Oklahoma Tax Rebate 2024 The Parental Choice Tax Credit has an annual cap of 150 million for the 2024 tax year and is expected to increase by 50 said AARP Oklahoma The tax credit will be available for the 2024 tax

The IRS inflation adjusted tax brackets for tax year 2024 are 37 for individual single taxpayers with incomes greater than 609 350 or 731 200 for married couples filing jointly 35 for incomes over 243 725 or 487 450 for married couples filing jointly 32 for incomes over 191 950 or 383 900 for married couples filing jointly Oklahoma Households with an income less than 100 000 are eligible to get 5 of the federal child tax credit PDF Oregon Families with an income less than 30 000 are eligible to get 1 000

Oklahoma Tax Rebate 2024

Oklahoma Tax Rebate 2024

https://www.pdffiller.com/preview/595/644/595644001/large.png

What You Should Know About The Oklahoma Tax Exemption Oklahoma News

https://i2.wp.com/www.dontwasteyourmoney.com/wp-content/uploads/2019/07/AdobeStock_70665822-e1562954289150.jpeg

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

You can quickly estimate your Oklahoma State Tax and Federal Tax by selecting the tax year your filing status Gross Income and Gross Expenses this is a great way to compare salaries in Oklahoma and for quickly estimating your tax commitments in 2024 In Oklahoma legislators have proposed sending taxpayers 75 checks in December 150 for married couples to help blunt the impact of higher prices In one respect it s a drop in the bucket with inflation costing the average household more than 4 000 this year But something is better than nothing or is it

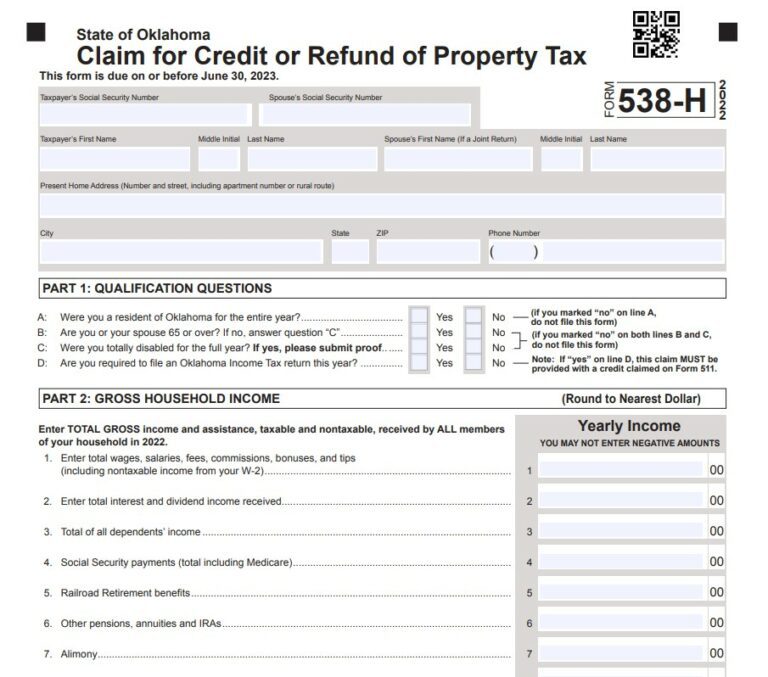

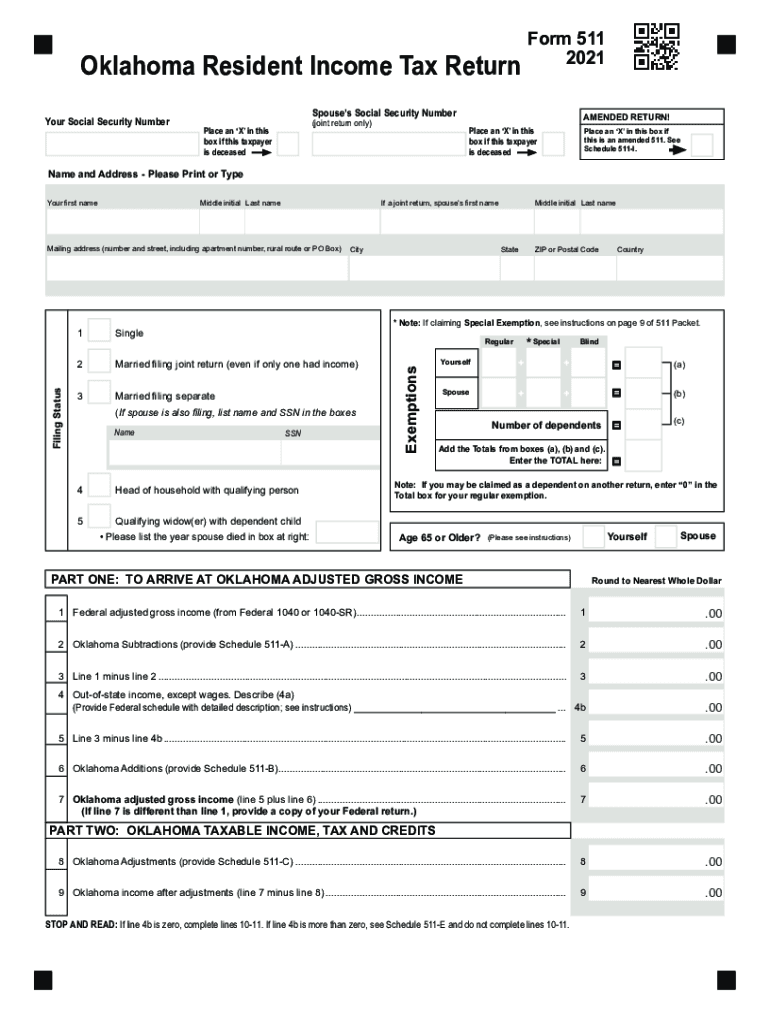

If died in 2023 or 2024 enter date of death Instructions on page 3 Please read carefully as an incomplete form may delay your refund Taxpayer s First Name Middle Initial Last Name Spouse s First Name If a Joint Return Middle Initial Mailing Address Number and street including apartment number or rural route City Last Name State ZIP The 2024 Lighting Retrofit Application Opportunity will be posted Summer Fall 2024 It will be approximately 12 to 18 months before the rebate programs are available to the Oklahoma public Winter 2025 Summer 2025 Eligible tax exempt entities include school districts units of local government and State government agencies that

Download Oklahoma Tax Rebate 2024

More picture related to Oklahoma Tax Rebate 2024

Virginia Tax Rebate 2024

https://www.taxuni.com/wp-content/uploads/2023/01/Virginia-Tax-Rebate-1024x576.jpg

Oklahoma Rebate Checks 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/Oklahoma-Renters-Rebate-2023-768x677.jpg

Smith Wesson Shield EZ Holiday Rebate H H Shooting Sports Oklahoma City

https://www.hhshootingsports.com/wp-content/uploads/2022/11/SmithWessonRebates-HalfPage-scaled.jpg

File ONLINE and choose to receive your refund by DEBIT CARD File by MAIL and choose to receive a refund by DIRECT DEPOSIT 6 weeks 10 to 12 weeks File by MAIL and choose to receive a refund by DEBIT CARD 11 to 13 weeks These wait times are approximate and processing time can fluctuate based on additional time to correct errors Generally state tax changes take effect either at the start of the calendar year January 1 or the fiscal year July 1 for most states with rate changes for major taxes typically implemented effective January 1 either prospectively as in these cases or retroactively as may happen under legislation enacted in the new year

The Oklahoma Medical Marijuana Authority is now an appropriated agency with an FY 2024 budget of 37 million Most health and social services agencies will see a budget increase including the Department of Health with a 16 percent increase for a total Health Department budget of 71 million The Health Care Authority budget will decrease by On Tuesday Rep Wolfley passed House Bill 2020 which increases the Oklahoma income tax exemption for retirement benefits from 10 000 to 20 000 beginning in the tax year 2024 The exemption for retirement income hasn t been increased in 16 years Wolfley said Inflation has severely eroded the purchasing power of those on fixed incomes

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A-1024x536.jpg

AlconChoice Rebate Form How To Qualify And Fill Out Printable Rebate Form

http://printablerebateform.net/wp-content/uploads/2023/01/Alcon-Rebate-Form-2023.png

https://www.msn.com/en-us/money/taxes/start-saving-your-receipts-new-ok-law-creates-tax-credit-for-eligible-oklahomans-providing-care-to-loved-ones/ar-AA1mk7Ly

The Parental Choice Tax Credit has an annual cap of 150 million for the 2024 tax year and is expected to increase by 50 said AARP Oklahoma The tax credit will be available for the 2024 tax

https://www.oklahoman.com/story/news/2024/01/09/oklahoma-state-taxes-what-to-know-to-file-for-free-wheres-my-refund-w2/72149509007/

The IRS inflation adjusted tax brackets for tax year 2024 are 37 for individual single taxpayers with incomes greater than 609 350 or 731 200 for married couples filing jointly 35 for incomes over 243 725 or 487 450 for married couples filing jointly 32 for incomes over 191 950 or 383 900 for married couples filing jointly

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

Income Tax Rebate Under Section 87A

Up To 1 044 Tax Rebate 2023 Arriving In Colorado Today See If You re Eligible South

Property Tax Rebate Pennsylvania LatestRebate

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

CT Tax Rebate Info Session YouTube

CT Tax Rebate Info Session YouTube

Get Up To A 300 Rebate On Bausch Lomb Contact Lenses Sunshine Optometry

Michigan Tax Rebate 2023 Eligibility Types Deadlines How To Claim PrintableRebateForm

Big Update On Income Tax Rebate In Union Budget 2023 No Tax Upto 7 Lakh YouTube

Oklahoma Tax Rebate 2024 - The 2024 Lighting Retrofit Application Opportunity will be posted Summer Fall 2024 It will be approximately 12 to 18 months before the rebate programs are available to the Oklahoma public Winter 2025 Summer 2025 Eligible tax exempt entities include school districts units of local government and State government agencies that