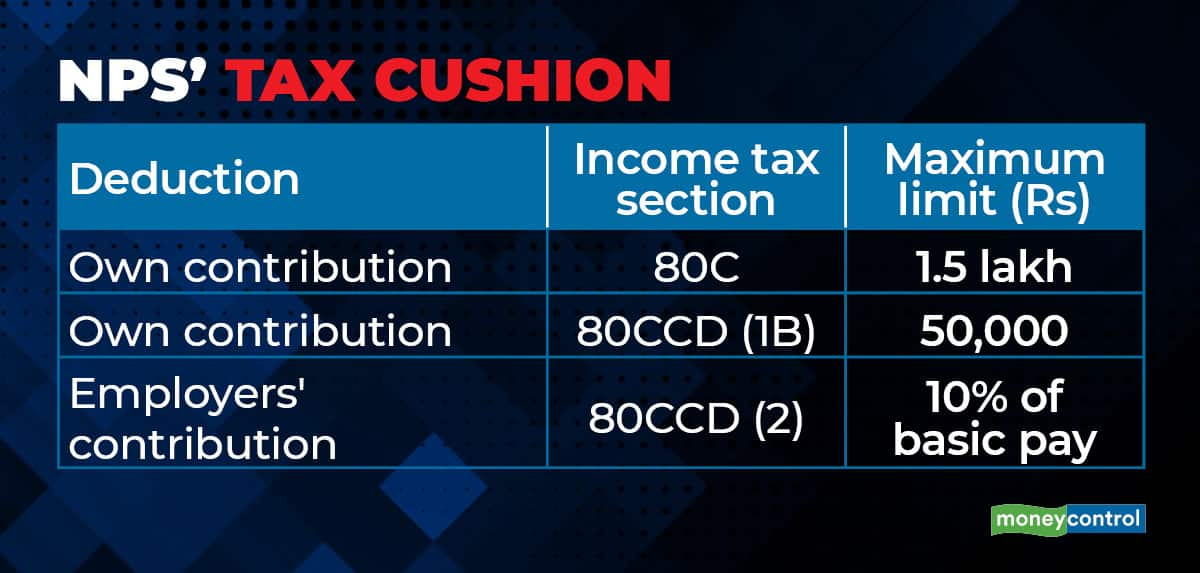

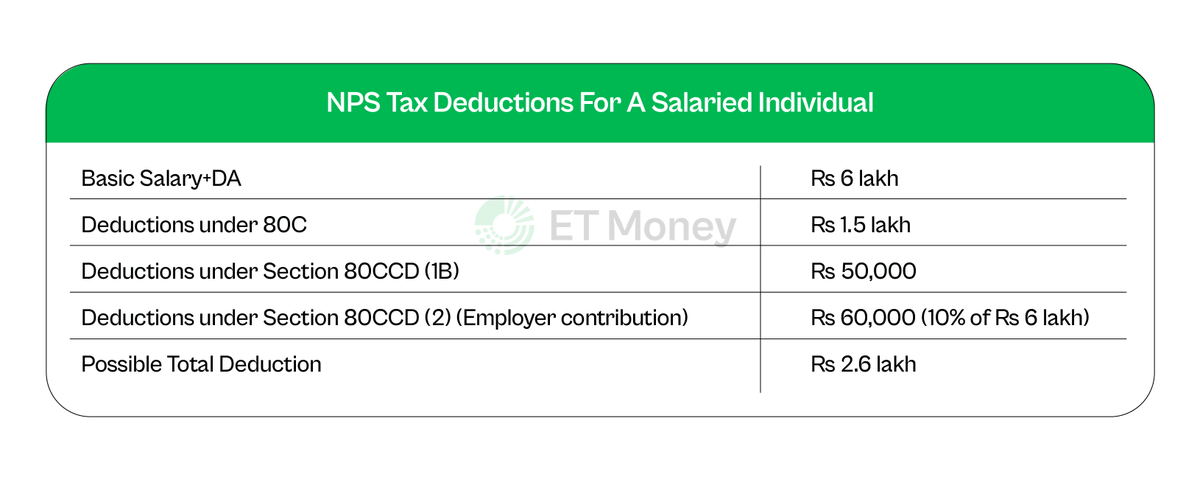

Nps Tax Benefit Under Section 80ccd 1 80ccd 2 And 80ccd 1b Web Section 80C 80CCC 80CCD 1 Up to Rs 1 5 lakh Section 80CCD 1B Up to Rs 50 000 Example Say you invest Rs 1 5 lakh under Section 80C PPF Tax Saver FD etc You also contribute Rs 70 000 annually towards NPS You can claim a total deduction of Rs 2 lakh Rs 1 50 lakh under Section 80C Rs 50 000 under Section 80CCD 1B

Web 11 Dez 2023 nbsp 0183 32 Tax benefits availed under Section 80CCD cannot be claimed again under Section 80C i e the combined deduction under Section 80C and 80CCD cannot exceed Rs 2 lakhs The money received from NPS as monthly payments or surrendered accounts will be liable for taxation as per the applicable provisions Web 21 Sept 2022 nbsp 0183 32 In essence by investing in NPS you can claim tax deductions of up to Rs 2 lakhs in total Rs 1 5 lakhs under Section 80C and an additional Rs 50 000 under Section 80CCD 1B This means that if you belong to the 30 tax bracket you could potentially save Rs 62 400 in taxes

Nps Tax Benefit Under Section 80ccd 1 80ccd 2 And 80ccd 1b

Nps Tax Benefit Under Section 80ccd 1 80ccd 2 And 80ccd 1b

https://i.ytimg.com/vi/6nlYwNEIo48/maxresdefault.jpg

NPS Tax Benefit Under Section 80CCD 1 80CCD 2 And 80CCD 1B

http://www.bankindia.org/wp-content/uploads/2018/12/nps-tax-benefits-80ccd1-80ccd2-80ccd1b.png

NPS Tax Benefits How To Avail NPS Income Tax Benefits

https://www.godigit.com/content/dam/godigit/directportal/en/contenthm/nps-tax-benefits.jpg

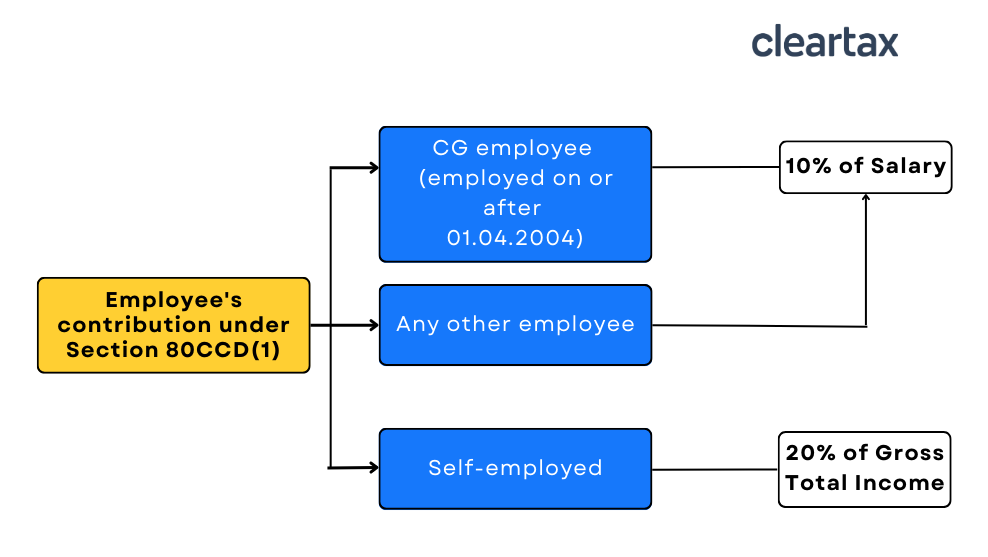

Web 25 Feb 2016 nbsp 0183 32 FAQ on Tax Benefits in NPS under sections 80CCD 1 80CCD 2 and 80CCD 1B A Govt employee Corporate employee can claim a deduction of your employer s contribution towards NPS under Section 80CCD 2 up to a limit of 10 of your salary i e Basic Salary Dearness Allowance Web 26 M 228 rz 2019 nbsp 0183 32 80CCD 1B As per Section 80CCD 1B the taxpayer either employee or self employed is allowed a deduction on the amount contributed towards NPS up to Rs 50 000 The deduction under

Web 13 Okt 2016 nbsp 0183 32 There is no tax benefit for the investment you do in Tier 2 NPS account Let us discuss one by one as below NPS Tax Benefits under Sec 80CCD 1 The maximum benefit available is Rs 1 5 lakh including Sec 80C limit Web 3 Mai 2019 nbsp 0183 32 NPS Tier 1 is eligible for a tax deduction on contributions up to 1 5 lakh under Section 80 C and an additional 50 000 under Section 80 CCD 1B of the Income Tax Act

Download Nps Tax Benefit Under Section 80ccd 1 80ccd 2 And 80ccd 1b

More picture related to Nps Tax Benefit Under Section 80ccd 1 80ccd 2 And 80ccd 1b

What Are The Tax Benefits That NPS Offers

https://images.moneycontrol.com/static-mcnews/2022/02/NPS-tax_001.jpg

Income Tax Deduction Under Section 80C To 80U FY 2022 23

https://navi.com/blog/wp-content/uploads/2022/05/Section-80-of-the-Income-Tax-Act.webp

NPS Tax Benefit U s 80ccd1 80ccd2 And 80ccd 1b NPS Tax Benefits

https://i.ytimg.com/vi/TNPR3oHyhIE/maxresdefault.jpg

Web 30 Jan 2023 nbsp 0183 32 Additional Contribution NPS subscribers also have an option to claim further tax benefits on investments up to INR 50 000 which is over and above the limit of INR 1 5 lakh under section 80CCD 1B Web 20 Sept 2022 nbsp 0183 32 First is Section 80CCD 1 where NPS competes with other investments like provident fund PPF life insurance premiums tax saving mutual funds etc The second is Section 80CCD 1B which is an additional tax benefit only given to NPS investors Under this section one can claim deductions for investment in NPS for up to Rs

Web 1 What are the tax benefits under NPS Tax Benefit available to Individual Any individual who is Subscriber of NPS can claim tax benefit under Sec 80 CCD 1 with in the overall ceiling of Rs 1 5 lac under Sec 80 CCE Exclusive Tax Web 7 Feb 2020 nbsp 0183 32 NPS tax benefits are available through 3 sections 80CCD 1 80CCD 2 and 80CCD 1B We discuss each below 1 Section 80CCD 1 Employee contribution up to 10 of basic salary and dearness allowance DA up to 1 5 lakh is eligible for tax deduction This contribution along with Sec 80C has 1 5 Lakh investment limit for tax

NPS 80CCD 1B Proof NPS Tax Benefits Sec 80C And Additional Tax

https://i.ytimg.com/vi/PbIdrmlETqQ/maxresdefault.jpg

How To Save Tax Via NPS By Investing Rs 50 000 Additionally B2b

https://business2business.co.in/uploads/2021/02/new/NPS-Tax-Benefits.jpg

https://cleartax.in/s/section-80-ccd-1b

Web Section 80C 80CCC 80CCD 1 Up to Rs 1 5 lakh Section 80CCD 1B Up to Rs 50 000 Example Say you invest Rs 1 5 lakh under Section 80C PPF Tax Saver FD etc You also contribute Rs 70 000 annually towards NPS You can claim a total deduction of Rs 2 lakh Rs 1 50 lakh under Section 80C Rs 50 000 under Section 80CCD 1B

https://cleartax.in/s/section-80ccd

Web 11 Dez 2023 nbsp 0183 32 Tax benefits availed under Section 80CCD cannot be claimed again under Section 80C i e the combined deduction under Section 80C and 80CCD cannot exceed Rs 2 lakhs The money received from NPS as monthly payments or surrendered accounts will be liable for taxation as per the applicable provisions

Invest Rs 50 000 Annually In NPS And You Can Create A Retirement

NPS 80CCD 1B Proof NPS Tax Benefits Sec 80C And Additional Tax

Exploring NPS Tax Benefits How 80CCD 1B Section Helps You Save On Taxes

Deductions Under Section 80C Its Allied Sections

Money Musingz Personal Finance Blog Section 80D 80CCD Explained

Section 80CCD Deductions For NPS And APY Contributions

Section 80CCD Deductions For NPS And APY Contributions

Can I Split NPS Deduction Into 80CCD 1B 80CCD 1 How To Get

What Is Dcps In Salary Deduction Login Pages Info

Deductions Under Section 80CCD Of Income Tax

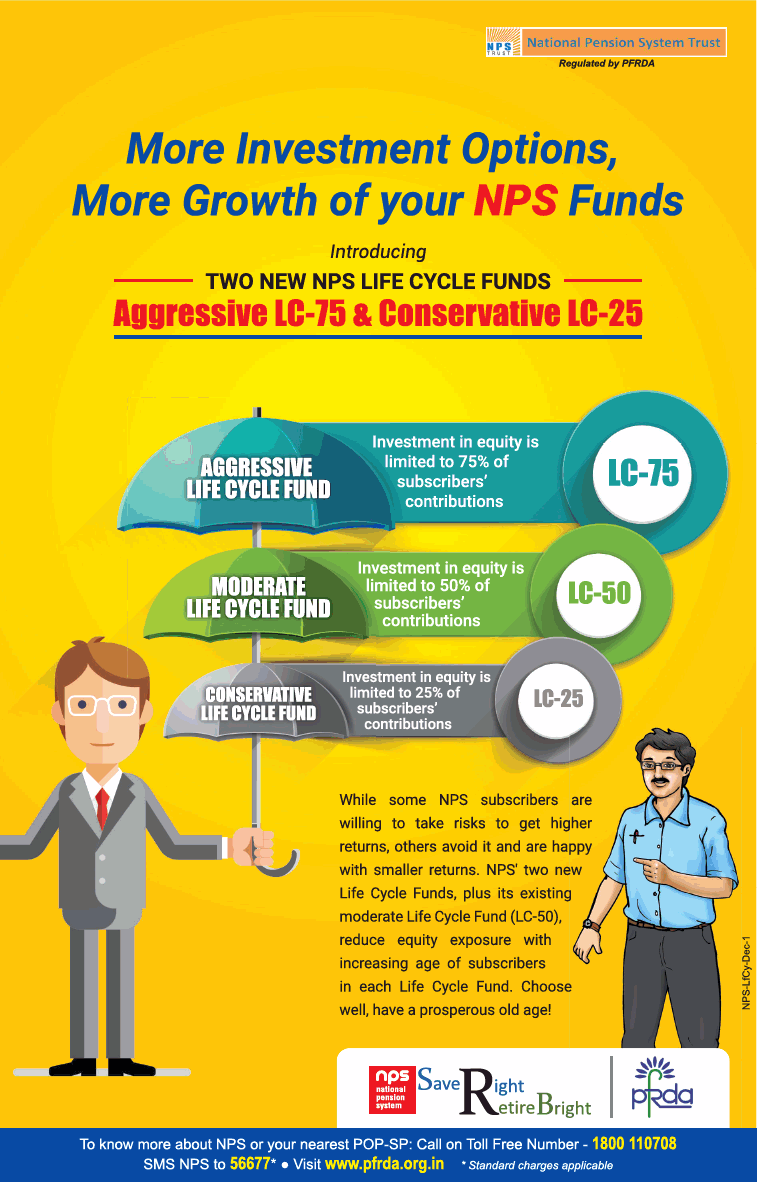

Nps Tax Benefit Under Section 80ccd 1 80ccd 2 And 80ccd 1b - Web Vor 9 Stunden nbsp 0183 32 NPS Additional tax benefits under 80CCD You can claim a tax exemption under Section 80CCD of the Income Tax Act if you invest in NPS This section has two sub sections 80CCD 1 and 80CCD 2 Apart from them there is another sub section of 80CCD 1 80CCD 1B You can get a tax exemption of Rs 1 5 lakh under