Nps Tier 2 Tax Rebate Web 8 f 233 vr 2019 nbsp 0183 32 This means you can invest up to Rs 2 lakhs in an NPS Tier 1 account and claim a deduction for the full amount i e Rs 1 50 lakh under Sec 80 CCD 1 and Rs

Web Under Section 80CCD 1 of the Income Tax Act NPS offers a tax exemption of up to Rs 1 5 lakh In case a company provides an NPS facility the employer s contribution to NPS Web 21 sept 2022 nbsp 0183 32 1 Understanding NPS Tax Benefits NPS offers investors two types of accounts to invest in Tier I and Tier II Tier I is a mandatory account for all NPS investors while Tier II is voluntary Tier I investments

Nps Tier 2 Tax Rebate

Nps Tier 2 Tax Rebate

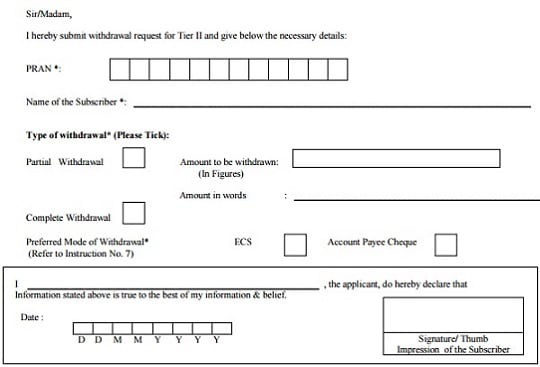

https://bemoneyaware.com/wp-content/uploads/2017/03/nps-tierII-withdrawal-form.jpg

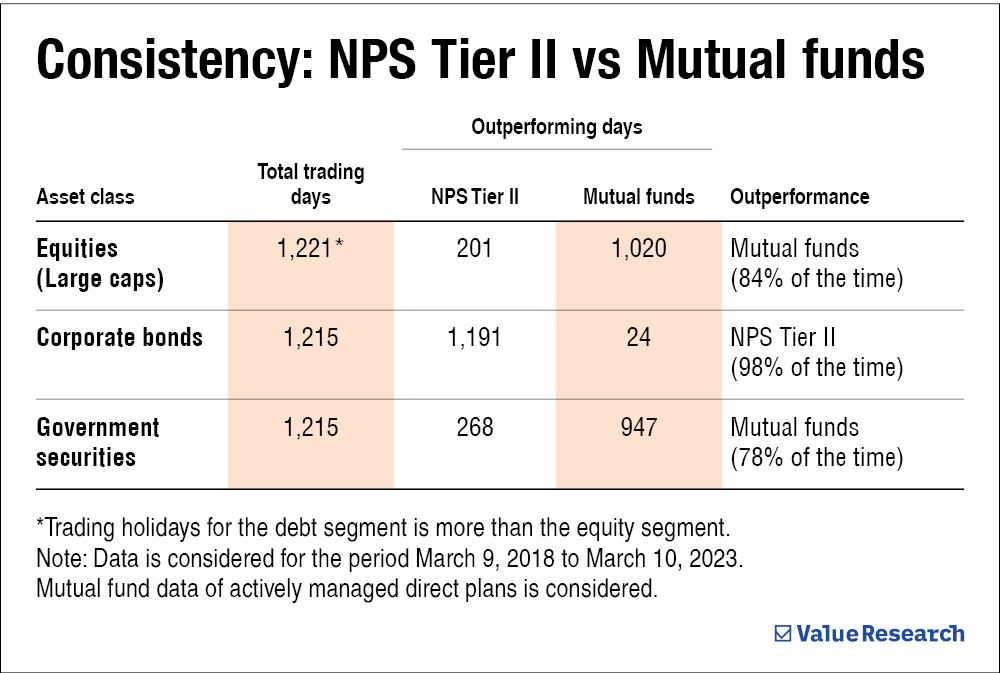

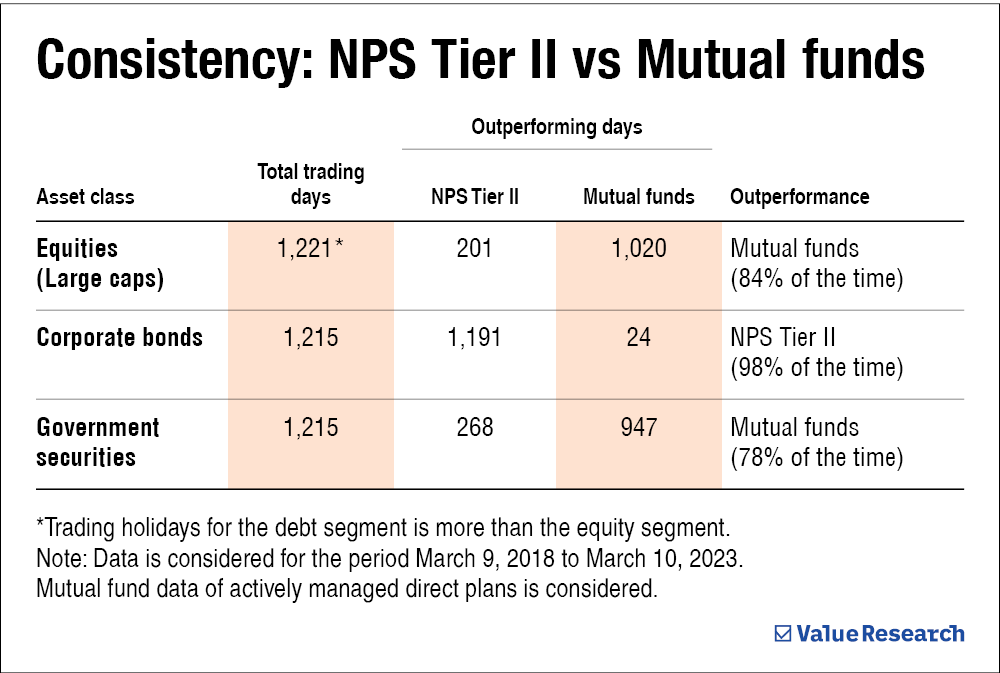

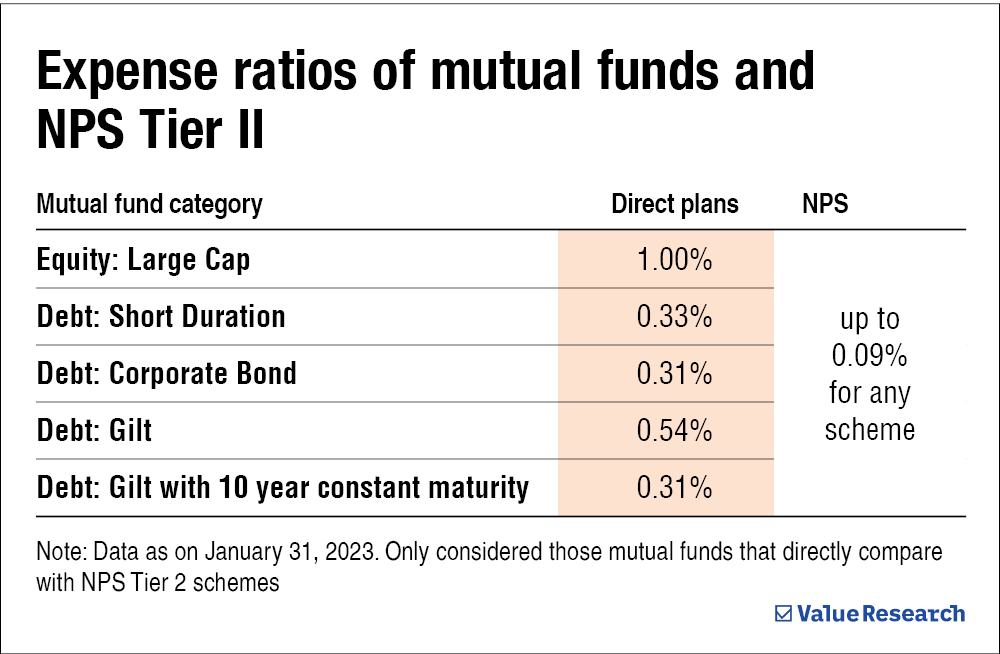

Comparing Large cap And Debt Funds With NPS Tier 2 Value Research

https://www.valueresearchonline.com/content-assets/images/52335_nps_tier_ii-2__w1000__.png

Your Employer s Contribution To NPS Can Make A Huge Difference

https://4.bp.blogspot.com/-ARdbRhlLIVQ/WRwDcrdb2HI/AAAAAAAAQrM/V_MeDWhbAvkaflKs7FCZ8-tNMIR3uupFQCLcB/s1600/nps-tier1-tier2-difference.jpg

Web 16 sept 2022 nbsp 0183 32 Tax Benefits on NPS Tier 1 amp Tier 2 Returns The contributions made to an NPS Tier 1 account are eligible for tax deductions Contributions to an NPS Tier 2 account do not offer any tax benefits Web 30 mars 2023 nbsp 0183 32 Investing in NPS Tier I offers three tax deductions Deduction of up to Rs 1 5 lakh from taxable income under Section 80C Additional deduction of up to Rs 50 000

Web 20 ao 251 t 2020 nbsp 0183 32 The asset class allocation is mix of equity debt and cash money market liquid funds under the NPS Tier II account income tax saving scheme NPS Tier II tax saver account does not offer Web 6 d 233 c 2022 nbsp 0183 32 Learn about National Pension Scheme NPS Tier 2 amp NPS Tier 2 advantages and disadvantages at Upstox Also learn about Tax Benefits Withdrawals amp Returns

Download Nps Tier 2 Tax Rebate

More picture related to Nps Tier 2 Tax Rebate

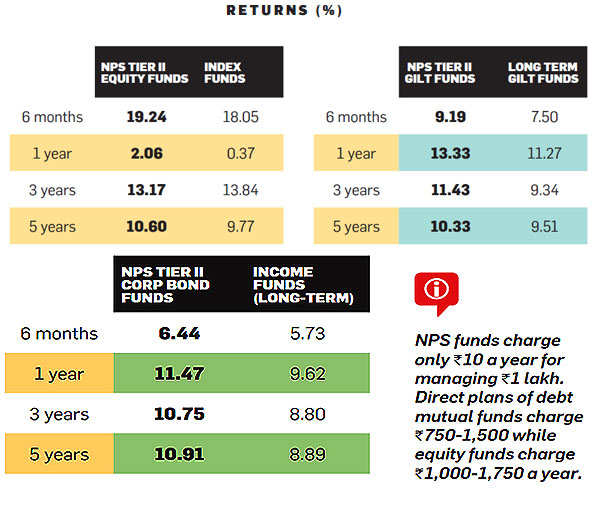

Low cost NPS Tier II Has Beaten Direct MFs The Economic Times

https://img.etimg.com/photo/53393660/gfx.jpg

NPS Tier 2 Account Risk Free Income

https://1.bp.blogspot.com/-bTvwQ1YJmiQ/YGKwXlvyjLI/AAAAAAAACAE/9XJy5-ZWNEU7-BzIhNV-2sxDedP6N4zYACLcBGAsYHQ/w640-h342/Screenshot%2B%252829%2529.png

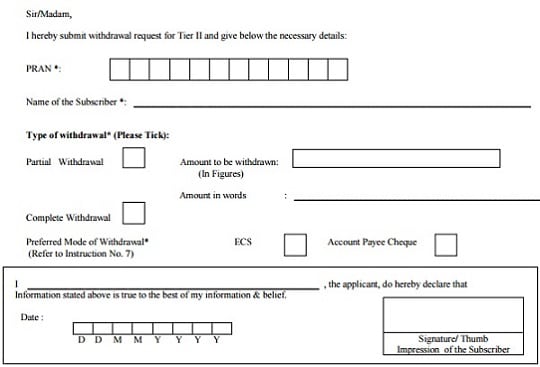

NPS Tier 2 Withdrawal Via Online In 2021 Taxation Time Charges

https://profitsolo.b-cdn.net/wp-content/uploads/2020/12/eNPSLogin-e1625581711415-768x323.jpg

Web 11 nov 2022 nbsp 0183 32 There are no tax benefits available to investors in NPS Tier 2 funds Therefore taxpayers can take advantage of up to one year of tax exemption when investing in NPS Moreover the above tax deductions Web The National Pension Scheme NPS is one of the ideal retirement plans backed by the Central Government From tax exemptions to flexibility regarding deposits and

Web 20 ao 251 t 2020 nbsp 0183 32 20 Aug 2020 Aakar Rastogi The Pension Fund Regulatory and Development Authority PFRDA has recently announced more details about the tax Web 11 juil 2021 nbsp 0183 32 How your NPS Tier II account withdrawals are taxed 4 min read 11 Jul 2021 09 51 AM IST Balwant Jain There is no specific and direct provision for taxation of

Stream Episode S23 How To Activate NPS Tier 2 Tax Saver Scheme O By

https://i1.sndcdn.com/artworks-EbXyasuOjQQzOIpn-ugC6vw-t500x500.jpg

Activate NPS Tier 2 Account National Pension System Invest In

https://i.ytimg.com/vi/TaQlbcPfSrM/maxresdefault.jpg

https://cleartax.in/s/section-80-ccd-1b

Web 8 f 233 vr 2019 nbsp 0183 32 This means you can invest up to Rs 2 lakhs in an NPS Tier 1 account and claim a deduction for the full amount i e Rs 1 50 lakh under Sec 80 CCD 1 and Rs

https://www.hdfcbank.com/personal/resources/learning-centre/invest/how...

Web Under Section 80CCD 1 of the Income Tax Act NPS offers a tax exemption of up to Rs 1 5 lakh In case a company provides an NPS facility the employer s contribution to NPS

NPS Tier 2 Account nps Tier 2 Tax Saver nps Tier 2 Tax Benefit nps Tier

Stream Episode S23 How To Activate NPS Tier 2 Tax Saver Scheme O By

HOW TO OPEN ONLINE NPS TIER 2 ACCOUNT Rajasthan

Should You Invest In National Pension System NPS Tier 2 Account

NPS Tier 2 Account Risk Free Income

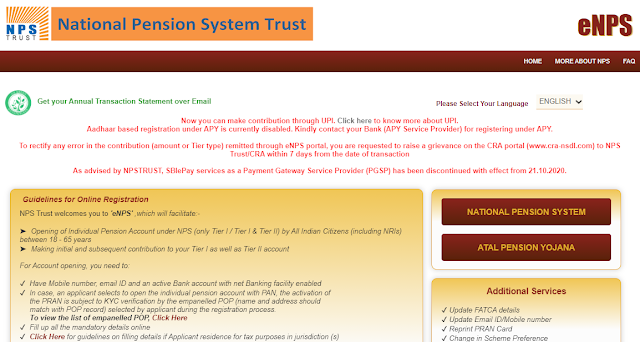

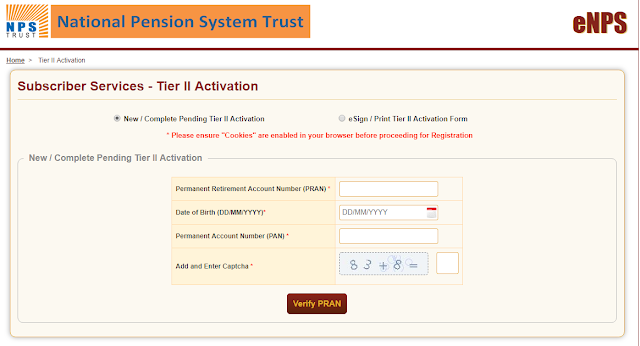

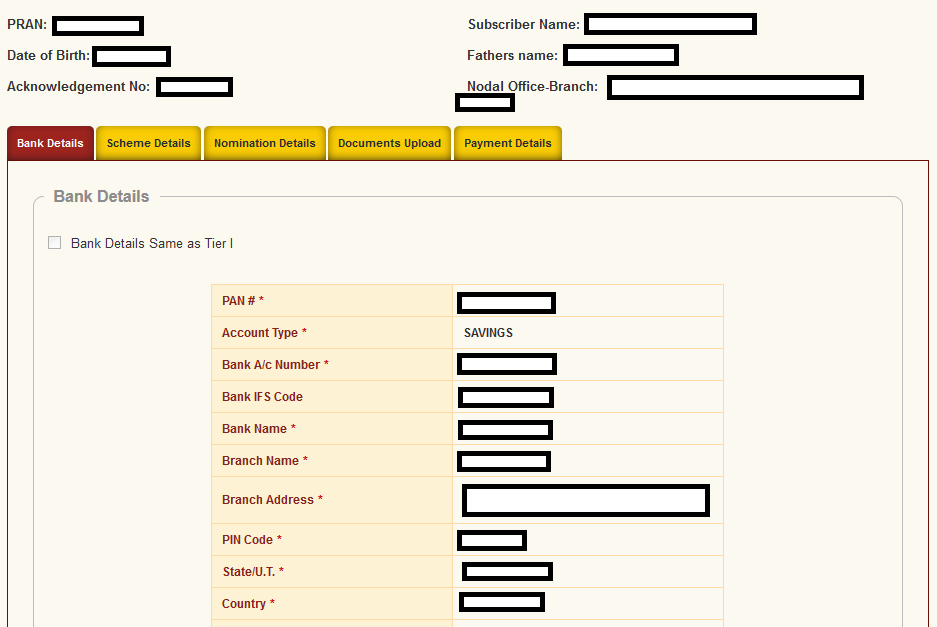

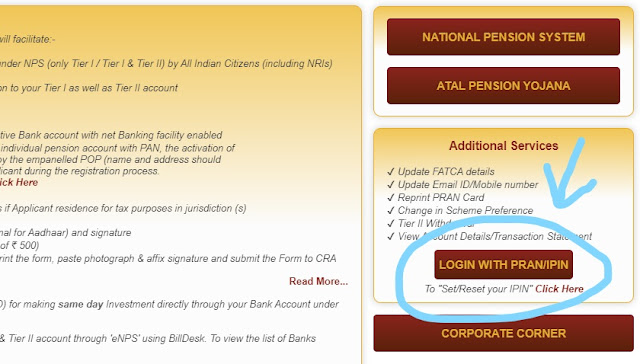

How To Open NPS Tier II Account Online Here s A Step by step Guide

How To Open NPS Tier II Account Online Here s A Step by step Guide

HOW TO OPEN ONLINE NPS TIER 2 ACCOUNT Rajasthan

Comparing Large cap And Debt Funds With NPS Tier 2 Value Research

How To Activate Nps Tier 2 Account Online NPS Tier 2 Online Open

Nps Tier 2 Tax Rebate - Web 16 sept 2022 nbsp 0183 32 Tax Benefits on NPS Tier 1 amp Tier 2 Returns The contributions made to an NPS Tier 1 account are eligible for tax deductions Contributions to an NPS Tier 2 account do not offer any tax benefits