Nys 2024 Tax Rebate New York state homeowners have until December 31 to apply for a rebate that could offer a check of 1 400 or more CHARLY TRIBALLEAU AFP via Getty Images Those who qualify for the Enhanced STAR

Note Are you wondering why you received a property tax rebate check from New York State last year You may be thinking of the homeowner tax rebate credit HTRC checks that we issued in 2022 HTRC was a one year program for 2022 only you will not receive an HTRC check for 2023 or other years The STAR program is separate from HTRC and Inflation Reduction Act Homeowners Back to Inflation Reduction Act Combine IRA Savings with State Incentives to Upgrade Your Home and Ditch Fossil Fuels The Inflation Reduction Act IRA helps New Yorkers get the latest clean energy technologies and equipment that will save energy for years to come

Nys 2024 Tax Rebate

Nys 2024 Tax Rebate

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/NYS-2023-Homeowner-Tax-Rebate.jpg?fit=996%2C728&ssl=1

Homeowner Tax Rebate Credit Checks On Their Way To NYS Residents WWTI InformNNY

https://www.informnny.com/wp-content/uploads/sites/58/2022/06/GettyImages-985842598-2.jpg?w=1752&h=986&crop=1

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

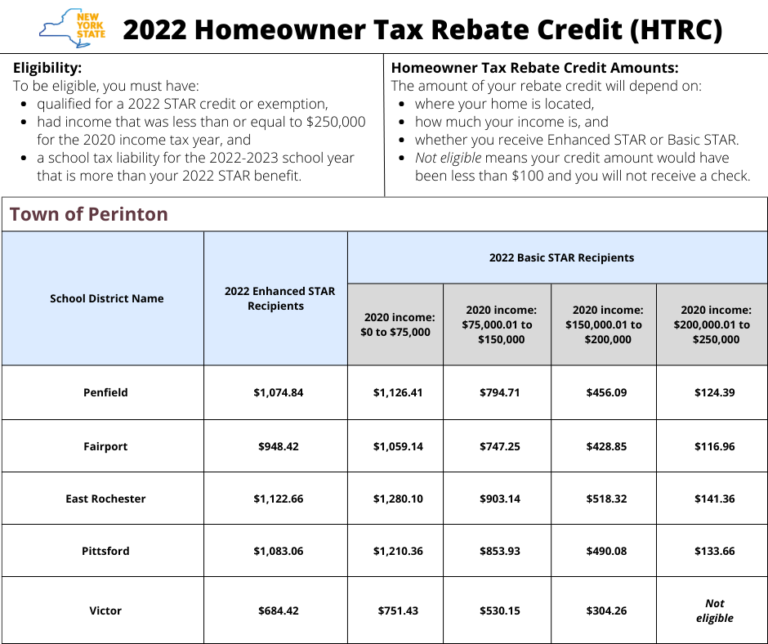

January stimulus check 2024 update If you received one of those special state rebate payments sometimes called stimulus checks last year there s some news from the IRS that you need to To be eligible for a homeowner tax rebate credit in 2022 you must have qualified for a 2022 STAR credit or exemption had income that was less than or equal to 250 000 for the 2020 income tax year and a school tax liability for the 2022 2023 school year that is more than your 2022 STAR benefit

The New York Department of Taxation and Finance will soon begin sending direct financial assistance to 1 75 million New Yorkers who received the Empire State Child Credit and or the Earned Income Credit on their 2021 state tax returns accelerated the distribution of 2 2 billion in tax relief to more than 2 million New Yorkers through the 2022 Homeowner Tax Rebate Credit Check Lookup Note The homeowner tax rebate credit was a one year program which ended in 2022 The credit is not available for future years If you have questions about the program or received a letter regarding your 2022 payment see Frequently asked questions Lost stolen destroyed and uncashed checks

Download Nys 2024 Tax Rebate

More picture related to Nys 2024 Tax Rebate

Nys Tax Rebate Checks 2023 Tax Rebate

https://i0.wp.com/www.freerebate.net/wp-content/uploads/2023/02/this-is-an-attachment-of-new-stimulus-checks-up-to-1-050-are-going-out-soon-to-nys-homeowners-from-nys-taxation-rebate-checks-2023-post.png?w=979&ssl=1

NYS Homeowner Tax Rebate Credit HTRC Info Town Of Perinton

https://perinton.org/wp-content/uploads/2022-Homeowner-Tax-Rebate-Credit-HTRC-1-768x644.png

Money In Your Pocket Who Qualifies For Tax Cut Property Tax Rebate In NYS 2023 Budget WRGB

https://cbs6albany.com/resources/media2/16x9/full/1015/center/80/6df365a4-868a-491a-b350-4442a687917a-large16x9_thumb_196074.png

As of January 1 2024 the IRS allows buyers to transfer the IRA tax credit to a car dealership to reduce the upfront purchase price of a new or used EV Alternatively buyers can claim the tax credit later when filing their tax returns New York state has the highest number of personal income tax PIT check offs in the nation but an analysis by State Comptroller Thomas P DiNapoli found that even as the number of check offs have grown over the last decade only a fraction of the money has been actually spent on their target purposes each year New York state offers many worthy causes for income tax filers to donate to on

1 01 STAR benefit checks and exemptions reflected on school property tax bills have already started filling New Yorkers inboxes and mailboxes and will continue to do so through the end of the The legislation maintains the current 7 25 tax rate for three additional years for all tax years ending before January 1 2027 previously scheduled to be reduced to 6 5 for tax years beginning January 1 2024 The capital base tax rate of 1875 is extended for three additional years through tax years ending before January 1 2027

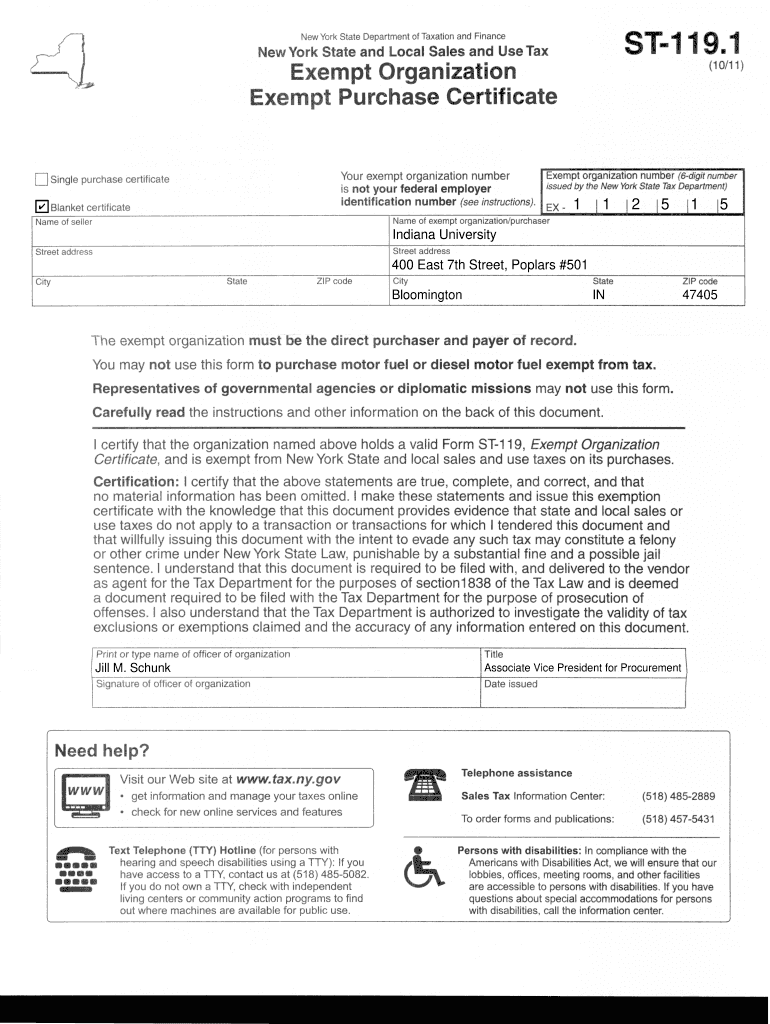

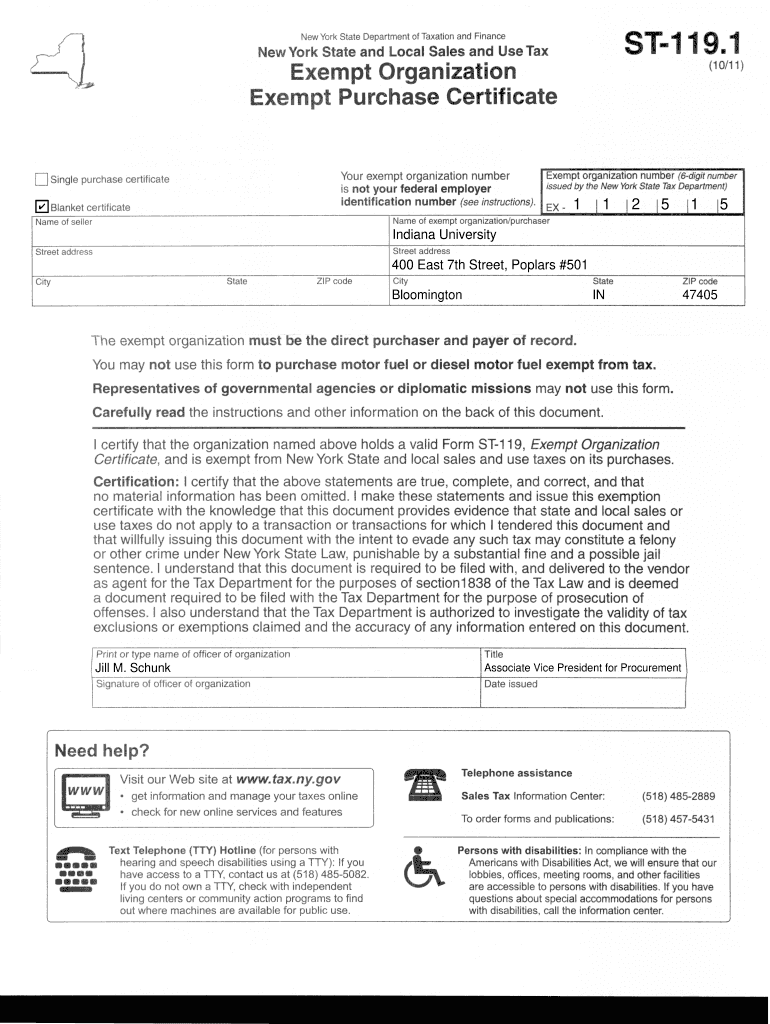

Nys Sales Tax Exempt Form 119 1 ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/nys-tax-exempt-form-st-119-1-fill-out-and-sign-printable-pdf-template-1.png

Nys School Tax Relief Checks Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/NYS-Drive-Clean-Rebate-Form-1024x812.png

https://www.newsweek.com/stimulus-check-update-homeowners-this-state-can-apply-rebate-1852264

New York state homeowners have until December 31 to apply for a rebate that could offer a check of 1 400 or more CHARLY TRIBALLEAU AFP via Getty Images Those who qualify for the Enhanced STAR

https://www.tax.ny.gov/pit/property/star/star-check-delivery-schedule.htm

Note Are you wondering why you received a property tax rebate check from New York State last year You may be thinking of the homeowner tax rebate credit HTRC checks that we issued in 2022 HTRC was a one year program for 2022 only you will not receive an HTRC check for 2023 or other years The STAR program is separate from HTRC and

2023 Nys Tax Form Printable Forms Free Online

Nys Sales Tax Exempt Form 119 1 ExemptForm

Property Tax Rebate Pennsylvania LatestRebate

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks Wgrz

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

Income Tax Rebate Under Section 87A

Income Tax Rebate Under Section 87A

Up To 1 044 Tax Rebate 2023 Arriving In Colorado Today See If You re Eligible South

Nys Star Tax Rebate Checks 2022 StarRebate

Missouri State Tax Rebate 2023 Printable Rebate Form

Nys 2024 Tax Rebate - Residents should be eligible based on their 2023 2024 property taxes if their property qualifies as a homestead and they meet other criteria The amount available depends on several factors but