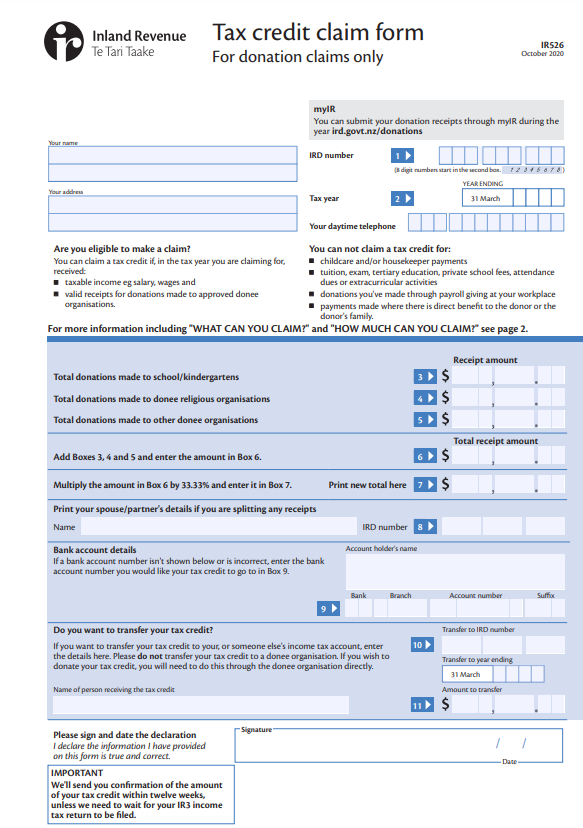

Nz Tax Rebate Web Pages in this section Independent earner tax credit IETC If you re a New Zealand tax resident and you earn between 24 000 and 48 000 in a tax year you might be able to

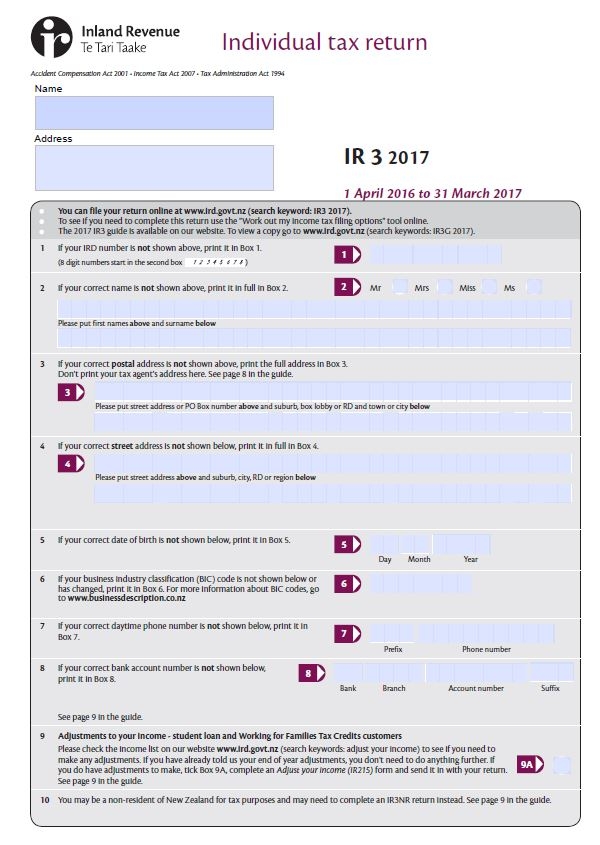

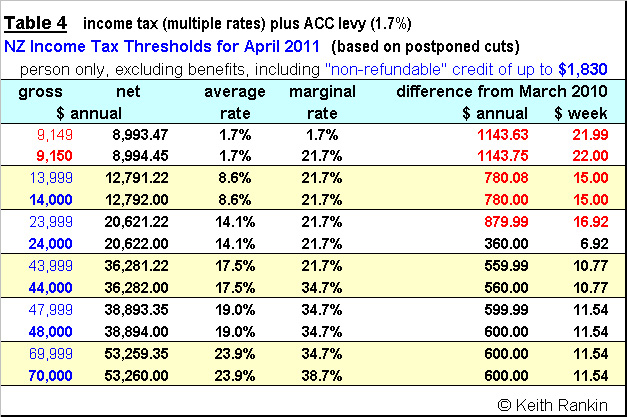

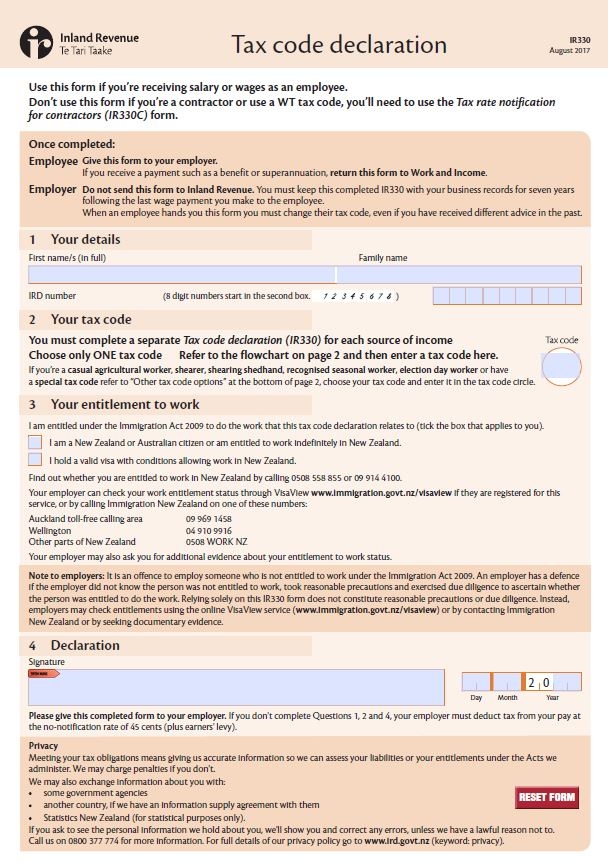

Web Use our tax code finder and tax on annual income calculator Types of individual income Individual income includes salary and wages foreign superannuation and other overseas Web New Zealand has progressive or gradual tax rates The rates increase as your income increases From 1 April 2021 Up to 31 March 2021 Secondary tax rates If you have

Nz Tax Rebate

Nz Tax Rebate

https://cdn0.tnwcdn.com/wp-content/blogs.dir/1/files/2021/06/nz-ratings-1120x378-796x269.jpg

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

https://www.basunivesh.com/wp-content/uploads/2019/02/Revised-Tax-Rebate-under-Sec.87A-after-Budget-2019.jpg

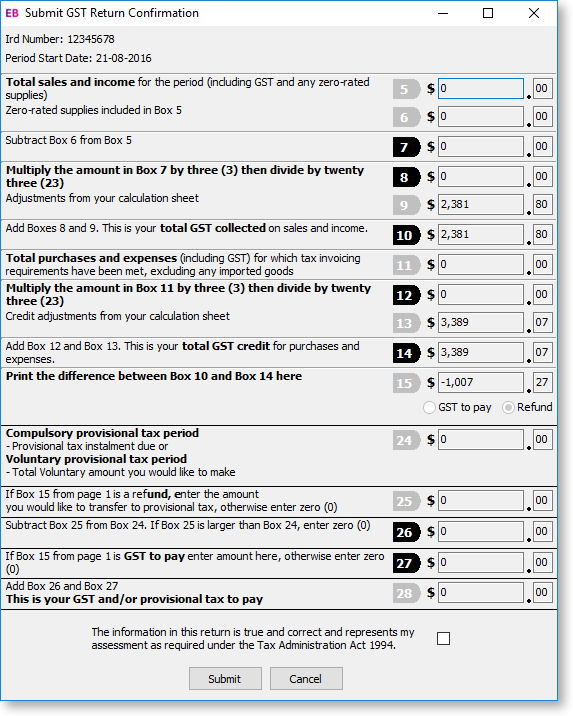

Exo Business Help NZ GST Return

https://help.myob.com.au/exo/help/exo2017/desktop/NZGSTReturn_sbr.png

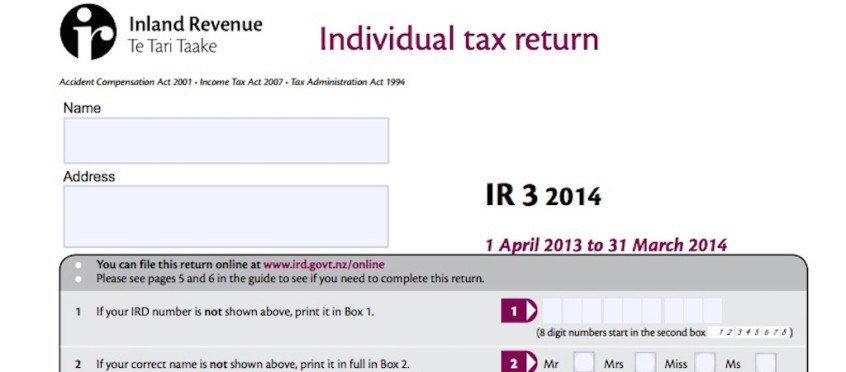

Web 1 Get Your Tax Refund Automatically The simplest way to get a New Zealand tax refund is to get it automatically from IRD by making sure you have done all the correct IRD Web 1 juil 2023 nbsp 0183 32 The Clean Car Discount will help New Zealand achieve its goal to be carbon neutral by making zero and low emission vehicles more affordable Changes to Clean Car Discount fees and rebates from 1 July

Web All NZ citizens and residents pay either Resident Withholding Tax RWT or tax at the Prescribed Investor Rate PIR on income from savings and investments in New Web 1 mai 2022 nbsp 0183 32 From 1 July 2021 until 31 March 2022 a rebate will be paid on application to the first registered person of an eligible vehicle or to a lessor where the first registered

Download Nz Tax Rebate

More picture related to Nz Tax Rebate

Doing Your Own Tax Return Nz Step By Step Guide How To File A Tax

https://www.taxback.com/resources/blogimages/20180502140450.1525259090443.973147488fb5f5c29ff4b46135a.jpg

Total Value Of Rates Rebates Granted By Tauranga City Council New

https://figure.nz/chart/E7XXux3iz8RIMPln-uQsMODMNSUMtDV3k/download

Donate Your Tax Return To UNICEF NZ

https://cdn.filestackcontent.com/cZXomloxQsCvENF8Me5N

Web A rebate is payable for an eligible light vehicle see definition only if the following criteria have been met It s being registered in New Zealand for the first time It must have a Web 1 avr 2022 nbsp 0183 32 the total rates you will pay for the current rating year 1 July 2023 to 30 June 2024 your total household income before tax for the last tax year 1 April 2022 to 31

Web 1 juil 2018 nbsp 0183 32 All rebates can be claimed for fuel purchased from 1 July 2018 Find out if you re eligible to receive a rebate What can you claim This table provides general Web Claiming a regional fuel tax rebate is offered as an online service only A summary claim history is available to let you know the status of your claims You can also save details of

NZ Tax Rate Roseby Rosner Young Pty Ltd

https://www.rosroy.com.au/wp-content/uploads/NZ-Tax-Rate.jpg

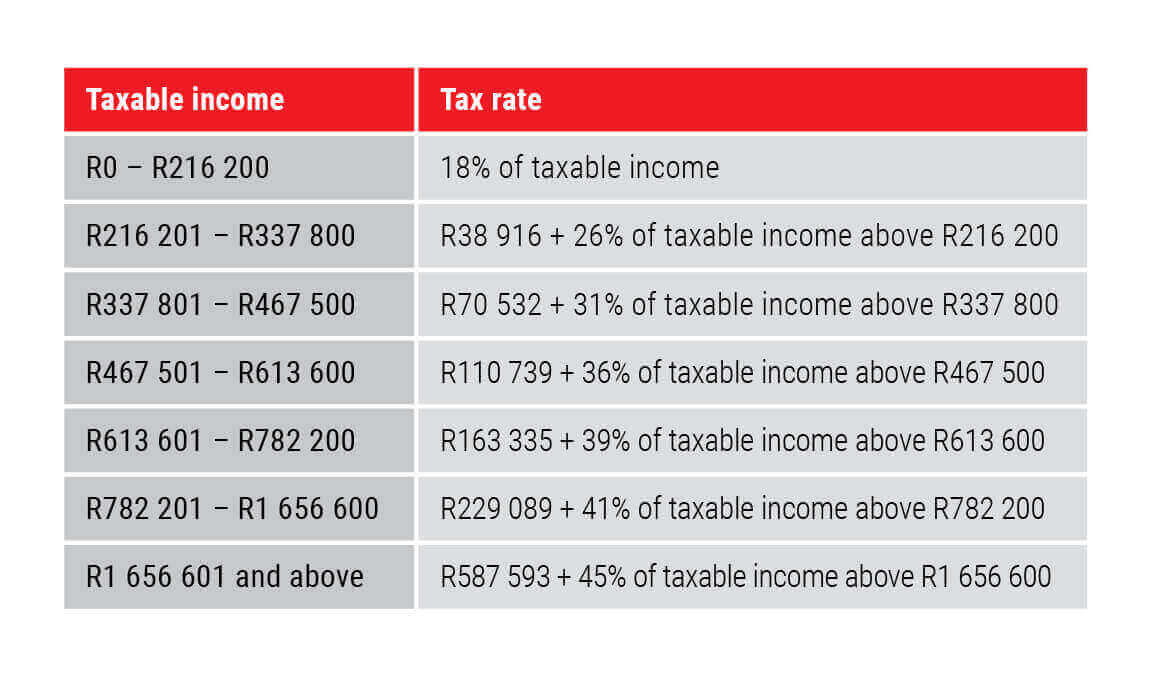

Allan Gray 2021 Budget Speech Update

https://www.allangray.com.na/contentassets/3774c8c96f8c4032b78c507e2a0f959c/budget-speech-feb-2021-tables1.jpg

https://www.ird.govt.nz/income-tax/income-tax-for-individuals/...

Web Pages in this section Independent earner tax credit IETC If you re a New Zealand tax resident and you earn between 24 000 and 48 000 in a tax year you might be able to

https://www.ird.govt.nz/income-tax/income-tax-for-individuals

Web Use our tax code finder and tax on annual income calculator Types of individual income Individual income includes salary and wages foreign superannuation and other overseas

Section 87A Tax Rebate Under Section 87A

NZ Tax Rate Roseby Rosner Young Pty Ltd

2022 Deductions List Name List 2022

Personal Income Tax Reform In New Zealand Scoop News

Pin On New Zealand

New Zealand Tax Schedule For Personal Income Tax Download Table

New Zealand Tax Schedule For Personal Income Tax Download Table

Here Are 6 Excellent New Zealand Tax Courses

Certificate In Taxation Nz TUTORE ORG Master Of Documents

New Zealand Tax Information

Nz Tax Rebate - Web The Rates Rebates Scheme provides a rebate for eligible applicants To apply for a rebate for the current rating year you need to provide the total household income before tax