Ny State Star Credit Amount You can receive the STAR credit if you own your home and it s your primary residence and the combined income of the owners and the owners spouses is 500 000 or less STAR exemption a reduction on

STAR exemption amounts Annually for each school district segment the amount of savings as a result of the STAR exemption cannot exceed the savings of the Maximum 2023 2024 STAR exemption savings Annually for each school district segment the amount of savings as a result of the STAR exemption cannot

Ny State Star Credit Amount

Ny State Star Credit Amount

https://i.ytimg.com/vi/TGcLRfcdRKM/maxresdefault.jpg

License Plate Star Washington State White Star Metal Star Metal

https://i.etsystatic.com/11202915/r/il/1e395e/2183109351/il_fullxfull.2183109351_hisi.jpg

Penn State Star LaMont Wade Reacts To Signing With Pittsburgh After

https://saturdaytradition.com/wp-content/uploads/2020/10/USATSI_10326496-scaled.jpg

The 2022 STAR exemption amounts are now available online except for school districts in Nassau County which we will certify in May If you require a paper Before you begin you ll need your prior year New York State income tax return Form IT 201 IT 201 X IT 203 or IT 203X filed for a prior tax year from 2018 to

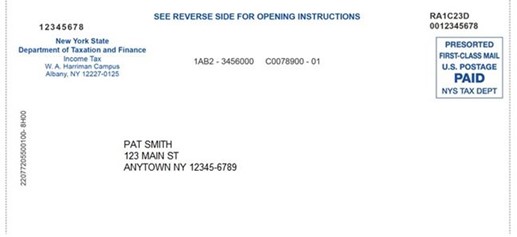

The Maximum Enhanced STAR exemption savings on our website is 1 000 The total amount of school taxes owed prior to the STAR exemption is 4 000 The The STAR credit program open to any eligible homeowner whose income is 500 000 or less provides you with a check in the mail from the New York State Tax

Download Ny State Star Credit Amount

More picture related to Ny State Star Credit Amount

Tax Relief Being Mailed To Eligible New Yorkers

https://www.tax.ny.gov/images/press/addtchildeiccheck.jpg

Herkimer And Oneida Counties Census Data Affiliate New Process To Be

https://1.bp.blogspot.com/-7IXbIeoEGIY/Uh4BGejvl_I/AAAAAAAABk8/Ub9idvj1Yj4/s1600/star.jpg

Star Notes 1 Dollar 2013 B Duplicate NY State EBay

https://i.ebayimg.com/images/g/jLAAAOSwP8FkkNWQ/s-l1600.jpg

The School Tax Relief STAR and Enhanced School Tax Relief E STAR benefits offer property tax relief to eligible New York homeowners STAR and E STAR can be issued Total income of all owners and resident spouses or registered domestic partners must be 93 200 or less Income eligibility for the 2023 STAR credit is based

1 01 For many New York homeowners the waning days of August and the start of September bring cheery back to school sendoffs and the arrival of the Make under 500 000 or under per household for the STAR credit and 250 000 or under for the STAR exemption Seniors are eligible for Enhanced STAR if

American Flags Across NY State Star Spangled Banner

https://sp.rmbl.ws/s8/6/n/V/p/6/nVp6m.GMGP.jpg

Star Notes 1 Dollar 2013 B Duplicate NY State EBay

https://i.ebayimg.com/images/g/LIsAAOSwv5dkkNWO/s-l1600.jpg

https://www.tax.ny.gov/star

You can receive the STAR credit if you own your home and it s your primary residence and the combined income of the owners and the owners spouses is 500 000 or less STAR exemption a reduction on

https://www.tax.ny.gov/pit/property/star/exemption-amounts

STAR exemption amounts Annually for each school district segment the amount of savings as a result of the STAR exemption cannot exceed the savings of the

Star Rebate Check Eligibility StarRebate PropertyRebate

American Flags Across NY State Star Spangled Banner

Star Notes 1 Dollar 2013 B Duplicate NY State EBay

New Extension For REAL ID Deadline Announced By DHS Bronxville Daily

Share Certificates North Star Community Credit Union

What Is New York State Star Program The Right Answer 2022 TraveliZta

What Is New York State Star Program The Right Answer 2022 TraveliZta

Tax Rebate Checks Come Early This Year Yonkers Times

Look Here s The Ultimate Credit Card Cheat Sheet For The 12 12 Sale

NY Sends Tiny Checks To Pay Interest On Last Year s Tax Refund

Ny State Star Credit Amount - The basic exemption will begin with at least a 10 000 full value assessment exemption in school year 1999 2000 and will be phased in over three years to at least 30 000 in