Nys Homeowner Rebate 2024 May 3 2023 Albany NY Governor Hochul Announces Support for Homeowners Tenants and Public Housing Residents as Part of FY 2024 Budget Adds 391 Million for New York s Emergency Rental Assistance Program to Support Thousands More Tenants and Families Including New York City Housing Authority Residents and Section 8 Voucher Recipients

You may be thinking of the homeowner tax rebate credit HTRC checks that we issued in 2022 HTRC was a one year program for 2022 only you will not receive an HTRC check for 2023 or other years The STAR program is separate from HTRC and STAR benefits are granted in the form of either To be eligible for a homeowner tax rebate credit in 2022 you must have qualified for a 2022 STAR credit or exemption had income that was less than or equal to 250 000 for the 2020 income tax year and a school tax liability for the 2022 2023 school year that is more than your 2022 STAR benefit

Nys Homeowner Rebate 2024

Nys Homeowner Rebate 2024

https://i0.wp.com/www.rebatecheck.net/wp-content/uploads/2023/04/new-york-state-star-rebate-checks-latestrebate-63.jpg?w=2048&ssl=1

NYS Homeowner Tax Rebate Credit Checks Being Mailed Out

https://townsquare.media/site/497/files/2022/06/attachment-RS28849_ThinkstockPhotos-623211702-scr.jpg?w=1200&h=0&zc=1&s=0&a=t&q=89

NYS Homeowner Tax Rebate Credit HTRC Info Town Of Perinton

https://perinton.org/wp-content/uploads/2022-Homeowner-Tax-Rebate-Credit-HTRC-1-600x503.png

Real property tax relief credit Who is eligible You are entitled to this refundable credit if you meet all of the following requirements for the tax year you are subject to tax under Tax Law Article 22 you were a New York State resident for all of the tax year your qualified gross income is 250 000 or less 2022 Homeowner Tax Rebate Credit Check Lookup Note The homeowner tax rebate credit was a one year program which ended in 2022 The credit is not available for future years If you have questions about the program or received a letter regarding your 2022 payment see Frequently asked questions Lost stolen destroyed and uncashed checks

The income limit for this program for 2024 is 98 700 The Bulletin Seagulls swirl around the Statue of Liberty at the end of the day in New York City on December 7 2023 New York state You can view and print the following information regarding your 2018 through 2024 property tax credits that have been issued description STAR HTRC or Property Tax Relief credit year check issue date property address property key amount Before you begin you ll need

Download Nys Homeowner Rebate 2024

More picture related to Nys Homeowner Rebate 2024

Homeowner Tax Rebate Credit Checks On Their Way To NYS Residents WWTI InformNNY

https://www.informnny.com/wp-content/uploads/sites/58/2022/06/GettyImages-985842598-2.jpg?w=1920&h=1080&crop=1

NYS 2023 Homeowner Tax Rebate Tax Rebate

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/NYS-2023-Homeowner-Tax-Rebate.jpg?fit=996%2C728&ssl=1

New York State Homeowner Assistance Fund Minerva New York

https://townofminerva.com/wp-content/uploads/2022/01/NYS-Homeowner-2022-1024x1325.jpg

You may be thinking of the homeowner tax rebate credit HTRC checks that we issued in 2022 HTRC was a one year program for 2022 only you will not receive an HTRC check for 2023 or other years The STAR program is separate from HTRC and STAR benefits are granted in the form of either The property tax relief credit directly reduced your property tax burden if you were a qualifying homeowner The amount of the credit was a percentage of your STAR savings The property tax relief credit has expired However if you were eligible for the credit in 2018 or 2019 but believe you did not receive it

Home Energy Efficiency Programs Improving the energy efficiency of your home is a smart investment NYSERDA offers a range of residential programs designed to help New York State residents identify areas where their homes are driving up energy costs and can provide assistance in completing energy efficiency improvements for a healthier more The New York Department of Taxation and Finance will soon begin sending direct financial assistance to 1 75 million New Yorkers who received the Empire State Child Credit and or the Earned Income Credit on their 2021 state tax returns including a gas tax moratorium and a homeowner tax rebate credit Our families have felt the effects of a

Nys School Tax Relief Checks Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/NYS-Drive-Clean-Rebate-Form-1024x812.png

Your Stories Q A Where Is My NYS Homeowner Tax Rebate Credit Check YouTube

https://i.ytimg.com/vi/ZN9k_nErOQE/maxresdefault.jpg

https://www.governor.ny.gov/news/governor-hochul-announces-support-homeowners-tenants-and-public-housing-residents-part-fy-2024

May 3 2023 Albany NY Governor Hochul Announces Support for Homeowners Tenants and Public Housing Residents as Part of FY 2024 Budget Adds 391 Million for New York s Emergency Rental Assistance Program to Support Thousands More Tenants and Families Including New York City Housing Authority Residents and Section 8 Voucher Recipients

https://www.tax.ny.gov/star/

You may be thinking of the homeowner tax rebate credit HTRC checks that we issued in 2022 HTRC was a one year program for 2022 only you will not receive an HTRC check for 2023 or other years The STAR program is separate from HTRC and STAR benefits are granted in the form of either

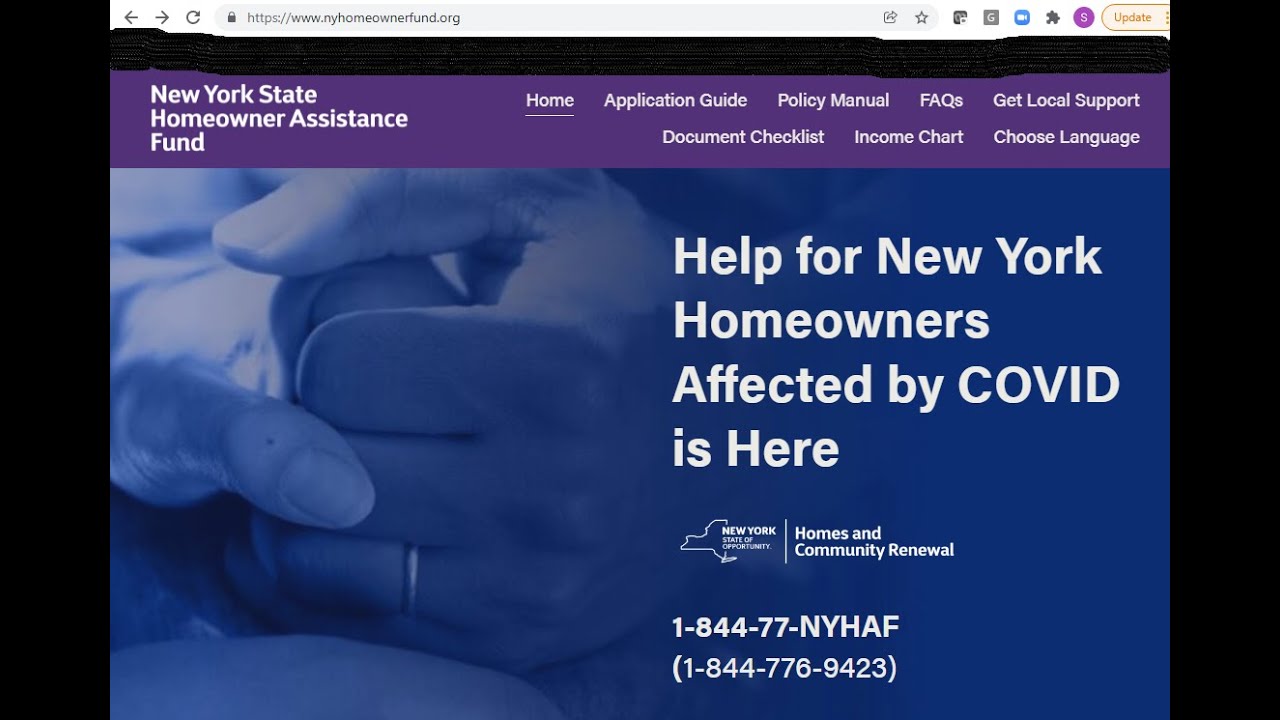

Applications Open For NYS Homeowner Assistance Fund

Nys School Tax Relief Checks Printable Rebate Form

NYS Homeowner Assistance Fund YouTube

Alcon Rebate Form 2023 Printable Rebate Form

Nys Tax Rebate Checks 2023 Tax Rebate

Lensrebates Alcon Com

Lensrebates Alcon Com

Mobil One Offical Rebate Printable Form Printable Forms Free Online

Printable Alcon Rebate Form 2023 Printable Forms Free Online

Get Up To A 300 Rebate On Bausch Lomb Contact Lenses Sunshine Optometry

Nys Homeowner Rebate 2024 - The income limit for this program for 2024 is 98 700 The Bulletin Seagulls swirl around the Statue of Liberty at the end of the day in New York City on December 7 2023 New York state