Owner Rebate In Property Tax Web 29 ao 251 t 2022 nbsp 0183 32 If your household income falls Below 80 of the area median income you can claim rebates for 100 of your upgrades up to a 14 000 limit From 80 to 150

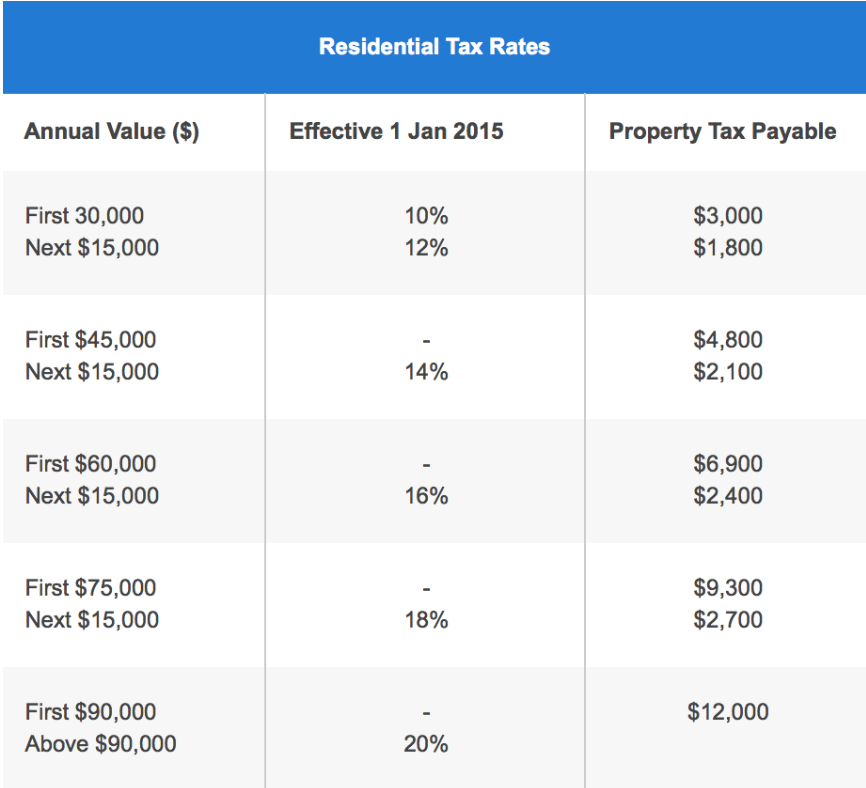

Web 31 mai 2023 nbsp 0183 32 How Tax Abatement Programs Work Tax abatement programs reduce or eliminate the amount of property tax owners pay on new construction rehabilitation Web Property Tax Rebate for Owner Occupied Residential Properties in 2023 Residential Properties HDB Flats Condominiums Landed Housing All Owner Occupied

Owner Rebate In Property Tax

Owner Rebate In Property Tax

http://www.formsbirds.com/formimg/pennsylvania-property-taxrent-rebate/21102/pa-1000-2014-property-tax-or-rent-rebate-claim-d1.png

New York Property Owners Getting Rebate Checks Months Early

https://s.hdnux.com/photos/01/26/04/67/22564341/10/1200x0.jpg

Property Tax Rebate Form For Seniors In Pa Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/11/PA-Property-Tax-Rebate-Form-768x719.png

Web 28 janv 2023 nbsp 0183 32 A property owner can claim a tax deduction on some or all of the property taxes paid if they use the property for personal use and itemize deductions on their Web The homeowner tax rebate credit is a one year program providing direct property tax relief to about 2 5 million eligible homeowners in 2022 If you qualify you don t need to do

Web HOME OWNERS PROPERTY TAX REBATE ACT In this Act quot Commissioner s land quot means land to which the Commissioner s Land Act applies terre domaniale Web The Property Tax Rebate is a rebate of up to 675 per year of property taxes paid on a principal residence There is a rebate available for property taxes paid for Tax Year

Download Owner Rebate In Property Tax

More picture related to Owner Rebate In Property Tax

Property Tax For Homeowners In Singapore How Much To Pay Rebates

https://www.99.co/singapore/insider/wp-content/uploads/2016/04/Screen-Shot-2016-04-06-at-11.54.40.png

Form 104 Ptc Colorado Property Tax rent heat Rebate Application

https://data.formsbank.com/pdf_docs_html/281/2814/281406/page_1_thumb_big.png

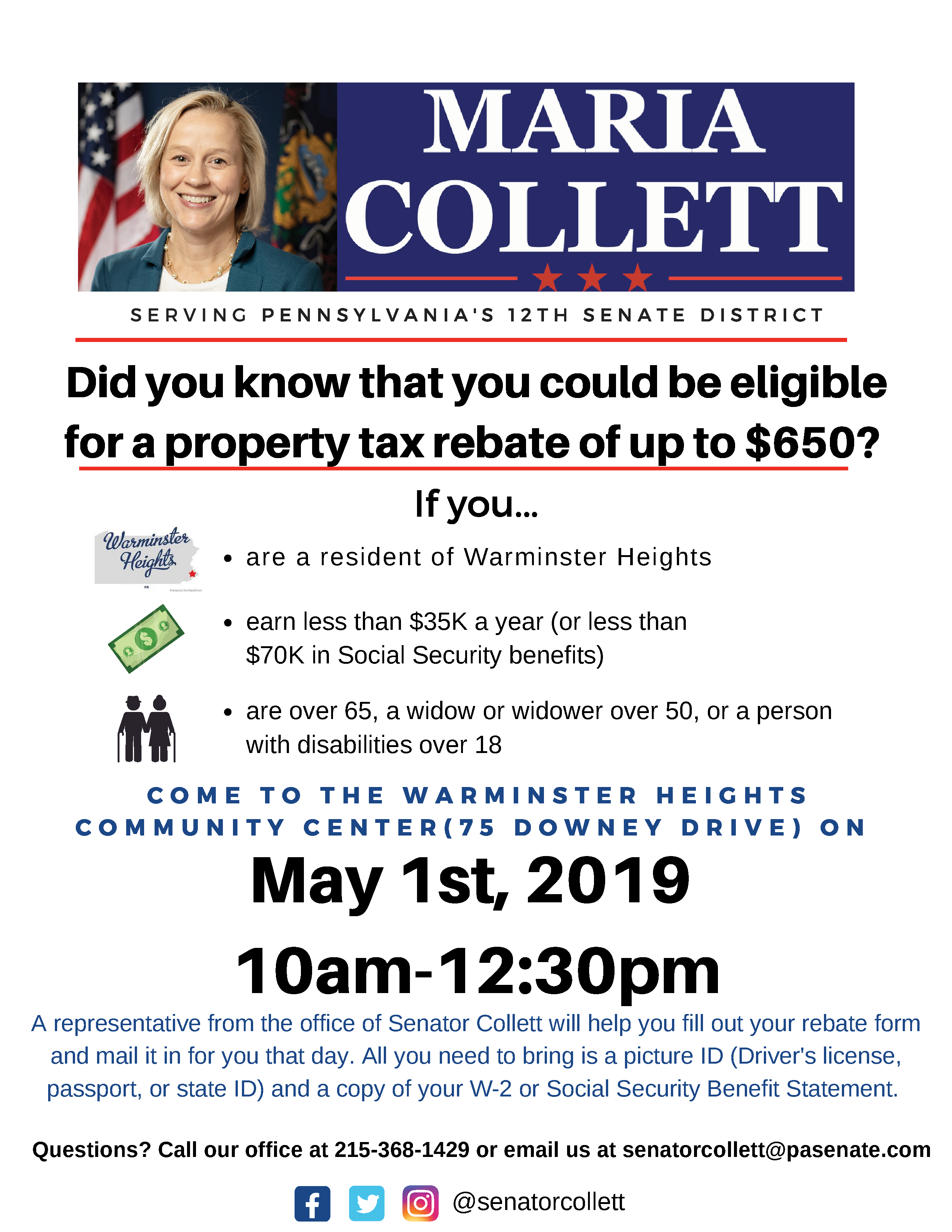

Help With Property Tax Rebate Forms click For Details Warminster

https://warminster-heights.org/wp-content/uploads/2019/04/Final-Warminster-Heights-Property-Tax-Rebate-4.png

Web 5 d 233 c 2022 nbsp 0183 32 In the same statement MOF and IRAS announced the provision of a one off property tax rebate in 2023 of up to 60 for owner occupied homes The rebate is Web 2 d 233 c 2022 nbsp 0183 32 To offset the burden the Government will provide a one off tax rebate of up to 60 for all owner occupied properties said the Ministry of Finance and Inland Revenue

Web 7 mars 2023 nbsp 0183 32 There are two types of deductions for the property owners who are liable to pay income tax under Section 24 as explained below Standard Deduction The house Web 10 f 233 vr 2023 nbsp 0183 32 The tax rebate is a reduction in property tax which is not income The only way it would be taxable on your federal return is if you itemized your deductions and

Top Mass Save Rebate Form Templates Free To Download In PDF Format

https://www.masssaverebate.net/wp-content/uploads/2022/10/form-104-ptc-colorado-property-tax-rent-heat-rebate-application-7.png

How To Get Property Tax Rebate PropertyRebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/pa-property-tax-rent-rebate-apply-by-12-31-2022-new-1-time-bonus-55.jpg?resize=1583%2C2048&ssl=1

https://www.investopedia.com/tax-credits-for-homeowners-what-you-need...

Web 29 ao 251 t 2022 nbsp 0183 32 If your household income falls Below 80 of the area median income you can claim rebates for 100 of your upgrades up to a 14 000 limit From 80 to 150

https://www.investopedia.com/.../12/property-tax-abatement.asp

Web 31 mai 2023 nbsp 0183 32 How Tax Abatement Programs Work Tax abatement programs reduce or eliminate the amount of property tax owners pay on new construction rehabilitation

Retirees Need To Take Action For Latest Property Tax Rebate NPR Illinois

Top Mass Save Rebate Form Templates Free To Download In PDF Format

Where Is My Property Tax Rebate TaxesTalk

Tulsa Sales Tax Rebate Form Fill Online Printable Fillable Blank

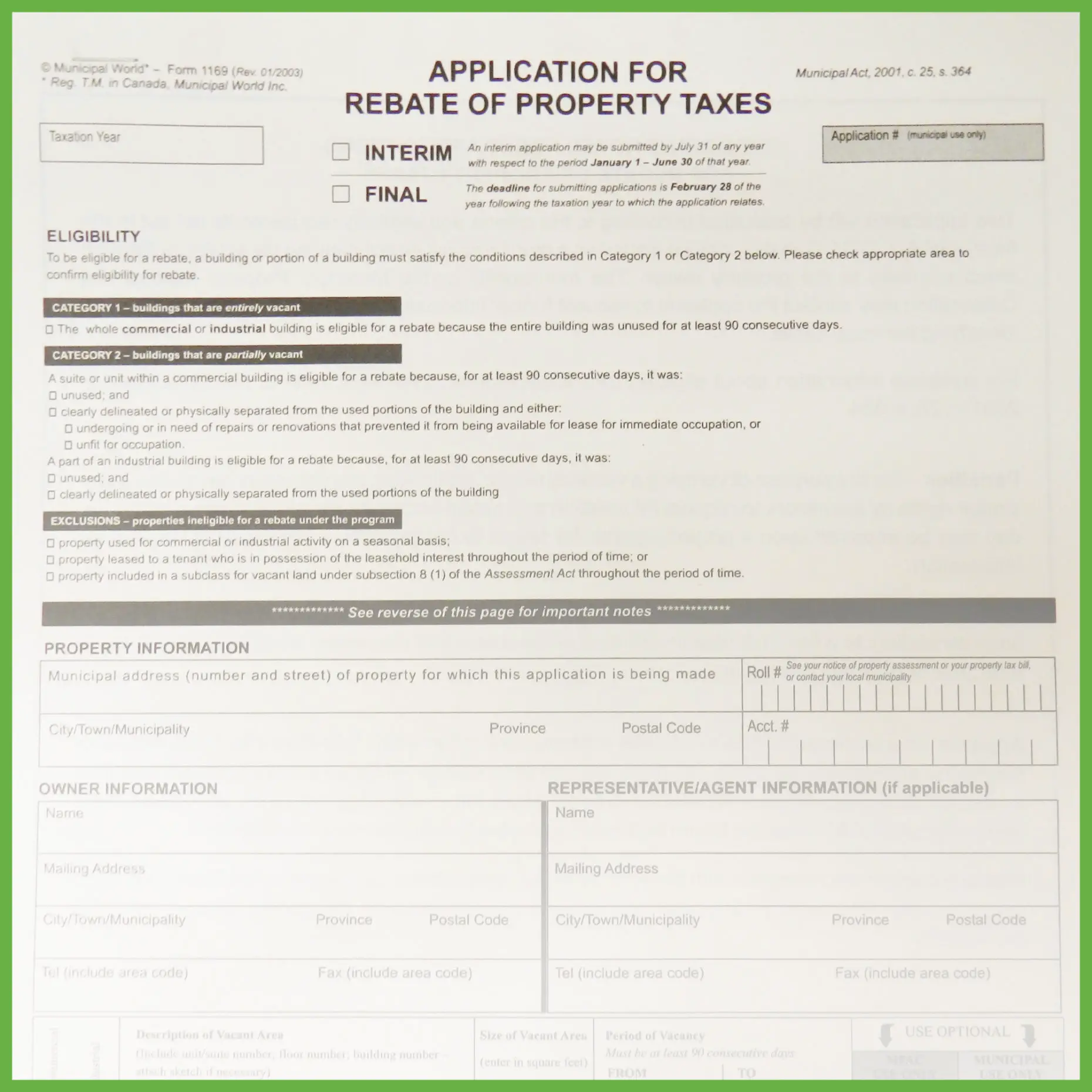

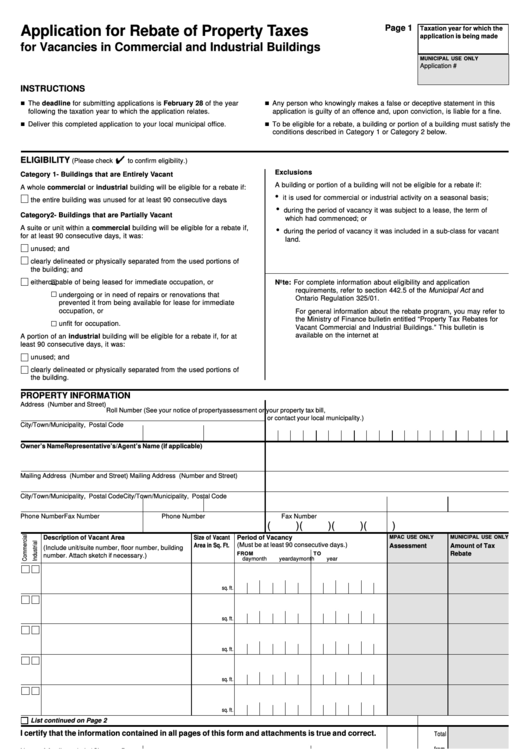

Application For Rebate Of Property Taxes Printable Pdf Download

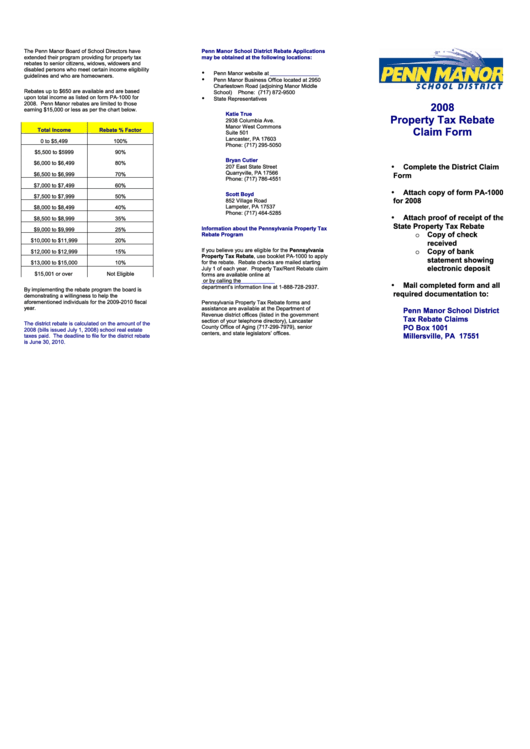

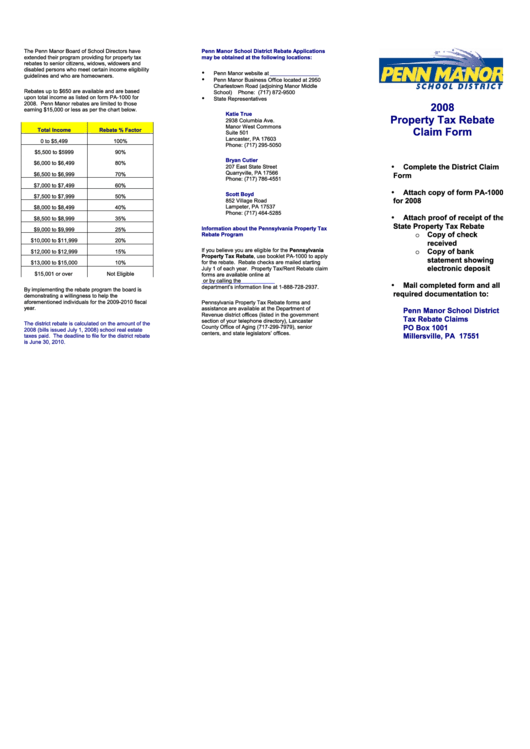

Property Tax Rebate Claim Form 2008 2009 Printable Pdf Download

Property Tax Rebate Claim Form 2008 2009 Printable Pdf Download

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

Scott Wasserman On Twitter That s A Critical Point TABOR Rebates

PA 1000 2014 Property Tax Or Rent Rebate Claim Free Download

Owner Rebate In Property Tax - Web The Property Tax Rebate is a rebate of up to 675 per year of property taxes paid on a principal residence There is a rebate available for property taxes paid for Tax Year