Nps Tax Rebate Section Web 8 f 233 vr 2019 nbsp 0183 32 Benefits for existing NPS subscribers under Section 80CCD Existing NPS subscribers can take the benefit of the deduction under section 80 CCD for their NPS

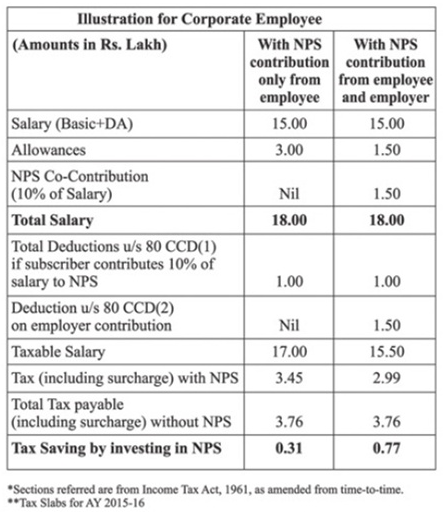

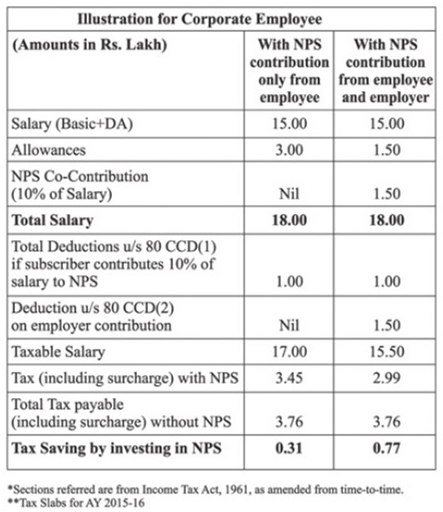

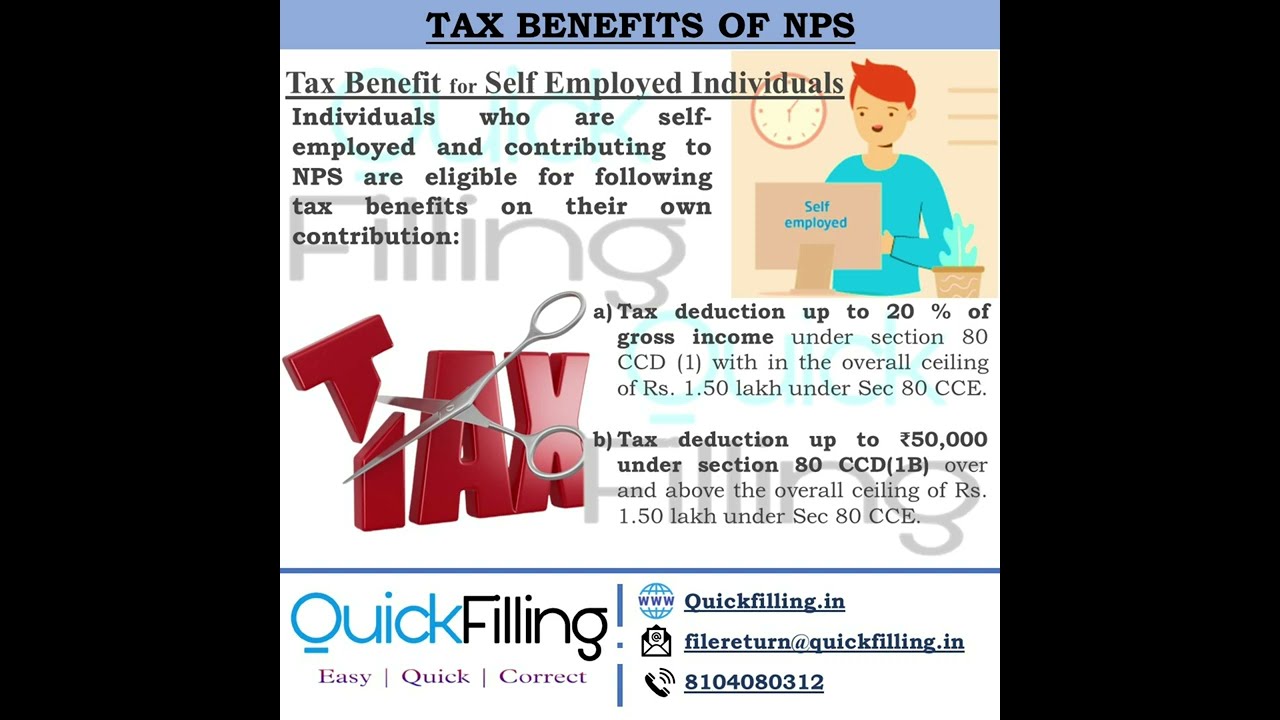

Web 1 What are the tax benefits of NPS Income Tax Act allows benefits under NPS as per the following sections On Employee s contribution Employee s own contribution is eligible Web 25 f 233 vr 2016 nbsp 0183 32 Tax benefits on NPS are available through 3 sections 80CCD 1 80CCD 2 and 80CCD 1B All the tax benefits annuity restrictions exit and withdrawal rules are applicable to NPS Tier I

Nps Tax Rebate Section

Nps Tax Rebate Section

https://www.apnaplan.com/wp-content/uploads/2015/12/NPS-illustration-of-Tax-Exemption-on-NPS-by-restructing-of-Salary.png

NPS Tax Benefit Sec 80C And Additional Tax Rebate Tax Benefit To

https://i.ytimg.com/vi/TqSSuNglkSg/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ac4FgALQBYoCDAgAEAEYZSBgKFUwDw==&rs=AOn4CLCBf5LDqx4ao2xyM9hyvx_JdhVGVQ

NPS National Pension Scheme A Beginners Guide For Rules Benefits

https://www.jagoinvestor.com/wp-content/uploads/files/Tax-Benefits-of-contributing-in-NPS.png

Web 30 janv 2023 nbsp 0183 32 Mandatory Own Contribution NPS subscribers are eligible to claim tax benefits up to INR 1 5 lakh under Section 80C Additional Contribution NPS subscribers also have an option to claim Web 7 f 233 vr 2020 nbsp 0183 32 The section 80CCD 1 along with Section 80C has investment limit eligible for tax deduction as Rs 1 5 lakhs So he should make additional investment of Rs 1 38 000 in Section 80C to save

Web 2 avr 2019 nbsp 0183 32 NPS Tax Benefit Sec 80C and Additional Tax Rebate NPS tax benefits are offered under section 80C Section 80 CCD 1 amp Section 80 CCD 1B and Section CCD 2 National Web 11 mai 2020 nbsp 0183 32 NPS tax rebate Investing in the NPS offers tax benefits under sections 80 CCD 1 80CCD 2 and 80CCD 1B Under section 80 CCD 1 investments up to Rs

Download Nps Tax Rebate Section

More picture related to Nps Tax Rebate Section

NPS Scheme National Pension Scheme NPS Tax Rebate In NPS YouTube

https://i.ytimg.com/vi/EmbzrLGi91k/maxresdefault.jpg

National Pension Scheme NPS Scheme NPS Tier 1 And Tier 2 NPS Tax

https://i.ytimg.com/vi/4Wn7yxDxwLQ/maxresdefault.jpg

Income Tax Deductions List FY 2018 19 List Of Important Income Tax

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

Web There is no escaping paying taxes but thankfully there are provisions to reduce your tax outgo that can soften the pinch Under Section 80CCD of the Income Tax Act you can Web 26 juin 2020 nbsp 0183 32 Importantly the Deduction under section 80CCD 2 on account of the contribution made by the employer to a pension scheme is not subject to a ceiling limit of

Web As a salaried or self employed person you may claim up to Rs 1 5 lakhs jointly when filing for income tax returns under Section 80CCD 1 for payments paid to NPS or APY on Web 22 nov 2021 nbsp 0183 32 If you contribute to NPS under the All Citizens Model you are eligible for deductions under section 80C with a limit of Rs 1 5 lakh Your contributions as an

What Is Section 80 Mean What Is NOTIFICATION Under GST 2019 02 18

https://www.mintwise.com/blog/wp-content/uploads/2014/08/New-Pension-Scheme-NPS-Section-80CCD2-_2.png

NPS TAX Benefit U s 80C 80CCD1 80CCD1B 80CCD2 Tax Benefit

https://i.ytimg.com/vi/nviDuHSBa5c/maxresdefault.jpg

https://cleartax.in/s/section-80-ccd-1b

Web 8 f 233 vr 2019 nbsp 0183 32 Benefits for existing NPS subscribers under Section 80CCD Existing NPS subscribers can take the benefit of the deduction under section 80 CCD for their NPS

https://npscra.nsdl.co.in/tax-benefits-under-nps-cg.php

Web 1 What are the tax benefits of NPS Income Tax Act allows benefits under NPS as per the following sections On Employee s contribution Employee s own contribution is eligible

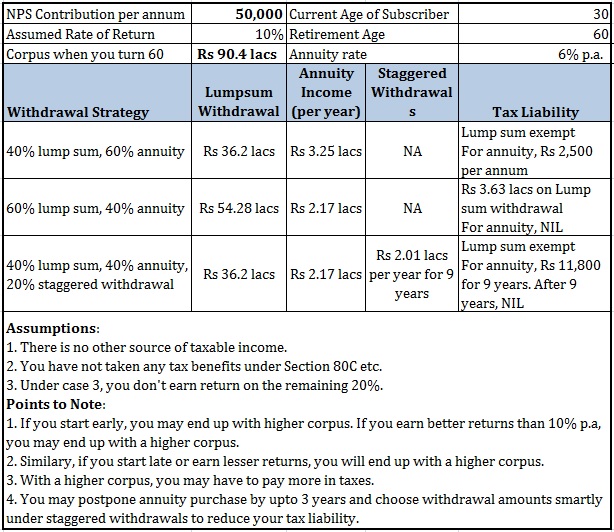

Should You Invest In NPS Personal Finance Plan

What Is Section 80 Mean What Is NOTIFICATION Under GST 2019 02 18

I Never Invested In NPS For 50000 Tax Rebate YouTube

Best NPS Funds 2019 Top Performing NPS Scheme

NPS Tax Benefit Experts Differ On How To Claim Additional NPS Tax

NPS Tax Benefits Sec 80CCD 1 80CCD 2 And 80CCD 1B BasuNivesh

NPS Tax Benefits Sec 80CCD 1 80CCD 2 And 80CCD 1B BasuNivesh

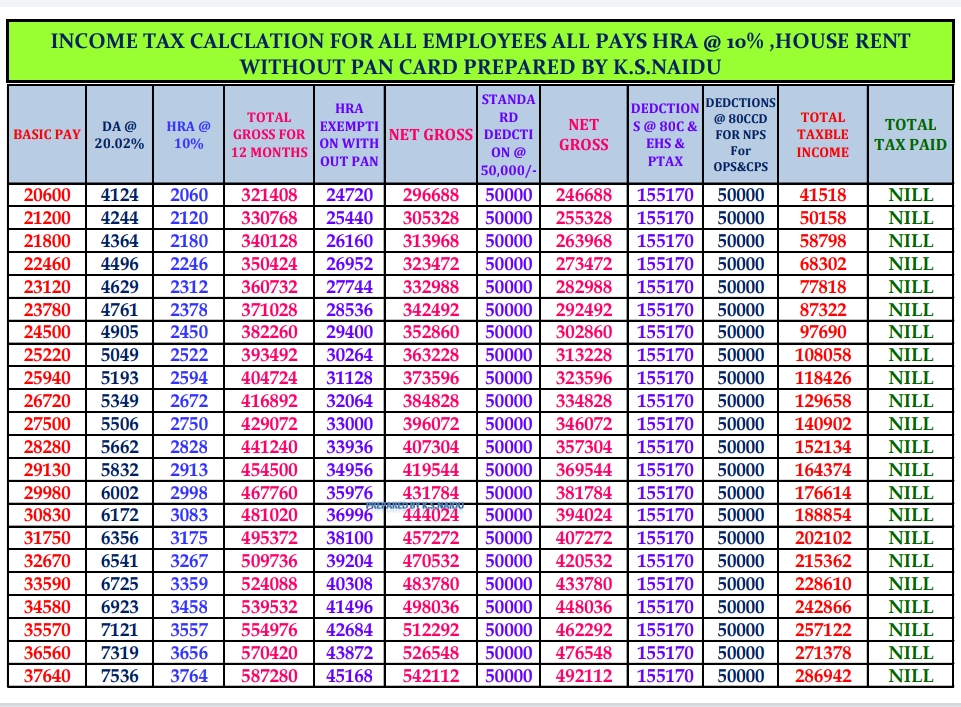

APTF VIZAG Income Tax Calculation For All Employees And Teachers With

Prepare At A Time Automated 100 Employees Form 16 Part B For F Y 2017

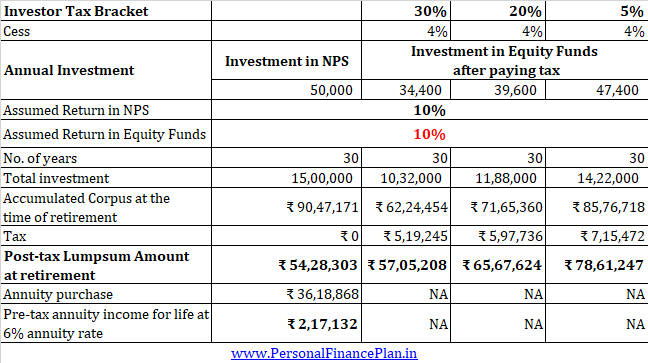

With NPS Almost EEE Should You Now Invest In NPS Personal Finance Plan

Nps Tax Rebate Section - Web 1 sept 2020 nbsp 0183 32 a The maximum tax deductions allowed is Rs 1 50 000 This limit is inclusive of section 80C limit b In case of salaried individual the maximum deduction