Ohio Real Estate Tax Reduction For Seniors The homestead exemption is a statewide property tax reduction program for senior citizens those who are disabled and surviving spouses of fallen first responders

A proposed state law passed by the Ohio Senate Wednesday would temporarily the next three taxing years exempt older Ohioans who earn 36 000 or COLUMBUS State Sen Andrew Brenner R Delaware on Wednesday announced the Ohio Senate passed House Bill 187 providing immediate property tax relief for eligible seniors and disabled veterans

Ohio Real Estate Tax Reduction For Seniors

Ohio Real Estate Tax Reduction For Seniors

https://i.pinimg.com/originals/4f/5d/e1/4f5de12b06ec64bfcbbeb89b15f04190.jpg

.png)

RELW100 2021

https://www.mylakewoodu.com/pluginfile.php/68862/course/overviewfiles/Real Estate Law-01 (1).png

Best Kept Real Estate Tax Strategy Using Cost Segregation YouTube

https://i.ytimg.com/vi/NEpBed2-9HA/maxresdefault.jpg

As homeowners brace for bigger property tax bills in 2024 a bipartisan group of state lawmakers is launching an effort to freeze those taxes for older Ohioans It s called the 70 under 70 The Homestead Exemption for senior and disabled persons allows eligible homeowners to exempt the first 26 200 of their home s value from taxation Here are the qualifications

The homestead exemption allows low income senior citizens and permanently and totally disabled Ohioans to reduce their property tax bills by shielding some of the market View an Estimated Reduction Schedule for the Senior and Disabled Persons Homestead Exemption for your tax district Auditor s Office at 373 South High Street 21st Floor

Download Ohio Real Estate Tax Reduction For Seniors

More picture related to Ohio Real Estate Tax Reduction For Seniors

Webinar Ohio Real Estate Tax Deadlines Are Looming YouTube

https://i.ytimg.com/vi/wTFC2OkM5A4/maxresdefault.jpg

Ohio Real Estate Tax Deadline Archives Real Estate Tax Lawyers

https://sdglegal.net/wp-content/uploads/2016/08/sdg-legal-cleveland-1080x675.jpg

How To Get An Ohio Real Estate License In 5 Easy Steps The Close In

https://i.pinimg.com/736x/7c/ff/19/7cff19ee5d3ea9a98b791e55119213f8.jpg

The Homestead Exemption is a real estate tax reduction available to senior citizens disabled persons or a surviving spouse that meet the following criteria During the year Ohio homeowners who are older or have a disability may be able to reduce their property taxes using a credit called the homestead exemption Learn more about how it works

The homestead exemption is a statewide program which reduces the property tax burden of qualified senior citizens permanently and totally disabled homeowners disabled The Homestead Exemption Program is a real estate tax reduction available to senior citizens disabled persons or a surviving spouse who meet the following criteria

Real Estate Tax Reduction Strategies For Seniors Boomer Buyer Guides

https://i0.wp.com/boomerbuyerguides.com/wp-content/uploads/2021/10/Untitled-design-5.jpg?w=775&ssl=1

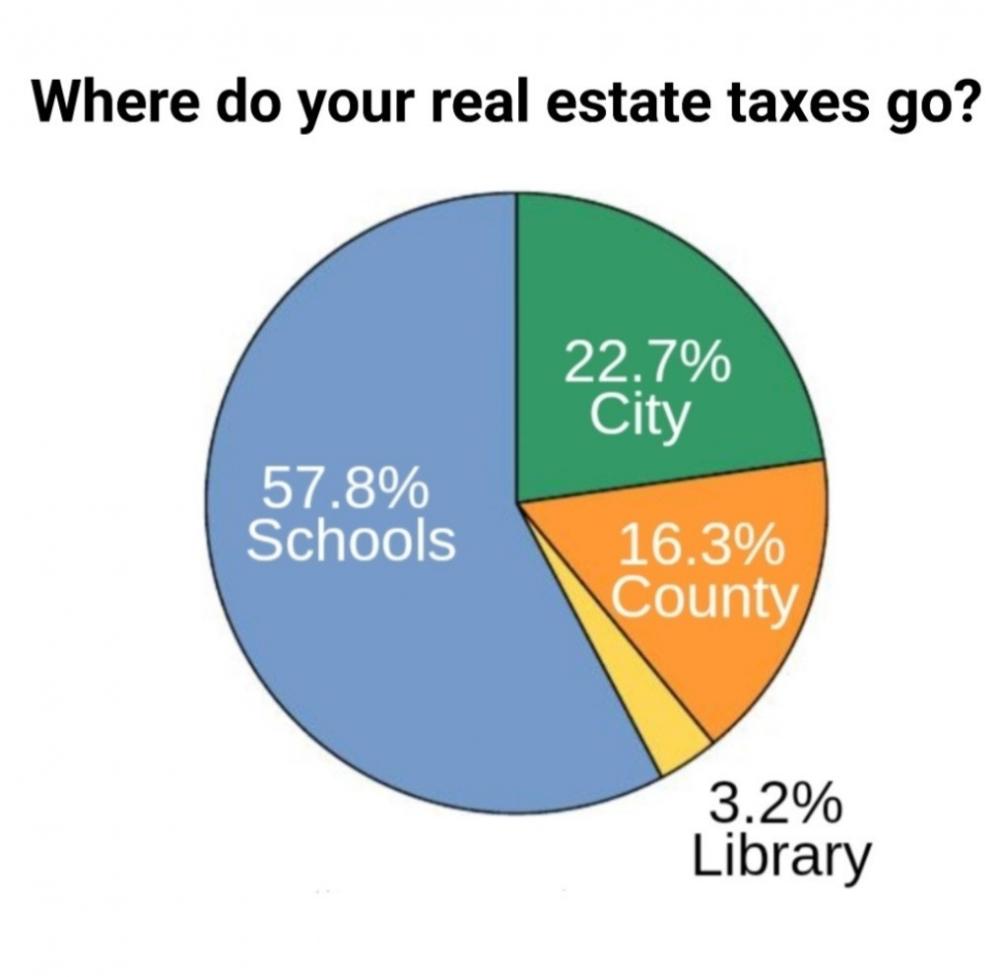

Property Tax Willowick Ohio

https://www.cityofwillowick.com/sites/default/files/styles/gallery500/public/imageattachments/finance/page/2305/pie_chart_2022-1.jpg?itok=HDJzuQhS

https://www.ohiosenate.gov/news/the-democratic...

The homestead exemption is a statewide property tax reduction program for senior citizens those who are disabled and surviving spouses of fallen first responders

.png?w=186)

https://www.daytondailynews.com/local/ohio-senate...

A proposed state law passed by the Ohio Senate Wednesday would temporarily the next three taxing years exempt older Ohioans who earn 36 000 or

The Real Estate Professional Rules What Counts As A Rental Activity

Real Estate Tax Reduction Strategies For Seniors Boomer Buyer Guides

The Ultimate Guide To Ohio Real Estate Taxes

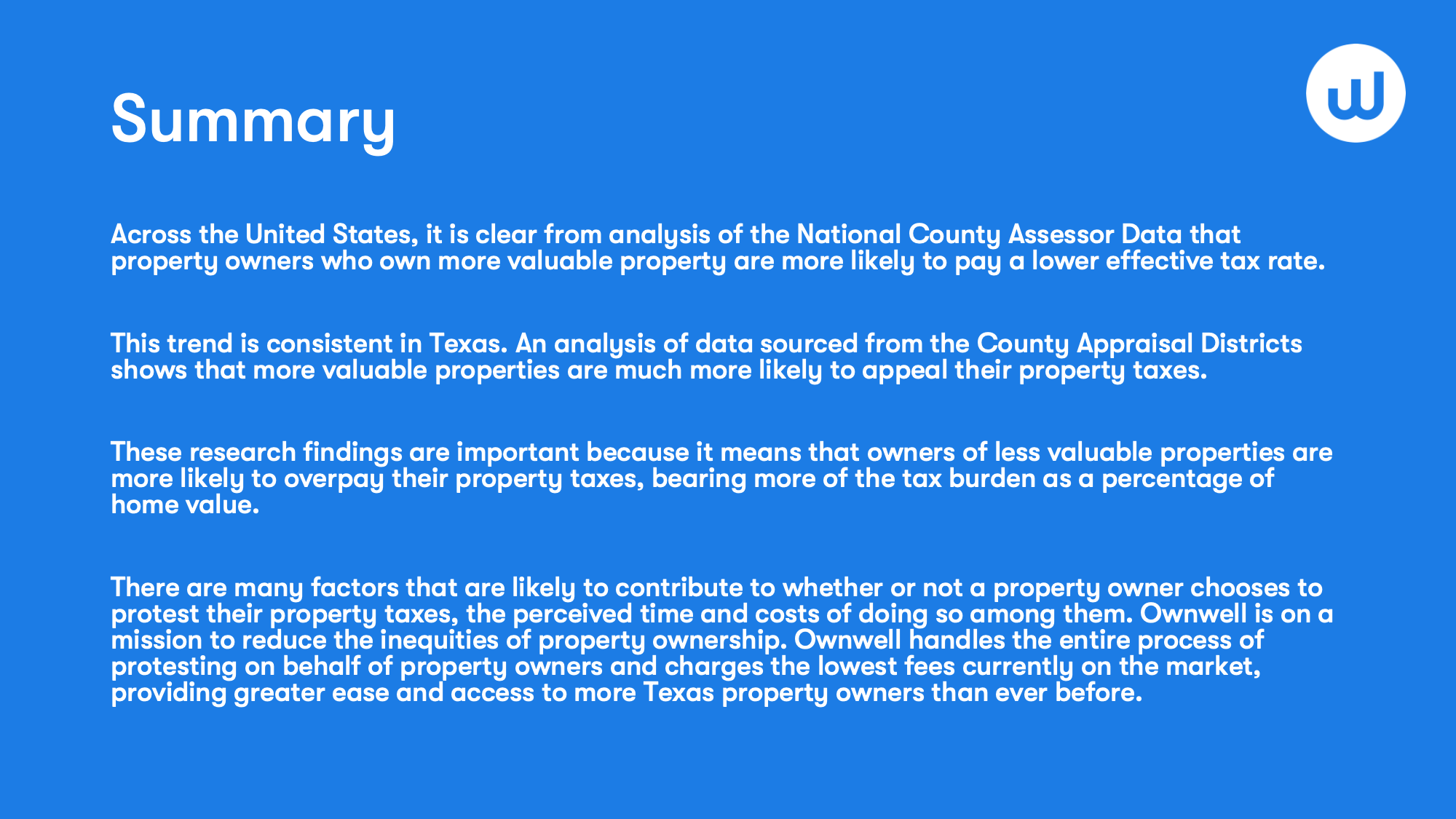

Ownwell Reduce Your Property Taxes

What Are The Tax Implications Of Investing In Real Estate In Columbus

Preparing For The Reduction In The Estate Tax Exemption Orsi Arone

Preparing For The Reduction In The Estate Tax Exemption Orsi Arone

Tax On Real Estate Purchase Price Reduction Tax Attorney Advice

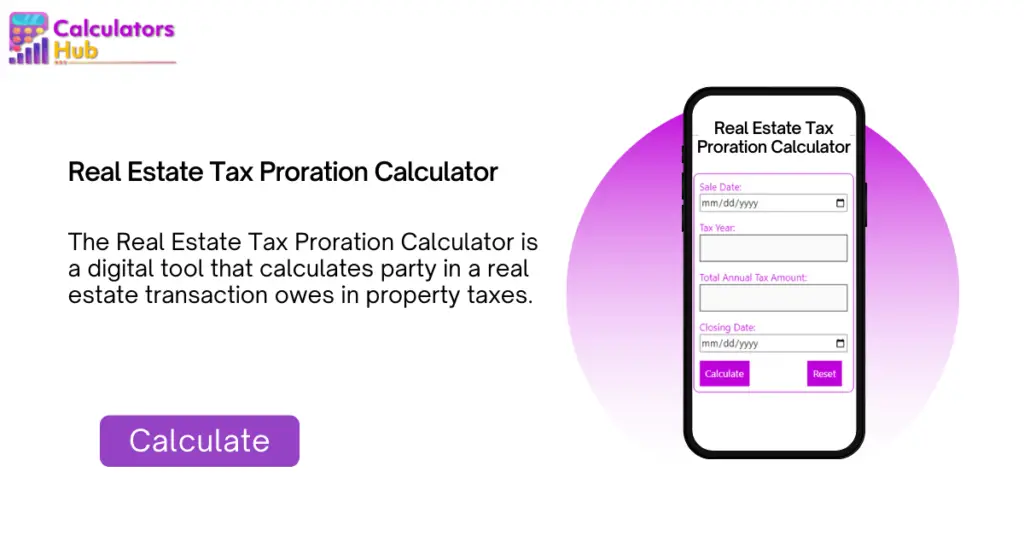

Real Estate Tax Proration Calculator Online CalculatorsHub

21 Differences Between Real Estate Tax And Property Tax

Ohio Real Estate Tax Reduction For Seniors - The Homestead exemption is available to all homeowners 65 and older and all totally and permanently disabled homeowners with a previous year s household income that does