Obama Housing Tax Rebate Web 10 f 233 vr 2009 nbsp 0183 32 Yesterday the Senate added a housing tax credit to the President s recovery bill that gives home buyers a 10 of purchase price tax credit up to a maximum of

Tax rebates that were created by the law were paid to individual U S taxpayers during 2008 Most taxpayers below the income limit received a rebate of at least 300 per person 600 for married couples filing jointly Eligible taxpayers received along with their individual payment 300 per dependent child under the age of 17 The payment was equal to the payer s net income tax liability but could not exceed 600 for a single person or 1200 married couple filing jointly Web 18 mars 2022 nbsp 0183 32 The Obama administration enacted the federal first time homebuyer tax credit in 2008 Created as a response to the 2008 financial crisis the Housing and Economic Recovery Act HERA allowed new

Obama Housing Tax Rebate

Obama Housing Tax Rebate

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/illinois-tax-rebate-2022-cray-kaiser-1.png

Obama Orders 2350 Dollar Tax Rebate In November Obama Rebates Dollar

https://i.pinimg.com/originals/c1/74/64/c17464b467f5edfafa1f7bd3614a5c5b.jpg

Guide To Housing Benefit And Council Tax Rebates Martin Ward

https://media.s-bol.com/BDxLXEY7xpx/543x840.jpg

Web 19 f 233 vr 2021 nbsp 0183 32 The federal government under President Barack Obama encouraged consumers to buy their first homes by offering tax credits of 7 500 in 2008 and 8 000 in both 2009 and 2010 via the Housing and Web 4 mars 2021 nbsp 0183 32 A stimulus rebate check was mailed out to 130 million taxpayers in amounts as follows Individuals would receive up to 600 Married couples would get up to 1 200

Web 6 nov 2009 nbsp 0183 32 NEW YORK CNNMoney President Obama signed an extension and expansion of the first time homebuyers tax credit on Friday The 8 000 credit was Web 31 d 233 c 2021 nbsp 0183 32 President Barack Obama signed the American Recovery and Reinvestment Act ARRA on February 17 2009 The Congressional Budget Office estimated it would

Download Obama Housing Tax Rebate

More picture related to Obama Housing Tax Rebate

What Are Reuluations About Getting A Home Loan On A Forclosed Home

https://www.paisabazaar.com/wp-content/uploads/2017/11/Tax-benefits-of-home-loan_2.jpg

Home Loan EMI And Tax Deduction On It EMI Calculator

https://www.loankuber.com/content/wp-content/uploads/2016/10/Image-5-1.png

PW1023 PRE RECOREDED WEBINAR GST HST And NEW HOUSING REBATES

https://simplysalestax.com/wp-content/uploads/2021/09/2020-03-HOUSING-REBATES-a.jpg

Web Obama has proposed a tax plan which includes tax credits to lower the amount of taxes paid It is argued that the typical middle class family would receive over 1 000 in tax relief with tax payments that are 20 lower Web 26 juin 2023 nbsp 0183 32 The housing tax on second homes depends on your situation to 1 er January of the taxation year You must pay it if you own or usufructuary a second home i e a

Web 26 f 233 vr 2009 nbsp 0183 32 The total amount allocated cannot exceed the smaller of 7 500 8 000 if you purchased your home in 2009 or 10 of the purchase price A reasonable Web 26 avr 2021 nbsp 0183 32 The bill would provide a tax credit for first time homebuyers of up to 10 of the purchase price or 15 000 In order to be eligible for the full credit potential buyers

President Obama s Housing Plan Business 2 Community

https://cdn.business2community.com/wp-content/uploads/2013/08/a_better_foundation_homeownership_01.jpg

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

https://images.moneycontrol.com/static-mcnews/2021/02/affordable-housing.jpg

https://themortgageinsider.net/mortgage-news/15000-housing-tax-credit...

Web 10 f 233 vr 2009 nbsp 0183 32 Yesterday the Senate added a housing tax credit to the President s recovery bill that gives home buyers a 10 of purchase price tax credit up to a maximum of

https://en.wikipedia.org/wiki/Economic_Stimulus_Act_of_2008

Tax rebates that were created by the law were paid to individual U S taxpayers during 2008 Most taxpayers below the income limit received a rebate of at least 300 per person 600 for married couples filing jointly Eligible taxpayers received along with their individual payment 300 per dependent child under the age of 17 The payment was equal to the payer s net income tax liability but could not exceed 600 for a single person or 1200 married couple filing jointly

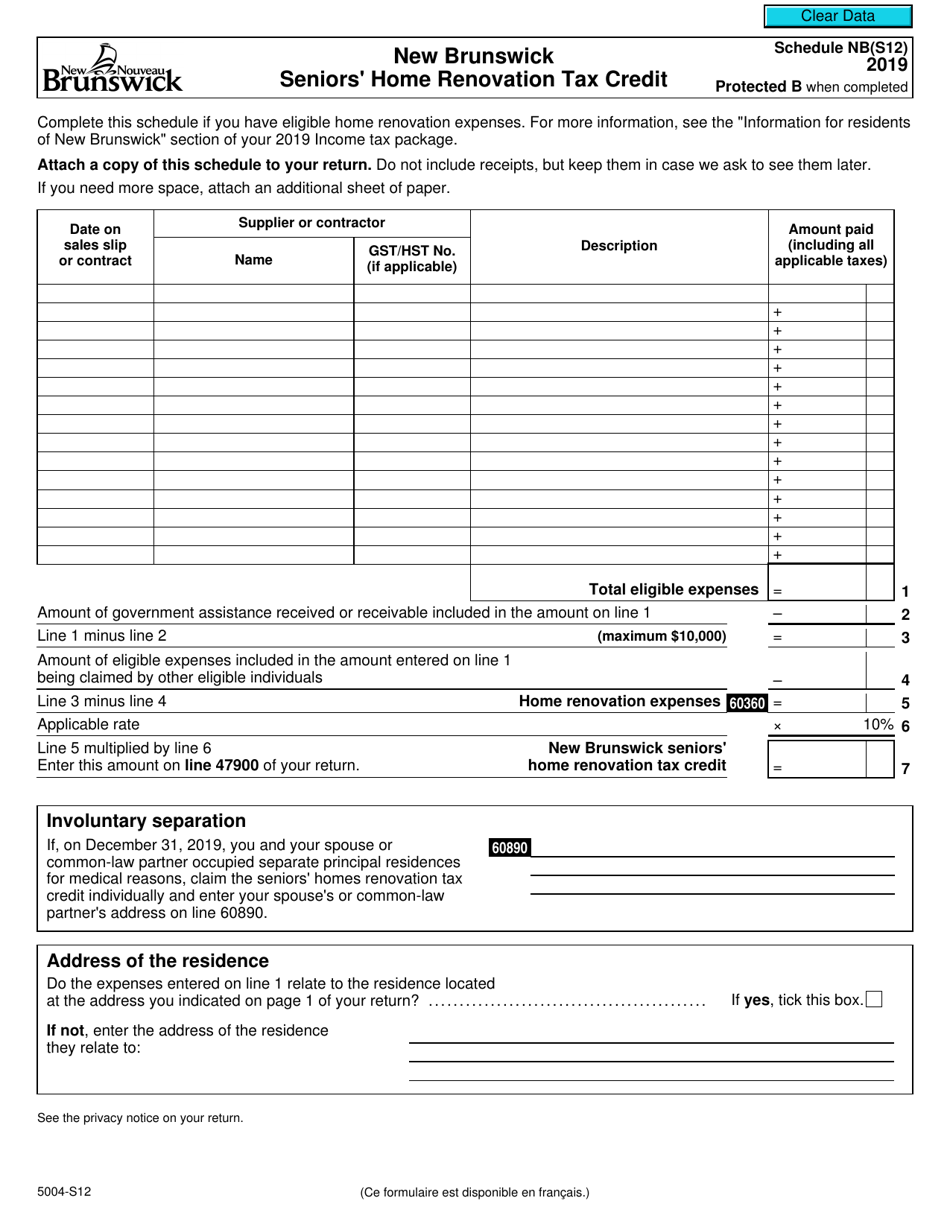

Form 5004 S12 Schedule NB S12 Download Fillable PDF Or Fill Online New

President Obama s Housing Plan Business 2 Community

Property Tax Rebate Application Printable Pdf Download

2007 Tax Rebate Tax Rebates Taxes History Deduction

T1159 Fill Out Sign Online DocHub

Taking A Peek At Obama Biden 2014 Tax Returns Don t Mess With Taxes

Taking A Peek At Obama Biden 2014 Tax Returns Don t Mess With Taxes

GST HST New Housing Rebate Denied BBTS Accountax Inc

2000 PUSH ARRIVING SSI SSDI HOUSING REBATES STIMULUS CHECK

Gst191 Fillable Form Printable Forms Free Online

Obama Housing Tax Rebate - Web 29 oct 2009 nbsp 0183 32 1 Roots and impact A tax credit of as much as 8 000 for certain qualified first time home buyers was included in the Obama administration s sweeping economic