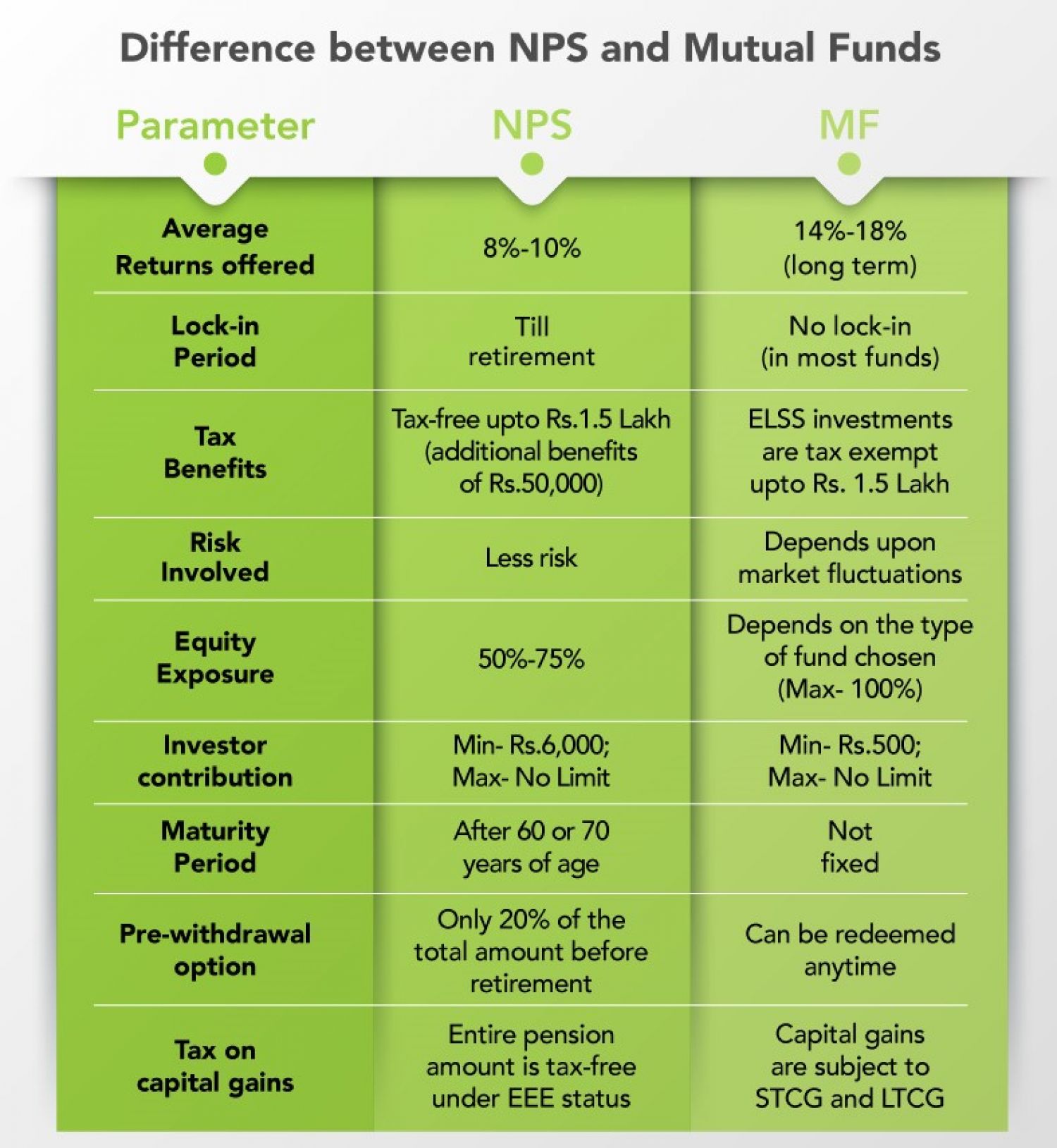

Nps Tax Deduction Calculator Verkko 8 helmik 2019 nbsp 0183 32 Section 80 CCD 1 gives a tax deduction on NPS contributions up to 10 of their salary basic salary DA made by employees However the total

Verkko 1 syysk 2020 nbsp 0183 32 a The maximum tax deductions allowed is Rs 1 50 000 This limit is inclusive of section 80C limit b In case of salaried individual the maximum deduction cannot exceed 14 of salary of Verkko 30 maalisk 2023 nbsp 0183 32 Investing in NPS Tier I offers three tax deductions Deduction of up to Rs 1 5 lakh from taxable income under Section 80C Additional deduction of up to Rs

Nps Tax Deduction Calculator

Nps Tax Deduction Calculator

https://business2business.co.in/uploads/2021/02/new/NPS-Tax-Benefits.jpg

How To Calculate Taxes With Standard Deduction Dollar Keg

https://dollarkeg.com/wp-content/uploads/2023/01/how-to-calculate-taxes-with-standard-deduction.png

Use The Sales Tax Deduction Calculator Simple Accounting

https://simple-accounting.org/wp-content/uploads/2021/09/603e8923-3ad2-46a9-932d-fa75cdb7e2e3.jpg

Verkko Employer s contribution toward NPS u s 80CCD i Note Deduction in respect of employer s contribution to NPS is allowed to the extent of 14 of salary in case of Verkko 20 syysk 2022 nbsp 0183 32 Under this section one can claim deductions for investment in NPS for up to Rs 50 000 This is over and above the Section 80C deductions In other words one can claim a tax

Verkko 5 lokak 2022 nbsp 0183 32 Effectively an employee can claim deduction upto Rs 7 50 lakhs for employer s contribution to his NPS account in a year In respect of employer s Verkko Tax benefits NPS provides tax benefits under Section 80CCD 1 of the Income Tax Act Salaried individuals can claim deductions of up to 10 of their salary while self

Download Nps Tax Deduction Calculator

More picture related to Nps Tax Deduction Calculator

NPS Deduction In Income Tax 2023 Guide InstaFiling

http://instafiling.com/wp-content/uploads/2023/01/NPS-Deduction-in-Income-Tax.png

Should Invest In NPS Just For The Tax Benefits NPS

https://carajput.com/art_imgs/why-we-should-invest-in-nps-just-for-the-tax-benefits.jpg

NPS Tax Benefits How To Avail NPS Income Tax Benefits

https://www.godigit.com/content/dam/godigit/directportal/en/contenthm/nps-tax-benefits.jpg

Verkko In addition to above benefit NPS investment saves your tax which may also be considered as return on NPS investment Furthermore if you have exhausted the tax Verkko What are the tax benefits of NPS Income Tax Act allows benefits under NPS as per the following sections On Employee s contribution Employee s own contribution is eligible

Verkko Read Annuity and NPS Everything to know Tax Benefits of NPS The NPS has its share of income tax benefits both at the time of making contributions and at the time of Verkko 17 tuntia sitten nbsp 0183 32 August 15 Last date for issuing quarterly TDS certificate for the tax deducted from payments other than salary such as interest income etc for the April

Tax deduction checklist Etsy

https://i.etsystatic.com/37903484/r/il/61e14b/5462529921/il_1588xN.5462529921_cvyy.jpg

Asset Allocation For NPS Equity Or Debt Active Or Auto Arthgyaan

https://arthgyaan.com/assets/images/asset-allocation-for-nps.jpg

https://cleartax.in/s/section-80-ccd-1b

Verkko 8 helmik 2019 nbsp 0183 32 Section 80 CCD 1 gives a tax deduction on NPS contributions up to 10 of their salary basic salary DA made by employees However the total

https://taxguru.in/income-tax/income-tax-ben…

Verkko 1 syysk 2020 nbsp 0183 32 a The maximum tax deductions allowed is Rs 1 50 000 This limit is inclusive of section 80C limit b In case of salaried individual the maximum deduction cannot exceed 14 of salary of

How To Invest In NPS To Earn A Tax Deduction Of Up To Rs 2 Lakh

Tax deduction checklist Etsy

Bill C19 Is The Largest Ever Tax Deduction Oaken Equipment

Example Tax Deduction System For A Single Gluten free GF Item And

What Will My Tax Deduction Savings Look Like The Motley Fool

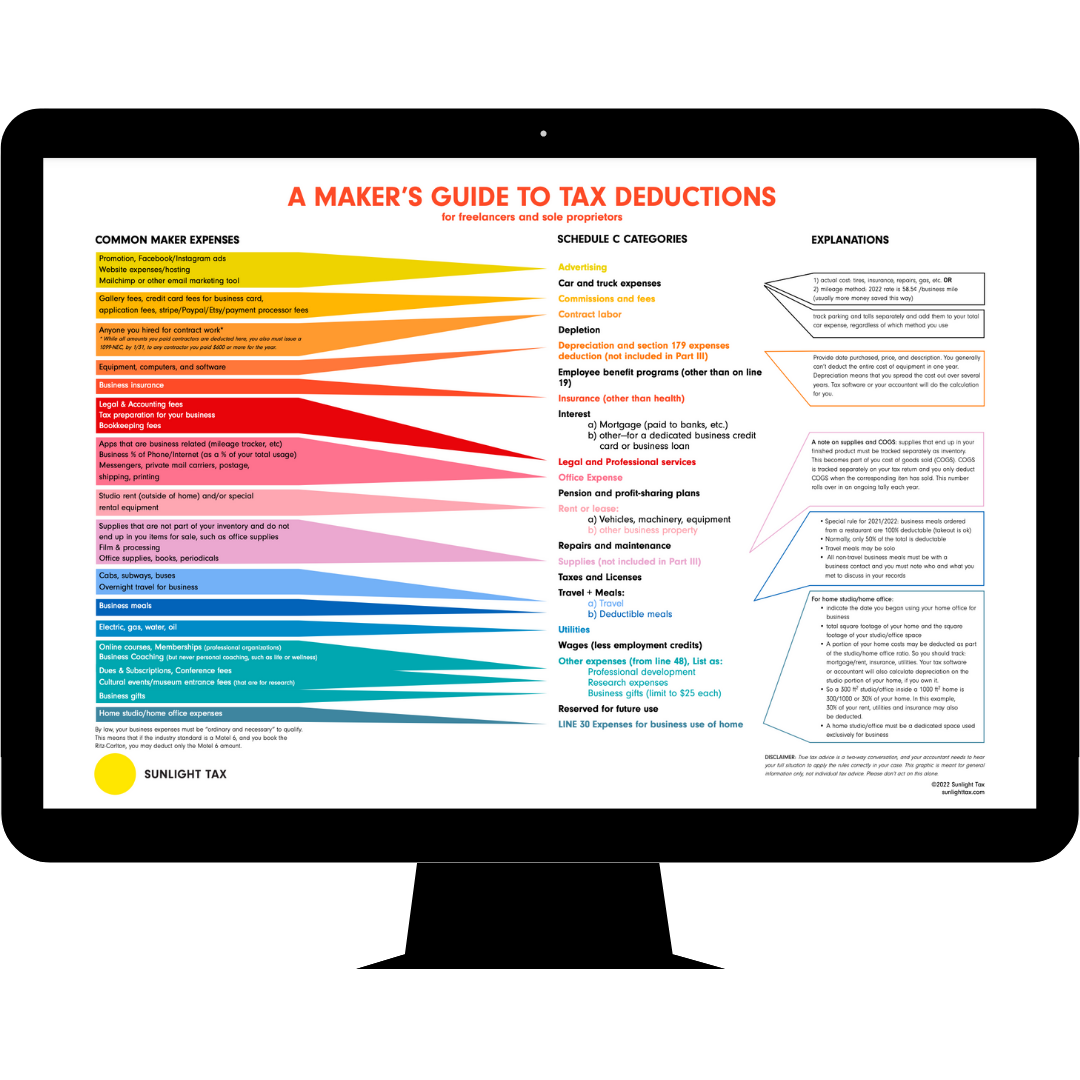

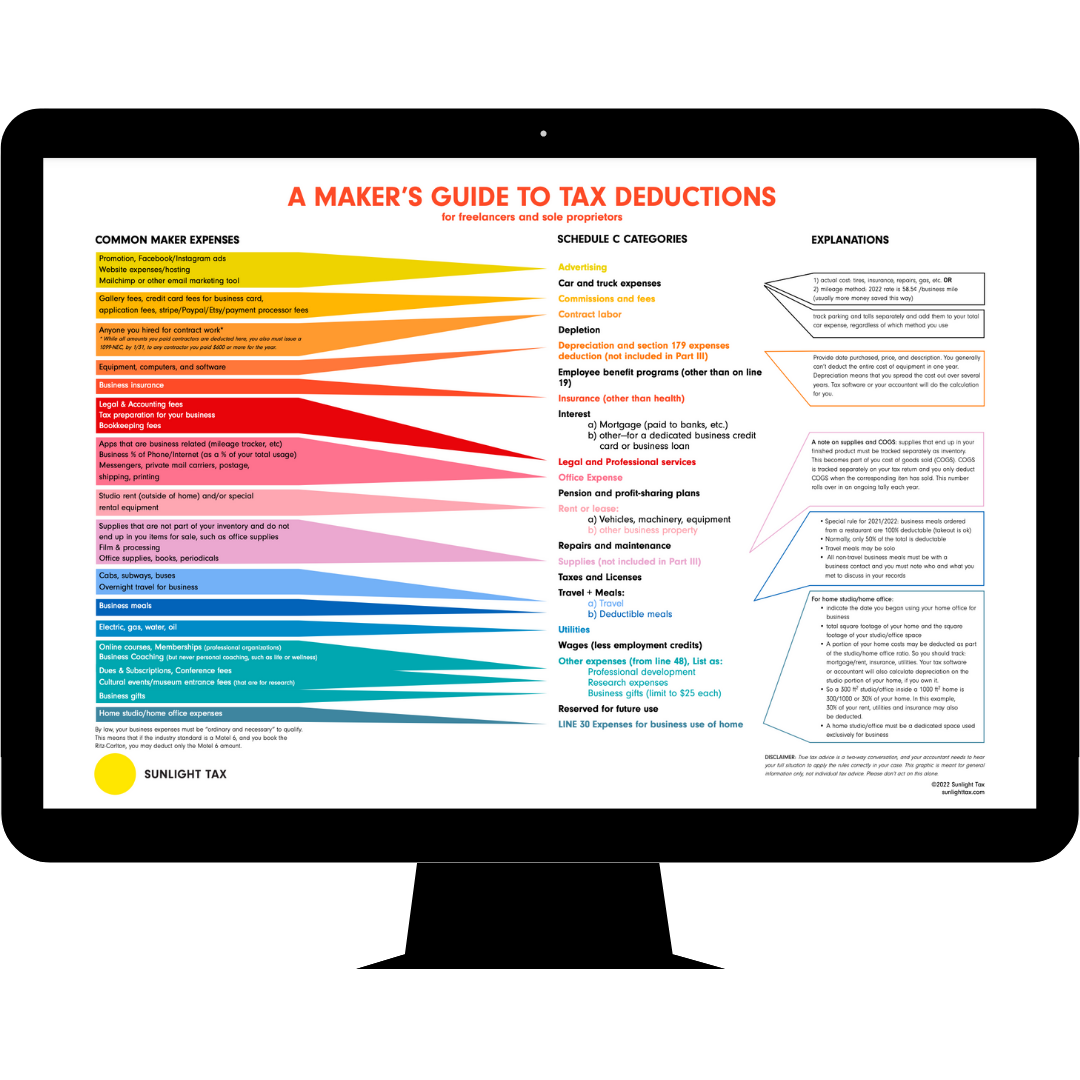

Tax Deductions Guide Sunlight Tax

Tax Deductions Guide Sunlight Tax

Nps Contribution By Employee Werohmedia

SIBAPRASAD CHAKRABORTY NPS Tax Deduction Instruction MINISTRY OF

Tax Credit Tax Deduction Gennadiy Arnautov CPA

Nps Tax Deduction Calculator - Verkko Under the NPS Tier I Account investors can invest up to INR 1 50 000 and get tax deduction under Section 80 C of the Income Tax Act Furthermore additional