Ontario Hst Input Tax Credit An input tax credit is what you earn every time you pay GST HST on an expenditure for your business You claim all these input tax credits or ITCs on your GST HST return for a rebate ITCs are subtracted from the GST HST you are required to remit to the Canada Revenue Agency CRA

Ontario HST Input Tax Credits Businesses which are registered to collect GST or HST can claim input tax credits to recover the GST or HST that they have paid with certain temporary exceptions for large businesses see below The change to HST meant a significant savings and boost in productivity for businesses in Ontario because A business input tax credits are essentially the sum of the GST HST that you have paid on any legitimate business expenses It could also be on the allowable portion of the total sum of the GST HST you

Ontario Hst Input Tax Credit

Ontario Hst Input Tax Credit

https://lh4.googleusercontent.com/5hwolQtDt61P7Mcah2HElnIoQsT2WceGufSC7Wq5tLISGADKSMir2eVSxHexbQxONOsMabhgjc6QkGyh1fCFZrn7ljeub6zzR1EvWan8mOtdtF7WzpXhyFssXjVJtXZ_YOiBnYgdEkDBh5fwpm2nkJ2Dzb5s8qin-_Ir7SSqkYC1Oxw1pB6fAhSEsbhL7Q

HST Input Tax Credit Alert If You re Behind Filing 4 Years Is Your Limit

https://media-exp1.licdn.com/dms/image/C5612AQF5rmmhY-jvxA/article-cover_image-shrink_600_2000/0/1520214180565?e=2147483647&v=beta&t=y5OSlEFIXTfXewSGHGKVR2i5dPF9JLfThJA3Sg3m_hs

HST Rebate WSIB Consulting Toronto HST WSIB Accountant JindalTax

https://jindaltax.com/wp-content/uploads/2019/11/hst1-768x512.jpg

There are a few basic requirements to permit a GST HST registrant to claim an input tax credit ITC As a general rule an ITC can be claimed when taxable property or services have been acquired by a registrant for consumption or use in the course of commercial activity Taxpayers entitled to input tax credits and subject to RITC

Input Tax Credits A registrant is entitled to an input tax credit equal to the amount of tax actually paid So if 15 H S T was paid the purchaser is entitled to an input tax credit for that amount The input tax credit ITC enables your business to recover the GST HST paid or payable on purchases and expenses for its commercial activities However many businesses are not sure what is required to support a GST HST claim and risk not recovering these costs In this article MNP s Tax Services team explains

Download Ontario Hst Input Tax Credit

More picture related to Ontario Hst Input Tax Credit

GST HST Input Tax Credit Claims Jeremy Scott Tax Law

https://jeremyscott.ca/wp-content/uploads/2023/02/GST-HST-Input-Tax-Credit-Claims.jpg

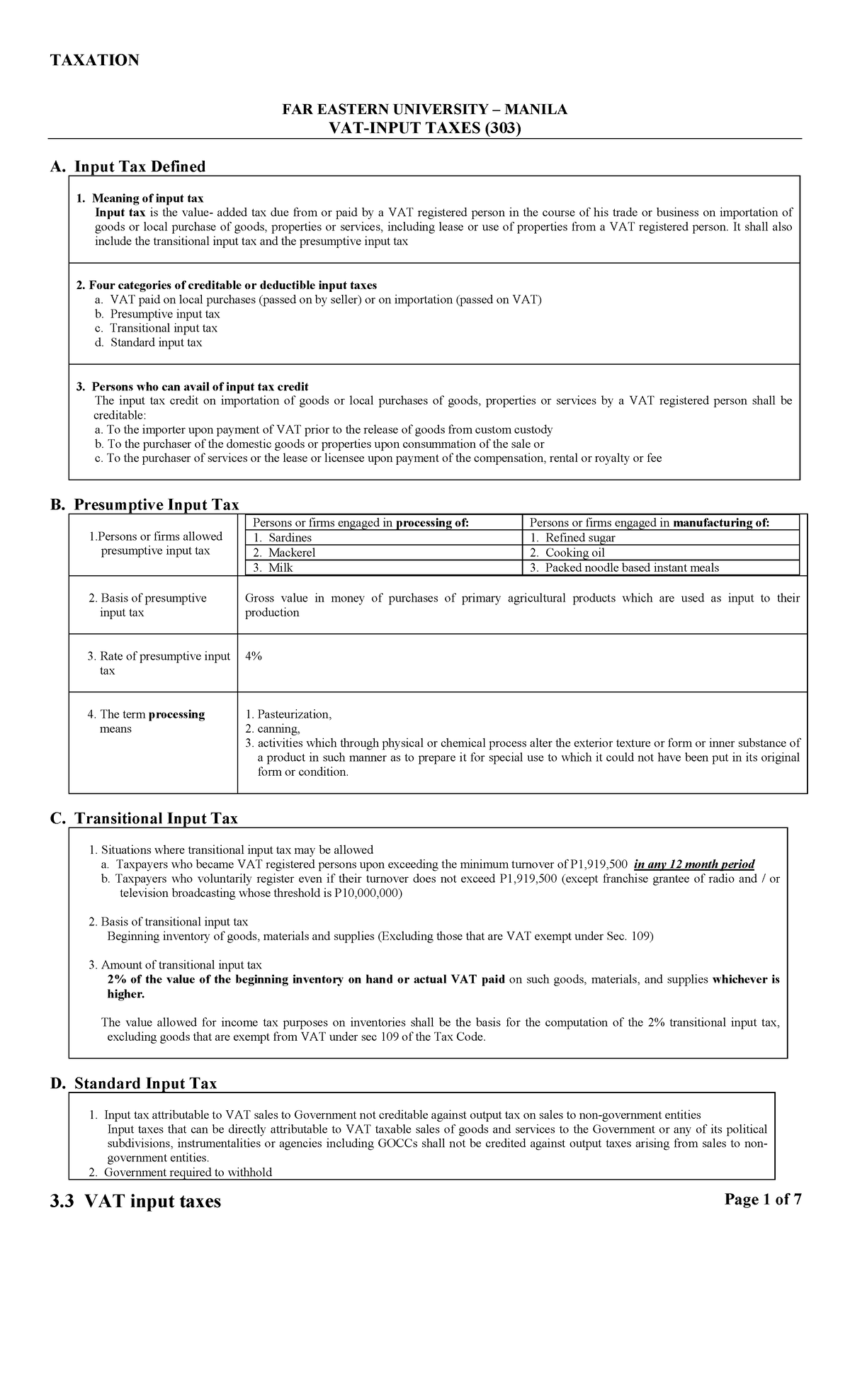

03 3 VAT Input Taxes Lecture Notes 3 TAXATION FAR EASTERN

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/80489c1ca4f0c259a700811a6fe90ddf/thumb_1200_1976.png

What Are GST HST Input Tax Credits Genesa CPA Corp

https://genesacpa.com/wp-content/uploads/2019/12/input-tax-credits-1024x683.jpg

Effective July 1 2010 the Harmonized Sales Tax HST replaced the 5 federal goods and services tax GST and the 8 retail sales tax RST on most goods and services in Ontario Currently the Harmonized Sales Tax is 13 in Ontario Most notably it introduced a requirement that large businesses be required to repay or recapture the portion of any available input tax credits ITCs attributable to the provincial portion of the HST that becomes payable or is paid without having become payable in respect of a specified property or service that is acquired

There are special rules that restrict the amount of Input Tax Credit that may be claimed on certain non inventory products and services for businesses with over 10 million of annual taxable sales How do I claim ITCs Ontario HST Restrictions on Input Tax Credits for Large Businesses GGFL LLP September 19 2015 Temporary Recapture of Input Tax Credits ITC

HST Rebate Forms Ontario PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2021/08/HST-Rebate-Form-2021-768x997.png

Hecht Group The Harmonized Sales Tax HST In Canada

https://img.hechtgroup.com/1664419265375.jpg

https://www.personaltaxadvisors.ca/what-is-an-input-tax-credit-itc

An input tax credit is what you earn every time you pay GST HST on an expenditure for your business You claim all these input tax credits or ITCs on your GST HST return for a rebate ITCs are subtracted from the GST HST you are required to remit to the Canada Revenue Agency CRA

https://www.taxtips.ca/gst/ontario-hst.htm

Ontario HST Input Tax Credits Businesses which are registered to collect GST or HST can claim input tax credits to recover the GST or HST that they have paid with certain temporary exceptions for large businesses see below The change to HST meant a significant savings and boost in productivity for businesses in Ontario because

GST HST Input Tax Credits Reasonable Expectation Of Profit SCARROW

HST Rebate Forms Ontario PrintableRebateForm

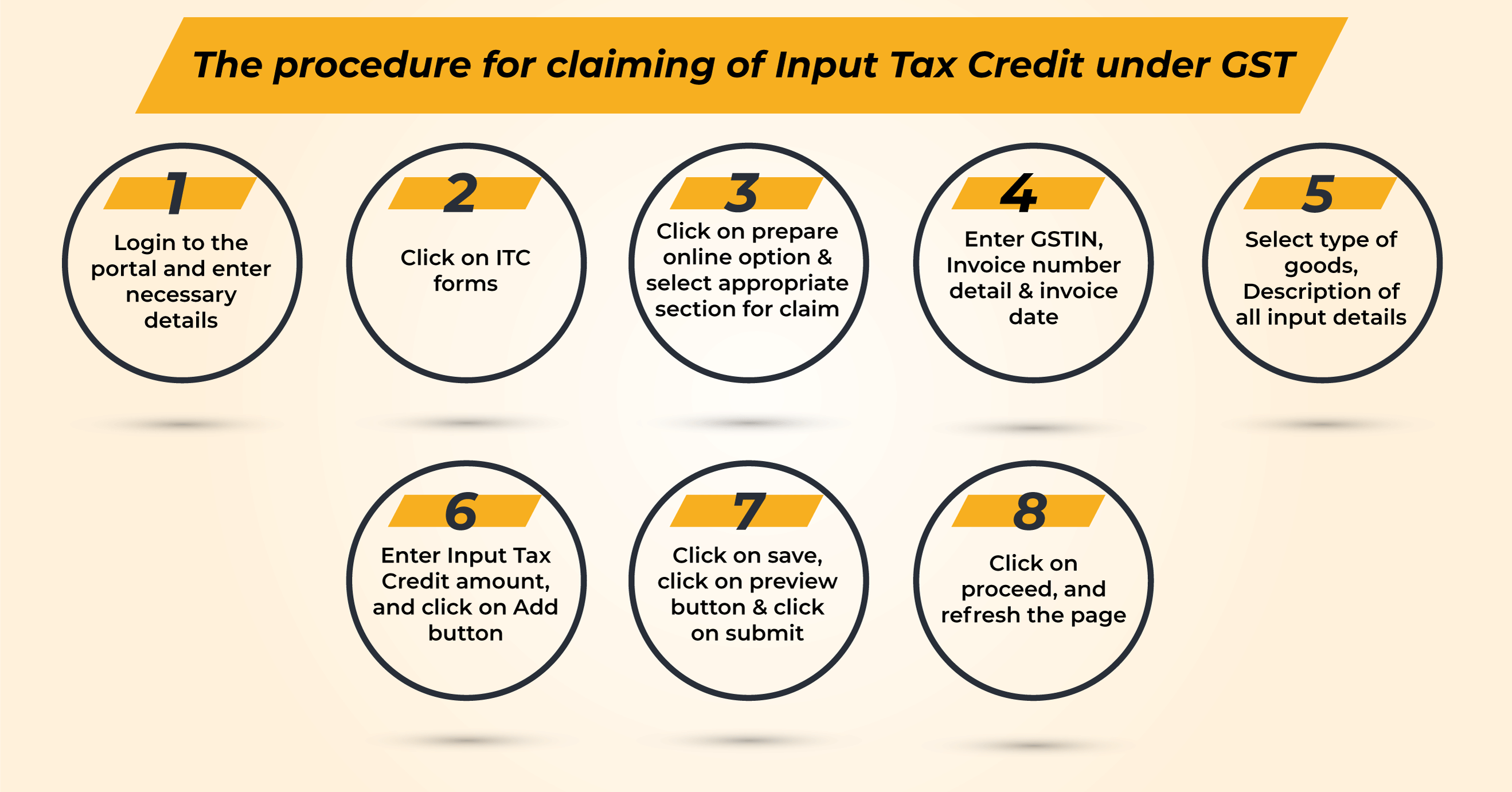

All About Input Tax Credit Under GST

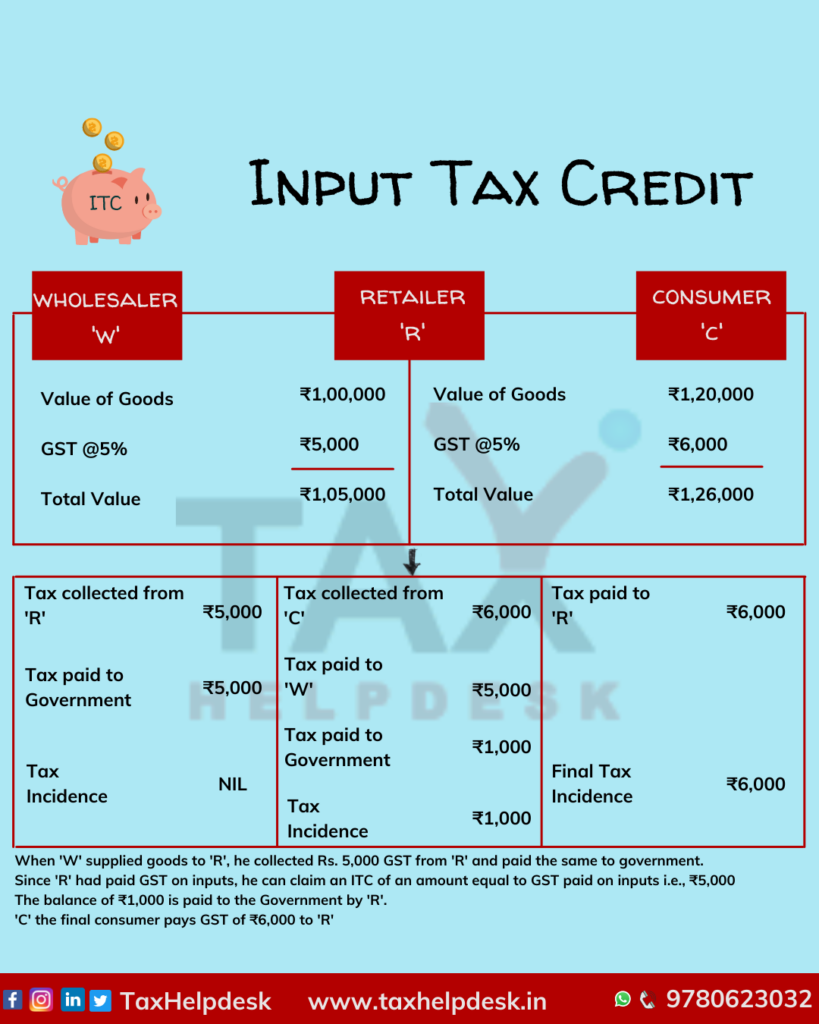

Input Tax Credit Know How Does It Work

Input Tax Credit ITC On Corporate Social Responsibilities CSR CA

Guide To Maximizing The Utilization Of GST Input Tax Credit

Guide To Maximizing The Utilization Of GST Input Tax Credit

GST HST Input Tax Credit Claims Does The Supporting Documentation Need

/cloudfront-us-east-1.images.arcpublishing.com/tgam/YVRAM5UNSFH7XIYKSPJJQWFL6E)

HST letter Challenges Arguments Against Tax The Globe And Mail

Where Can Input Tax Credit Under GST Not Be Availed

Ontario Hst Input Tax Credit - There are a few basic requirements to permit a GST HST registrant to claim an input tax credit ITC As a general rule an ITC can be claimed when taxable property or services have been acquired by a registrant for consumption or use in the course of commercial activity