Nys School Tax Rebate 2024 Good news for 2023 We ve partnered with the Free File Alliance again to offer you more options to e file your New York State income tax return at no cost Am I eligible to Free File You may be eligible for Free File using one of the software providers below if your federal adjusted gross income AGI is 79 000 or less

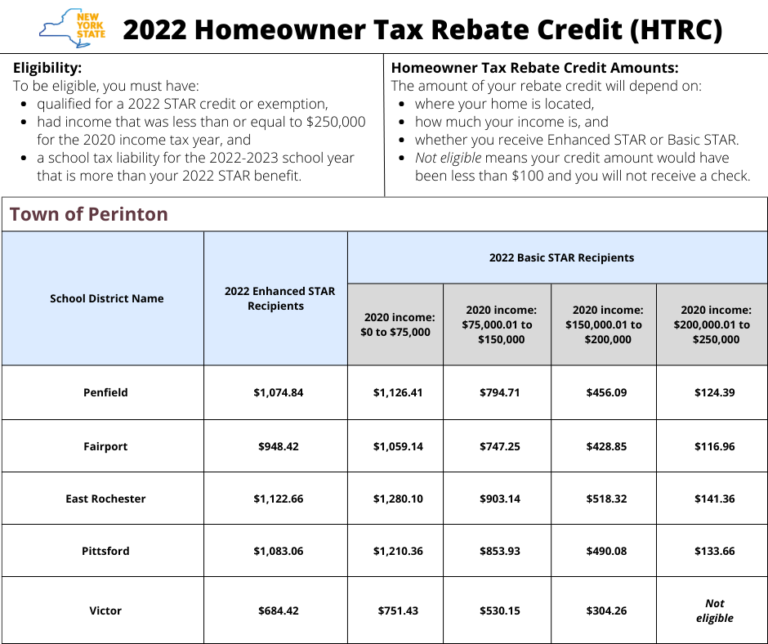

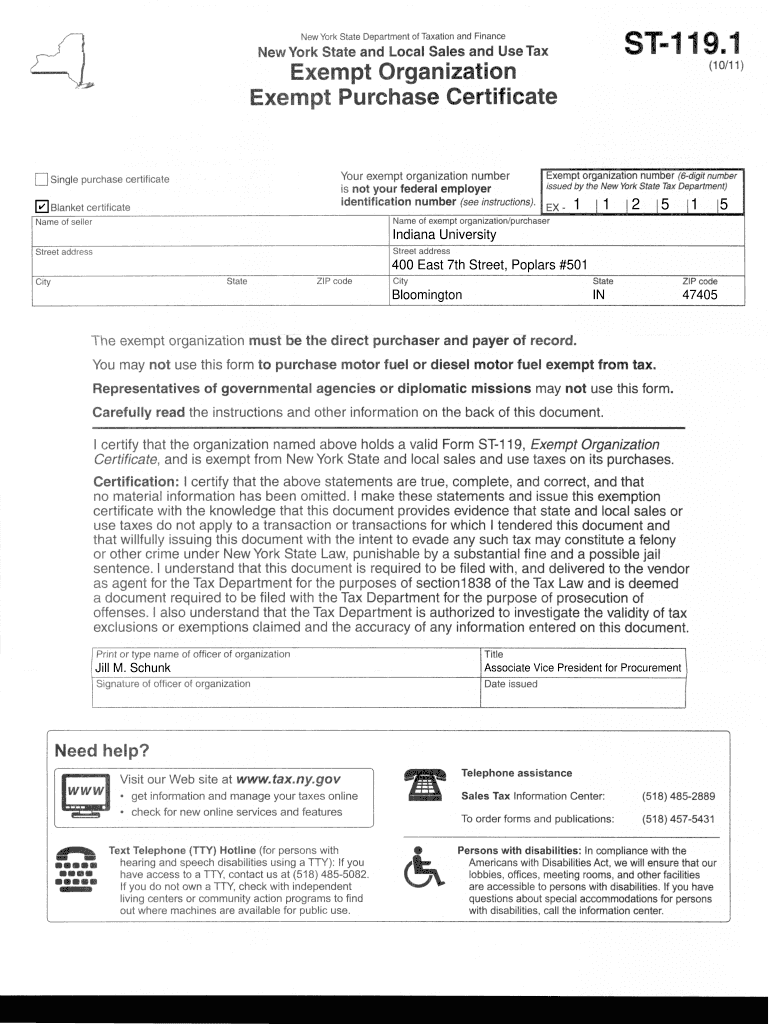

The Maximum STAR exemption savings Use the links below to find the maximum STAR exemption savings amount for your school district segment Select your municipality and then scroll to your school district or Select your school district and scroll to your municipality Note Your actual STAR savings may be less than the maximum STAR savings You can receive your New York State tax refund up to two weeks sooner than if you filed by paper and requested a paper check User friendly e file software ensures you file all the right forms and do not miss out on valuable credits E file information Using software

Nys School Tax Rebate 2024

Nys School Tax Rebate 2024

https://perinton.org/wp-content/uploads/2022-Homeowner-Tax-Rebate-Credit-HTRC-1-768x644.png

Nys School Tax Relief Checks Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/NYS-Drive-Clean-Rebate-Form-1024x812.png

36 NYS School Districts Poised To Exceed Tax Cap Including 4 In CNY No Rebates Syracuse

https://www.syracuse.com/resizer/_y2c2KShN6SjUnQUvOuHc5aTyGg=/1280x0/smart/advancelocal-adapter-image-uploads.s3.amazonaws.com/image.syracuse.com/home/syr-media/width2048/img/schools_impact/photo/179287790-544d0c0661fa30d0.jpg

210001230094 For ofice use only NYC 210 2023 back When and where to file Form NYC 210 File your claim as soon as you can after January 1 2024 Mail your claim to NYS TAX PROCESSING PO BOX 15192 ALBANY NY 12212 5192 Private delivery services 1 01 STAR benefit checks and exemptions reflected on school property tax bills have already started filling New Yorkers inboxes and mailboxes and will continue to do so through the end of the

Senior exemption forms for 2024 now available The following forms and instructions are now available for 2024 following the law changes to income eligibility earlier this year For a description of the law changes see the summary that we previously shared Form RP 467 Form RP 467 Rnw New Form RP 467 Wkst Instructions for the forms NY State made several changes to its STAR School Tax Assessment Relief program Because New York State is mailing out STAR credit checks on a rolling basis February 12 2024 2024 1st half General Tax payments are due to the Receiver of Taxes February 20 2024

Download Nys School Tax Rebate 2024

More picture related to Nys School Tax Rebate 2024

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Money In Your Pocket Who Qualifies For Tax Cut Property Tax Rebate In NYS 2023 Budget WRGB

https://cbs6albany.com/resources/media2/16x9/full/1024/center/80/6df365a4-868a-491a-b350-4442a687917a-large16x9_thumb_196074.png

School Tax Rebates Are In The Mail Winnipeg For Free

https://wpgforfree.ca/wp-content/uploads/2023/06/school-tax-rebate-1.png

The New York Department of Taxation and Finance will soon begin sending direct financial assistance to 1 75 million New Yorkers who received the Empire State Child Credit and or the Earned Income Credit on their 2021 state tax returns New Yorkers can expect to receive their checks by the end of October The School Tax Relief STAR and Enhanced School Tax Relief E STAR benefits offer property tax relief to eligible New York homeowners STAR and E STAR can be issued as a credit by the State of New York or in some cases as a tax exemption by the City of New York

If you re eligible you will receive the Enhanced STAR benefit on your school tax bill The New York State Department of Taxation and Finance will annually inform the assessor whether you meet the income requirements for the Enhanced STAR exemption The benefit is estimated to be a 293 tax reduction Enhanced STAR is for homeowners 65 and older whose total household income for all owners and residents spouses is 93 200 or less The benefit is estimated to be a 650 tax reduction In 2016 STAR was made available as an exemption or a credit You do not need to re register for STAR

Nys Tax Rebate Checks 2023 Tax Rebate

https://i0.wp.com/www.freerebate.net/wp-content/uploads/2023/02/this-is-an-attachment-of-new-stimulus-checks-up-to-1-050-are-going-out-soon-to-nys-homeowners-from-nys-taxation-rebate-checks-2023-post.png?w=979&ssl=1

Virginia Tax Rebate 2024

https://www.taxuni.com/wp-content/uploads/2023/01/Virginia-Tax-Rebate-1024x576.jpg

https://www.tax.ny.gov/pit/ads/efile_addnyc210.htm

Good news for 2023 We ve partnered with the Free File Alliance again to offer you more options to e file your New York State income tax return at no cost Am I eligible to Free File You may be eligible for Free File using one of the software providers below if your federal adjusted gross income AGI is 79 000 or less

https://www.tax.ny.gov/pit/property/star/max-savings/

The Maximum STAR exemption savings Use the links below to find the maximum STAR exemption savings amount for your school district segment Select your municipality and then scroll to your school district or Select your school district and scroll to your municipality Note Your actual STAR savings may be less than the maximum STAR savings

Income Tax Rebate Under Section 87A

Nys Tax Rebate Checks 2023 Tax Rebate

Back To School Tax Rebate YouTube

Nys Rebate Check For Property Tax Tax Rebate

2023 Tax Exemption Form Pennsylvania ExemptForm

Homeowner Tax Rebate Credit Checks On Their Way To NYS Residents WWTI InformNNY

Homeowner Tax Rebate Credit Checks On Their Way To NYS Residents WWTI InformNNY

Province Of Manitoba School Tax Rebate

New York State Tax Exempt Form St 119 ExemptForm

Nys Star Tax Rebate Checks 2022 StarRebate

Nys School Tax Rebate 2024 - Texas California and New York are among the 12 states participating It s supposed to work like other step by step tax return software programs There are no income requirements but you must