Ny State Tax Credit For Solar Panels 2022 In addition to our incentive programs and financing options you may qualify for federal and or New York State tax credits for installing solar at home

To qualify for the credit the solar energy system must use solar radiation to produce energy for heating cooling hot water or electricity for residential use The equipment must be installed New York residents may also be eligible for an Inflation Reduction Act tax credit of up to 30 of the solar project cost In addition to incentives NYSERDA offers loan options to help New

Ny State Tax Credit For Solar Panels 2022

Ny State Tax Credit For Solar Panels 2022

https://i.ytimg.com/vi/1fI71WzZo5w/maxresdefault.jpg

How To Get Free Solar Panels Installed In Pennsylvania March 2024

https://ecogenamerica.com/wp-content/uploads/How-to-get-free-solar-panels-in-Pennsylvania.jpg

Solar Panels Other DIY Electricity Solutions Rethink Green

https://re-thinkgreen.com/wp-content/uploads/2016/03/Solar_Panels_square-1024x1024.jpg

NY Sun provides incentives and financing to make solar generated electricity accessible and affordable for all New York homeowners renters and businesses Using solar can help lower energy costs compared to using conventionally New York State Solar Energy System Equipment Credit New York residents can also claim a tax credit from the state for new solar systems The credit is equal to 25 of the cost up to a maximum of 5 000 If the credit is

Submit this form with Form IT 201 or Form IT 203 Complete the information in the applicable chart with respect to your solar energy system equipment Current year credit see New York State Tax Credit Residential building owners who install solar may be eligible for a tax credit for the lesser of 25 of the installed cost of the solar energy system up to 25 kW on net

Download Ny State Tax Credit For Solar Panels 2022

More picture related to Ny State Tax Credit For Solar Panels 2022

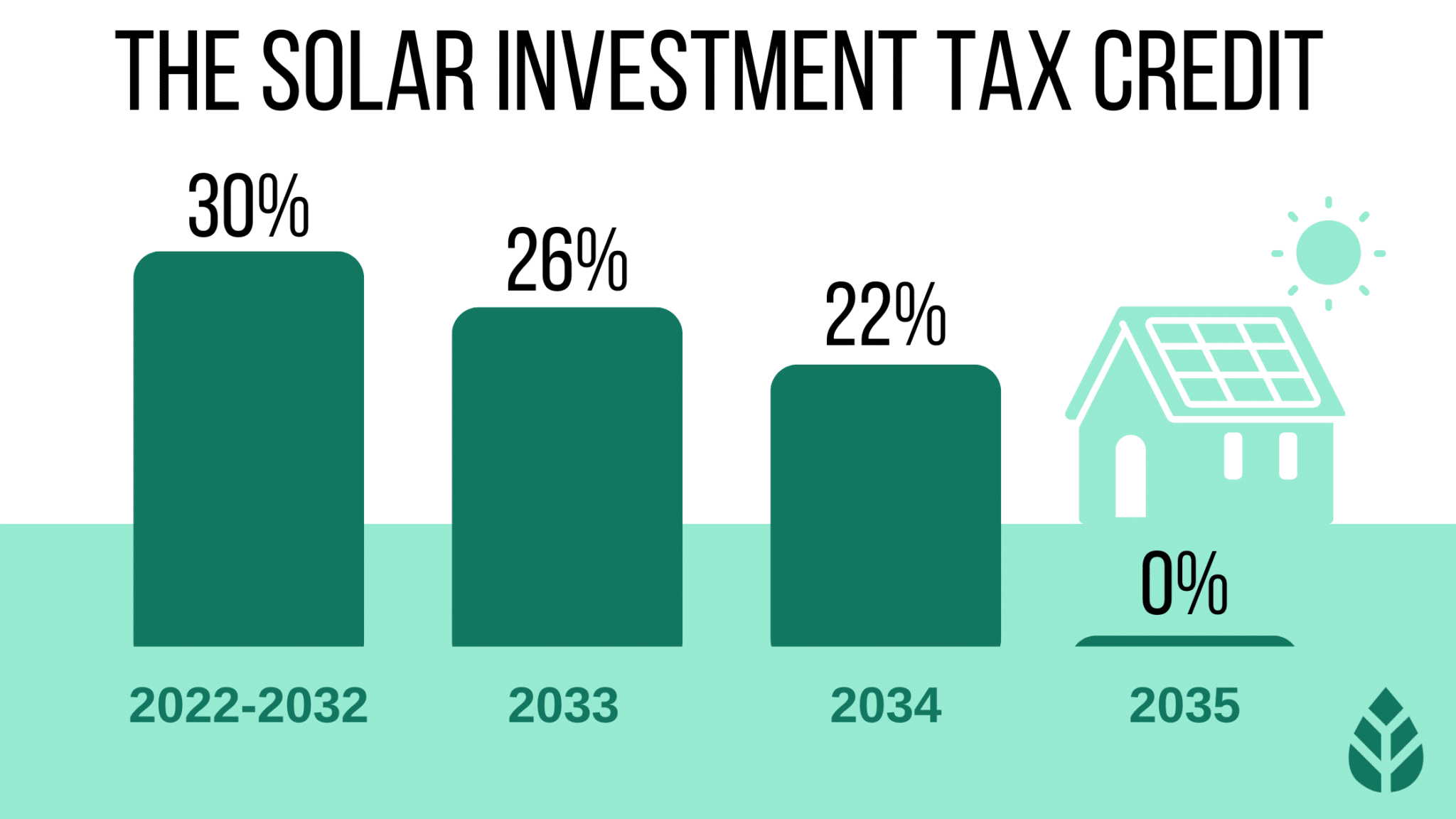

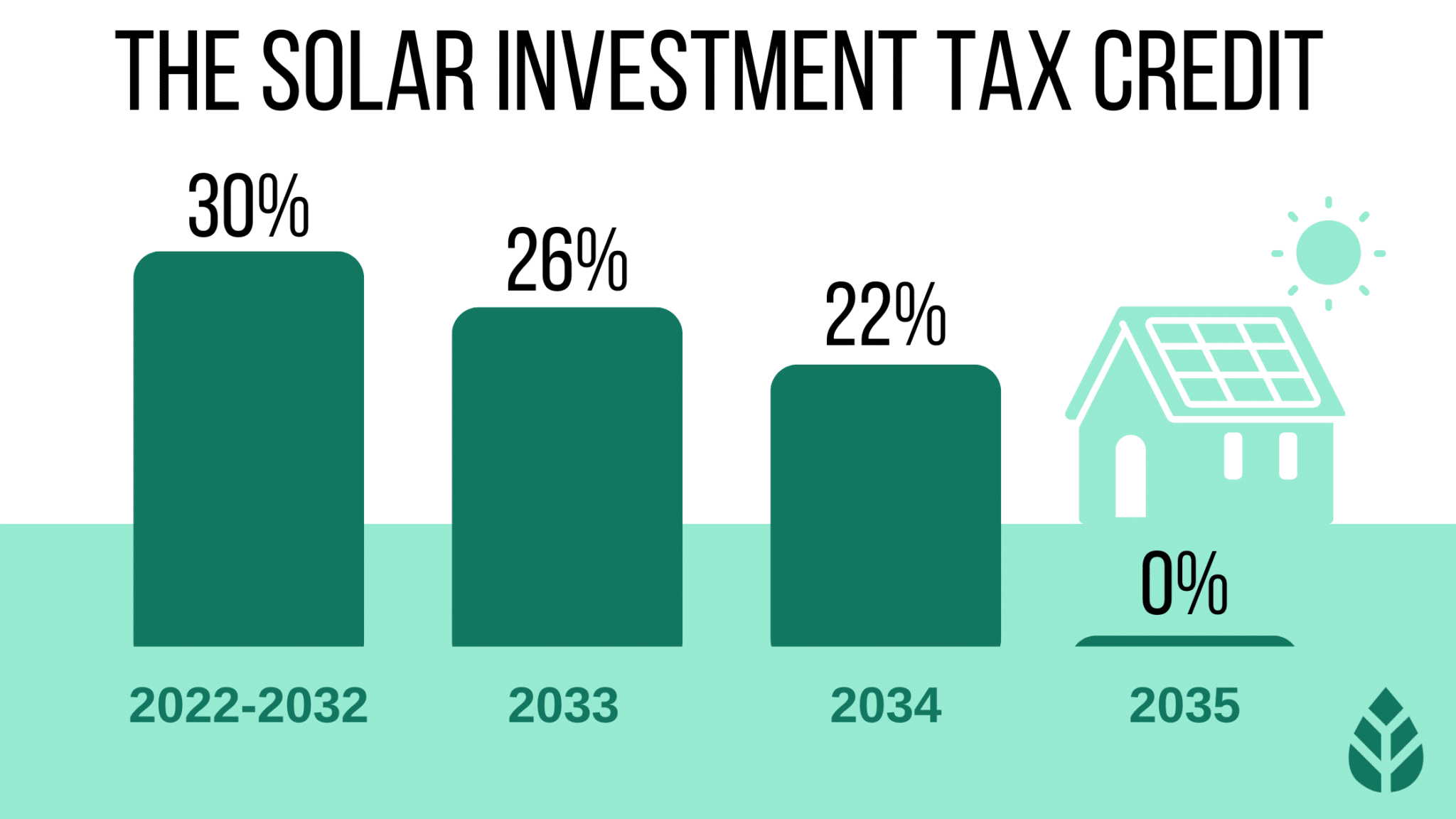

Solar Tax Credit 2022 Incentives For Solar Panel Installations

https://quickelectricity.com/wp-content/uploads/2020/12/Federal-Solar-Tax-Credit-Extension-2022.jpg

Pennsylvania Solar Incentives Tax Credits For 2023 LeafScore

https://www.leafscore.com/wp-content/uploads/2022/11/im39_Pennsylvania.png

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2022-10/Summary-ITC-and-PTC-Values-Table.png?itok=_72eWNBC

The NYS solar tax credit 2022 includes the basic state credit as well as reimbursement based on the size of your system New Yorkers benefit from A tax credit worth up to 5 000 of the total cost of installation Qualified homeowners with home solar could be eligible for a tax credit of up to 30 against the cost of the system The 25 state solar tax credit is available for purchased home solar

He s getting a 30 tax credit from the federal government for his latest set of solar panels introduced by the recent Inflation Reduction Act for any solar project completed by homeowners over the next 10 years Then there s Residential solar incentives in New York include the NY Sun Megawatt Block program a 25 state tax credit a 30 federal tax credit sales and property tax exemptions a

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

How Does The Federal Tax Credit For Solar Work Tampa Bay Solar

https://tampabaysolar.com/wp-content/uploads/2022/04/AdobeStock_201159810-2048x1365.jpeg

https://www.nyserda.ny.gov/.../Tax-Credit

In addition to our incentive programs and financing options you may qualify for federal and or New York State tax credits for installing solar at home

https://www.tax.ny.gov/pdf/current_forms/it/it255i.pdf

To qualify for the credit the solar energy system must use solar radiation to produce energy for heating cooling hot water or electricity for residential use The equipment must be installed

Solar Tax Credit In 2021 SouthFace Solar Electric AZ

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

What Is An R D Tax Credit

Tution Tax Credit For Students NCS CA

Federal Tax Credit For Solar Panels In 2023

Texas Solar Incentives Tax Credits Rebates More In 2023

Texas Solar Incentives Tax Credits Rebates More In 2023

The Federal Solar Tax Credit What You Need To Know 2022

How To Save Money On Solar Panels In New York History Computer

Another Way To Save New Tax Credit For Plan Participants

Ny State Tax Credit For Solar Panels 2022 - As of June 2024 income eligible New Yorkers can access IRA rebates to get upfront discounts on home energy upgrades Both IRA tax credits and rebates can help homeowners cut energy