One Time Tax Rebate 2024 WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline

The IRS expects most EITC and ACTC related refunds to be available in taxpayer bank accounts or on debit cards by Feb 27 2024 if the taxpayer chose direct deposit and there are no other issues with the tax return Last quarterly payment for 2023 is due on Jan 16 2024 Last year many states distributed one time payments to qualifying residents and some states continue to offer rebates January stimulus check 2024 update If you received one of those

One Time Tax Rebate 2024

One Time Tax Rebate 2024

https://sdkcpa.com/wp-content/uploads/Tax-Rebate-081723.png

What You Need To Know About The 2022 One Time Tax Rebate Virginia Tax Monthly Enrollment

https://gutenberg.blog/399d50eb/https/624061/www.tax.virginia.gov/sites/default/files/news-images/2022-06/TaxRebateNewscardImage.jpg

One time Tax Rebate Checks For Idaho Residents KLEW

https://klewtv.com/resources/media2/16x9/full/1024/center/80/bcd0e069-efe3-406d-b87f-b52ab4b43fd3-large16x9_IdahoTaxRebateCheckpic.jpg

That s because a one time tax credit of up to 3 600 is available Beyond just the initial tax credit California also offers a young child tax credit worth up to 1 083 To qualify Residents should be eligible based on their 2023 2024 property taxes if their property qualifies as a homestead and they meet other criteria The amount available depends on several factors but

Here are the following The income caps are 300 000 for married couples filing jointly 225 000 for heads of households 150 000 for all other filers Furthermore depending on factors such as battery component and part manufacturing location vehicles can either qualify for a 7 500 or 3 750 one time tax rebate IRS Tax Tip 2024 01 Jan 4 2024 Tax credits and deductions change the amount of a person s tax bill or refund People should understand which credits and deductions they can claim and the records they need to show their eligibility Tax credits A tax credit reduces the income tax bill dollar for dollar that a taxpayer owes based on their

Download One Time Tax Rebate 2024

More picture related to One Time Tax Rebate 2024

Alabama s One time Tax Rebate Payments Begin Processing Friday

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA18Uz5G.img?w=1920&h=1080&m=4&q=86

Council Approves 350 One Time Tax Rebate From Honolulu

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1clqqd.img?w=2000&h=1000&m=4&q=75

Alabama Senate Committee Approves Reduction Of One time Tax Rebate From 400 To 100 Blogging

https://www.bloggingbigblue.com/wp-content/uploads/2023/05/pexels-karolina-grabowska-4968548-scaled.jpg

Tap the Banking tab on the bottom left side of your screen It s the one shaped like a building 3 Scroll down and select Direct Deposit It ll note that you can get your money two days faster 4 These credits which can provide cash back or lower any tax you might owe are available to Californians with incomes up to 30 950 for CalEITC and up to 30 931 for YCTC and FYTC CalEITC can be worth up to 3 529 while YCTC and FYTC can be up to 1 117 Individuals earning less than 63 398 may also qualify for the federal EITC

On January 1 2024 With the ratification of HB360 the Delaware Department of Finance will issue a one time 300 tax rebate throughout the summer to every adult resident of the state Georgia HB 304 contains a provision that issues tax rebates of up to 250 for single filers or 500 per household An expanded child tax credit In 2021 in the midst of the coronavirus pandemic President Biden and Democrats in Congress temporarily beefed up the child tax credit allowing most families to

Kansas Governor Laura Kelly Wants To Give 1 2M Residents One Time Tax Rebate

https://d.newsweek.com/en/full/1957211/laura-kelly-proposal-one-time-tax-rebates.jpg?w=790&f=fdd494b00d945484bae0d6d6bc10bc5a

Some Virginians Are Getting A One Time Tax Rebate Find Out If You re Eligible

https://northernvirginiamag.com/wp-content/uploads/2022/09/taxes.jpg

https://www.irs.gov/newsroom/2024-tax-filing-season-set-for-january-29-irs-continues-to-make-improvements-to-help-taxpayers

WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline

https://www.irs.gov/newsroom/get-ready-to-file-in-2024-whats-new-and-what-to-consider

The IRS expects most EITC and ACTC related refunds to be available in taxpayer bank accounts or on debit cards by Feb 27 2024 if the taxpayer chose direct deposit and there are no other issues with the tax return Last quarterly payment for 2023 is due on Jan 16 2024

One Time 800 Tax Rebate Check Exact Release Date E AGROVISION

Kansas Governor Laura Kelly Wants To Give 1 2M Residents One Time Tax Rebate

As Alabama s Challenges Mount Where Is Kay Ivey

/cloudfront-us-east-1.images.arcpublishing.com/gray/KOGOAMBIMRKB7ENL6GNHWB4KHA.jpg)

Checks For Virginia s One time Tax Rebate Roll Out Monday

Virginia Tax Rebate 2024

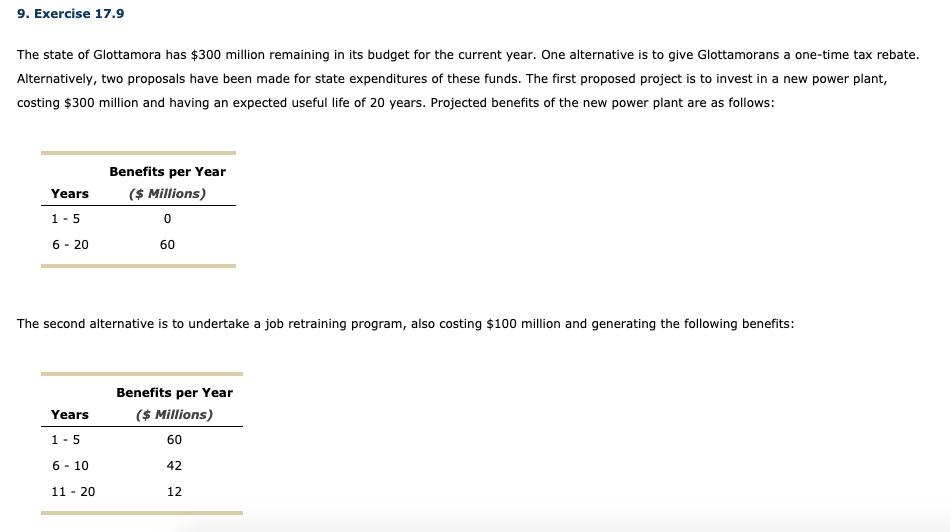

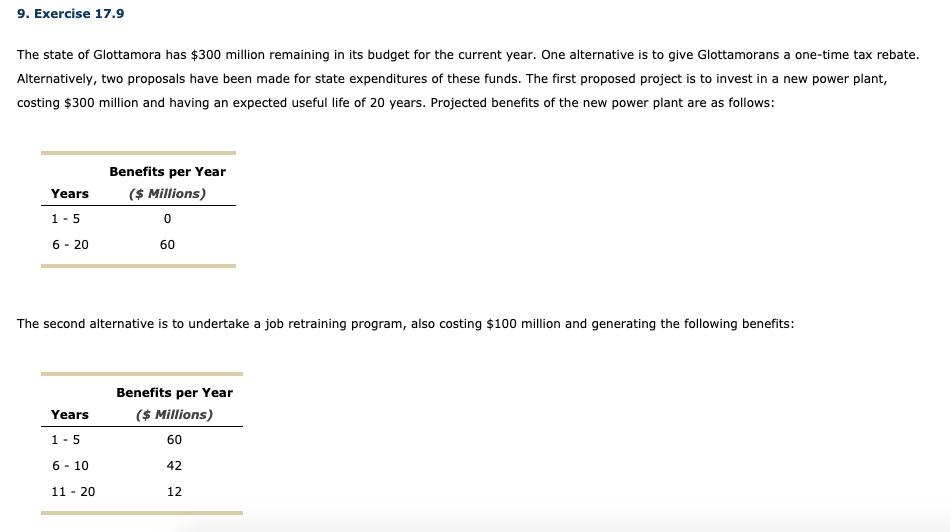

Solved 9 Exercise 17 9 The State Of Glottamora Has 300 Chegg

Solved 9 Exercise 17 9 The State Of Glottamora Has 300 Chegg

Ivey Memo Signals Government Belt Tightening Alabama Daily News

One time Tax Rebate In Virginia YouTube

All One time Tax Rebate Checks Have Been Dispersed To 2 1 Million Eligible Minnesotans

One Time Tax Rebate 2024 - While the tax rebate is a plus the reality is that EV prices in the United States are still at a high level According to the Chevy website the current Chevy Bolt EV has an MSRP of 26 500 The 2024 Nissan Leaf one of the most well known electric cars retails at 28 140 for the latest model year This is despite the model having had few