Nys Star Rebate 2024 When Will I Get It The School Tax Relief STAR program offers property tax relief to eligible New York State homeowners If you are eligible and enrolled in the STAR program you ll receive your benefit each year in one of two ways STAR credit If you are registered for the STAR credit the Tax Department will issue your STAR benefit via check or direct deposit

1 01 STAR benefit checks and exemptions reflected on school property tax bills have already started filling New Yorkers inboxes and mailboxes and will continue to do so through the end of the When will I receive my STAR credit Use the STAR Credit Delivery Schedule for updated information on when we will begin to issue STAR credit payments in your area Already registered for the STAR credit You don t need to register again unless there s been a change in the ownership of your home

Nys Star Rebate 2024 When Will I Get It

Nys Star Rebate 2024 When Will I Get It

https://i0.wp.com/www.rebatecheck.net/wp-content/uploads/2023/04/new-york-state-star-rebate-checks-latestrebate-63.jpg?w=2048&ssl=1

State Assembly Acts To Change STAR Rebate System

https://cnycentral.com/resources/media2/16x9/full/1024/center/80/4a65a35b-01db-4a55-812f-fa95d0789638-large16x9_80218c474ed447aea1a408e1c44270d8large16x9_star.png

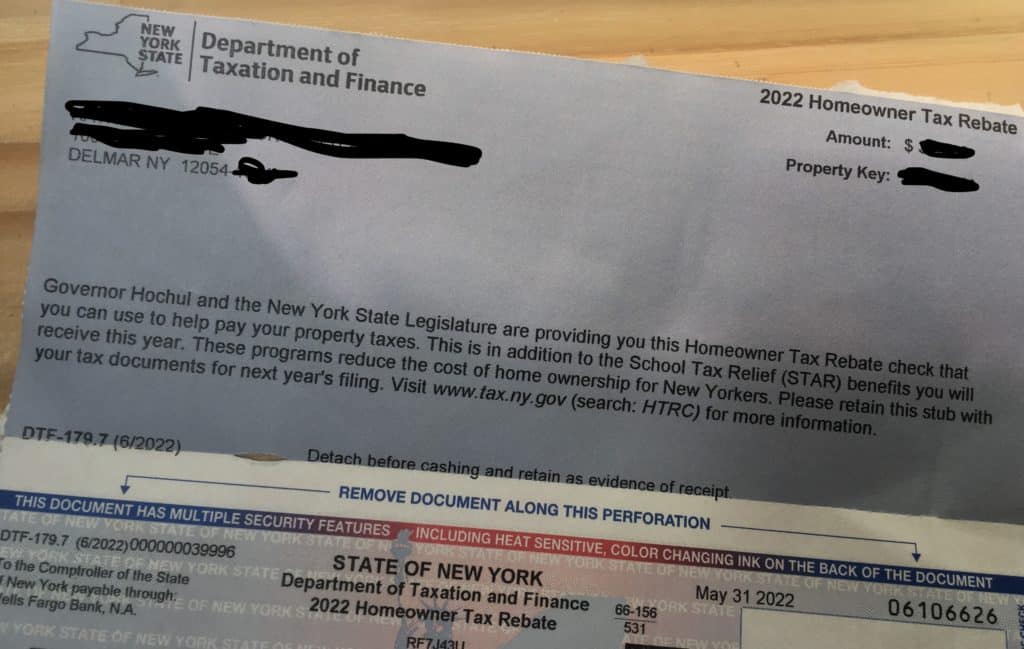

Governor Hochul Mails Out Rebate Checks Early Suozzi Cries Foul Yonkers Times

https://yonkerstimes.com/wp-content/uploads/2022/06/FUVtPL9WIAM9l1Zggggg-1024x649.jpg

General questions Q What is the STAR program Q How do I find out if I m eligible to participate in the STAR program Q How can I find out if I m receiving the STAR credit or the STAR exemption Q What are some of the differences between the STAR exemption and STAR credit Registering for the STAR credit For the 2024 STAR benefit refer to 2022 income tax form Special eligibility rules Nursing home residents If you own your home you re eligible for Basic or Enhanced STAR as long as no one other than the co owner or spouse resides there Trusts

The STAR savings amount is the lesser of The STAR exemption amount multiplied by the school tax rate excluding any library levy portion divided by 1000 or The Maximum STAR exemption savings Use the links below to find the maximum STAR exemption savings amount for your school district segment By Suzanne Blake Reporter Consumer Social Trends New Yorkers have just days left to apply for a rebate that could offer a check of 1 400 or more The deadline to apply for a change in the

Download Nys Star Rebate 2024 When Will I Get It

More picture related to Nys Star Rebate 2024 When Will I Get It

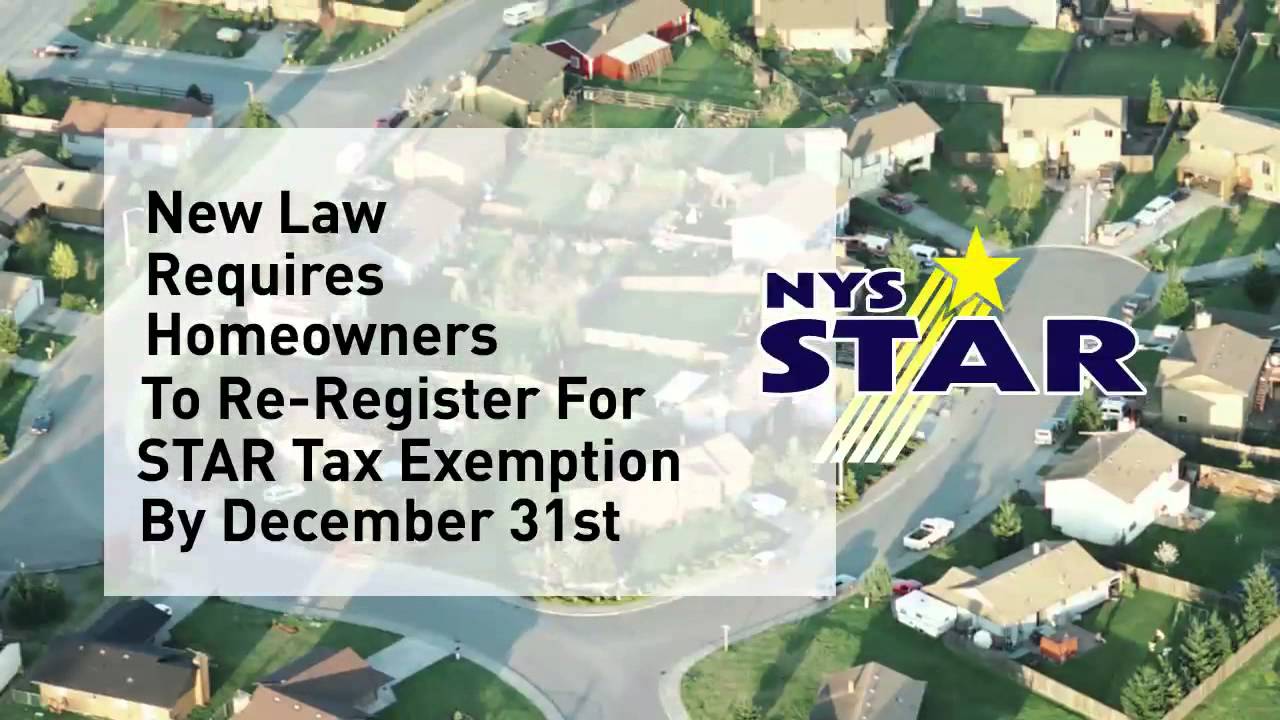

Changes To The NYS STAR Program

https://static.wixstatic.com/media/74c4f9_d3d933188d8a4ccf85c311e761b3dc64~mv2_d_8118_5412_s_4_2.jpeg/v1/fill/w_1000,h_667,al_c,q_85,usm_0.66_1.00_0.01/74c4f9_d3d933188d8a4ccf85c311e761b3dc64~mv2_d_8118_5412_s_4_2.jpeg

NYS Drive Clean Rebate Form Printable Rebate Form

http://printablerebateform.net/wp-content/uploads/2022/09/NYS-Drive-Clean-Rebate-Form.png

Nys Star Tax Rebate Checks 2022 StarRebate

https://i0.wp.com/www.starrebate.net/wp-content/uploads/2022/10/senator-o-brien-reminds-homeowners-to-reapply-for-star-property-tax-2.jpg?resize=1024%2C717&ssl=1

The deadline to apply to your assessor is March 1 Eligibility requirements for the Enhanced STAR exemption To be eligible for the Enhanced STAR exemption you must meet all of the following conditions You own your home and it is your primary residence You will be 65 or older by December 31 of the year of exemption Because New York State is mailing out STAR credit checks on a rolling basis if you want to see when you can expect to get one 2024 1st half General Tax payments are due to the Receiver of Taxes February 20 2024 2024 25 Village tax grievance deadline for most Villages

The STAR benefit program provides eligible homeowners with a break on their property taxes through an up front savings that comes directly off their tax bill the STAR exemption or a By Susan Arbetter New York State PUBLISHED 2 55 PM ET Aug 29 2022 If you haven t yet received your STAR property tax rebate check there s an easy way to find out what its status is Simply visit this website https www8 tax ny gov SCDS scdsGateway You will need to input your zip code county of residence and school district It s that simple

NYS 2023 Homeowner Tax Rebate Tax Rebate

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/NYS-2023-Homeowner-Tax-Rebate.jpg?fit=996%2C728&ssl=1

NYS STAR Program Reminder With Assembly Minority Leader Brian Kolb YouTube

https://i.ytimg.com/vi/WpMjUxFB0ys/maxresdefault.jpg

https://www.tax.ny.gov/star/

The School Tax Relief STAR program offers property tax relief to eligible New York State homeowners If you are eligible and enrolled in the STAR program you ll receive your benefit each year in one of two ways STAR credit If you are registered for the STAR credit the Tax Department will issue your STAR benefit via check or direct deposit

https://www.democratandchronicle.com/story/news/2023/09/08/ny-star-checks-when-to-expect-yours-school-tax-relief/70785077007/

1 01 STAR benefit checks and exemptions reflected on school property tax bills have already started filling New Yorkers inboxes and mailboxes and will continue to do so through the end of the

How Much Is The Nys Star Exemption

NYS 2023 Homeowner Tax Rebate Tax Rebate

How Do I Check My NYS Star Status YouTube

Nys Rebate Check For Property Tax Tax Rebate

Lensrebates Alcon Com

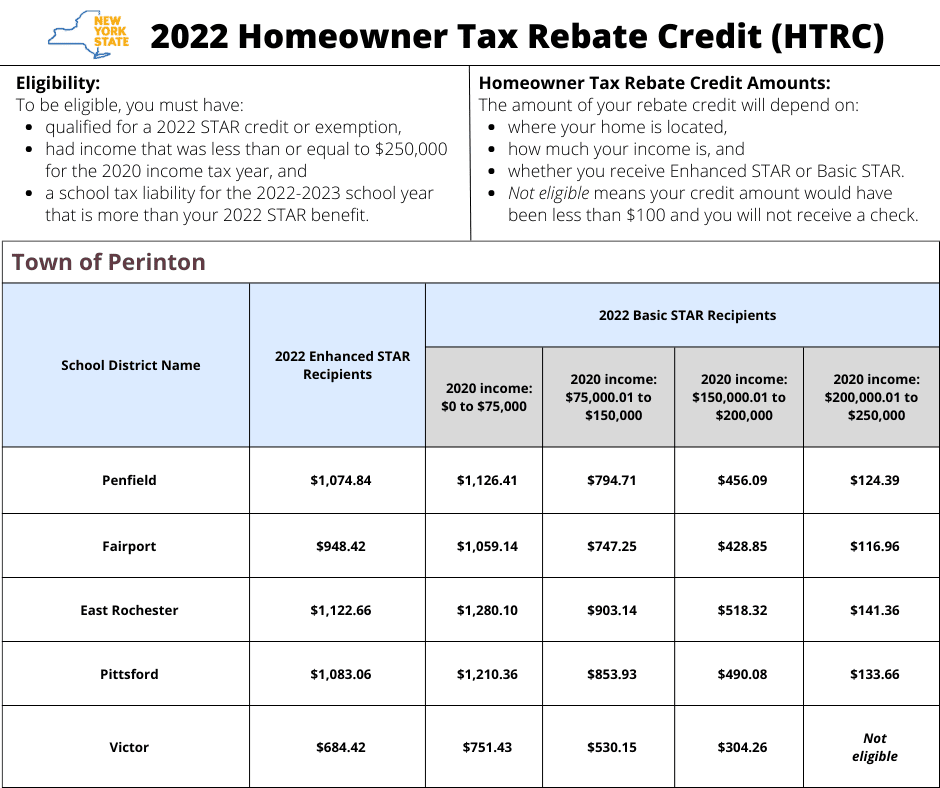

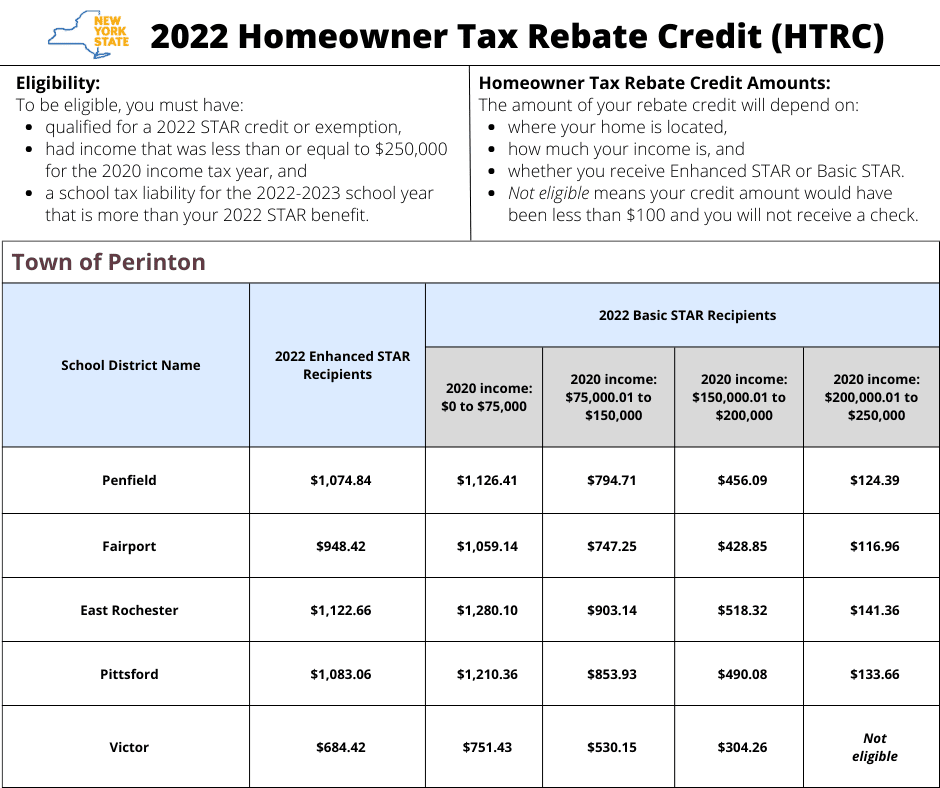

NYS Homeowner Tax Rebate Credit HTRC Info Town Of Perinton

NYS Homeowner Tax Rebate Credit HTRC Info Town Of Perinton

How Much Is The Nys Star Exemption There Are A Lot Webcast Picture Galleries

Rp 5300 Ws Fill Out Sign Online DocHub

A Short Story Why I Think The NYS Star Program Is Great YouTube

Nys Star Rebate 2024 When Will I Get It - The STAR savings amount is the lesser of The STAR exemption amount multiplied by the school tax rate excluding any library levy portion divided by 1000 or The Maximum STAR exemption savings Use the links below to find the maximum STAR exemption savings amount for your school district segment