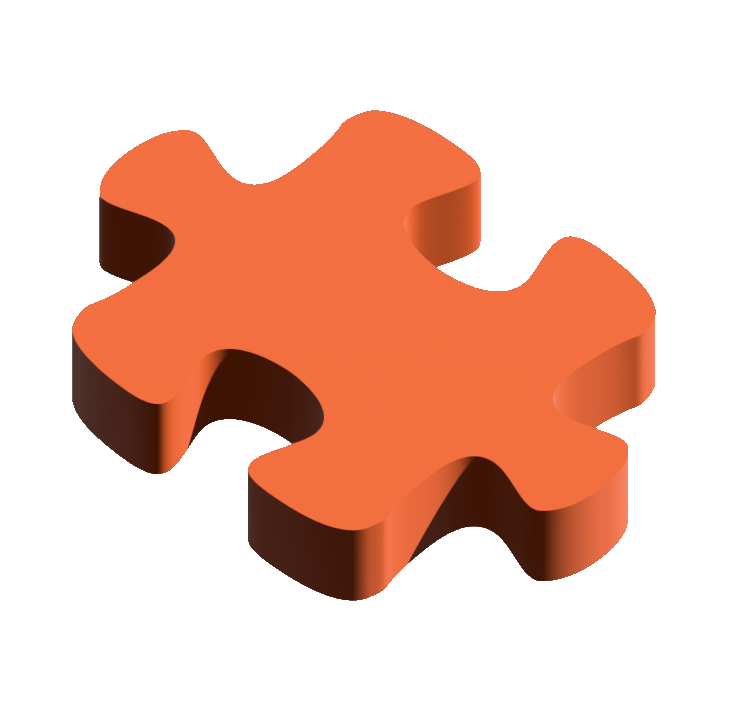

Ny 2024 Homeowner Tax Rebate You may be thinking of the homeowner tax rebate credit HTRC checks that we issued in 2022 HTRC was a one year program for 2022 only you will not receive an HTRC check for 2023 or other years The STAR program is separate from HTRC and STAR benefits are granted in the form of either

Homeowner tax rebate credit registration If you received a letter Form RP 5303 requesting that you register for the homeowner tax rebate credit please follow the instructions below This will enable us to determine your eligibility for the credit If you did not receive a letter please do not register for the credit How to register 1 Real property tax relief credit Who is eligible You are entitled to this refundable credit if you meet all of the following requirements for the tax year you are subject to tax under Tax Law Article 22 you were a New York State resident for all of the tax year your qualified gross income is 250 000 or less

Ny 2024 Homeowner Tax Rebate

Ny 2024 Homeowner Tax Rebate

https://perinton.org/wp-content/uploads/2022-Homeowner-Tax-Rebate-Credit-HTRC-1-600x503.png

Confusion Over When Eligible New Yorkers Will Get Their Homeowner Tax Rebate Check WSTM

https://cnycentral.com/resources/media2/16x9/full/1024/center/80/bb776db9-9697-43c3-882f-8577bedc9e89-large16x9_tax_rebate.PNG

Homeowner Tax Rebate Credit Checks On Their Way To NYS Residents WWTI InformNNY

https://www.informnny.com/wp-content/uploads/sites/58/2022/06/GettyImages-985842598-2.jpg?w=1920&h=1080&crop=1

New Yorkers have just days left to apply for a rebate that could offer a check of 1 400 or more The deadline to apply for a change in the School Tax Relief STAR exemption program is 2022 Homeowner Tax Rebate Credit Check Lookup Note The homeowner tax rebate credit was a one year program which ended in 2022 The credit is not available for future years If you have questions about the program or received a letter regarding your 2022 payment see Frequently asked questions Lost stolen destroyed and uncashed checks

Inflation Reduction Act Homeowners Back to Inflation Reduction Act Combine IRA Savings with State Incentives to Upgrade Your Home and Ditch Fossil Fuels The Inflation Reduction Act IRA helps New Yorkers get the latest clean energy technologies and equipment that will save energy for years to come The FY 2024 Budget adds 50 million for a Homeowner Stabilization Fund to finance home repairs in 10 communities across the state that have been identified as having high levels of low income homeowners of color and homeowner distress

Download Ny 2024 Homeowner Tax Rebate

More picture related to Ny 2024 Homeowner Tax Rebate

Over 3M New Yorkers To Receive Homeowner Tax Rebate Checks This Summer Port Washington NY Patch

https://patch.com/img/cdn20/shutterstock/23121104/20220610/034752/styles/patch_image/public/shutterstock-228062581___10154715779.jpg?width=1200

The NY Homeowner Tax Rebate Credit Benefits Plus

https://bplc.cssny.org/assets/Tools-Puzzle-Piece-Only - clear background-bd0547fd151a7c846519968fecddde810372d2bd0a60b7c74e85109663f0482b.png

NY Homeowner Tax Rebate Checks Are In The Mail RBT CPAs LLP

https://www.rbtcpas.com/wp-content/uploads/2022/07/NY-Homeowner-Tax-Rebate-Checks-Are-in-the-Mail.jpg

For the property tax relief credit income is defined as federal adjusted gross income FAGI from two years prior modified so that the net amount of loss reported on Federal Schedule C D E or F doesn t exceed 3 000 the net amount of any other separate category of loss doesn t exceed 3 000 and The New York Department of Taxation and Finance will soon begin sending direct financial assistance to 1 75 million New Yorkers who received the Empire State Child Credit and or the Earned Income Credit on their 2021 state tax returns including a gas tax moratorium and a homeowner tax rebate credit Our families have felt the effects of a

New York News Homeowner tax rebate credit checks coming to New Yorkers by Delaney Keppner Posted Jul 5 2022 02 19 PM EDT Updated Jul 5 2022 02 41 PM EDT ALBANY N Y WWTI When you file your tax return you must decide whether to take the standard deduction 13 850 for single tax filers 27 700 for joint filers or 20 800 for heads of household or married filing

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks Wgrz

https://media.wgrz.com/assets/WGRZ/images/a07fcd1f-3754-4e57-bce5-9be83e9634c0/a07fcd1f-3754-4e57-bce5-9be83e9634c0_1140x641.jpg

https://www.tax.ny.gov/star/

You may be thinking of the homeowner tax rebate credit HTRC checks that we issued in 2022 HTRC was a one year program for 2022 only you will not receive an HTRC check for 2023 or other years The STAR program is separate from HTRC and STAR benefits are granted in the form of either

https://www.tax.ny.gov/pit/property/htrc-registration.htm

Homeowner tax rebate credit registration If you received a letter Form RP 5303 requesting that you register for the homeowner tax rebate credit please follow the instructions below This will enable us to determine your eligibility for the credit If you did not receive a letter please do not register for the credit How to register 1

The NY Homeowner Tax Rebate Credit Benefits Plus

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

Homeowner Tax Rebate Program For People Who Live In Their Home YouTube

New York State To Mail Out Homeowner Tax Rebate Credit Checks DSJ

Your Stories Q A Are You Still Waiting For Your Homeowner Tax Rebate Credit Check YouTube

NYS 2023 Homeowner Tax Rebate Tax Rebate

NYS 2023 Homeowner Tax Rebate Tax Rebate

The NY Homeowner Tax Rebate Credit Benefits Plus

Property Tax Rebate Pennsylvania LatestRebate

Your Stories Q A Where Is My NYS Homeowner Tax Rebate Credit Check YouTube

Ny 2024 Homeowner Tax Rebate - 2022 Homeowner Tax Rebate Credit Check Lookup Note The homeowner tax rebate credit was a one year program which ended in 2022 The credit is not available for future years If you have questions about the program or received a letter regarding your 2022 payment see Frequently asked questions Lost stolen destroyed and uncashed checks