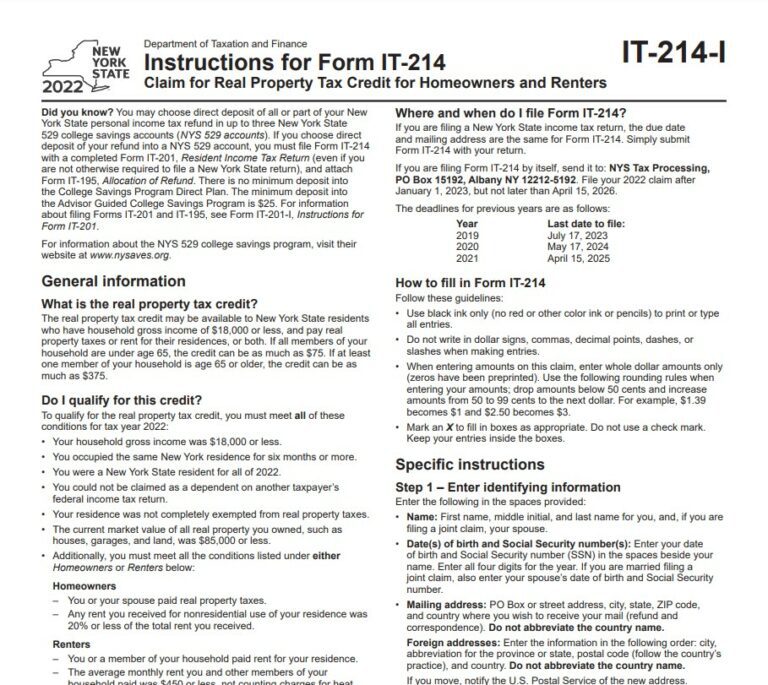

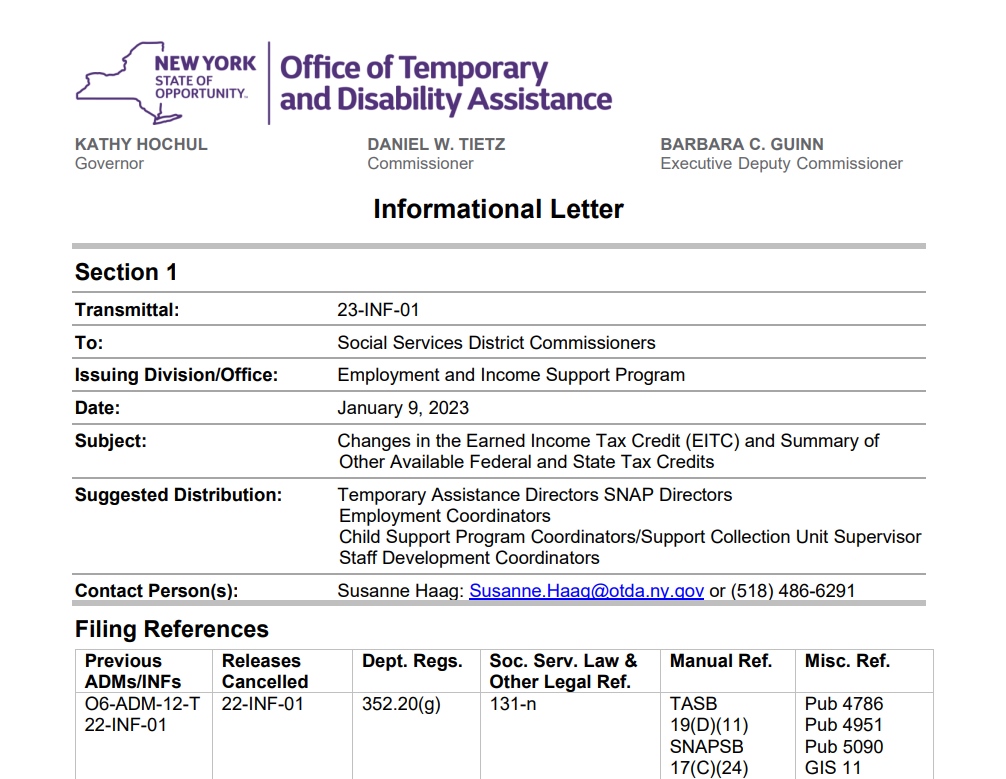

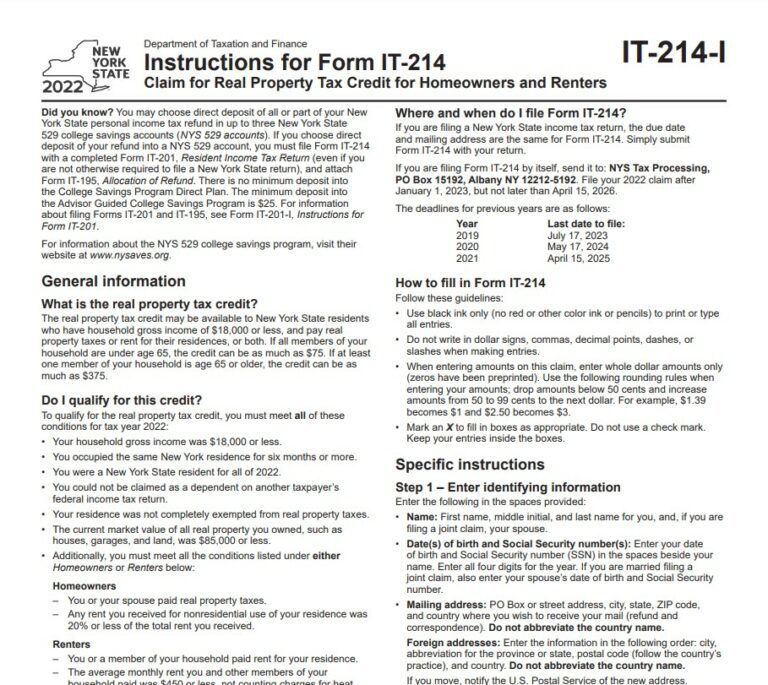

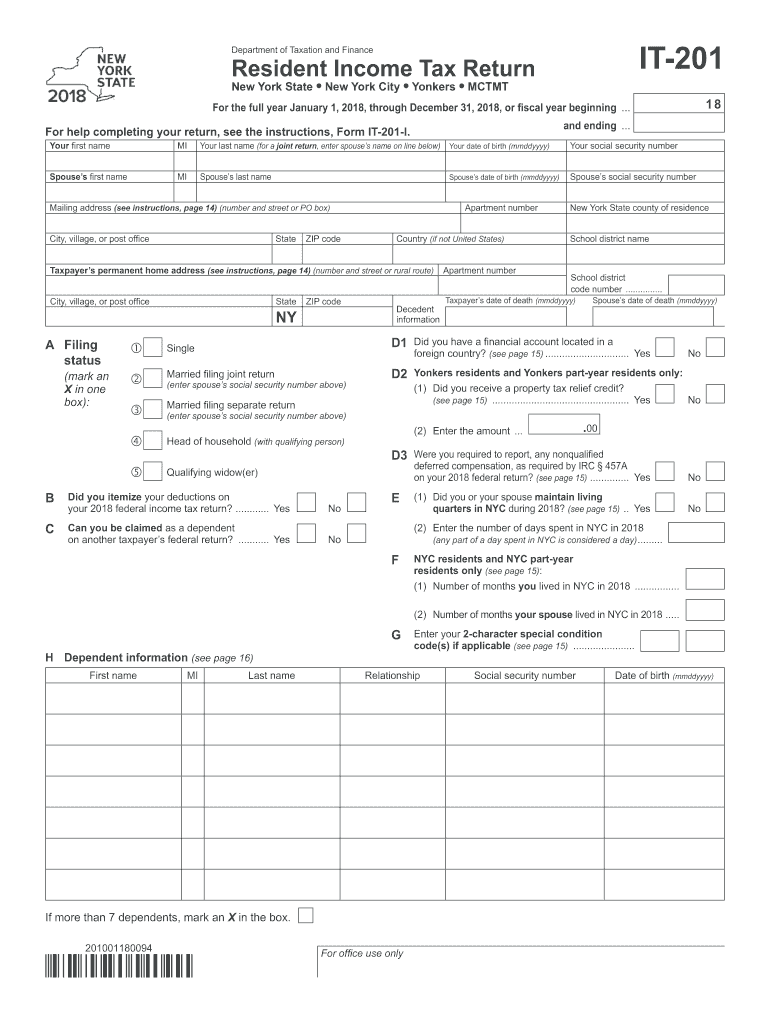

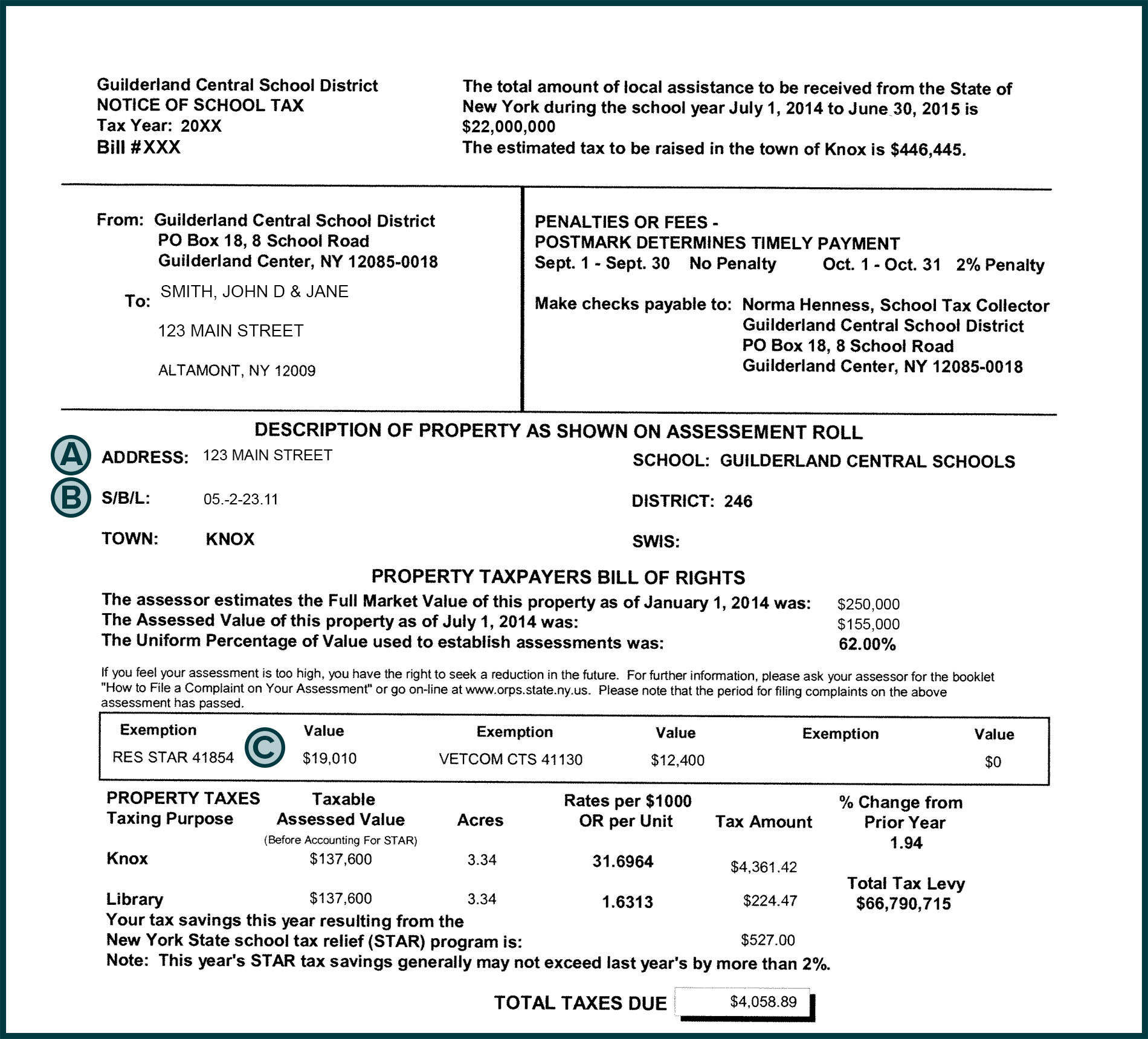

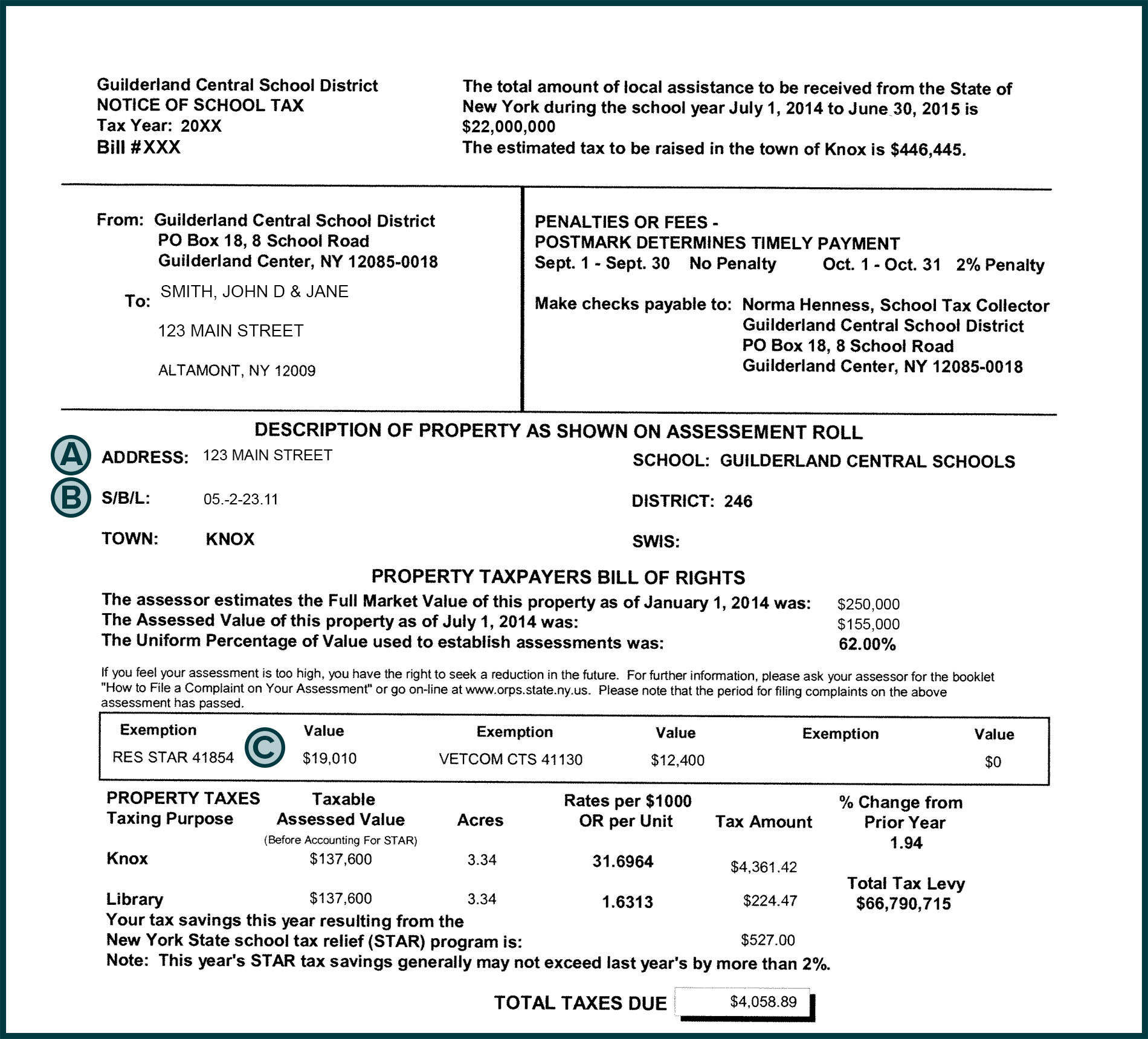

Nys Property Tax Rebate Taxable Irs Web To be eligible for a homeowner tax rebate credit in 2022 you must have qualified for a 2022 STAR credit or exemption had income that was less than or equal to 250 000 for

Web 9 juin 2022 nbsp 0183 32 homeowner tax rebate credit HTRC If you itemize your deductions reduce your itemized deduction for real estate taxes paid by the total amount of any STAR credit Web 10 f 233 vr 2023 nbsp 0183 32 Per IRS Refund or rebate of real estate taxes If you receive a refund or rebate of real estate taxes this year for amounts you paid this year you must reduce

Nys Property Tax Rebate Taxable Irs

Nys Property Tax Rebate Taxable Irs

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/Nys-Property-Tax-Rebate-Checks-2023.jpg

Property Tax Rebate New York State Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/New-York-Renters-Rebate-2023-768x685.jpg

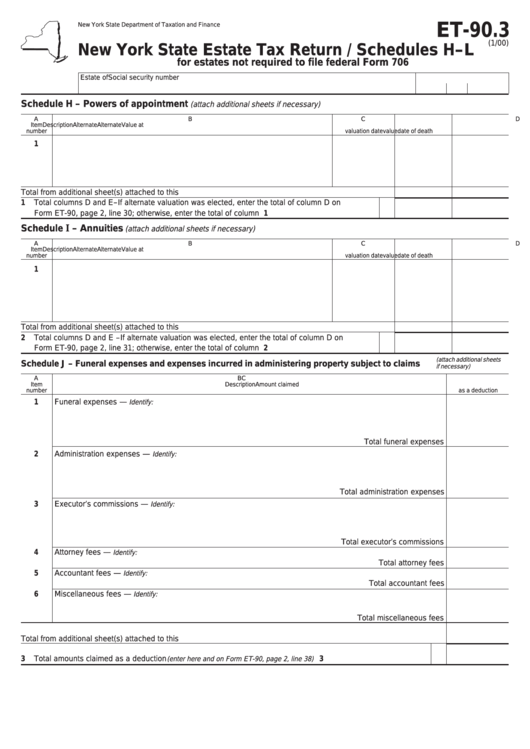

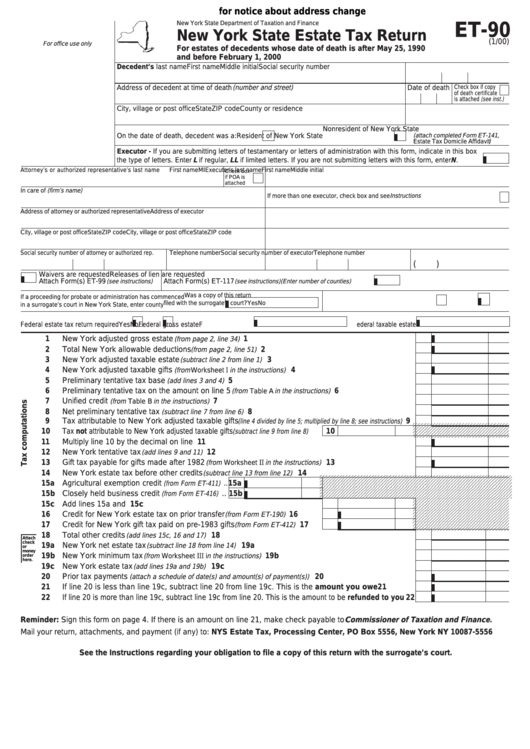

Form Et 90 3 Schedules H L New York State Estate Tax Return

https://www.propertyrebate.net/wp-content/uploads/2023/05/form-et-90-3-schedules-h-l-new-york-state-estate-tax-return-1.png

Web 5 avr 2007 nbsp 0183 32 They pay 5 000 in total property taxes this year and receive a 400 property tax rebate check in the fall For federal tax purposes the Jones can only claim 4 600 in Web 27 janv 2023 nbsp 0183 32 The amount of the credit is the product of the amount of real property tax which exceeds 6 of the taxpayer s qualified gross income QGI and a specified rate

Web 9 f 233 vr 2023 nbsp 0183 32 Feb 9 2023 If you re one of the millions of taxpayers who received a one time tax payment from your state last year the Internal Revenue Service has some Web We ve begun issuing homeowner tax rebate checks We recently began mailing nearly three million checks for the 2022 homeowner tax rebate credit HTRC to eligible New

Download Nys Property Tax Rebate Taxable Irs

More picture related to Nys Property Tax Rebate Taxable Irs

NY Tax Rebate 2023 Everything You Need To Know Tax Rebate

https://www.tax-rebate.net/wp-content/uploads/2023/04/Nys-Tax-Rebate-2023.jpg

Money In Your Pocket Who Qualifies For Tax Cut Property Tax Rebate In

https://cbs6albany.com/resources/media2/16x9/full/1900/center/80/75ea137d-d90b-4e6c-9179-5003af955c7f-thumb_196074.png

Tax Tables 2021 Help 2021julllg

https://i2.wp.com/federal-withholding-tables.net/wp-content/uploads/2021/07/2021-tax-brackets-new-york-state-newreay-1-1024x636.png

Web 14 mars 2023 nbsp 0183 32 For homeowners within New York City If you are a New York City homeowner see New York City t o find the amount of your HTRC check For Web 5 juil 2023 nbsp 0183 32 For the property tax relief credit income is defined as federal adjusted gross income FAGI from two years prior modified so that the net amount of loss reported on

Web 10 f 233 vr 2023 nbsp 0183 32 2022 State of Illinois Tax Rebates Illinois Department of Revenue Property Tax Rebate 2022 State of Illinois Tax Rebates Illinois Department of Revenue Web 21 sept 2022 nbsp 0183 32 The Real Property Tax Relief Credit NY IT 229 RPTR was implemented to provide relief to New York State NYS taxpayers who own qualified real property in the

Money In Your Pocket Who Qualifies For Tax Cut Property Tax Rebate In

https://cbs6albany.com/resources/media2/16x9/full/1500/center/80/6df365a4-868a-491a-b350-4442a687917a-jumbo16x9_thumb_196074.png

2020 Form NY DTF CT 3 S Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/541/592/541592476/large.png

https://www.tax.ny.gov/pit/property/homeowner-tax-rebate-credit.htm

Web To be eligible for a homeowner tax rebate credit in 2022 you must have qualified for a 2022 STAR credit or exemption had income that was less than or equal to 250 000 for

https://www.tax.ny.gov/pit/property/report_property_tax_credits.htm

Web 9 juin 2022 nbsp 0183 32 homeowner tax rebate credit HTRC If you itemize your deductions reduce your itemized deduction for real estate taxes paid by the total amount of any STAR credit

Rebate Checks Gone In NYS STAR Checks Continue For Now Yonkers Times

Money In Your Pocket Who Qualifies For Tax Cut Property Tax Rebate In

Proposal To Update Ailing PA Rent Property Tax Rebate Program Would

Nys Tax Forms Fill Out Sign Online DocHub

Form Et 90 New York State Estate Tax Return Printable Pdf Download

Pay New York City Property Taxes Online

Pay New York City Property Taxes Online

Property Taxes By State Map Map Vector PropertyRebate

How To Get Property Tax Rebate PropertyRebate

Nys Property Tax Rebate Check 2023 PropertyRebate

Nys Property Tax Rebate Taxable Irs - Web 5 avr 2007 nbsp 0183 32 They pay 5 000 in total property taxes this year and receive a 400 property tax rebate check in the fall For federal tax purposes the Jones can only claim 4 600 in