Ny State Property Tax Relief For Seniors Senior citizens exemption Income requirements You cannot receive the senior citizens exemption if the income of the owner or the combined income of all the owners exceeds the maximum income limit set by the locality

Real property tax relief credit Who is eligible You are entitled to this refundable credit if you meet all of the following requirements for the tax year you are subject to tax under Tax Law Article 22 you were a New York State resident for all of the tax year your qualified gross income is 250 000 or less A property tax break for seniors who own one two or three family homes condominiums or cooperative apartments The SCHE and DHE Disabled Homeowners Exemption tax breaks are available to eligible homeowners with a

Ny State Property Tax Relief For Seniors

Ny State Property Tax Relief For Seniors

https://static.wixstatic.com/media/f7bec5_e74f6da8ebb24b27881972f3ce7e7cd3~mv2.jpeg/v1/fill/w_1000,h_667,al_c,q_85/f7bec5_e74f6da8ebb24b27881972f3ce7e7cd3~mv2.jpeg

Property Tax Relief For Senior Citizens Riverside Township Of Illinois

https://riversidetownship.org/wp-content/uploads/2022/01/propertytaxdeferral.jpg

N Y Has New Property Tax Relief What About N J Nj

https://www.nj.com/resizer/wwT_I0C8rksX3t7VxgBVokQTM8k=/1280x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/RF6P5SE4G5ESJPZS4E3LINQMIU.jpg

Older New York homeowners could be in line for expanded tax relief in the state under legislation approved Monday by Gov Kathy Hochul The measure will allow local governments to increase the maximum allowable income eligible for a property tax exemption to 50 000 for people who are 65 and older as well as people with disabilities The Senior Citizen Homeowners Exemption SCHE is a New York State tax credit program that provides a property tax exemption of up to 50 of the amount of property taxes to senior homeowners age 65 and over The maximum amount of annual income cannot be more than 58 399

Friday is the deadline to apply for property tax exemptions in most towns in New York state There are two important tax breaks for seniors Enhanced STAR The STAR exemption applies to school This bill allows municipalities to increase the maximum income eligible for New York s real property tax exemption to 50 000 for people age 65 and over and people with disabilities Before today the maximum income eligible was 29 000 per year outside of New York City for seniors and people with disabilities

Download Ny State Property Tax Relief For Seniors

More picture related to Ny State Property Tax Relief For Seniors

Property Tax Relief For Seniors The Consumer HQ

https://d330kfagldeqw1.cloudfront.net/media/Senior-Tax-relief-.jpg

Property Tax Relief For Seniors In Tennessee Raybin Weissman

https://www.nashvilletnlaw.com/assets/images/Property-Tax-Elderly-Nashville.jpg

AICPA Advocacy Efforts And Milestones For Disaster Tax Relief

https://images.ctfassets.net/rb9cdnjh59cm/3R79pmqkKJcuHB50hQSuUt/345a1b981754f441b0881bc8c3b2b872/tax-cubic-character-illuminated-919486546.jpg?fm=webP

The Senior Citizen Homeowners Exemption SCHE provides a reduction of 5 to 50 on New York City s real property tax to seniors age 65 and older A property tax exemption for seniors is a great benefit for homeowners 65 years of age or older Here s how to qualify for one in your state

Common property tax exemptions STAR School Tax Relief exemption Senior citizens exemption Veterans exemption Exemption for persons with disabilities Exemptions for agricultural properties For a list of available property tax exemptions in New York State see Assessor Manuals Exemption Administration Part 1 Subject Index The newly approved 212 billion state budget includes relief for qualifying homeowners in New York who pay among the highest tax levies in the country But not everyone will qualify for the relief as part of the state budget which is

Texans Want Property Tax Relief A Homestead Exemption Would Help

https://s.hdnux.com/photos/01/22/31/40/21600258/4/rawImage.jpg

SB 25 Property Tax Relief For Seniors Libertas Institute

https://libertasutah.org/img/utleg/2022/sb25.jpg

https://www.tax.ny.gov/pit/property/exemption/seniorincome.htm

Senior citizens exemption Income requirements You cannot receive the senior citizens exemption if the income of the owner or the combined income of all the owners exceeds the maximum income limit set by the locality

https://www.tax.ny.gov/pit/credits/real-property-tax-relief-credit.htm

Real property tax relief credit Who is eligible You are entitled to this refundable credit if you meet all of the following requirements for the tax year you are subject to tax under Tax Law Article 22 you were a New York State resident for all of the tax year your qualified gross income is 250 000 or less

Potential Tax Relief For Volunteer First Responders In NY Is One Step

Texans Want Property Tax Relief A Homestead Exemption Would Help

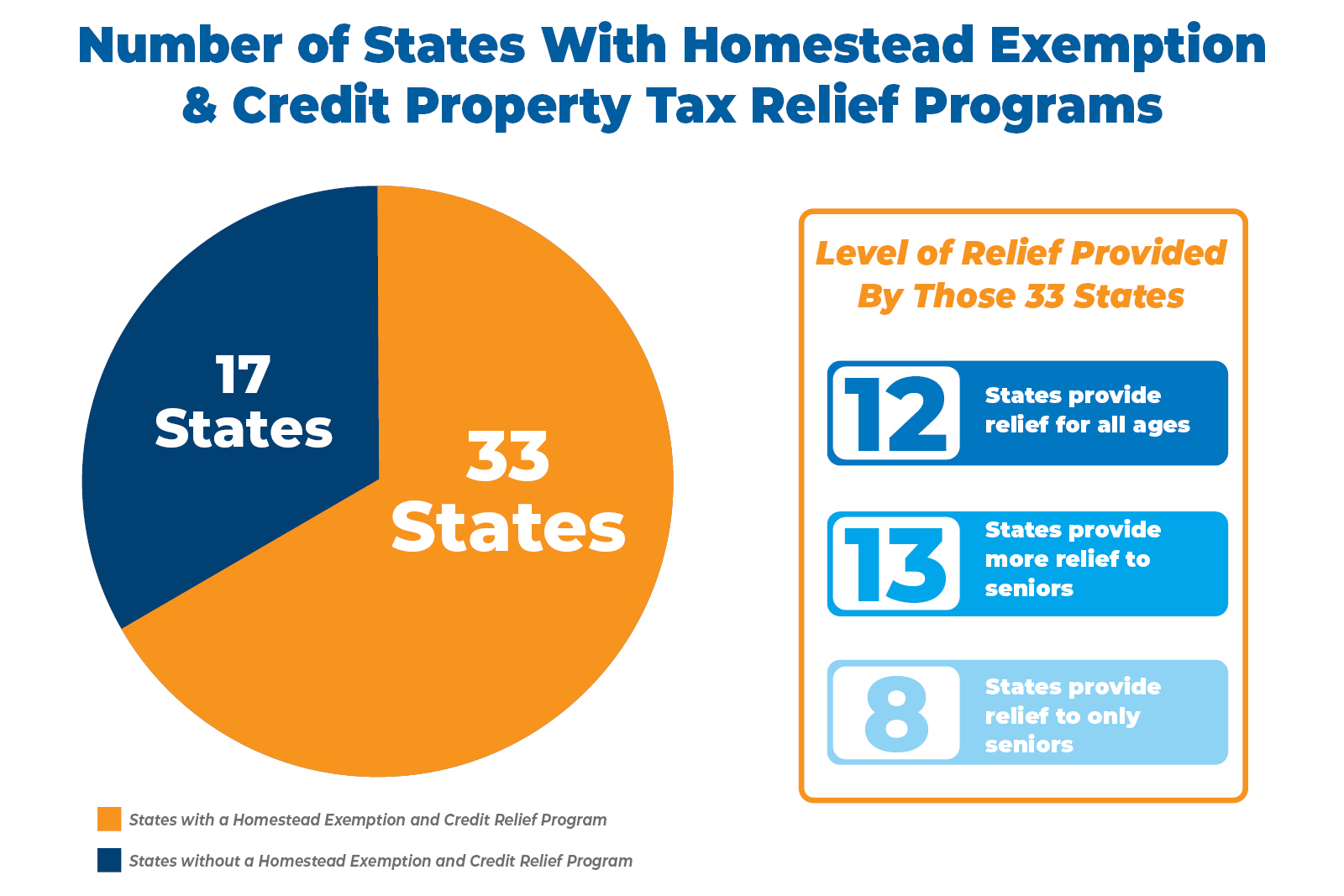

Credit Versus Exemption In Homestead Property Tax Relief ITR Foundation

Tax Help Today Colonial Tax Relief Trusted Tax Relief For Families

Tax Relief For Working From Home During The Pandemic Here s How To

Iowa s High Property Taxes ITR Foundation

Iowa s High Property Taxes ITR Foundation

Property Tax Reports South Carolina Revenue And Fiscal Affairs Office

What To Know About The Texas Property Tax Relief Bill Before Voting In

CT Tax Exemption For Retirees

Ny State Property Tax Relief For Seniors - In Chapter 59 of the Laws of 2023 the New York State Legislature amended three aspects of the senior citizens exemption Real Property Tax Law 467 and the exemption for persons with disabilities and limited incomes RPTL 459 c