Ny Property Tax Rebate Database Web 14 mars 2023 nbsp 0183 32 For homeowners outside of New York City To find the amount of your HTRC check Select your county below On the next page select your city or town On

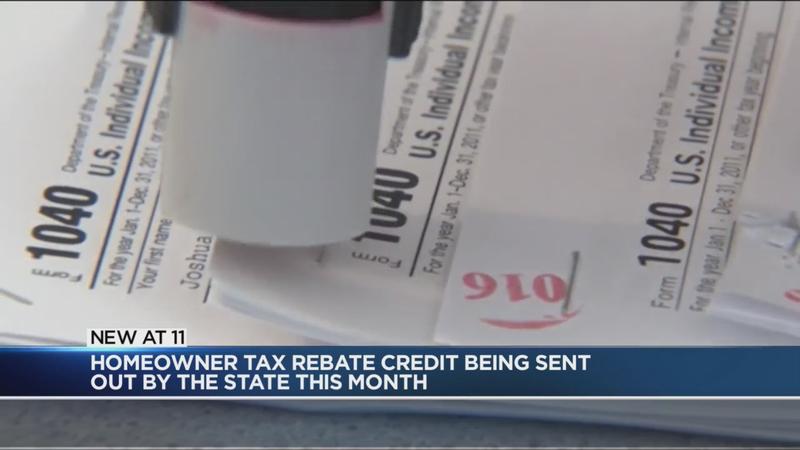

Web The homeowner tax rebate credit is a one year program providing direct property tax relief to about 2 5 million eligible homeowners in 2022 If you qualify you don t need to do Web 5 juil 2023 nbsp 0183 32 If you re looking for information about the 2022 homeowner tax rebate credit see homeowner tax rebate credit The property tax relief credit directly reduced your

Ny Property Tax Rebate Database

Ny Property Tax Rebate Database

https://i0.wp.com/www.freerebate.net/wp-content/uploads/2023/02/this-is-an-attachment-of-solar-rebates-by-state-in-2023-solar-from-new-york-state-property-tax-rebate-2023-post.png?w=677&h=438&ssl=1

NY Property Tax Rebate Search Database To Estimate Your Chances Of

https://www.syracuse.com/resizer/oiaXjEXXxuIIWslmK2Xk9aDyU3k=/1280x0/smart/advancelocal-adapter-image-uploads.s3.amazonaws.com/image.syracuse.com/home/syr-media/width2048/img/state_impact/photo/2015/11/23/ny-tax-freezejpg-00fa0196e65a028e.jpg

Nys Property Tax Rebate Checks 2023 Eligibility Application Process

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/Nys-Property-Tax-Rebate-Checks-2023.jpg

Web Instructions Enter the security code displayed below and then select Continue Web The fiscal year 2023 property tax rebate is for homeowners whose New York City property is their primary residence and whose combined income is 250 000 or less Most

Web 5 sept 2023 nbsp 0183 32 Homeowner tax rebate credit HTRC Full list Assessments Learn about assessments and property taxes Check your assessment Contest your assessment Web 27 mai 2022 nbsp 0183 32 2022 Homeowner Tax Rebate Credit Amounts Below are the homeowner tax rebate credit HTRC amounts for the school districts in your municipality If the

Download Ny Property Tax Rebate Database

More picture related to Ny Property Tax Rebate Database

New York Property Owners Getting Rebate Checks Months Early

https://s.hdnux.com/photos/01/26/04/67/22564341/10/1200x0.jpg

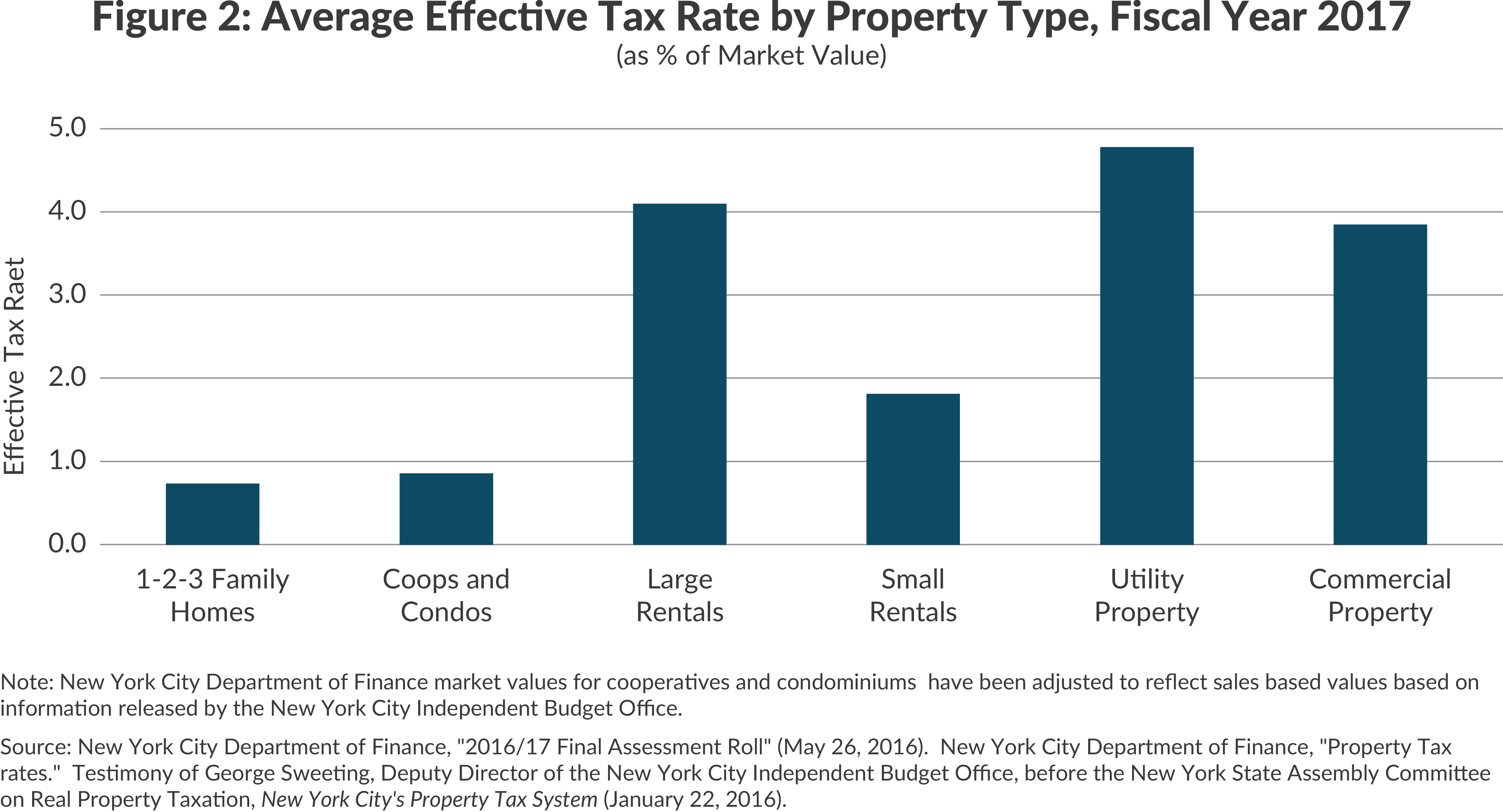

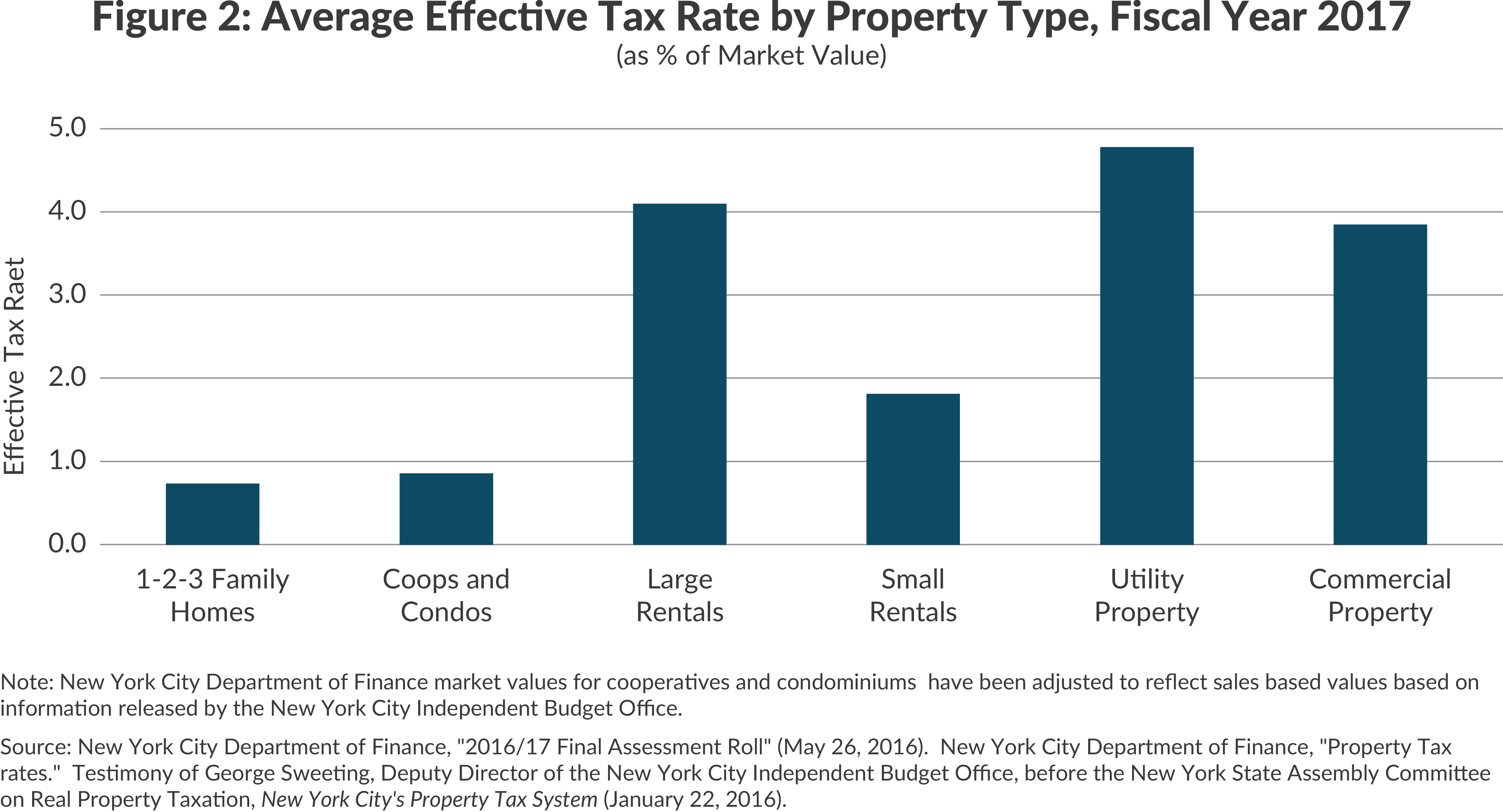

New York City Property Taxes 2022

https://cbcny.org/sites/default/files/media/image-caption/Figure-09.png

How To Get Property Tax Rebate PropertyRebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/pa-property-tax-rent-rebate-apply-by-12-31-2022-new-1-time-bonus-55.jpg?resize=1583%2C2048&ssl=1

Web 5 sept 2023 nbsp 0183 32 Our property owner webpages include information about assessments property tax relief and more You ll find everything you need to know whether your Web 15 mars 2023 nbsp 0183 32 Look Up Service Requests Some New York City homeowners will be eligible to receive a 150 property tax rebate The deadline to apply for the property

Web 7 nov 2022 nbsp 0183 32 The property tax rebate is for homeowners whose New York City property is their primary residence and whose combined income is 250 000 or less How to Apply Web 1 How will I know if I am eligible for the property tax rebate 2 When will I receive my property tax rebate check 3 My check was damaged How can I get a replacement

New York City Property Taxes 2023

https://cbcny.org/sites/default/files/media/image-caption/Figure-07_2.png

Retirees Need To Take Action For Latest Property Tax Rebate NPR Illinois

https://npr.brightspotcdn.com/dims4/default/759130d/2147483647/strip/true/crop/758x413+0+0/resize/880x479!/quality/90/?url=http:%2F%2Fnpr-brightspot.s3.amazonaws.com%2Fcf%2F92%2Fc1613a8b4b4ba9b8b28ebd901285%2Ftaxrebate.png

https://www.tax.ny.gov/pit/property/htrc/lookup.htm

Web 14 mars 2023 nbsp 0183 32 For homeowners outside of New York City To find the amount of your HTRC check Select your county below On the next page select your city or town On

https://www.tax.ny.gov/pit/property/homeowner-tax-rebate-credit.htm

Web The homeowner tax rebate credit is a one year program providing direct property tax relief to about 2 5 million eligible homeowners in 2022 If you qualify you don t need to do

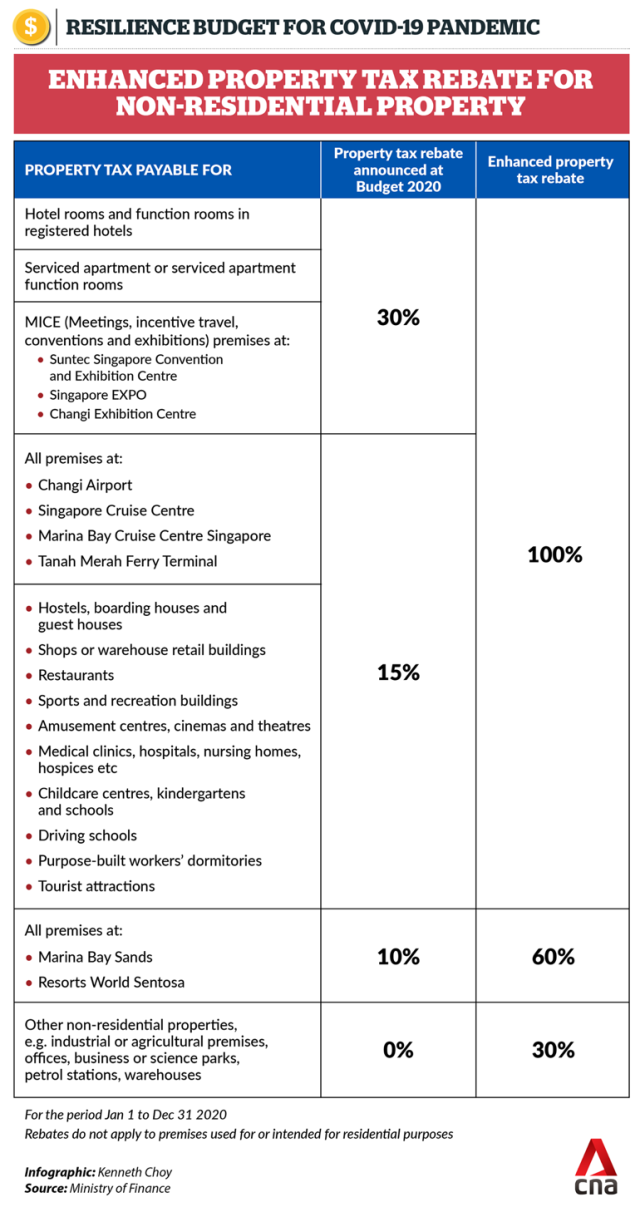

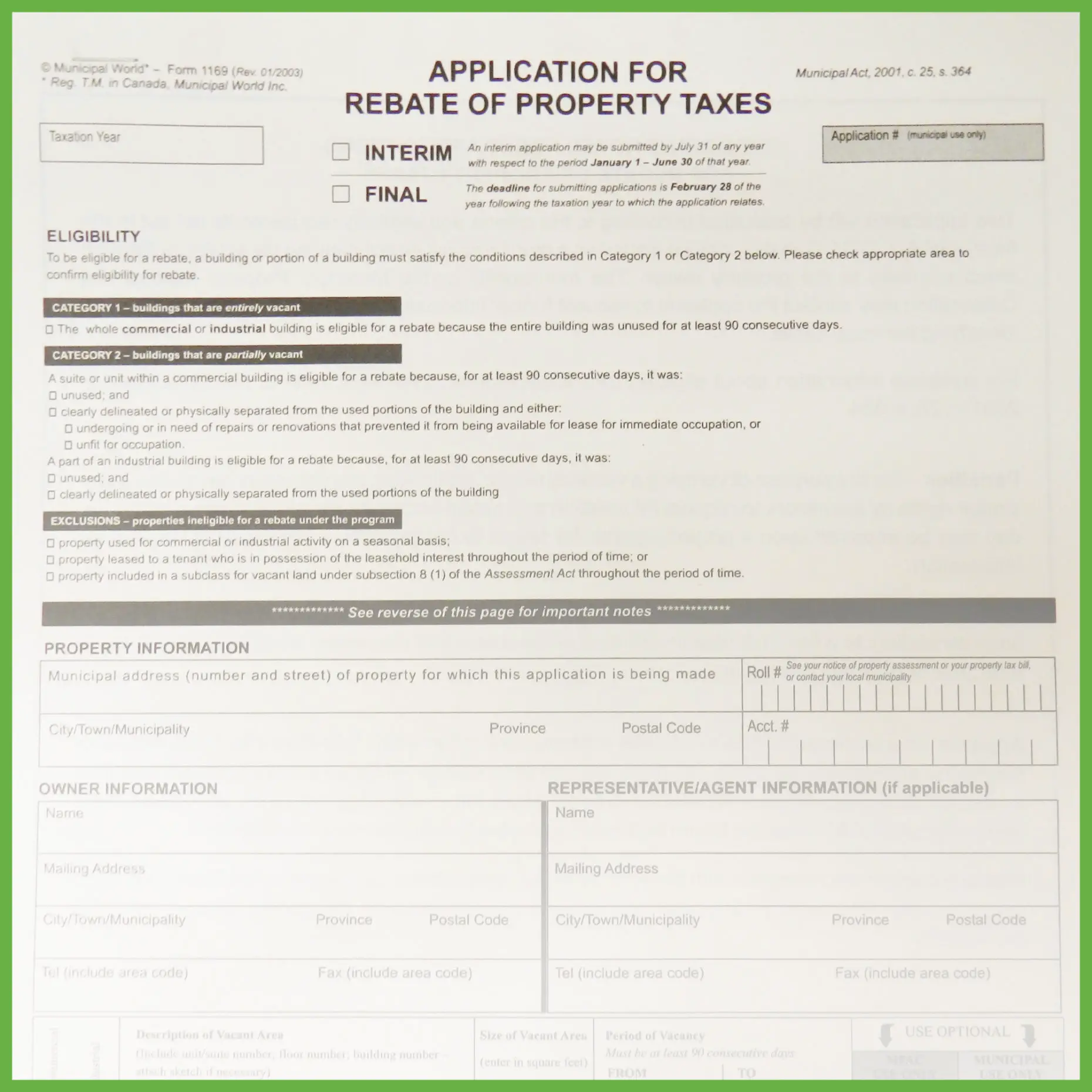

Covid 19 Property Tax Rebate To Help Individuals Business

New York City Property Taxes 2023

Where Is My Property Tax Rebate TaxesTalk

Pennsylvania Property Tax Rent Rebate 5 Free Templates In PDF Word

Proposal To Update Ailing PA Rent Property Tax Rebate Program Would

Tax Rebate Checks Come Early This Year Yonkers Times PropertyRebate

Tax Rebate Checks Come Early This Year Yonkers Times PropertyRebate

Rebate Checks Are Coming What To Know This Year Wgrz PropertyRebate

Star Rebate Check Eligibility StarRebate

NY Homeowner Tax Rebate Checks Arriving Early WHEC

Ny Property Tax Rebate Database - Web 23 janv 2023 nbsp 0183 32 NY Homeowner Tax Rebate Credit HTRC is a one year tax credit program for eligible homeowners The amount of the credit is between 250 and 350 and will be