Nys Homeowners Tax Rebate Check 2024 Check issue date property address property key amount Before you begin you ll need your prior year New York State income tax return Form IT 201 IT 201 X IT 203 or IT 203X filed for a prior tax year from 2018 to 2022 and the Total payments amount from the return you use for verification

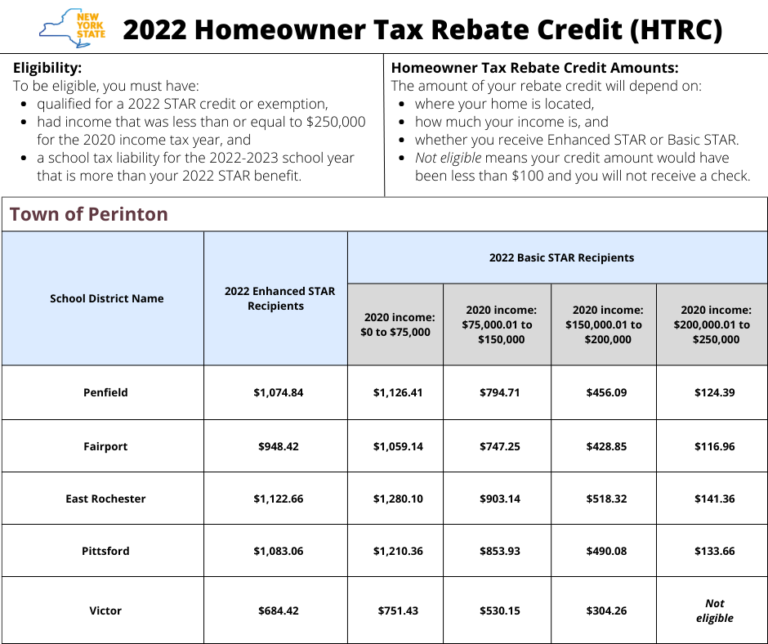

To be eligible for a homeowner tax rebate credit in 2022 you must have qualified for a 2022 STAR credit or exemption had income that was less than or equal to 250 000 for the 2020 income tax year and a school tax liability for the 2022 2023 school year that is more than your 2022 STAR benefit Homeowners used this lookup to determine the amount they would receive for the homeowner tax rebate credit HTRC Please note by law we cannot issue checks for the HTRC that are less than 100 Ready For homeowners within New York City If you are a New York City homeowner see New York City t o find the amount of your HTRC check

Nys Homeowners Tax Rebate Check 2024

Nys Homeowners Tax Rebate Check 2024

https://www.rebatecheck.net/wp-content/uploads/2023/08/nys-property-tax-rebate-checks-2023-eligibility-application-process-29.jpg

Nys Tax Rebate Checks 2023 Tax Rebate

https://i0.wp.com/www.freerebate.net/wp-content/uploads/2023/02/this-is-an-attachment-of-new-stimulus-checks-up-to-1-050-are-going-out-soon-to-nys-homeowners-from-nys-taxation-rebate-checks-2023-post.png?w=979&ssl=1

NYS Homeowner Tax Rebate Credit HTRC Info Town Of Perinton

https://perinton.org/wp-content/uploads/2022-Homeowner-Tax-Rebate-Credit-HTRC-1-768x644.png

The income limit for this program for 2024 is 98 700 The Bulletin Seagulls swirl around the Statue of Liberty at the end of the day in New York City on December 7 2023 New York state To claim the credit the computed amount must exceed 250 The maximum credit allowed is 350 Note If you itemize deductions on your New York State income tax return you must reduce the amount you claim by the amount of this credit

The income limit for the program is 500 000 Enhanced STAR is an extra benefit for seniors age 65 and older with incomes up to 93 200 for the 2023 2024 school year It exempts the first 81 400 May 3 2023 Albany NY Governor Hochul Announces Support for Homeowners Tenants and Public Housing Residents as Part of FY 2024 Budget Adds 391 Million for New York s Emergency Rental Assistance Program to Support Thousands More Tenants and Families Including New York City Housing Authority Residents and Section 8 Voucher Recipients

Download Nys Homeowners Tax Rebate Check 2024

More picture related to Nys Homeowners Tax Rebate Check 2024

Nys Star Rebate Check 2023 RebateCheck

https://i0.wp.com/www.rebatecheck.net/wp-content/uploads/2023/04/new-york-state-star-rebate-checks-latestrebate-63.jpg?w=2048&ssl=1

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Nys Rebate Check For Property Tax Tax Rebate

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/04/Nys-Property-Tax-Rebate-2023.jpg?ssl=1

For the property tax relief credit income is defined as federal adjusted gross income FAGI from two years prior modified so that the net amount of loss reported on Federal Schedule C D E or F doesn t exceed 3 000 the net amount of any other separate category of loss doesn t exceed 3 000 and Security Check Instructions Enter the security code displayed below and then select Continue Required field Security check The following security code is necessary to prevent unauthorized use of this web site If you are using a screen reading program select listen to have the number announced

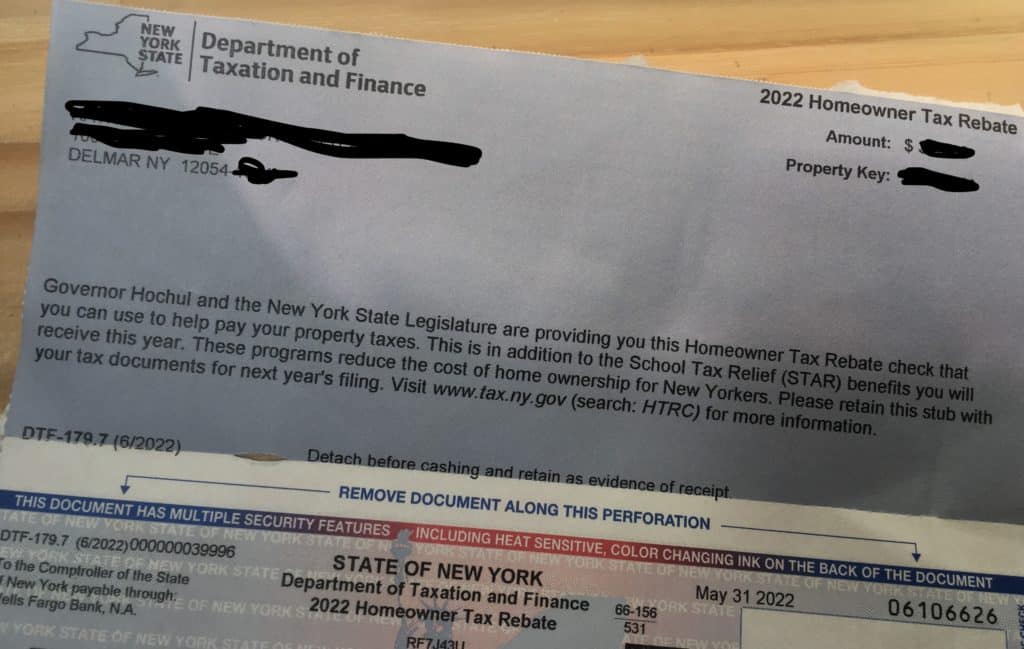

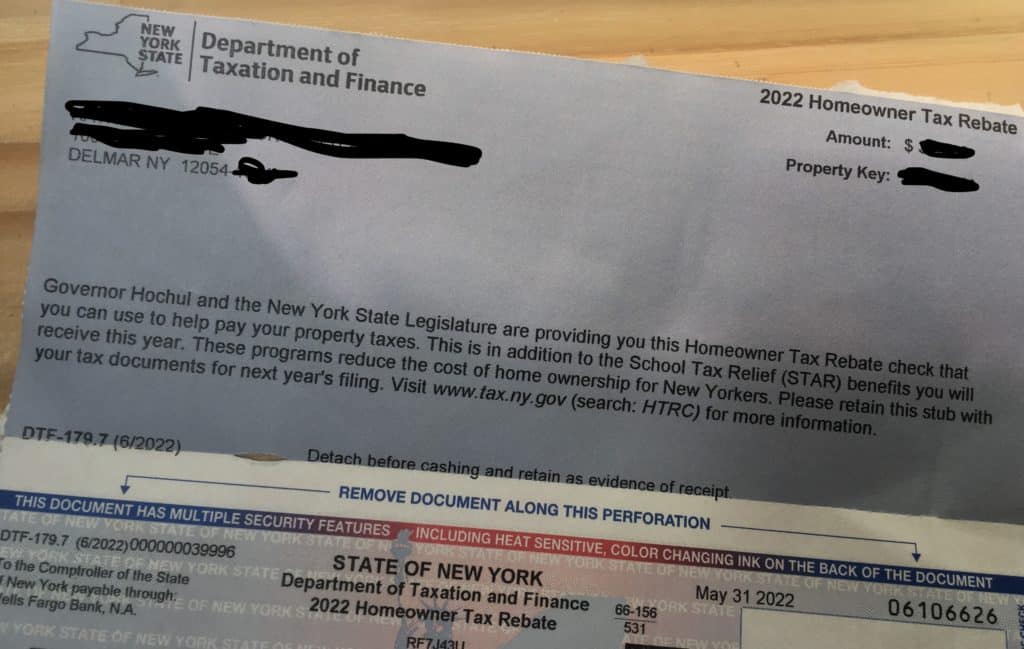

ALBANY N Y In June Governor Kathy Hochul announced the one time Homeowner Tax Rebate Credit would be sent out available to eligible New Yorkers The state s Department of Taxation and The state cannot legally issue checks for Homeowner Tax Rebate Credits below 100 Unexpected property cost could cause homeowners debt According to the state Department of Taxation and

Governor Hochul Mails Out Rebate Checks Early Suozzi Cries Foul Yonkers Times

https://yonkerstimes.com/wp-content/uploads/2022/06/FUVtPL9WIAM9l1Zggggg-1024x649.jpg

Confusion Over When Eligible New Yorkers Will Get Their Homeowner Tax Rebate Check CNYcentral

https://chittenango.com/wp-content/uploads/2022/08/bb776db9-9697-43c3-882f-8577bedc9e89-large16x9_tax_rebate.PNG

https://www.tax.ny.gov/pit/property/credit-lookup.htm

Check issue date property address property key amount Before you begin you ll need your prior year New York State income tax return Form IT 201 IT 201 X IT 203 or IT 203X filed for a prior tax year from 2018 to 2022 and the Total payments amount from the return you use for verification

https://www.tax.ny.gov/pit/property/homeowner-tax-rebate-credit.htm

To be eligible for a homeowner tax rebate credit in 2022 you must have qualified for a 2022 STAR credit or exemption had income that was less than or equal to 250 000 for the 2020 income tax year and a school tax liability for the 2022 2023 school year that is more than your 2022 STAR benefit

Your Stories Q A Where Is My NYS Homeowner Tax Rebate Credit Check YouTube

Governor Hochul Mails Out Rebate Checks Early Suozzi Cries Foul Yonkers Times

Money In Your Pocket Who Qualifies For Tax Cut Property Tax Rebate In NYS 2023 Budget WRGB

New York State To Mail Out Homeowner Tax Rebate Credit Checks DSJ

Property Tax Rebate Checks Are Coming Here s How Much Money You re Due

When Will We Get The Extra Tax Rebate Checks In Montana Details

When Will We Get The Extra Tax Rebate Checks In Montana Details

Nys Tax Rebate Checks 2023 Tax Rebate

Nys Star Tax Rebate Checks 2022 StarRebate

One time Tax Rebate Checks For Idaho Residents KLEW

Nys Homeowners Tax Rebate Check 2024 - According to New York s Department of Taxation and Finance more than 2 1 million checks have been mailed to homeowners The office says about another 400 000 homeowners are expected to receive