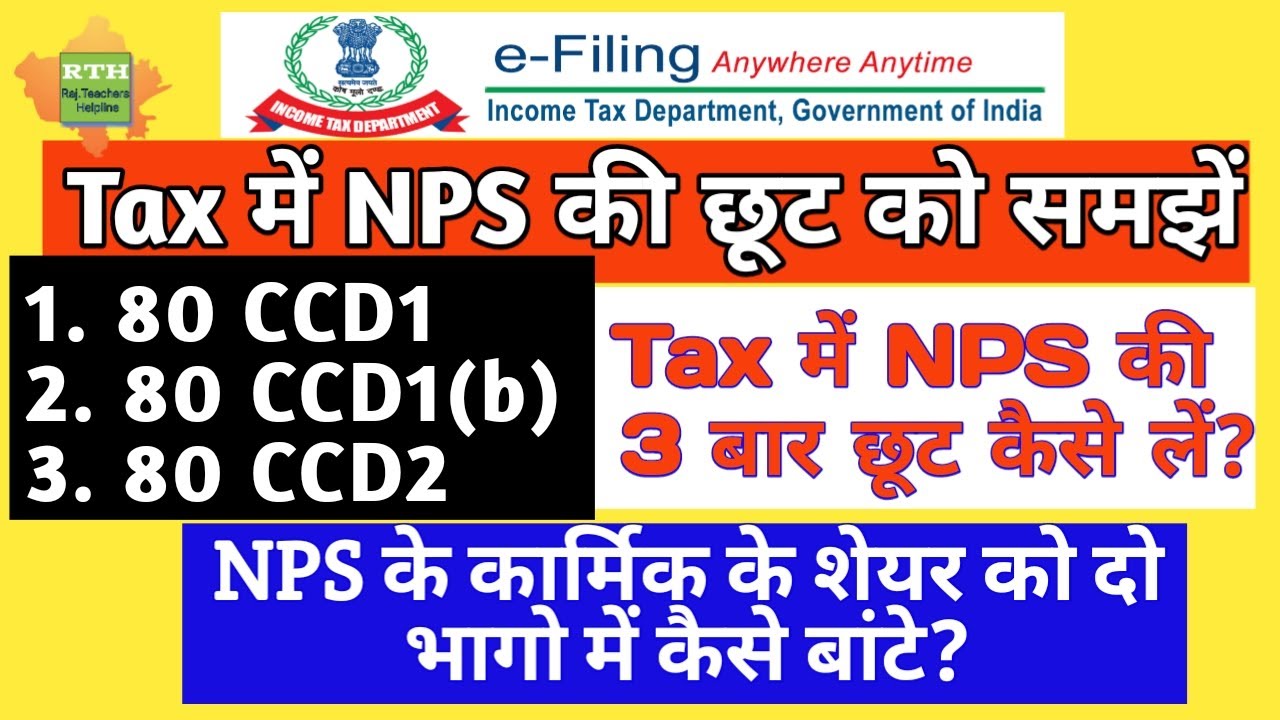

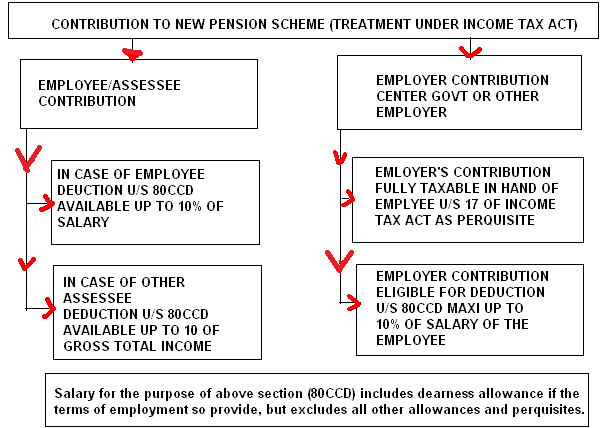

Nps Tax Rebate 80ccd Web 8 f 233 vr 2019 nbsp 0183 32 Tax deductions up to Rs 1 5 lakhs are eligible under section 80CCD 1 Like NPS an additional investment of up to Rs 50 000 is eligible for tax deduction under

Web 8 f 233 vr 2019 nbsp 0183 32 Section 80 CCD 1 gives a tax deduction on NPS contributions up to 10 of their salary basic salary DA made by employees However the total amount of Web 22 sept 2022 nbsp 0183 32 Section 80CCD relates to the tax deduction for the contributions made in the National Pension System NPS and the Atal Pension Yojana APY Under this section

Nps Tax Rebate 80ccd

Nps Tax Rebate 80ccd

https://media-exp1.licdn.com/dms/image/C5112AQHj8P9qw6GsUQ/article-cover_image-shrink_720_1280/0/1576844791541?e=2147483647&v=beta&t=IahHExoprpNvpUT_C_kldjv1SsTLjw5FkXx3HqakH7A

Section 80 CCD Deduction For NPS Contribution Updated Automated

https://1.bp.blogspot.com/-B5IsiXE1lI8/YLg_Fs0SXTI/AAAAAAAAQuo/GmaWUBT2Cy0ChneUN3nRzyjjUTQvHRxTACNcBGAsYHQ/s1078/NPS_2.jpg

NPS Employee Income Tax 80CCD 1B

https://i.ytimg.com/vi/rw6otVRjsG4/maxresdefault.jpg

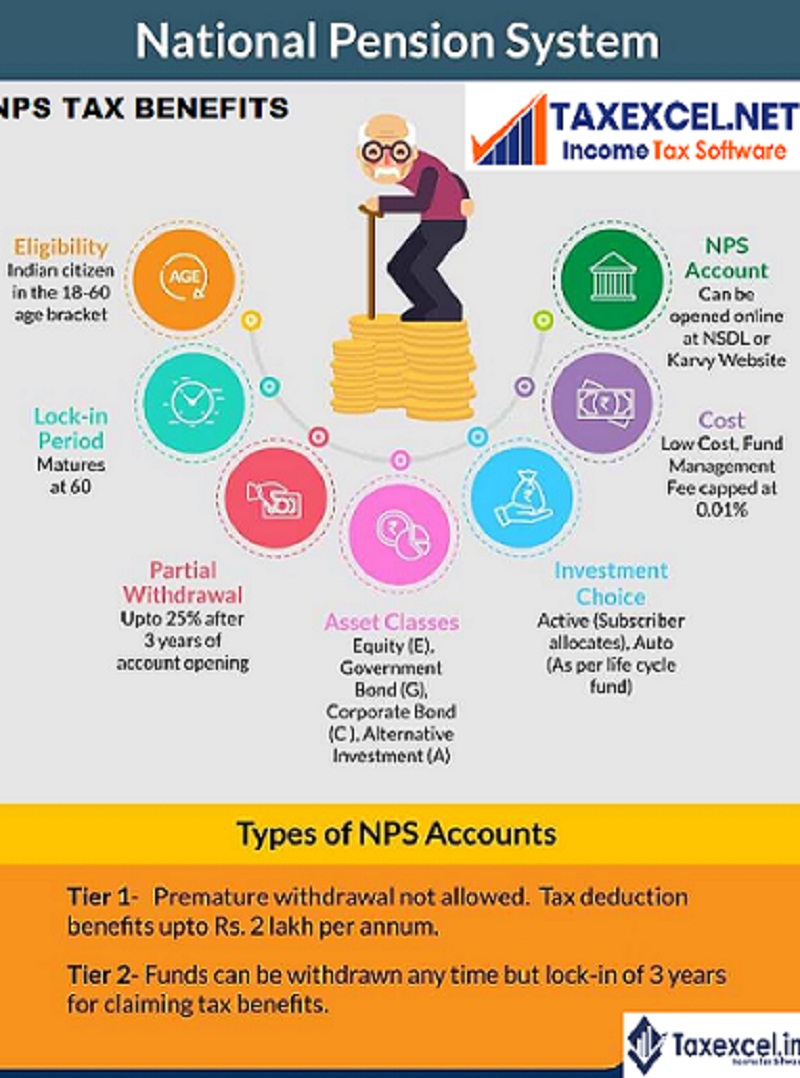

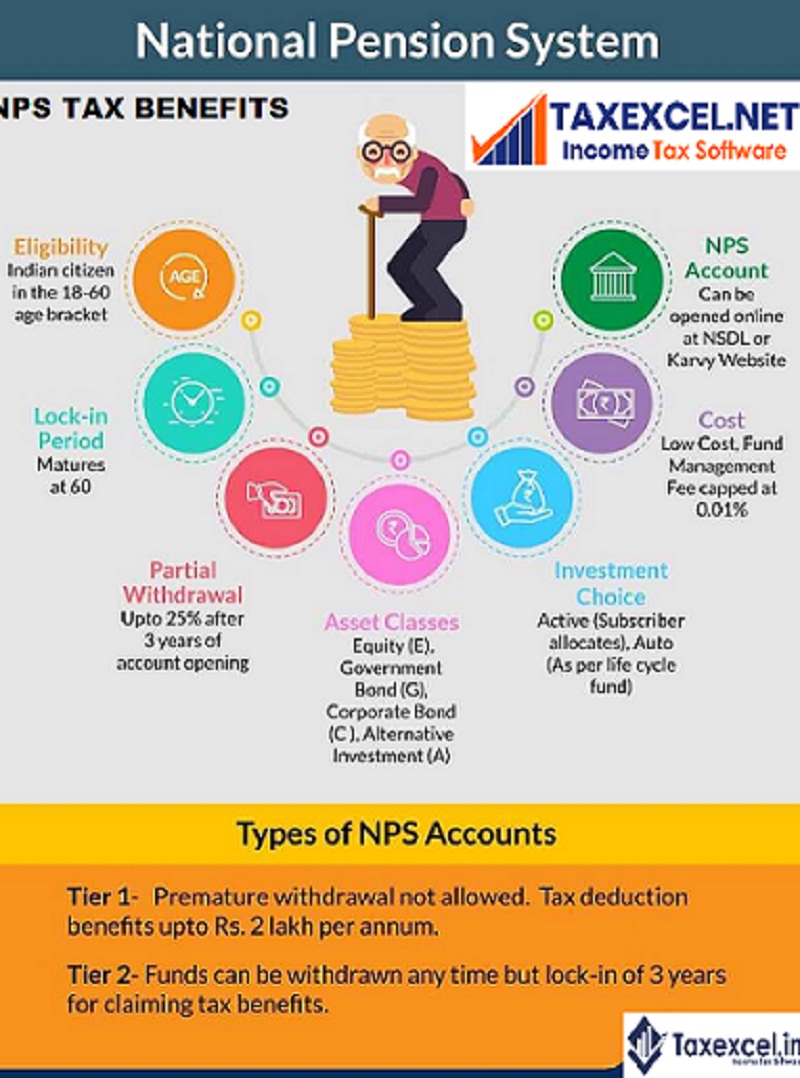

Web Section 80CCD1 allows every tax paying individual in India to get tax deduction benefits from the amount you deposit in your NPS account This tax benefit is open to both Web What are the tax benefits under NPS Tax Benefit available to Individual Any individual who is Subscriber of NPS can claim tax benefit under Sec 80 CCD 1 with in the overall

Web 26 f 233 vr 2021 nbsp 0183 32 To encourage investment in NPS Section 80CCD 1B of the Income tax Act allows an additional deduction of Rs 50 000 over and above the Rs 1 5 lakh available under Section 80CCE Web 30 mars 2023 nbsp 0183 32 Additional deduction of up to Rs 50 000 under Section 80CCD 1B of the Income Tax Act exclusively available through NPS investment The third deduction is in

Download Nps Tax Rebate 80ccd

More picture related to Nps Tax Rebate 80ccd

NPS TAX Benefit U s 80C 80CCD1 80CCD1B 80CCD2 Tax Benefit

https://i.ytimg.com/vi/nviDuHSBa5c/maxresdefault.jpg

NATIONAL PENSION SYSTEM NPS SECTION 80CCD 1 SAVE TAX INCOME

https://licbranchesinindia.com/wp-content/uploads/2023/01/WhatsApp-20Image-202023-01-11-20at-2011.55.45-20AM.jpeg

HOW TO PAY NPS ONLINE II NPS CONTRIBUTION ONLINE PAYMENT II TAX SAVING

https://i.ytimg.com/vi/LrCY2AM_KQY/maxresdefault.jpg

Web Section 80CCD provides for Income Tax deductions for contributions made to the notified Pension Scheme of the Central Govt i e for contribution to the National Pension Web 7 f 233 vr 2020 nbsp 0183 32 NPS Tax Benefits NPS tax benefits are available through 3 sections 80CCD 1 80CCD 2 and 80CCD 1B We discuss each below 1 Section 80CCD 1 Employee contribution up to 10 of basic

Web The scheme is portable across jobs and locations with tax benefits under Section 80C and Section 80CCD Who should invest in the NPS The NPS is a good scheme for anyone Web 13 oct 2016 nbsp 0183 32 October 13 2016 Share This Post There is so much confusion about NPS Tax Benefits after the 2016 Budget Hence in this post let us discuss about NPS Tax

80CCD 1B Tax NPS

https://i.ytimg.com/vi/XPyEEok8V_4/maxresdefault.jpg

How To Claim Section 80CCD 1B TaxHelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2022/02/How-to-claim-Section-80CCD1B-National-Pension-Scheme.png

https://cleartax.in/s/section-80ccd

Web 8 f 233 vr 2019 nbsp 0183 32 Tax deductions up to Rs 1 5 lakhs are eligible under section 80CCD 1 Like NPS an additional investment of up to Rs 50 000 is eligible for tax deduction under

https://cleartax.in/s/section-80-ccd-1b

Web 8 f 233 vr 2019 nbsp 0183 32 Section 80 CCD 1 gives a tax deduction on NPS contributions up to 10 of their salary basic salary DA made by employees However the total amount of

NPS Returns For 2019 Who Is Best NPS Fund Manager

80CCD 1B Tax NPS

NPS Tax Benefit Sec 80C And Additional Tax Rebate Difference Between U

Tax Benefits Of NPS Scheme Deduction Coming Under Section 80CCD 1B

What Is Dcps In Salary Deduction Login Pages Info

National Pension Scheme NPS Tax Benefits How To Save Tax NPS

National Pension Scheme NPS Tax Benefits How To Save Tax NPS

Investing Can Be Interesting Financial Awareness Deduction Under

80CCD 2 Nps Contribution Deduction In Income Tax

NPS Tax Benefit Sec 80C And Additional Tax Rebate Tax Benefit To

Nps Tax Rebate 80ccd - Web 26 f 233 vr 2021 nbsp 0183 32 To encourage investment in NPS Section 80CCD 1B of the Income tax Act allows an additional deduction of Rs 50 000 over and above the Rs 1 5 lakh available under Section 80CCE