Disadvantages Explained Mint

https://images.livemint.com/img/2023/02/01/original/New_Tax_Regime_1675252771001.jpg

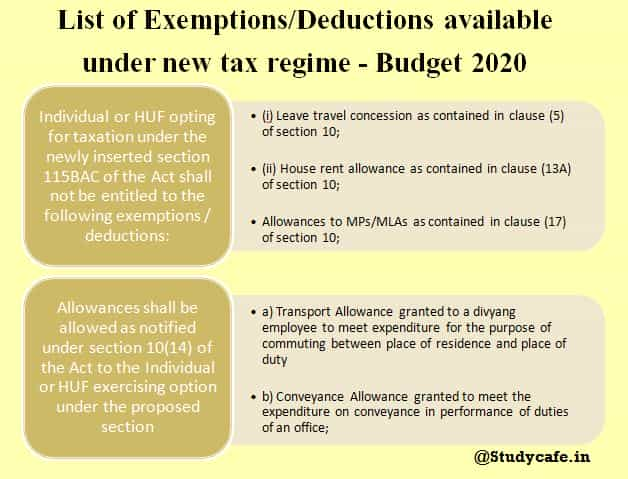

NPS deduction Provident fund The taxpayers can choose between the new tax regime or the old tax regime from FY 2020 21 If you plan to choose the new tax regime you can deduct the employer s February 6 2023 After the Budget 2023 what are the NPS Tax Benefits 2023 under the new tax and old tax regimes This confusion started mainly because the government stressed promoting the new tax regime rather

There is no tax benefit on investment towards a Tier II NPS Account Old Tax Regime Taxpayers going with the Old Tax Regime can claim tax deductions Following the Budget 2023 there has been some confusion regarding the tax benefits of the National Pension System NPS under both the new tax regime and the

Download Nps Tax Benefit Under New Tax Regime

More picture related to Nps Tax Benefit Under New Tax Regime

NPS Income Tax Benefits FY 2020 21 Old New Tax Regimes

https://www.relakhs.com/wp-content/uploads/2020/02/NPS-Income-Tax-Benefits-for-FY-2020-2021-AY-2021-2022-New-Tax-Regime-Sec-80CCD.jpg

New Tax Regime Vs Old Tax Regime How To Choose The Better Option For

https://imgk.timesnownews.com/media/1_2_7.jpg

Why The New Income Tax Regime Has Few Takers

https://images.moneycontrol.com/static-mcnews/2022/01/New-tax-regime-1.jpeg

Under Old Tax Regime If you are opting old tax regime then you can continue claiming income tax deduction of Rs 50 000 u s 80CCD 1b New Tax Under the new tax regime NPS contributions are eligible for a tax deduction of up to 10 of salary including dearness allowance DA and further deductions

The NPS tax benefit is the tax deduction that investors can avail of under Section 80CCD of the Income Tax Act Let s understand Section 80CCD better Section Investing in Tier I account of NPS via your employer makes you eligible to claim deduction from your gross total income under the Income tax Act 1961 even

The New Tax Regime FY 2020 21 VS The Old Tax Regime Quick Tax Help

https://mkrk.co.in/wp-content/uploads/2021/03/Blog18-Old-Versus-New-Tax-Regime-33.png

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-11.jpg

https://www.financialexpress.com/money/new-tax...

Is NPS deduction allowed under New Tax Regime In the new tax regime taxpayers will have to forgo most of the income tax exemptions and deductions to avail

https://www.etmoney.com/learn/nps/nps-tax-…

In essence by investing in NPS you can claim tax deductions of up to Rs 2 lakhs in total Rs 1 5 lakhs under Section 80C and an additional Rs 50 000 under Section 80CCD 1B This means

Deductions Allowed Under The New Income Tax Regime Paisabazaar Com

The New Tax Regime FY 2020 21 VS The Old Tax Regime Quick Tax Help

E calculator Launched By The Income Tax Department For Individuals To

Rebate Limit New Income Slabs Standard Deduction Understanding What

Exemptions Still Available In New Tax Regime with English Subtitles

Income Tax Clarification Opting For The New Income Tax Regime U s

Income Tax Clarification Opting For The New Income Tax Regime U s

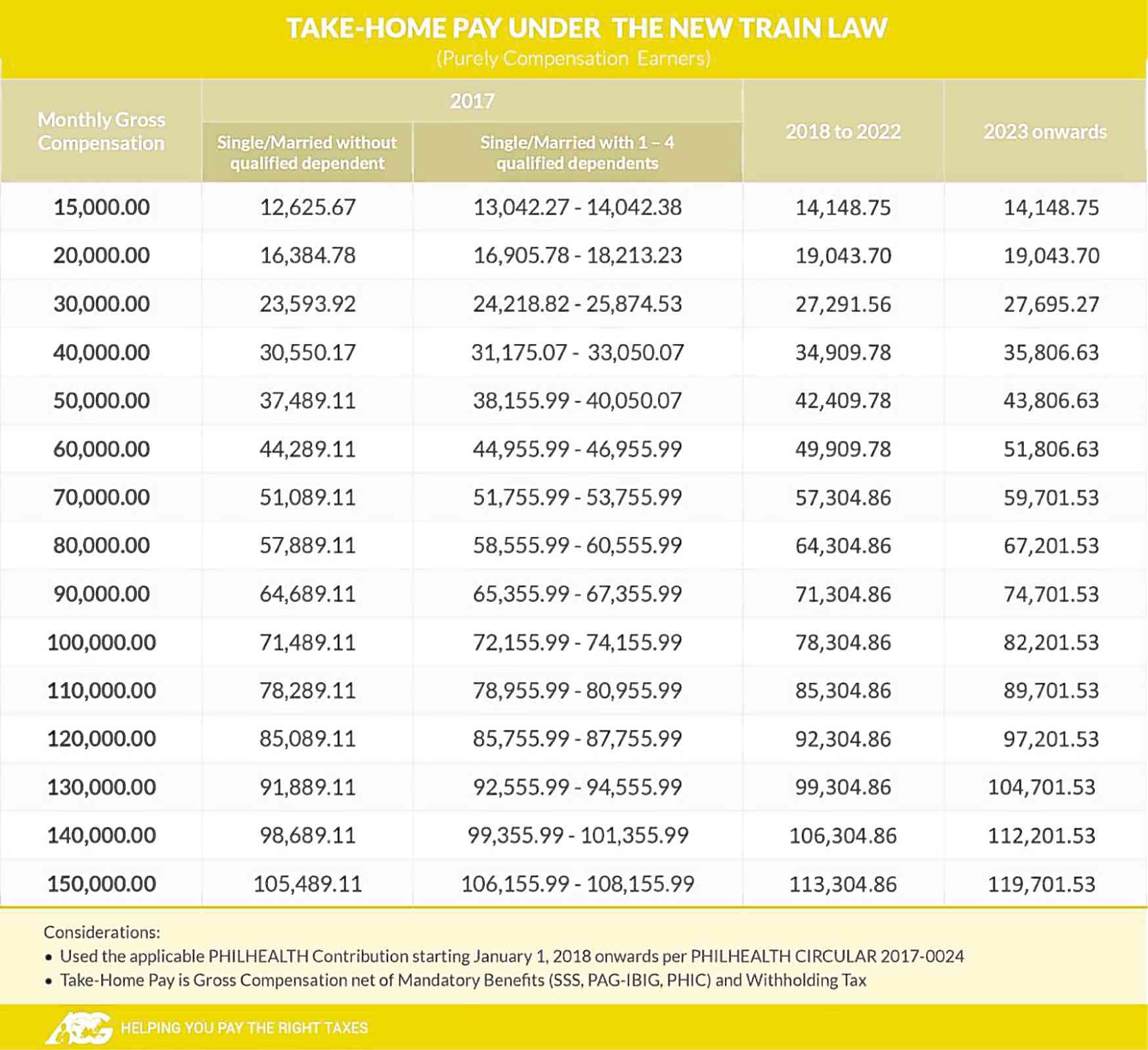

New Tax Regime For The New Year Inquirer Business

Old Vs New Income Tax Slabs After Budget Which Is Better Mint

Opt New Tax Regime If Deduction Exemption Claims Less Than Rs 3 75

Nps Tax Benefit Under New Tax Regime - Income tax benefits for NPS You can claim tax deductions against NPS under three sections of the Income tax Act 1961 in India Sections 80CCD 1 80CCD