Obama Tax Rebate Plan Web 31 d 233 c 2021 nbsp 0183 32 Obama s tax rebates were supposed to encourage consumer spending but many experts doubted it Why The rebates showed up as lower tax withholding Unlike with the Bush tax cuts workers did not receive checks As a result most people weren t

The American Recovery and Reinvestment Act of 2009 ARRA Pub L 111 5 text PDF nicknamed the Recovery Act was a stimulus package enacted by the 111th U S Congress and signed into law by President Barack Obama in February 2009 Developed in response to the Great Recession the primary objective of this federal statute was to save existing jobs and create new one Web The Economic Stimulus Act of 2008 had three main parts an individual income tax rebate sent in mid 2008 and two business provisions to encourage investment during 2008 Tax Credits for Individuals People who filed tax returns for either 2007 or 2008 could qualify

Obama Tax Rebate Plan

Obama Tax Rebate Plan

http://www.dailyherald.com/storyimage/DA/20120413/news/704139861/AR/0/AR-704139861.jpg&updated=201204131110&MaxW=800&maxH=800&updated=201204131110&noborder

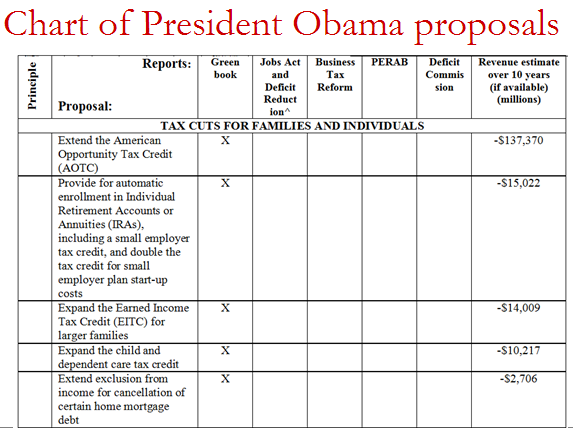

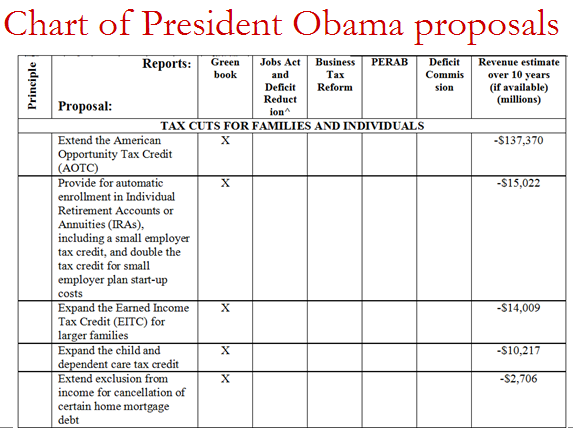

21st Century Taxation President Obama Tax Plans

http://1.bp.blogspot.com/-D7npC2ccuHs/UJnlNaNg9nI/AAAAAAAAAaM/D-wNmUpHQsc/s1600/ObamaTaxTable.png

Obama Orders 2350 Dollar Tax Rebate In November Obama Rebates Dollar

https://i.pinimg.com/originals/c1/74/64/c17464b467f5edfafa1f7bd3614a5c5b.jpg

Web In June 2008 Obama voted in favor of a budget that would raise the taxes on unmarried individuals with a taxable income of over 32 000 by Web 24 f 233 vr 2021 nbsp 0183 32 Tax credits of 500 per person 1 000 per family They got 400 800 through the reduction of withholding tax Eliminate income tax for seniors making less than 50 000 per year Social Security recipients

Web Obama s Stimulus Plan Won t Work Either By MARTIN FELDSTEIN PDF Version Congress enacted the tax rebate program earlier this year because it perceived a growing risk of recession In addition it feared monetary policy alone would not be effective Web 8 sept 2023 nbsp 0183 32 IR 2023 166 Sept 8 2023 Capitalizing on Inflation Reduction Act funding and following a top to bottom review of enforcement efforts the Internal Revenue Service announced today the start of a sweeping historic effort to restore fairness in tax

Download Obama Tax Rebate Plan

More picture related to Obama Tax Rebate Plan

Hard Numbers On Obama s Redistribution Plan Tax Foundation

http://taxfoundation.org/sites/taxfoundation.org/files/UserFiles/Image/Fiscal Facts/ff132_fig1.jpg

The Economic And Fiscal Effects Of The Obama Tax Plan The Heritage

https://www.heritage.org/sites/default/files/~/media/images/reports/2012/12/bg2752/bgobamataxplan2012appendixtable1p3_750.jpg

Jansource Did You Get Your Obama Rebate

https://3.bp.blogspot.com/-QNLlIRj3bw4/T9ElwGZBTqI/AAAAAAAAAFY/UaH3tKz0XFM/s1600/Obama+Bucks.jpg

Web 15 janv 2009 nbsp 0183 32 WASHINGTON President elect Barack Obama s 825 billion plan to jump start the economy and create or save up to 4 million jobs includes twice as much money for spending as for tax cuts setting Web 28 sept 2021 nbsp 0183 32 Tue 28 Sep 2021 07 11 EDT Last modified on Tue 28 Sep 2021 17 00 EDT Barack Obama says wealthy Americans including himself can afford tax increases to help fund Joe Biden s ambitious

Web 25 janv 2010 nbsp 0183 32 For Working Parents Expanding Child and Dependent Care Tax Credit for Middle Class Families Right now parents earning above 43 000 a year can receive credit for 20 percent of their child care Web President Obama s plan would lower the overall corporate income tax rate from 35 percent to 28 percent and lower the effective corporate tax rate for manufacturers to 25 percent 1 He wants to fund those lower rates by eliminating loopholes including ones that

Obama Tax Return Hints At His Post Presidency Plans The New York Times

https://static01.nyt.com/images/2016/04/15/us/politics/image-Obamas-2015-Taxes/image-Obamas-2015-Taxes-videoLarge.gif

Obama Versus Romney Tax Plan Infographic Black Men s Dossier

https://www.blackmensdossier.com/sites/default/files/infographics/tax_obama_plan_infographic.png

https://www.thebalancemoney.com/what-was-obama-s-stimulus-package …

Web 31 d 233 c 2021 nbsp 0183 32 Obama s tax rebates were supposed to encourage consumer spending but many experts doubted it Why The rebates showed up as lower tax withholding Unlike with the Bush tax cuts workers did not receive checks As a result most people weren t

https://en.wikipedia.org/wiki/American_Recovery_and_Reinvestment_A…

The American Recovery and Reinvestment Act of 2009 ARRA Pub L 111 5 text PDF nicknamed the Recovery Act was a stimulus package enacted by the 111th U S Congress and signed into law by President Barack Obama in February 2009 Developed in response to the Great Recession the primary objective of this federal statute was to save existing jobs and create new one

Obama Tax Hikes The Economic And Fiscal Effects The Heritage Foundation

Obama Tax Return Hints At His Post Presidency Plans The New York Times

Romney s And Obama s Tax Plans In One new And Improved Chart The

Obama Tax Plan Who Gets Hit CSMonitor

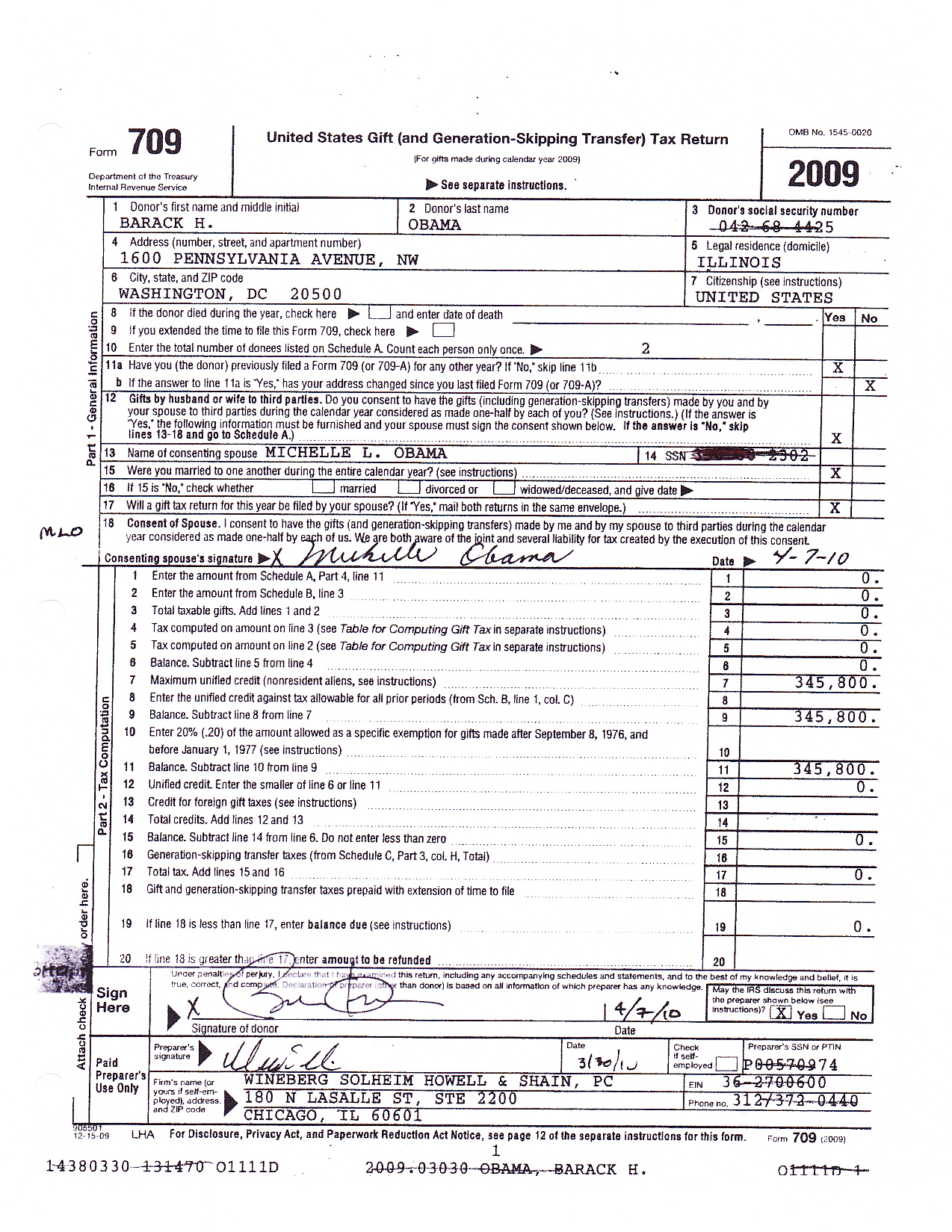

Obama Tax Returs And E verify 0003 OrlyTaitzEsq

Obama Tax Relief Program Makes It Easy To Create Your Tax Debt With T

Obama Tax Relief Program Makes It Easy To Create Your Tax Debt With T

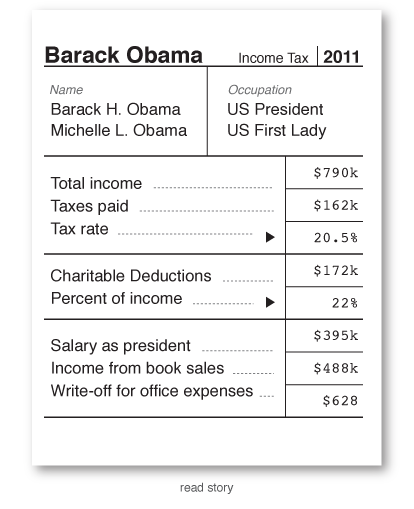

Obama And Romney s Tax Returns 2011 CNNMoney

Presidential Finance FT Alphaville

Social Post Wrong About Obama s Tax Returns FactCheck

Obama Tax Rebate Plan - Web 9 sept 2011 nbsp 0183 32 Le pr 233 sident am 233 ricain mise sur des r 233 ductions d imp 244 ts des investissements et l emploi public Voici les principaux points du plan du pr 233 sident am 233 ricain Barack Obama pour l emploi pr 233 sent 233 jeudi et dont le co 251 t est chiffr 233 par la Maison Blanche 224 447