Nps Tier 1 Income Tax Rebate Web 30 janv 2023 nbsp 0183 32 Thus the total maximum tax rebate an individual can avail on NPS is of INR 2 lakh including INR 1 5 lakh which is a part of Section 80 C limit NPS Tier II Account The members of

Web 8 f 233 vr 2019 nbsp 0183 32 Contributions made towards Tier 1 are tax deductible and qualify for deductions under Section 80 CCD 1 and Section 80 CCD 1B This means you can Web 1 What are the tax benefits of NPS Income Tax Act allows benefits under NPS as per the following sections On Employee s contribution Employee s own contribution is eligible

Nps Tier 1 Income Tax Rebate

Nps Tier 1 Income Tax Rebate

https://www.relakhs.com/wp-content/uploads/2019/08/Latest-NPS-Income-Tax-Benefits-for-FY-2019-2020-AY-2020-2021-pic.jpg

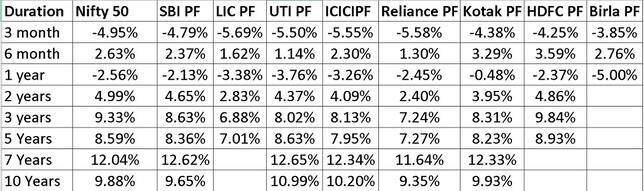

NPS Returns For 2019 Who Is Best NPS Fund Manager

https://www.basunivesh.com/wp-content/uploads/2019/05/NPS-Returns-for-2019-Tier-1-C-Scheme.jpg

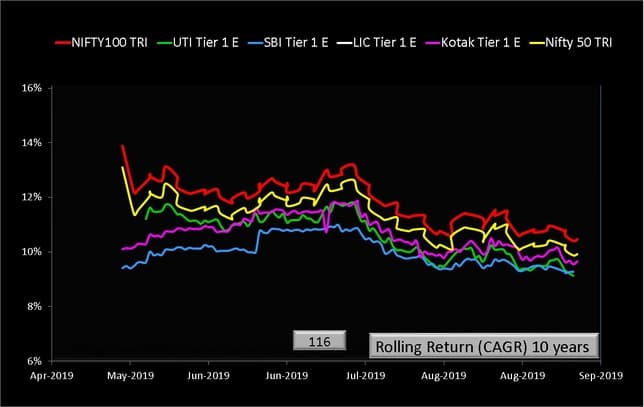

NPS Tier 1 Equity Scheme Performance Vs Nifty 50 And Nifty 100

https://freefincal.com/wp-content/uploads/2019/09/NPS-Tier-1-Equity-Scheme-Returns-as-on-31-July-2019-new.jpg

Web Under Section 80CCD 1 of the Income Tax Act NPS offers a tax exemption of up to Rs 1 5 lakh In case a company provides an NPS facility the employer s contribution to NPS Web 6 mars 2023 nbsp 0183 32 Tax Benefits On NPS Tier 1 And Tier 2 returns You should be aware of the following NPS tier 1 and tier 2 tax benefits while investing Under Section 80CCE all

Web 30 mars 2023 nbsp 0183 32 Investing in NPS Tier I offers three tax deductions Deduction of up to Rs 1 5 lakh from taxable income under Section 80C Additional deduction of up to Rs Web This rebate is over and above the limit prescribed under Section 80C c Interim Partial withdrawal up to 25 of the contributions made by the subscriber from NPS Tier I is tax

Download Nps Tier 1 Income Tax Rebate

More picture related to Nps Tier 1 Income Tax Rebate

NPS Tier 1 Equity Scheme Performance Vs Nifty 50 And Nifty 100

https://freefincal.com/wp-content/uploads/2019/09/NPS-Tier-1-E-all-schemes-ten-year-performance.jpg

Your Employer s Contribution To NPS Can Make A Huge Difference

https://4.bp.blogspot.com/-ARdbRhlLIVQ/WRwDcrdb2HI/AAAAAAAAQrM/V_MeDWhbAvkaflKs7FCZ8-tNMIR3uupFQCLcB/s1600/nps-tier1-tier2-difference.jpg

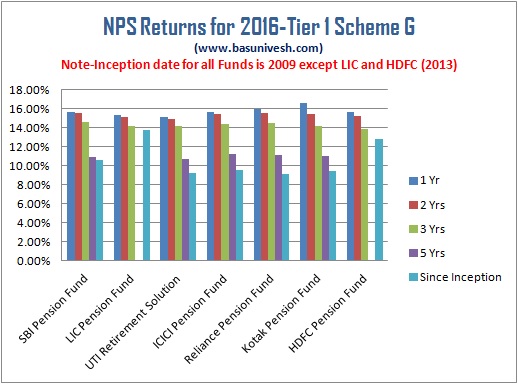

NPS Returns For 2016 Who Is Best NPS Fund Manager BasuNivesh

http://www.basunivesh.com/wp-content/uploads/2016/10/NPS-Returns-for-2016-Tier-1-Scheme-G.jpg

Web 26 f 233 vr 2021 nbsp 0183 32 Tax benefits are available in respect of contributions to NPS made by the employer as well as employee self employed person to the NPS Tier 1 account Tax benefits at the stage of contributions are Web 2 avr 2019 nbsp 0183 32 NPS Tax Benefit Sec 80C and Additional Tax Rebate Asset Yogi 3 7M subscribers Subscribe 9 3K Share 374K views 4 years ago Income Tax NPS tax

Web 1 sept 2020 nbsp 0183 32 a The maximum tax deductions allowed is Rs 1 50 000 This limit is inclusive of section 80C limit b In case of salaried individual the maximum deduction cannot exceed 14 of salary of Individual Web 16 sept 2022 nbsp 0183 32 It is administered by the Pension Fund Regulatory and Development Authority PFRDA NPS Tier 1 accounts are the primary accounts for employees

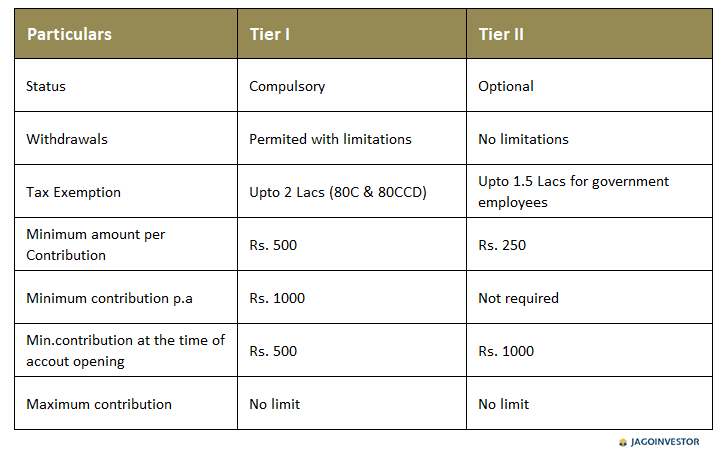

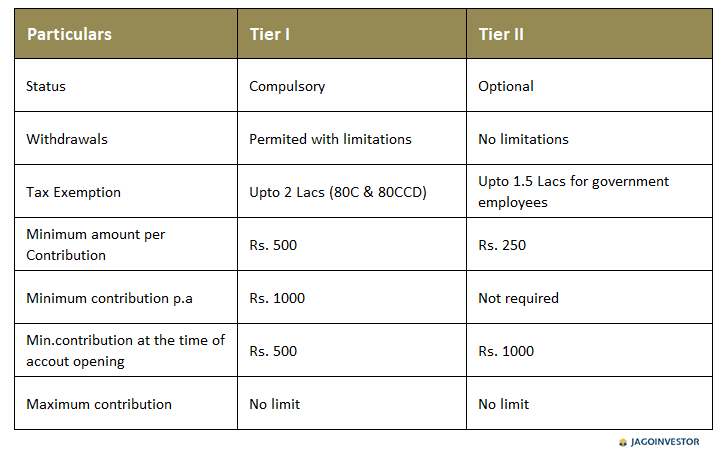

NPS National Pension Scheme A Beginners Guide For Rules Benefits

https://www.jagoinvestor.com/wp-content/uploads/files/National-Pension-Scheme-TierI-TierII.png

NPS Returns For 2016 Who Is Best NPS Fund Manager BasuNivesh

https://www.basunivesh.com/wp-content/uploads/2016/10/Best-NPS-Fund-Manager-2.jpg

https://www.forbes.com/advisor/in/retirement/…

Web 30 janv 2023 nbsp 0183 32 Thus the total maximum tax rebate an individual can avail on NPS is of INR 2 lakh including INR 1 5 lakh which is a part of Section 80 C limit NPS Tier II Account The members of

https://cleartax.in/s/section-80-ccd-1b

Web 8 f 233 vr 2019 nbsp 0183 32 Contributions made towards Tier 1 are tax deductible and qualify for deductions under Section 80 CCD 1 and Section 80 CCD 1B This means you can

NPS Returns For 2018 Who Is Best NPS Fund Manager BasuNivesh

NPS National Pension Scheme A Beginners Guide For Rules Benefits

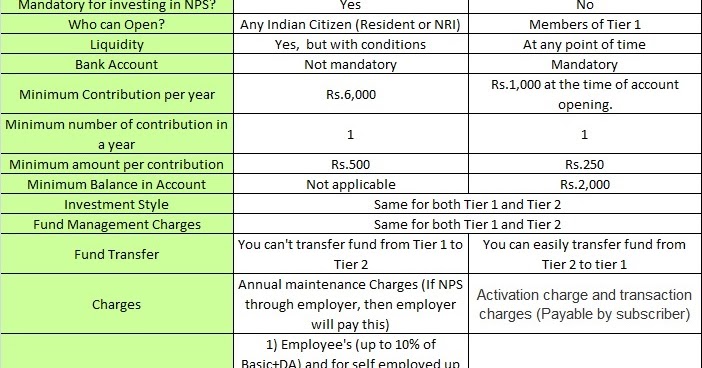

Difference Between Tier 1 And Tier 2 Account In New Pension Scheme NPS

Best NPS Funds 2019 Top Performing NPS Scheme

Taxation Of NPS Return From The Scheme

Best NPS Funds 2021 NPS Scheme Returns Best Fund Managers

Best NPS Funds 2021 NPS Scheme Returns Best Fund Managers

National Pension Scheme NPS Scheme NPS Tier 1 And Tier 2 NPS Tax

NPS Tax Benefit Experts Differ On How To Claim Additional NPS Tax

Best NPS Funds 2020 21 Top Performing NPS Scheme Categories

Nps Tier 1 Income Tax Rebate - Web 30 mars 2023 nbsp 0183 32 Investing in NPS Tier I offers three tax deductions Deduction of up to Rs 1 5 lakh from taxable income under Section 80C Additional deduction of up to Rs