Ny Property Tax Rebate 2024 Note Are you wondering why you received a property tax rebate check from New York State last year but you haven t received one this year You may be thinking of the homeowner tax rebate credit HTRC checks that we issued in 2022 HTRC was a one year program for 2022 only you will not receive an HTRC check for 2023 or other years

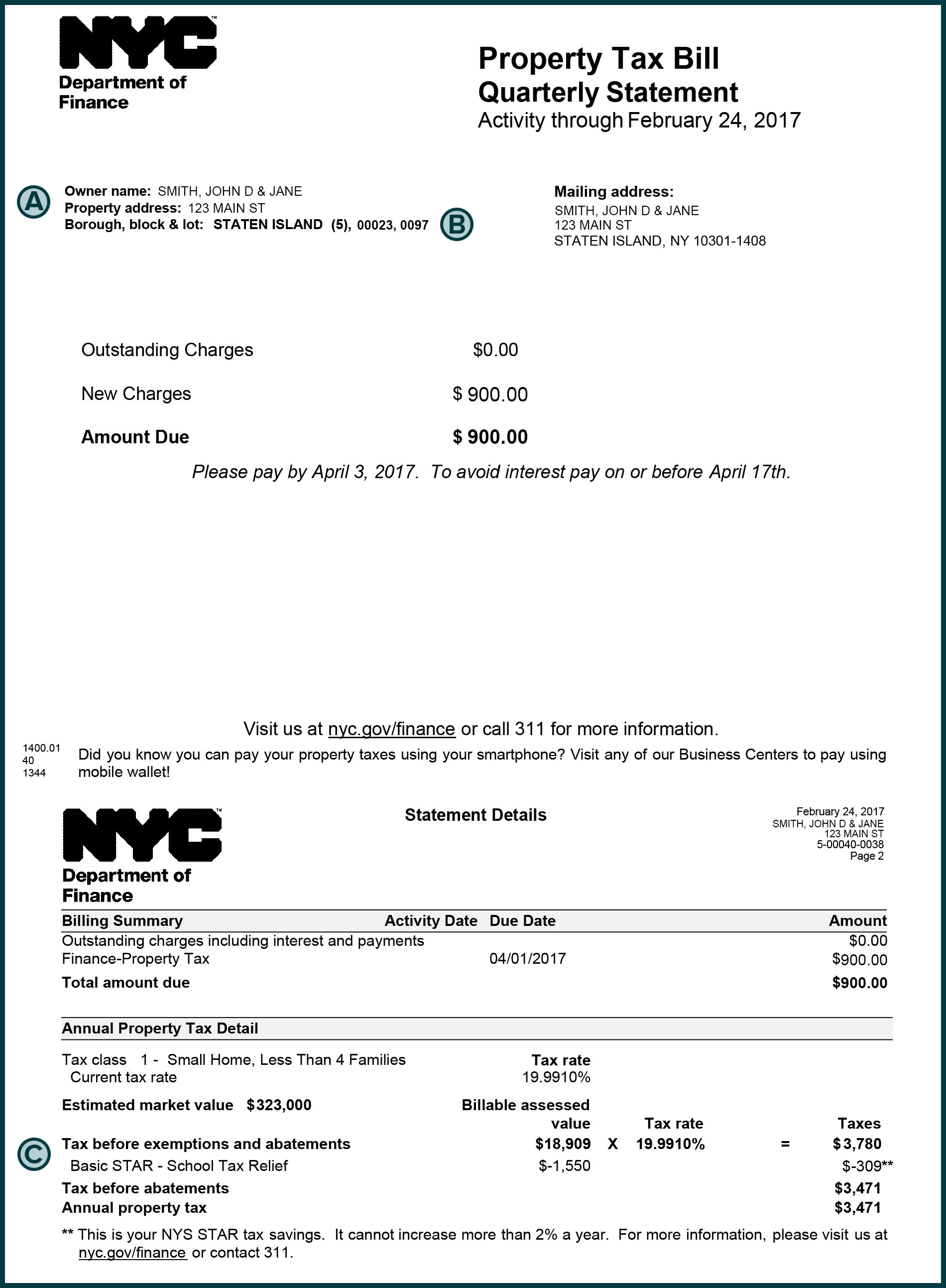

You can receive the STAR credit if you own your home and it s your primary residence and the combined income of the owners and the owners spouses is 500 000 or less STAR exemption a reduction on your school tax bill If you ve been receiving the STAR exemption since 2015 you can continue to receive it for the same primary residence The following forms and instructions are now available for 2024 following the law changes to income eligibility earlier this year For a description of the law changes see the summary that we previously shared Form RP 467 Form RP 467 Rnw New Form RP 467 Wkst Instructions for the forms

Ny Property Tax Rebate 2024

Ny Property Tax Rebate 2024

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-42.png?w=530&ssl=1

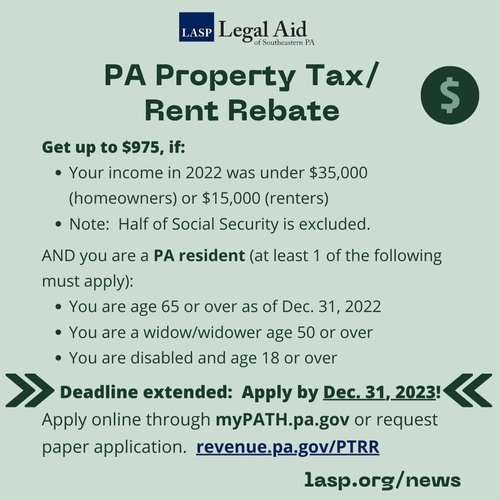

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Tax Rebate For First Time Homeowners How To Claim Your Tax Rebate

https://asapapartmentfinders.com/wp-content/uploads/2016/12/tax-rebate.jpg

Krey l ayisyen Italiano Polski Free interpretation The property tax relief credit directly reduced your property tax burden if you were a qualifying homeowner The amount of the credit was a percentage of your STAR savings The property tax relief credit has expired Definition of income for the homeowner tax rebate credit For the homeowner tax rebate credit income was defined as federal adjusted gross income FAGI from two years prior tax year 2020 modified so that the net amount of loss reported on federal Schedule C D E or F is 3 000 or less

Property Fiscal Year 2023 Property Tax Rebates New York City s homeowners contribute so much to our city s neighborhoods economy and quality of life In recognition of this Mayor Eric Adams and the New York City Council are issuing property tax rebates in the amount of 150 to eligible homeowners Eligibility Publication 532 2024 A publication is an informational document that addresses a particular topic of interest to taxpayers Subsequent changes in the law or regulations judicial decisions Tax Appeals Tribunal decisions or changes in Department policies could affect the validity of the information contained in a publication Publications

Download Ny Property Tax Rebate 2024

More picture related to Ny Property Tax Rebate 2024

How To Get Property Tax Rebate PropertyRebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/pa-property-tax-rent-rebate-apply-by-12-31-2022-new-1-time-bonus-55.jpg?resize=1583%2C2048&ssl=1

Deposit Your Due Property Tax Latest By 31st December 2019 Don T Ignore Bill Rismedia Vrogue

http://tax.ny.gov/images/orpts/proptaxbills/nyc.jpg

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/585/571/585571881/large.png

2022 Homeowner Tax Rebate Credit Check Lookup 2022 Homeowner Tax Rebate Credit Check Lookup Note The homeowner tax rebate credit was a one year program which ended in 2022 The credit is not available for future years If you have questions about the program or received a letter regarding your 2022 payment see Frequently asked questions What should I do with it 5 I received a letter asking me to provide more information How can I submit my additional information 6 I mailed in my additional information or my application How long will it take for me to receive my check 7 What should I do if I think I am eligible for a rebate but do not receive a check

Housing Budget May 3 2023 Albany NY Governor Hochul Announces Support for Homeowners Tenants and Public Housing Residents as Part of FY 2024 Budget The plan will also accelerate the implementation of 1 2 billion in New York s existing Middle Class Tax Cut for 6 million New Yorkers which first began to be implemented in 2018 and establish a 1 billion property tax rebate program to put money back into the pockets of more than 2 million New Yorkers who have had to endure rising costs as

Deadline For Tax And Rent Relief Extended

https://www.senatorhughes.com/wp-content/uploads/2022/06/property-tax-rebate-2021-booklet.jpg

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/9e98951b-5acf-419a-afcd-ce4692a6a772/2023-12-31+property+tax+rebate+DEADLINE.2-insta.jpg?format=500w

https://www.tax.ny.gov/pit/property/star/star-check-delivery-schedule.htm

Note Are you wondering why you received a property tax rebate check from New York State last year but you haven t received one this year You may be thinking of the homeowner tax rebate credit HTRC checks that we issued in 2022 HTRC was a one year program for 2022 only you will not receive an HTRC check for 2023 or other years

https://www.tax.ny.gov/star/

You can receive the STAR credit if you own your home and it s your primary residence and the combined income of the owners and the owners spouses is 500 000 or less STAR exemption a reduction on your school tax bill If you ve been receiving the STAR exemption since 2015 you can continue to receive it for the same primary residence

NY Homeowner Tax Rebate Checks Are In The Mail RBT CPAs LLP

Deadline For Tax And Rent Relief Extended

Missouri Rent Rebate 2023 Printable Rebate Form PropertyRebate

Property Tax Rebate Checks Are Coming Here s How Much Money You re Due

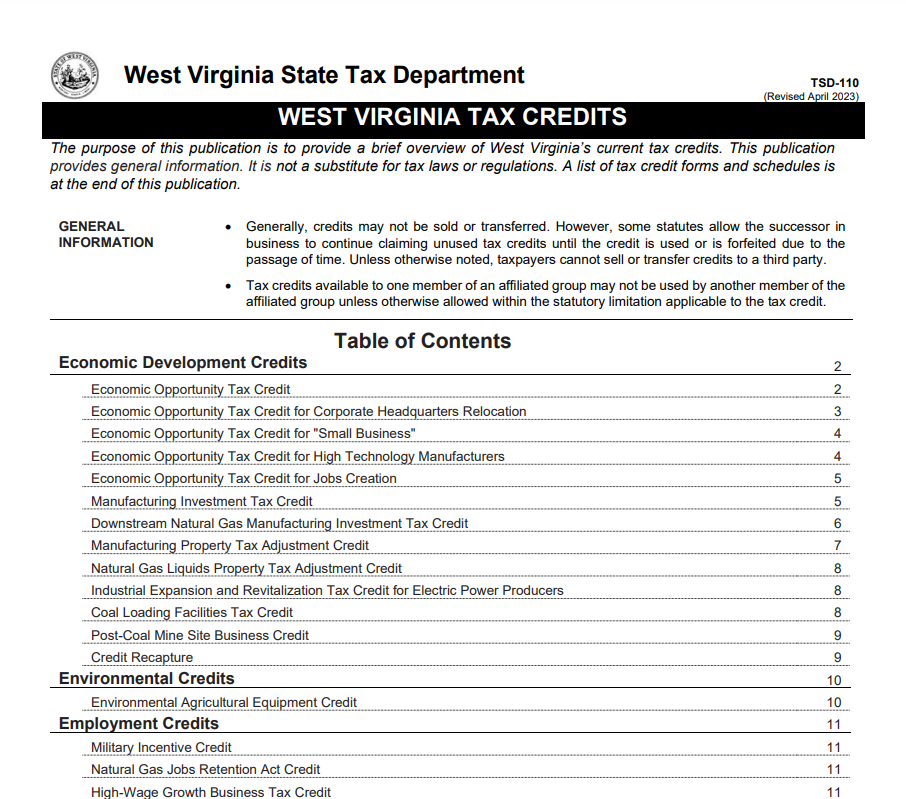

West Virginia Tax Rebate 2023 Claiming Tax Rebates WV Tax Relief PrintableRebateForm

Stimulus Check 2022 Update New York State Property Tax Rebate Arrived PropertyRebate

Stimulus Check 2022 Update New York State Property Tax Rebate Arrived PropertyRebate

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

PA Property Tax Rebate What To Know Credit Karma

Minnesota Fillable Tax Forms Printable Forms Free Online

Ny Property Tax Rebate 2024 - Reporter Consumer Social Trends New Yorkers have just days left to apply for a rebate that could offer a check of 1 400 or more The deadline to apply for a change in the School Tax Relief