Ny State Property Tax Exemption For Seniors Check with your assessor to determine what exemptions are available in your community For a list of available property tax exemptions in New York State see Assessor

Senior citizens exemption Income requirements You cannot receive the senior citizens exemption if the income of the owner or the combined income of all the owners exceeds the Partial Tax Exemption for Real Property of Senior Citizens also known as the senior citizens or aged exemption were automatically granted the Enhanced STAR exemption Due to changes

Ny State Property Tax Exemption For Seniors

Ny State Property Tax Exemption For Seniors

https://assets.website-files.com/5a43cca98192d400018e40cc/620a5fcb6f30fb06bfebd31a_TaxFoundationPropertytaxesMap 2021.png

18 States With Full Property Tax Exemption For 100 Disabled Veterans

https://vaclaimsinsider.com/wp-content/uploads/2021/05/11-States-With-Full-Property-Tax-Exemption-for-100-Disabled-Veterans-scaled.jpg

County Legislature Increases Senior Citizen Tax Exemption Rodney J

https://i0.wp.com/www.rodneyjstrange.com/wp-content/uploads/2019/05/Elderly-Tax-Exemption-1.jpg?w=504&ssl=1

The senior citizens property tax exemption can reduce property taxes for lower income homeowners who are at least 65 years old by up to 50 percent Cities towns villages New York State Senior Citizens Exemptions are available for homeowners over the age of 65 who meet certain income requirements The exemption may be as high as 50

The Senior Citizen Homeowners Exemption SCHE is a New York State tax credit program that provides a property tax exemption of up to 50 of the amount of property taxes to senior Tioga County senior citizens are advised that in 2023 the New York State Legislature made changes to the Senior Citizens Exemption Real Property Tax Law 467 The

Download Ny State Property Tax Exemption For Seniors

More picture related to Ny State Property Tax Exemption For Seniors

Using A 1031 Exchange To Turn A Rental Property Into Your Primary

https://m.foolcdn.com/media/millionacres/images/real_estate_taxes.width-1440.jpg

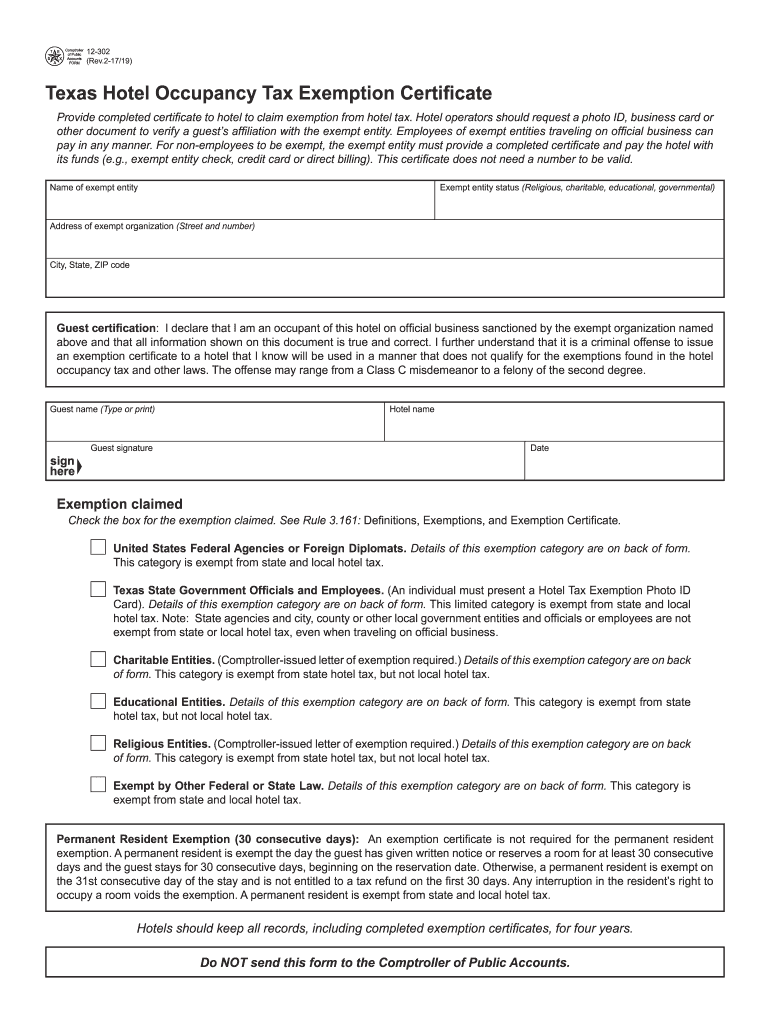

12 302 2017 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/441/48/441048899/large.png

Ca Sales Tax Exemption Certificate Resale Fill Online Printable

https://www.pdffiller.com/preview/442/869/442869902/large.png

Older New York homeowners could be in line for expanded tax relief in the state under legislation approved Monday by Gov Kathy Hochul The measure will allow local governments to increase the maximum allowable A property tax break for seniors who own one two or three family homes condominiums or cooperative apartments The SCHE and DHE Disabled Homeowners Exemption tax breaks

The measure made similar changes to New York City s senior citizens rent increase exemption SCRIE and disability rent increase exemption DRIE authorized by RPTL 467 b and 467 Are you 65 or older own your home and e arn less than 29 000 per year Then you may qualify for a partial exemption in your New York State property taxes To qualify for

Colorado Homestead Exemption Form Homemade Ftempo

https://img.yumpu.com/38616658/1/500x640/homestead-exemption-form-hidalgo-county-appraisal-district.jpg

Jefferson County Property Tax Exemption Form ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/fillable-short-form-property-tax-exemption-for-seniors-2017-3.png

https://www.tax.ny.gov/pit/property/exemption/index.htm

Check with your assessor to determine what exemptions are available in your community For a list of available property tax exemptions in New York State see Assessor

https://www.tax.ny.gov/pit/property/exemption/seniorincome.htm

Senior citizens exemption Income requirements You cannot receive the senior citizens exemption if the income of the owner or the combined income of all the owners exceeds the

California Property Tax Exemption For Seniors Save On Property Tax At

Colorado Homestead Exemption Form Homemade Ftempo

Tax Exempt Form TAX

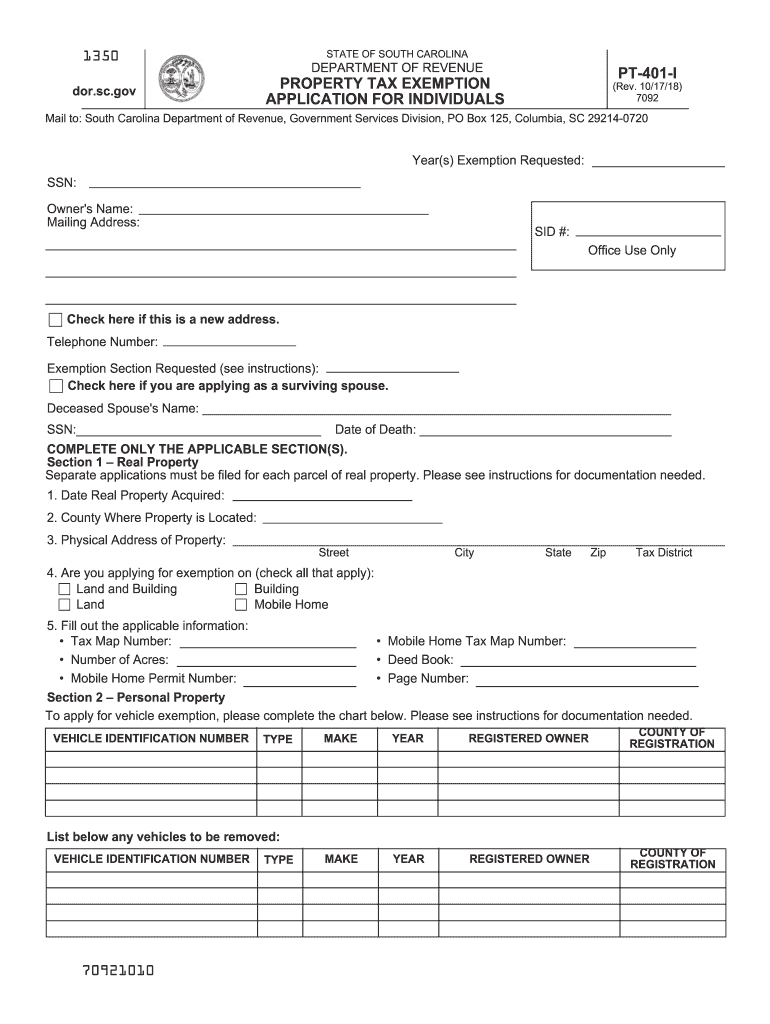

Pt 401 1 Fill Out And Sign Printable PDF Template SignNow

Low income Seniors May Apply For Special Property Tax Exemption

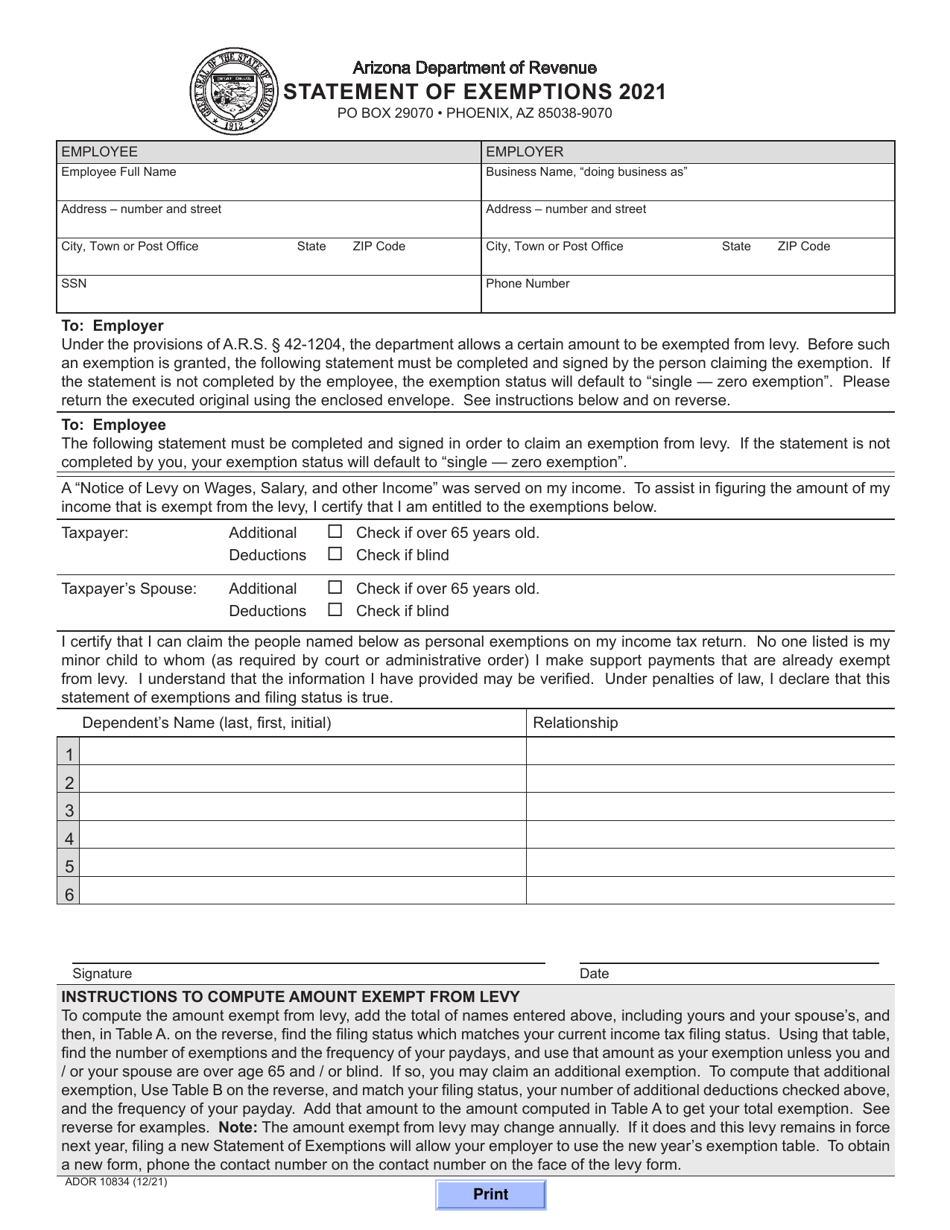

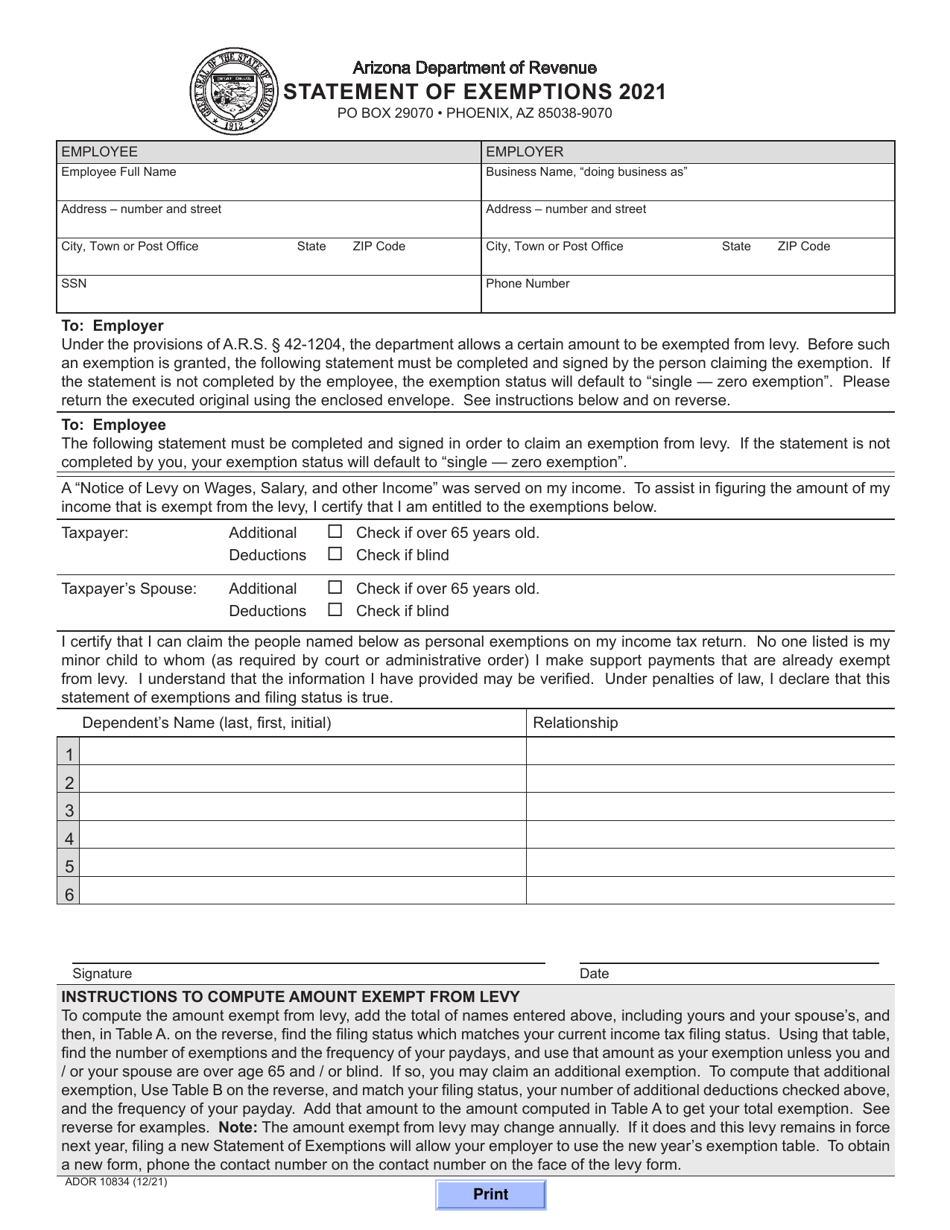

Form ADOR10834 Download Fillable PDF Or Fill Online Statement Of

Form ADOR10834 Download Fillable PDF Or Fill Online Statement Of

Certificate Of Exemption Tax Exemption Sales Taxes In The United States

How High Are Property Taxes In Your State American Property Owners

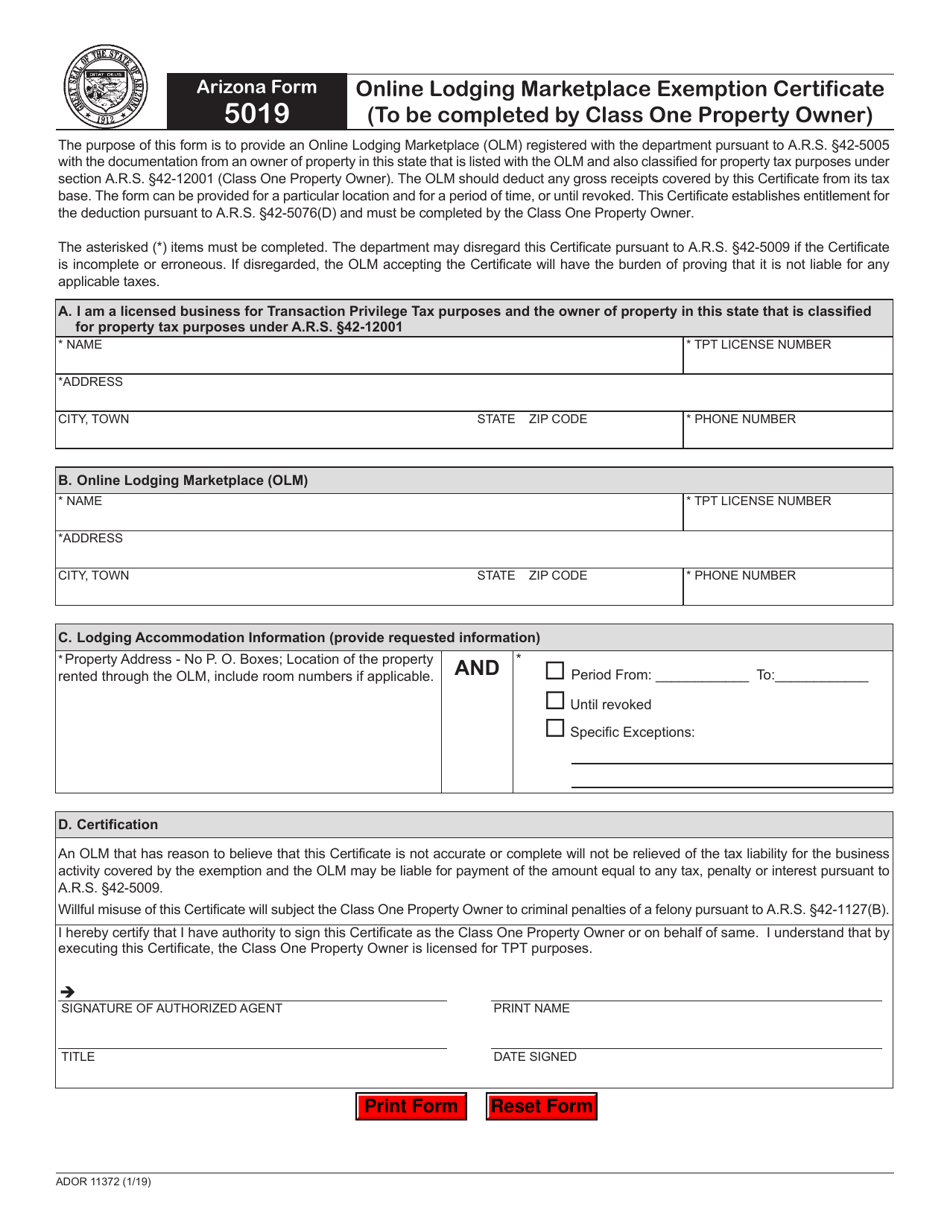

Arizona Form 5019 ADOR11372 Fill Out Sign Online And Download

Ny State Property Tax Exemption For Seniors - New York State Senior Citizens Exemptions are available for homeowners over the age of 65 who meet certain income requirements The exemption may be as high as 50