Off Road Diesel Tax Credit The one most familiar to taxpayers is probably the federal gas tax 18 4 cents gallon as of 2021 which pays for road projects across the country Certain uses of fuels are untaxed however and fuel users can get a credit for the taxes they ve paid by filing Form 4136 TABLE OF CONTENTS Untaxed uses of fuels

Fuel tax credits provide businesses with a credit for the fuel tax excise or customs duty that s included in the price of fuel used in machinery plant equipment heavy vehicles light vehicles travelling off public roads or on private roads The Fuel Tax Credit is for offsetting the tax that the U S government charges on fuels such as gasoline and diesel in specific circumstances The Internal Revenue Service IRS taxes

Off Road Diesel Tax Credit

Off Road Diesel Tax Credit

https://thejeepgirlsblog.com/wp-content/uploads/2022/09/off-raod-diesel.jpg

SignMission Off Road Diesel Only Heavy Duty Sign Wayfair

https://secure.img1-cg.wfcdn.com/im/79491700/compr-r85/2191/219109293/off-road-diesel-only-heavy-duty-sign.jpg

How Much Fuel Tax Is On Petrol And Diesel Ask The Car Expert

https://www.askthecarexpert.com/wp-content/uploads/2020/10/How-much-do-we-pay-in-fuel-duty-700x510.jpg?x21968

Note 3 Fuel tax credit rates change for fuel used in a heavy vehicle for travelling on a public road due to changes in the road user charge The heavy vehicle road user charge will increase by 6 each year over 3 years from 28 8 cents per litre for petrol and diesel in 2023 24 to 30 5 cents per litre in 2024 25 and to 32 4 cents per litre Sequence No 79 Name as shown on your income tax return Taxpayer identification number 4136 Caution Claimant has the name and address of the person who sold the fuel to the claimant and the dates of purchase For claims on lines 1c and 2b type of use 13 or 14 3d 4c and 5 claimant has not waived the right to make the claim

A credit for certain nontaxable uses or sales of fuel during your income tax year A credit for blending a diesel water fuel emulsion A credit for exporting dyed fuels or gasoline blendstocks Substainable aviation fuel SAF credit Attach Form 4136 to your tax return Instead of waiting to claim an annual credit on Form Heavy vehicles You can claim fuel tax credits for eligible fuels you use in heavy vehicles with a GVM greater than 4 5 tonnes Last updated 21 February 2023 Print or Download Fuel tax credits for heavy vehicles Find out about fuel tax credits for eligible fuels Travelling on public roads

Download Off Road Diesel Tax Credit

More picture related to Off Road Diesel Tax Credit

SignMission Osha Notice Off Road Diesel Fuel Only Sign Or Label Wayfair

https://secure.img1-cg.wfcdn.com/im/90322745/compr-r85/2191/219101342/osha-notice-off-road-diesel-fuel-only-sign-or-label.jpg

Danger Sign Off Road Diesel Only ANSI

https://media.compliancesigns.com/media/catalog/product/a/n/ansi-diesel-sign-ade-28298_1000.gif

Off Road Diesel Vehicle EIN ARB Decals

https://i.pinimg.com/736x/f4/cf/76/f4cf76109c2620d80a3d664ba522fbe6.jpg

Diesel fuel is also available for off road use without payment of excise tax in which case it is dyed to designate it as exempt Taxpayers that produce their own fuel such as biodiesel are required to file and pay for any over the road usage of the fuel The information contained in the Knowledgebase KB is for general information only and is not intended to be tax financial or legal advice The user is encouraged to review additional state and federal resources and publications as needed Site Map Details and Disclosures Form 4136 is no longer supported in our program

For companies unable to obtain off road diesel directly from a supplier relief can be found in the form of tax credits This is where IRS Form 4136 Credit for Federal Tax Paid on Fuels comes into play Credit for Federal Tax Paid on Fuels Tax credits calculated on IRS Form 4136 directly reduce your tax obligations Biodiesel or Renewable Diesel Mixture Credit Reduce tax liability for using biodiesel or renewable diesel blends Businesses and individuals using these fuels for qualified purposes e g on road use off highway use heating Alternative Fuel Credit Offset tax liability for using alternative fuels like ethanol methanol and natural gas

SignMission Off Road Diesel Fuel Only Sign Wayfair

https://secure.img1-fg.wfcdn.com/im/47431720/compr-r85/2191/219103013/off-road-diesel-fuel-only-sign.jpg

Transportation Sign Off Road Diesel Not For Use In On Road Vehicles

https://media.compliancesigns.com/media/catalog/product/f/u/fuel-sign-nhe-31164_1000_1.gif

https://turbotax.intuit.com/tax-tips/small...

The one most familiar to taxpayers is probably the federal gas tax 18 4 cents gallon as of 2021 which pays for road projects across the country Certain uses of fuels are untaxed however and fuel users can get a credit for the taxes they ve paid by filing Form 4136 TABLE OF CONTENTS Untaxed uses of fuels

https://www.ato.gov.au/.../fuel-schemes/fuel-tax-credits-business

Fuel tax credits provide businesses with a credit for the fuel tax excise or customs duty that s included in the price of fuel used in machinery plant equipment heavy vehicles light vehicles travelling off public roads or on private roads

Difference Between On Road And Off Road Diesel McIntosh Energy

SignMission Off Road Diesel Fuel Only Sign Wayfair

Portrait Off Road Diesel Fuel Sign NHEP 29747

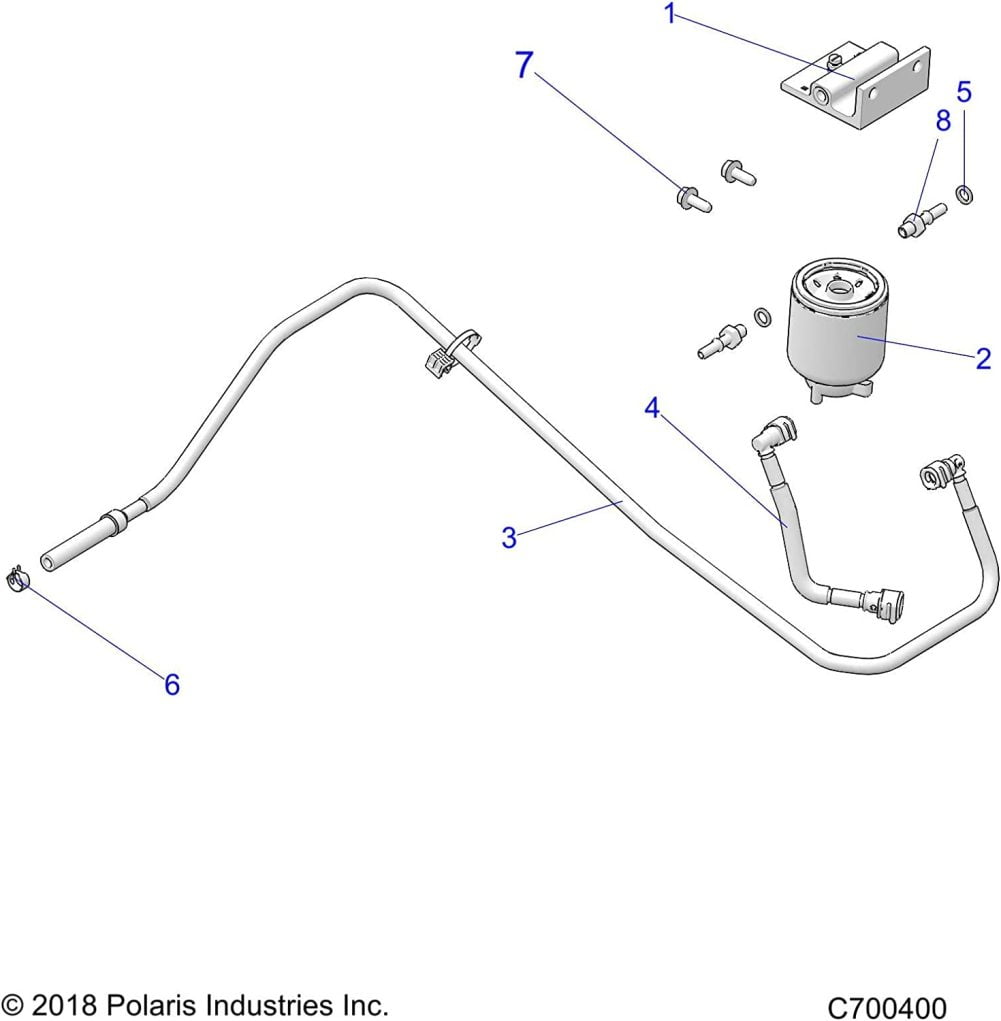

Off Road Diesel Fuel Filter With Water Separator Genuine OEM Part

Diesel Fuel Delivery Bulk Diesel Fuel Supplier Fleetfuelz

Image Fuels Heating Oil And Diesel Fuel Delivery Service

Image Fuels Heating Oil And Diesel Fuel Delivery Service

Regulation Provides Safe Harbor For Diesel Tax Refunds

ComplianceSigns Off Road Diesel Label Decal 7x5 Inch Vinyl For Fuel

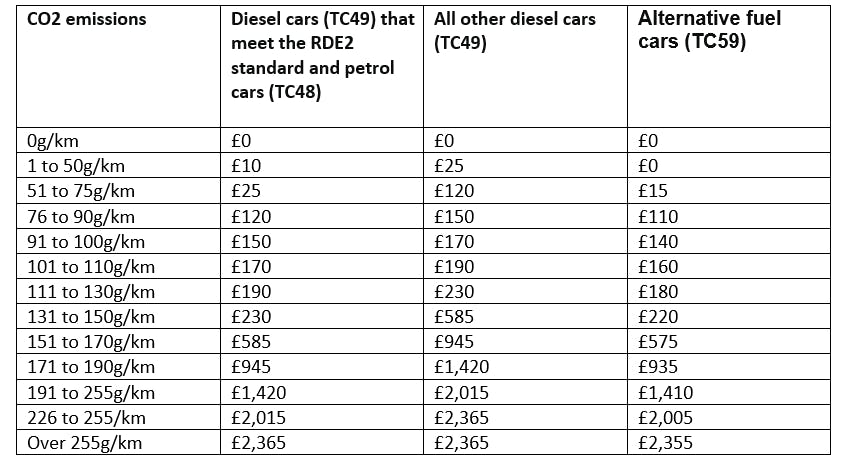

Vehicle Tax Bands Explained Findandfundmycar

Off Road Diesel Tax Credit - The biodiesel or renewable diesel mixture credit The alternative fuel credit A credit for certain nontaxable uses or sales of fuel during your income tax year A credit for blending a diesel water fuel emulsion A credit for exporting dyed fuels or gasoline blendstocks Substainable aviation fuel SAF credit