Ny Star Rebate Checks 2024 Select Delivery Schedule lookup below Choose the county you live in from the drop down menu Select your school district to view the information for your area Select your town or city The lookup shows the date we began or will begin to mail STAR credit and eligibility letters to your area Please allow five to ten business days for delivery

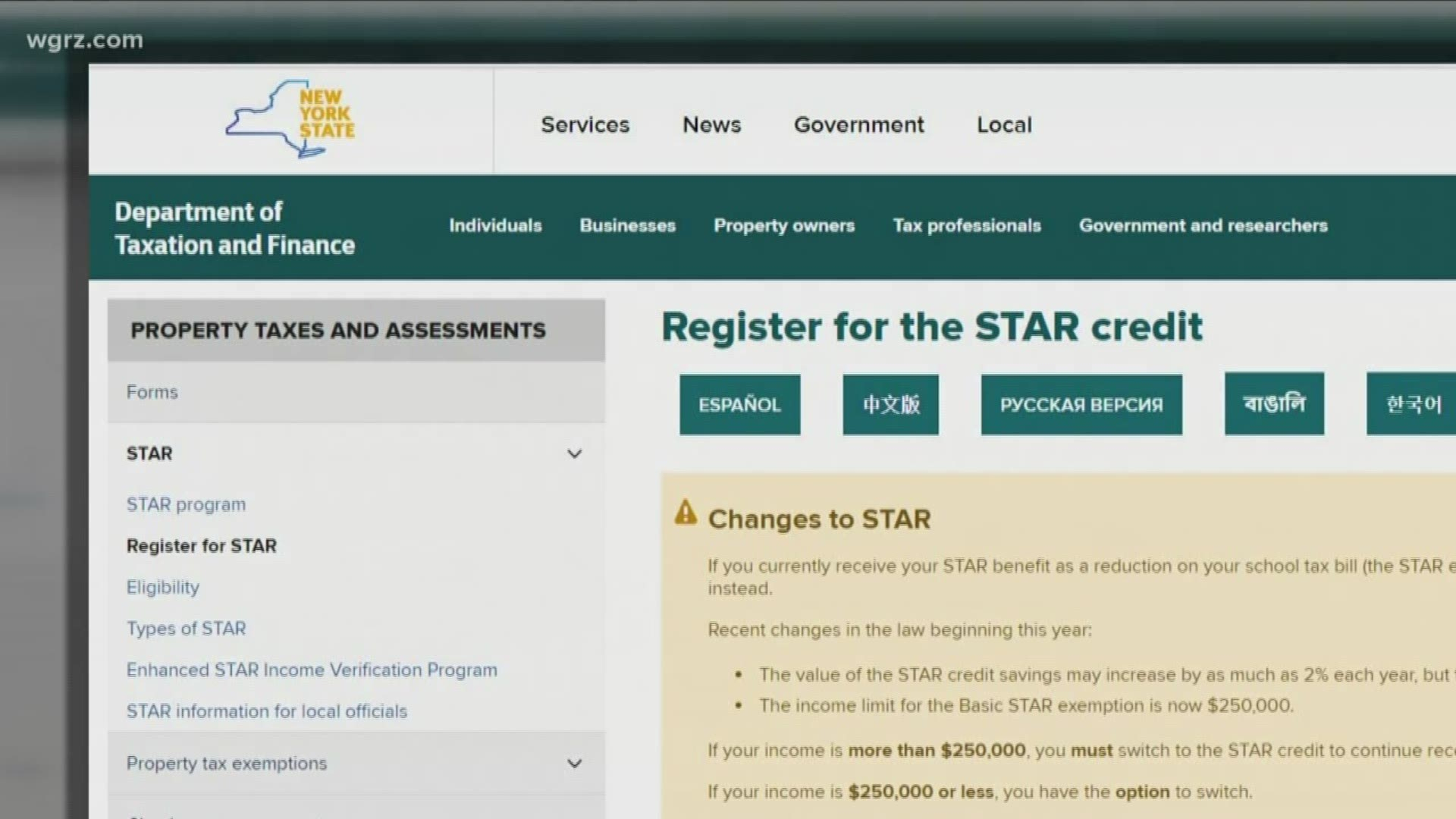

1 01 STAR benefit checks and exemptions reflected on school property tax bills have already started filling New Yorkers inboxes and mailboxes and will continue to do so through the end of the Beginning in 2024 we plan to make STAR Credit Direct Deposit available to homeowners statewide If you live outside of Nassau or Suffolk County and you enroll in STAR Credit Direct Deposit you can expect to receive your credit by check in 2023 and by direct deposit in future years as long as you are eligible

Ny Star Rebate Checks 2024

Ny Star Rebate Checks 2024

https://i0.wp.com/www.rebatecheck.net/wp-content/uploads/2023/08/mount-vernon-star-rebate-checks-2022-starrebate-5.jpg?w=682&h=546&ssl=1

NY Legislature End STAR Rebate s Check System

https://www.lohud.com/gcdn/-mm-/356cf371d712b9bedce825dd7143ba976da91f9b/c=0-180-4012-2447/local/-/media/2017/01/18/Westchester/Westchester/636203474143968580-New-York-State-Capitol-2017.jpg?width=1320&height=746&fit=crop&format=pjpg&auto=webp

Star Rebate Check Eligibility StarRebate PropertyRebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/star-rebate-check-eligibility-starrebate-57.jpg?w=2100&ssl=1

A manufactured homeowner who received a letter that you must register for the STAR credit to continue receiving a STAR benefit Form RP 425 RMM an existing homeowner who is not receiving the STAR exemption or credit or a senior who may be eligible for the Enhanced STAR credit The Basic STAR program exempts the first 30 000 of the full value of a home from school property taxes for owner occupied primary residences The income limit for the program is 500 000

The Maximum STAR exemption savings Use the links below to find the maximum STAR exemption savings amount for your school district segment Select your municipality and then scroll to your school district or Select your school district and scroll to your municipality Note Your actual STAR savings may be less than the maximum STAR savings You can view and print the following information regarding your 2018 through 2024 property tax credits that have been issued description STAR HTRC or Property Tax Relief credit year check issue date property address property key amount Before you begin you ll need

Download Ny Star Rebate Checks 2024

More picture related to Ny Star Rebate Checks 2024

When Will NY Homeowners Get New STAR Rebate Checks Syracuse

https://www.syracuse.com/resizer/d5Fht24Xbm2Z-MQedKvKt1kuy_M=/800x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/QIMGUVTTIFFGFPKEIOPG2ECTTU.jpg

Star Rebate Checks Exploring The Eligibility And Further Details

https://www.eduvast.com/wp-content/uploads/2023/10/MONEY-1024x576.jpg

NY Rebate Checks To Come In September

https://www.gannett-cdn.com/-mm-/93fb50fb9d10e321545e878bcf60a485f9b34f08/c=0-1016-3174-2810/local/-/media/Ithaca/2014/08/09/shutterstock181719584.jpg?width=3200&height=1680&fit=crop

Income eligibility for the 2024 STAR credit is based on federal or state income tax return information from the 2022 tax year Income for STAR purposes Income means federal adjusted gross income minus the taxable amount of total distributions from IRAs individual retirement accounts and individual retirement annuities If your STAR check hasn t shown up and your due date to pay your school property taxes has passed contact the Department of Taxation and Finance through your Online Services Account or by

The income limit for this program for 2024 is 98 700 The Bulletin Seagulls swirl around the Statue of Liberty at the end of the day in New York City on December 7 2023 New York state How to check the status of your STAR property tax rebate By Susan Arbetter New York State PUBLISHED 2 55 PM ET Aug 29 2022 If you haven t yet received your STAR property tax rebate check there s an easy way to find out what its status is Simply visit this website https www8 tax ny gov SCDS scdsGateway

Governor Hochul Mails Out Rebate Checks Early Suozzi Cries Foul Yonkers Times

https://yonkerstimes.com/wp-content/uploads/2022/06/FUVtPL9WIAM9l1Zggggg-1024x649.jpg

STAR Rebate Check Fiasco What You Need To Know WSTM

https://cnycentral.com/resources/media2/16x9/full/1024/center/80/80218c47-4ed4-47ae-a1a4-08e1c44270d8-large16x9_star.png

https://www.tax.ny.gov/pit/property/star/star-check-delivery-schedule.htm

Select Delivery Schedule lookup below Choose the county you live in from the drop down menu Select your school district to view the information for your area Select your town or city The lookup shows the date we began or will begin to mail STAR credit and eligibility letters to your area Please allow five to ten business days for delivery

https://www.democratandchronicle.com/story/news/2023/09/08/ny-star-checks-when-to-expect-yours-school-tax-relief/70785077007/

1 01 STAR benefit checks and exemptions reflected on school property tax bills have already started filling New Yorkers inboxes and mailboxes and will continue to do so through the end of the

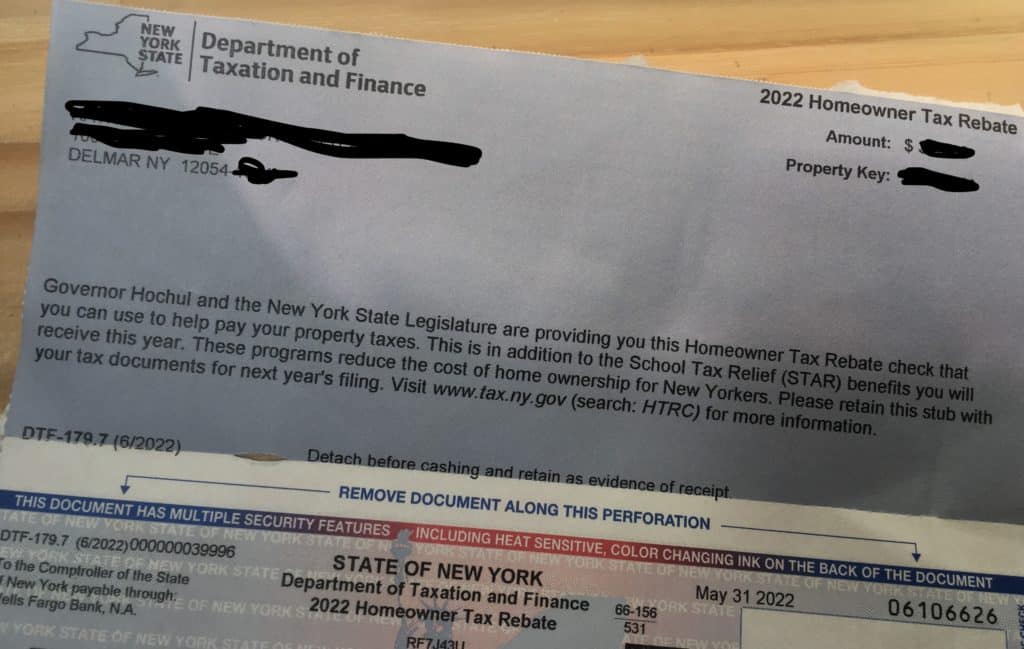

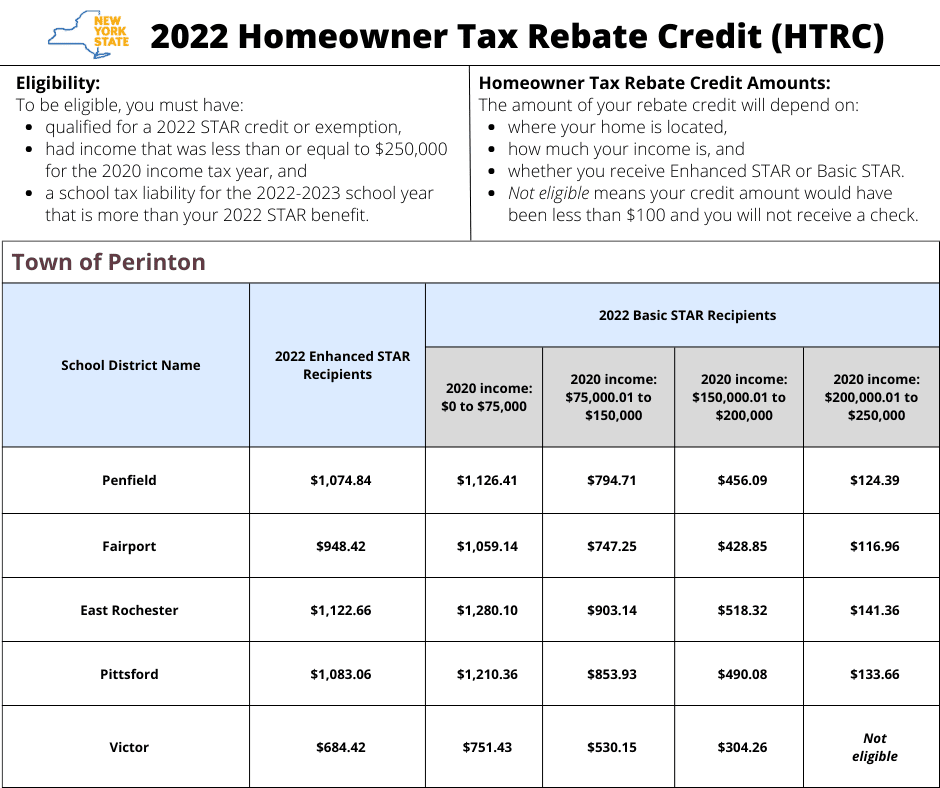

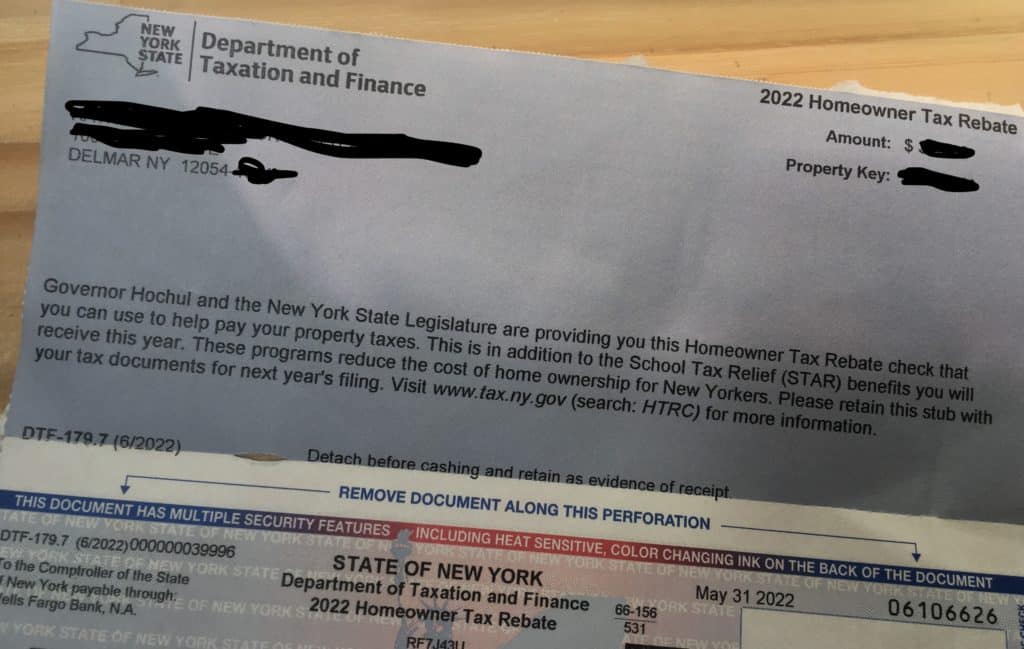

NYS Homeowner Tax Rebate Credit HTRC Info Town Of Perinton

Governor Hochul Mails Out Rebate Checks Early Suozzi Cries Foul Yonkers Times

Long Island Star Rebate Checks RebateCheck

Homeowners Still Waiting For STAR Rebate Checks WRGB

Star Rebate Checks 2023 Schedule RebateCheck

STAR Rebate Checks Come To Some Homeowners In Time For Governor s June Primary Syracuse

STAR Rebate Checks Come To Some Homeowners In Time For Governor s June Primary Syracuse

Assembly Votes To Stop STAR Rebate Checks

Alcon Choice Rebate Code 2023 Printable Rebate Form Rebate2022

NY Homeowner Tax Rebate Checks Are In The Mail RBT CPAs LLP

Ny Star Rebate Checks 2024 - The new application forms for 2024 25 tax year are due by March 1st 2024 The New York State School Tax Relief Program STAR provides homeowners with two types of partial exemptions from school property taxes The Basic STAR Exemption and the Enhanced STAR Exemption The procedures for obtaining the Basic STAR and the Enhanced STAR exemptions