Obama Tax Plan Rebate Web 31 d 233 c 2021 nbsp 0183 32 Obama s tax rebates were supposed to encourage consumer spending but many experts doubted it Why The rebates showed up as lower tax withholding Unlike

Tax rebates that were created by the law were paid to individual U S taxpayers during 2008 Most taxpayers below the income limit received a rebate of at least 300 per person 600 for married couples filing jointly Eligible taxpayers received along with their individual payment 300 per dependent child under the age of 17 The payment was equal to the payer s net income tax liability but could not exceed 600 for a single person or 1200 married couple filing jointly Web Obama has proposed a tax plan which includes tax credits to lower the amount of taxes paid It is argued that the typical middle class family

Obama Tax Plan Rebate

Obama Tax Plan Rebate

https://i.pinimg.com/originals/c1/74/64/c17464b467f5edfafa1f7bd3614a5c5b.jpg

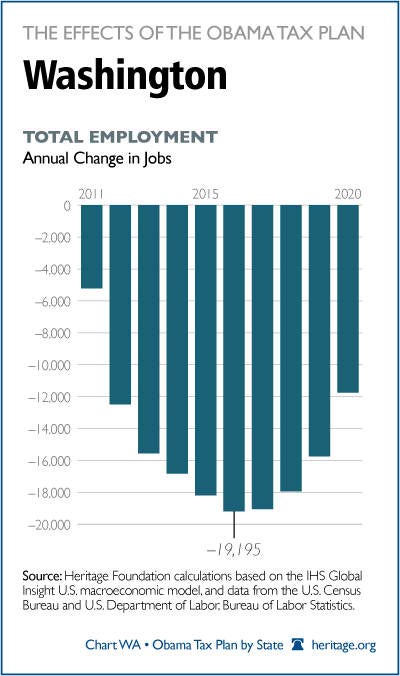

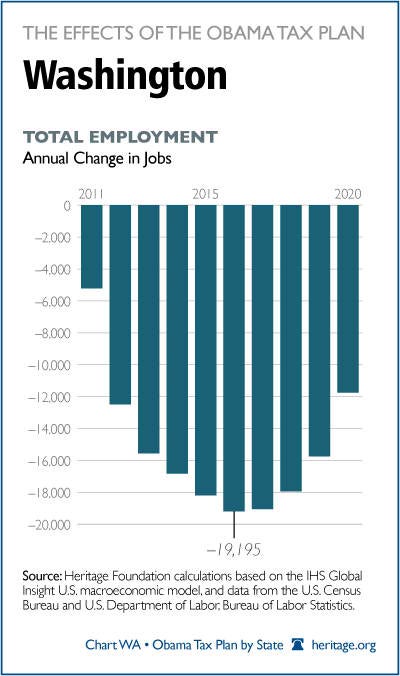

The Effects Of The Obama Tax Plan On Washington The Heritage Foundation

https://www.heritage.org/sites/default/files/~/media/infographics/2010/obama tax hikes/w/wastatecdaobamataxplanchart1.jpg

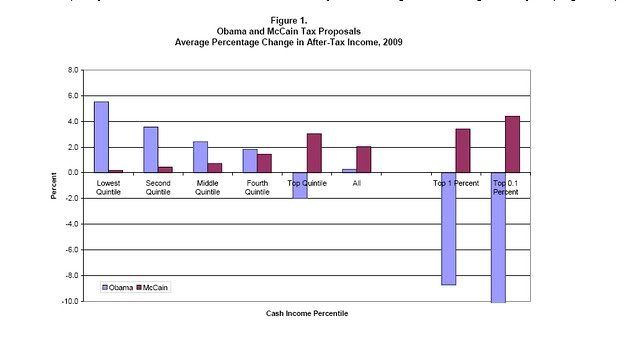

Hard Numbers On Obama s Redistribution Plan Tax Foundation

http://taxfoundation.org/sites/taxfoundation.org/files/UserFiles/Image/Fiscal Facts/ff132_fig1.jpg

Web 8 sept 2023 nbsp 0183 32 IR 2023 166 Sept 8 2023 Capitalizing on Inflation Reduction Act funding and following a top to bottom review of enforcement efforts the Internal Revenue Web His plan to finance those rebates with an extra tax on oil companies would reduce investment in refining and exploration keeping oil prices higher than they would

Web 11 f 233 vr 2015 nbsp 0183 32 The president s plan would create a 0 07 percent tax on the liabilities of financial firms with assets over 50 billion The White House estimates the tax would hit Web 25 janv 2010 nbsp 0183 32 For a single person with a 30 000 income and a 20 000 student loan monthly payments would drop from 228 a month to 115 a month on a ten year

Download Obama Tax Plan Rebate

More picture related to Obama Tax Plan Rebate

No Wonder The Voters Are Confused Two Views Of The Obama Tax Plan

http://i206.photobucket.com/albums/bb201/kavips/TheBailoutAfterTheBailout.jpg

Middle Class Targeted By Obama Tax Plans

https://townsquare.media/site/667/files/2015/01/486955577.jpg?w=980&q=75

Dividend Tax Rates Fixing The Game

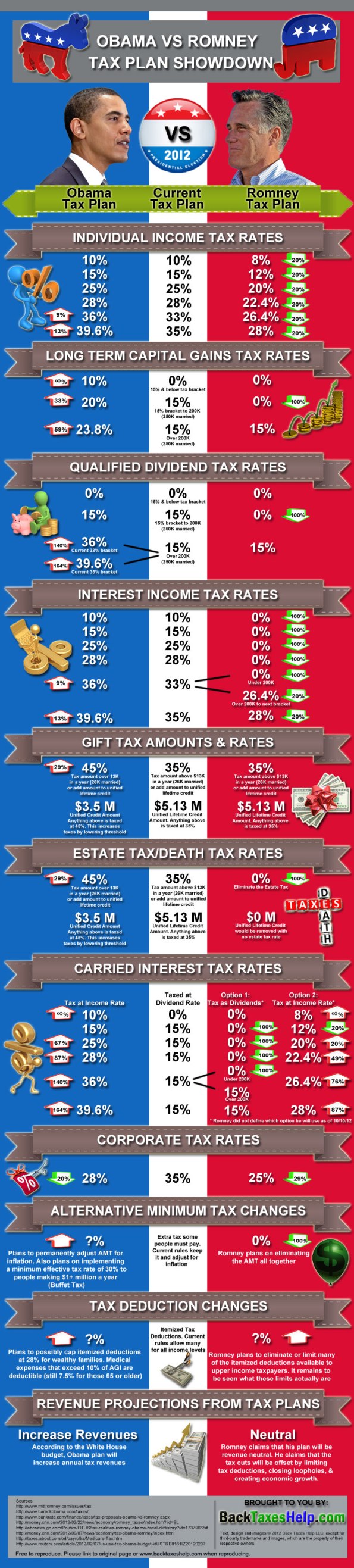

https://fixingthegame.files.wordpress.com/2012/10/obama-vs-romney-tax-plan-showdown_50770fb4a675b1.jpg?w=595&h=2634

Web 1 mai 2023 nbsp 0183 32 The Affordable Care Act contains comprehensive health insurance reforms and includes tax provisions that affect individuals families businesses insurers tax exempt Web 1 ao 251 t 2008 nbsp 0183 32 U S Democratic presidential candidate Barack Obama proposed a package of measures on Friday to help workers fight rising energy costs including an immediate

Web 28 sept 2021 nbsp 0183 32 Barack Obama says wealthy Americans including himself can afford tax increases to help fund Joe Biden s ambitious spending plan Pelosi Biden spending Web 24 ao 251 t 2008 nbsp 0183 32 On the advice of Jason Furman Austan Goolsbee and Warren Buffet Obama has proposed a tax rebate scheme to get the economy moving Critics have pointed out

Obama Tax Return Hints At His Post Presidency Plans The New York Times

https://static01.nyt.com/images/2016/04/15/us/politics/image-Obamas-2015-Taxes/image-Obamas-2015-Taxes-master495.gif

Obama Tax Plan Who Gets Hit CSMonitor

https://images.csmonitor.com/csmarchives/2010/09/toptaxes.jpg?alias=standard_900x600nc

https://www.thebalancemoney.com/what-was-obama-s-stimulus-package …

Web 31 d 233 c 2021 nbsp 0183 32 Obama s tax rebates were supposed to encourage consumer spending but many experts doubted it Why The rebates showed up as lower tax withholding Unlike

https://en.wikipedia.org/wiki/Economic_Stimulus_Act_of_2008

Tax rebates that were created by the law were paid to individual U S taxpayers during 2008 Most taxpayers below the income limit received a rebate of at least 300 per person 600 for married couples filing jointly Eligible taxpayers received along with their individual payment 300 per dependent child under the age of 17 The payment was equal to the payer s net income tax liability but could not exceed 600 for a single person or 1200 married couple filing jointly

Obama Tax Hikes The Economic And Fiscal Effects The Heritage Foundation

Obama Tax Return Hints At His Post Presidency Plans The New York Times

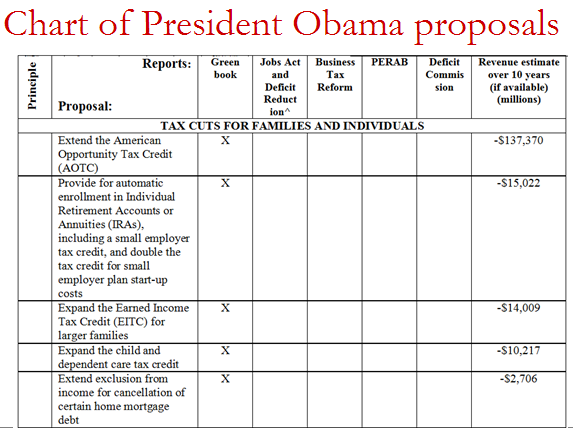

21st Century Taxation President Obama Tax Plans

Obama Versus Romney Tax Plan Infographic Black Men s Dossier

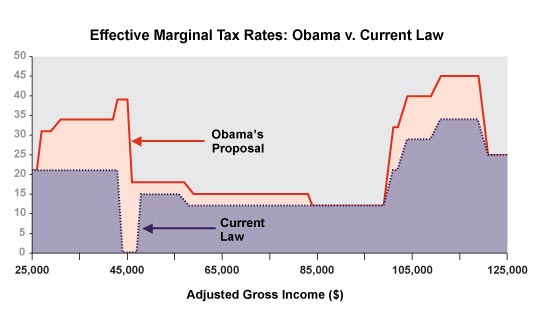

The Economic And Fiscal Effects Of The Obama Tax Plan The Heritage

Competitiveness Expert Slams Obama Tax Plan

Competitiveness Expert Slams Obama Tax Plan

Obama s Tax Plan

The Economic And Fiscal Effects Of The Obama Tax Plan The Heritage

Obama Tax Hikes The Economic And Fiscal Effects The Heritage Foundation

Obama Tax Plan Rebate - Web 20 janv 2022 nbsp 0183 32 The fiscal cliff refers to the disaster that would have occurred if Obama and Congress hadn t agreed on a plan to prevent it Without the deal a combination of five